States With No Income Tax

A good way to minimize your retirement income tax bill is to move to one of the eightor nine, depending on how you classify incomestates that do not have any income taxes. These states do not tax income earned from wages, salaries or investments.

New Hampshire is often misclassified as having no income tax. While the Granite State does not tax income from wages or salaries, it does tax income earned from interest and dividends at a 5% rate. Starting in 2024, the state will begin gradually phasing out this tax, and it will be completely eliminated by 2027.

Just remember, income taxes arent the only kind of tax you need to consider when choosing where to live in retirement. Its important to consider your total tax burden, including property taxes and sales taxes.

How Our Social Security Lawyers Can Help You With Back Pay

As mentioned, it is not uncommon for your initial claim to be denied. However, that doesnt mean its not daunting it might put you in a tight spot. If you are experiencing a similar situation, our lawyers can fight to get you the backpay you need to help cover your expenses.

You can rely on us to:

- Act as a messenger between you and the SSA

- Help you comply with deadlines

- Advise and explain your options

- Assist you throughout the appeals process

In reference to the last point, the appeals process can be complicated, and taking it on by yourself is no easy task. A lawyer on our team can represent you throughout all stages:

- Reconsideration

- A hearing in front of the Administrative Law Judge , which can be done via phone, video conference, or in person

- The Appeals Council

Take Advantage Of Breaks Where You Can Get Them

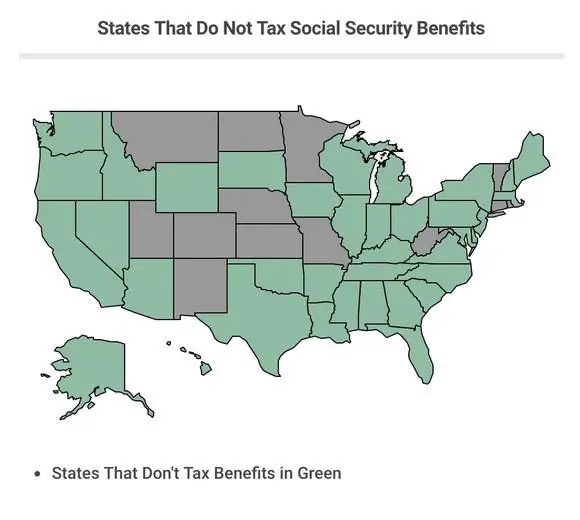

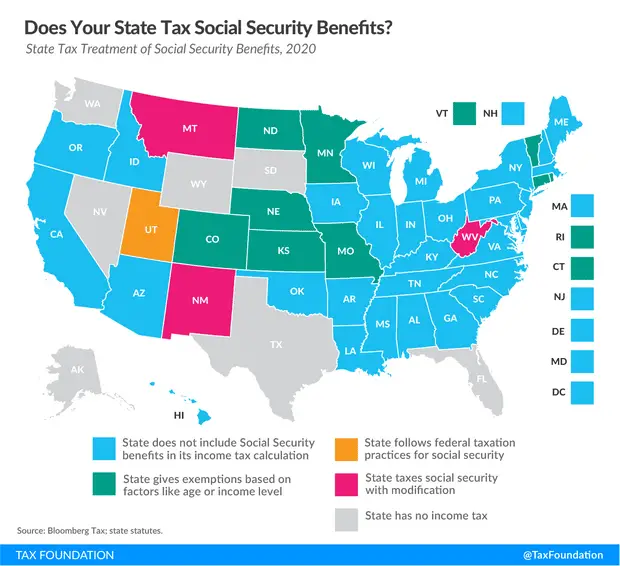

In 37 states, you dont have to worry about state income tax on Social Security. Yet even in some of the others, there are often things you can do. For instance, New Mexico has an exemption for some retirement income that lets you shelter Social Security if you choose to use it in that way. However, many residents use the exemption to protect IRA distributions or pension income instead.

Also, just because your benefits are taxable for federal purposes doesnt mean that they will be even in states that tax Social Security. Many states have much higher thresholds for taxation than the IRS.

Retirees like to hold onto as much of their Social Security as they can, and dealing with taxes is never ideal. Knowing which states tax Social Security at the local level means you can take that into consideration in planning where you want to spend your retirement.

This article was written by Dan Caplinger from The Motley Fool and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

Read Also: How Do I Qualify For Child Tax Credit

These 38 States Wont Touch Your Social Security

If you live in one of these 38 states or the District of Columbia, you wont have to worry about state Social Security taxes. Nine of these states dont have state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming . In the other states, Social Security benefits arent considered taxable income.

That doesnt mean, however, youll avoid taxes altogether on your Social Security checks. Benefits are still taxable at the federal level if your income exceeds certain thresholds.

For single filers with incomes between $25,000 and $34,000, up to 50% of benefits are taxable. Up to 85% of your benefit is taxable if youre a single filer whose income is greater than $34,000.

Up to 50% of benefits are taxable for married couples filing a joint return who have a combined income between $32,000 and $44,000. Up to 85% of benefits are taxable for couples whose combined income exceeds $44,000.

You May Like: Hours Of Operation For Social Security Office

States That Don’t Tax Estates Or Inheritances

The federal estate tax exemption for individuals who pass away in 2023 is $12.92 million, up from $12.06 million in 2022. The vast majority of Americans wont be paying federal estate taxes.

Some states impose inheritance or estate taxes, which is worth considering when deciding where to live in retirement. The states often have much lower exemption amounts than federal estate taxes. For example, Massachusetts only exempts estates worth less than $1 million.

Recommended Reading: Why Is My Taxes Still Processing 2021

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Recommended Reading: When Do You Stop Filing Taxes

Do Senior Citizens Have To File Pa State Taxes

While seniors are exempt from pension and Social Security taxes in PA, the federal government may still tax this income. As of 2018, retirees who file individual tax returns must pay taxes if they receive more than $25,000 in total pensions and other income plus one-half of Social Security benefits each year.

Do You Pay Taxes On Social Security

Some individuals who receive Social Security must pay federal income taxes on their payments. However, no one pays taxes on more than 85 percent of their Social Security benefits. If you file a federal tax return as an individual and your combined income is greater than $25,000, you must pay taxes on your benefits.

Also Check: Where To Get Income Tax Done Free

State Taxes On Retirement Income

Managing your state retirement income taxes can save you thousands of dollars a year in unnecessary costs.

Many retirees are set on fixed incomes and must follow a strict budget, says Ron Tallou, founder and owner of Tallou Financial Services. That means every little bit helps when stretching your retirement savings.

Retirement income tax rules vary widely from state to state. And state taxes on retirement income largely depend on the source of the income. Some states dont tax any income, period, while others may tax your pension but leave income from your 401 or individual retirement account untaxed.

Whats more, state income tax rules can change from year to year. For the most up-to-date information, visit your states tax department website or work with a tax pro.

Is Pennsylvania A Retirement Friendly State

Why are Pennsylvania retirees so enamored with the state? While there are many advantages to spending ones senior years in Pennsylvania, including quick access to big cities such as Philadelphia and the Big Apple, as well as being surrounded by historical landmarks, one significant benefit is the state’s retirement tax-friendliness. However, what are the financial advantages of retirement in Pennsylvania? These financial advantages are discussed further in this article.

Recommended Reading: Do You Have Until Midnight To File My Taxes

Why Are Social Security Benefits Adjusted Due To Inflation

In 1973, the Social Security Administration tied benefits to a price index known as the Consumer Price Index for Urban Wage Earners and Clerical Workers . Every year, the Social Security Administration uses this index to adjust the value of benefits.

Benefits represent about 30% of retirement income for all seniors, so the adjustment ensures that the value of the benefits does not diminish with inflation. And of course, since most people don’t receive a significant amount of retirement income from Social Security benefits, you should try to save for retirement independently through an employer-sponsored 401 or an individual retirement account .

-

Offers free financial planning for college planning, retirement and homebuying

Terms apply.

Social Security benefits are funded through payroll tax deductions which are split between the employee and employer. The total payroll tax for Social Security is 12.4%, so workers and employers each pay 6.2%. The payroll tax only applies up to a certain income threshold.

The Social Security Administration adjusts the income threshold each year in response to changes in wages. For 2023, the payroll tax applies to up to $160,200 of an individual’s salary, up from $147,000, from the previous year.

Determining If You Owe Federal And State Income Tax On Disability Benefits In Pennsylvania

While SSDI benefits are taxable, whether you owe taxes depends on whether you file jointly or individually and your provisional income. Provisional income includes half of your SSDI benefits, your adjusted gross income, and any tax-exempt interest you earned over the year.

If your only source of income is SSDI, you will most likely not owe any federal income tax. However, if you are an individual with between $25,000 and $34,000 of provisional income, up to half of your SSDI benefits will be considered taxable income. For individuals with more than $34,000 of provisional income, 85% of their SSDI benefits are taxable.

If you are married, filing jointly, and have a combined income of over $32,000, 50% of your disability benefits are taxable. When the combined income exceeds $44,000, then up to 85% of your SSDI benefits are taxable. It is important to remember that the percentages relate to the amount of taxable income and not your marginal tax rate. Your disability benefits will be taxed at your normal marginal rate. For most people, this falls somewhere between 10% and 28%.

Pennsylvania is one of a small number of states that taxes Social Security disability benefits. The same figures apply when determining your state tax obligation. The experienced Philadelphia Social Security benefits lawyers at Young, Marr, Mallis & Associates are available to answer your questions or concerns regarding your benefits.

Recommended Reading: How To Get Tax Exempt Status For Nonprofit

Don’t Miss: How Much Do You Need To Make To Pay Taxes

How Does The Cola Affect The Program

Social Security is funded by current workers paying for current beneficiaries. Due to demographic changes in the coming years, there will be a decreasing number of workers paying for an increasing number of beneficiaries. This means that the Social Security trust fund could face a funding shortfall with too few workers paying for too many beneficiaries.

The Social Security Administration forecasts that in 2034, the Social Security trust fund will be depleted and that retirees will only receive 77 percent of their benefits if Congress doesn’t take action before then to resolve the funding issue.

The 8.7% COLA adjustment could expedite how fast the trust fund is depleted, according to Shai Akabas, Director of Economic Policy at the Bipartisan Policy Center.

However, there’s no specific projection on how the new COLA will affect the trust fund depletion date.

Rep Frank Ryan Introduced The 314

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

A state lawmaker has come up with a revised version of a plan he first introduced three years ago that would not only eliminate school property taxes but would make it illegal for a Pennsylvania school district to impose one.

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

Of course, the plan calls for some tax shifting to generate the $16 billion needed to replace the lost property tax revenue for schools. It also includes new taxes on certain retirement income and food and clothing.

Rep. Frank Ryan, R-Lebanon County, on Thursday unveiled his a 314-page House Bill 13 that is the product of five years of work and pulls in the expertise of a bipartisan working group of property tax elimination advocates.

Everybody wants to get rid of property taxes as long as the other person is the one who is going to pay the replacement tax, Ryan said at a Capitol news conference flanked by members of his working group. It is clear that any solution will require sacrifice on the part of all Pennsylvanians.

His plan tries to spread that burden around. It would:

Ryan acknowledges applying the tax on retirement income makes the sales pitch for his plan a tough pill to swallow, but said he believes Pennsylvanians will face that eventuality anyway.

Don’t Miss: How Much Is Sales Tax In New Mexico

How Do I Calculate Part Year Residency For Time I Resided In Cumberland County Taxing Jurisdiction

To calculate your prorated portion of wages, earned income tax withheld and unreimbursed business expenses please use the following formula.

Total W2 income divided by number of months you worked for that employer times length of time you lived in Cumberland County Tax Bureau jurisdiction.

Example: Wages $12,000.00/worked 7 months x 4 months living in Cumberland County = Taxable wages $6,857.00.

Example: Earned income tax withheld $192/worked 7 months x 4 months living in Cumberland County = Earned Income tax withheld credit $109.00.

Example: Expenses $1,000 / worked 7 months x 4 months living in Cumberland County=Unreimbursed Expenses Credit $571.00.

Read Also: Doordash Taxes How Much

Taxation Of Social Security Disability Backpay

SSDI benefits are often delayed. Therefore, if you qualify, you will likely receive a lump-sum payment for the back payments you are owed. A large lump-sum benefits payment could significantly impact your taxable income for the year in which you receive it.

Fortunately, there is a way to avoid losing a substantial part of your benefits through taxes. Under the current federal tax laws, you are allowed to apply your SSDI benefits owed from a prior year to that years tax returns, lowering your taxable income for the year in which you received the lump-sum payment. For example, if you were owed 18 months of disability payments and received it in one lump sum, you could amend your previous years return to spread the benefits income over your two returns. If you have any questions, contact our Berks County Social Security Disability attorneys.

Read Also: How Much Is Tax In Washington State

Taxation Of Disability Benefits

Beneficiaries in Pennsylvania will have their disability benefits taxed if their household incomes surpass the programs limits. The IRS taxes 50 percent of individual and married couple’s SSA benefits at normal tax rates if their incomes exceed $25,000 and $34,000 respectively. Eighty-five percent of their disability benefits are subject to taxation if an individual’s income top $34,000 and married couples earn over $44,000.

References

Overview Of Pennsylvania Retirement Tax Friendliness

Pennsylvania fully exempts all income from Social Security, as well as payments from retirement accounts, like 401s and IRAs. It also exempts pension income for seniors age 60 or older. While its property tax rates are higher than average, the average total sales tax rate is among the 20 lowest in the country.

To find a financial advisorwho serves your area, try our free online matching tool.

| Annual Social Security Income |

Read Also: One Becomes Eligible For Social Security Disability

Also Check: How To Get My Unemployment Tax Form

Nys Pension Taxation Requirements By State

Will Your NYS Pension be Taxed If You Move to Another State?

If you are considering moving to another state, you should be mindful of the fact that states often enact, amend, and repeal their tax laws please contact their Revenue Agency yourself to verify that the information is accurate. The following taxability information was obtained from each states web site.

We also strongly recommend that you do some further preparation, such as discussing the matter with your tax advisor, before making important decisions that may affect the taxability of your pension and other retirement income.

Information updated 2/24/2022.