Volunteer Income Tax Assistance Program

United Ways Free Tax Preparation program helps low- to moderate-income households meet their basic needs and build financial assets. Residents who earn a household income of $66,000 or less can have their federal tax returns prepared, e- filed and direct deposited for FREE by United Ways Volunteer Income Tax Assistance program.

United Way IRS-certified volunteers who are passionate about taxes will prepare your return and determine if you are eligible for the Earned Income Tax Credit , Child Tax Credits, Childcare Credits and/or Education Credits when you file.

We do simple returns. We cannot do returns that have rental income or self-employment income at a loss, with expenses that exceed $35,000, or with employees. Please call to see if you qualify.

United Way Offering Free Tax Return Assistance Beginning On Jan 31

If Beaver County residents find themselves struggling to file their taxes this season, one local organization is extending a helping hand with the process at the end of the month.

United Way of Beaver County will be offering a limited number of appointments with AARP Tax-Aide in Chippewa and New Brighton from Jan. 31 to April 13. The service is intended to offer free help for taxpayers with low and moderate-income by providing trained tax preparers for the community.

Two appointments will take place throughout the process, with the first meeting with tax preparers being used to scan all of the important tax documents needed. Exactly two weeks later, participants will review and pick up their tax returns from the same location.

The tax preparation will begin on Jan. 31 in New Brighton at the Circle of Friends building at 1851 Third Ave., taking place every Monday from 9 a.m. to 1 p.m. On Feb. 2, appointments will also start to be held on Wednesdays from 9 a.m. to 1 p.m. in Chippewa Township at Pathway Church, 239 Braun Road.

Residents can begin scheduling appointments at 9 a.m. on Jan. 18 by calling the United Way office at 724-774-3210. Employees will help schedule appointments during office hours Monday through Friday from 9 a.m. to 3 p.m. until all available slots are filled. They ask that callers do not leave messages.

Tax Time: Free Tax Prep And Financial Resources

If individuals and families are to obtain long-term financial independence, they need tools and resources to help them maximize their income and build assets.

Recognizing the EITCs potential benefit to individuals, families and communities, United Way of Central Ohio partnered with Columbus City Council and the Franklin County commissioners to launch the Franklin County EITC Coalitionnow Tax Timein October 2006.

Each year, Tax Time supports free tax assistance sites throughout Columbus between January and April. In 2013, 47 sites prepared 14,530 tax returns, resulting in $14.8 million dollars in refunds and savings of more than $3.6 million to taxpayers who may have otherwise used a paid tax preparer.

Tax Time works collaboratively to maximize community resources that promote economic self-sufficiency. The program raises awareness of the EITC, provides access to free, high-quality tax assistance and connects people to a network of services, including financial education opportunities that help them plan for their future.

Tax Times lead partners include AARP, LSS 211 Central Ohio, Legal Aid Society of Columbus, The Ohio Benefit Bank , and United Way of Central Ohio. For more information, go to

You May Like: What States Have The Lowest Sales Tax

Helping Families Work Toward Financial Stability By Providing Free Tax Assistance

United Ways Volunteer Income Tax Assistance program offers free in-person tax preparation for families and individuals with income of $60,000 or less. Tax prep sites are located throughout the Greater Richmond and Petersburg region.

Our work is made possible with the support of the Internal Revenue Service VITA Grant and Virginia Community Action Partnership.

In addition to in-person services, we also now offer Virtual VITA Online Tax Filing Assistance. Our program offers a 100% online tax preparation from the comfort and security of home. This service requires that filers have access to the internet and a camera through a smart phone or a tablet.

How Does Virtual VITA work?

Am I eligible for Virtual VITA?

This program is available to any taxpayer:

- With a valid email address and phone number.

- With an income below $60,000.

- With a current SSN or ITIN.

- Please note that all customers are required to provide us with a valid government-issued ID for each taxpayer, social security card/ITIN paperwork for all individuals listed on the tax return, and all tax documents.

What is GetYourRefund?

What To Bring To Your Appointment:

- COVID-19 Precautions are in place at all sites social distancing, as well as masks and face coverings are required.

- Valid drivers license or proof of identification

- Social Security cards and birth dates for you, spouse and/or dependents

- A copy of last years tax return

- 2020 Stimulus Payment amount

- Wage and earning statements

- Interest and dividend statements

- Total amount you paid for day care and the day care providers tax ID number

- Your spouse, if married and filing jointly, to sign the required forms

- Bank routing/account numbers for direct deposit

- Individual taxpayer ID Number letter

- Any IRS correspondence received in last 2 years.

Recommended Reading: How To Efile Your Tax Return

An Added Boost For Families With Children And Working Individuals

Through the new Child Tax Credit passed last spring, families are eligible to receive up to $3,600 for each child in their care under the age of 6 and up to $3,000 per year for children ages 6 to 17. Most families are eligible for this new Child Tax Credit, including families in which the adult is not the childs biological parent, families that donot usually file taxes, and families with low/no earnings.

The first half of this credit was paid out in regular monthly payments from July through December 2021. Families received $300 per month, per child younger than age 6 and $250 per month, per child age 6 to 17. To receive the second half of the credit, families must file taxes in 2022.

If youdidnt receive your monthly payments,its not too late to claimyourChild Tax Credit! Families who did not receive theirmonthly payments in 2021 can still claim the entire credit by filing taxes in 2022.

The Earned Income Tax Credit gives working individuals with low to moderate incomes more money in their pockets at tax time. Families with and without children are all eligible for the credit, though the amountdepends on income and family situation.Last year, nearly 80,000 Detroiters claimed a total of nearly $240 million in EITC.

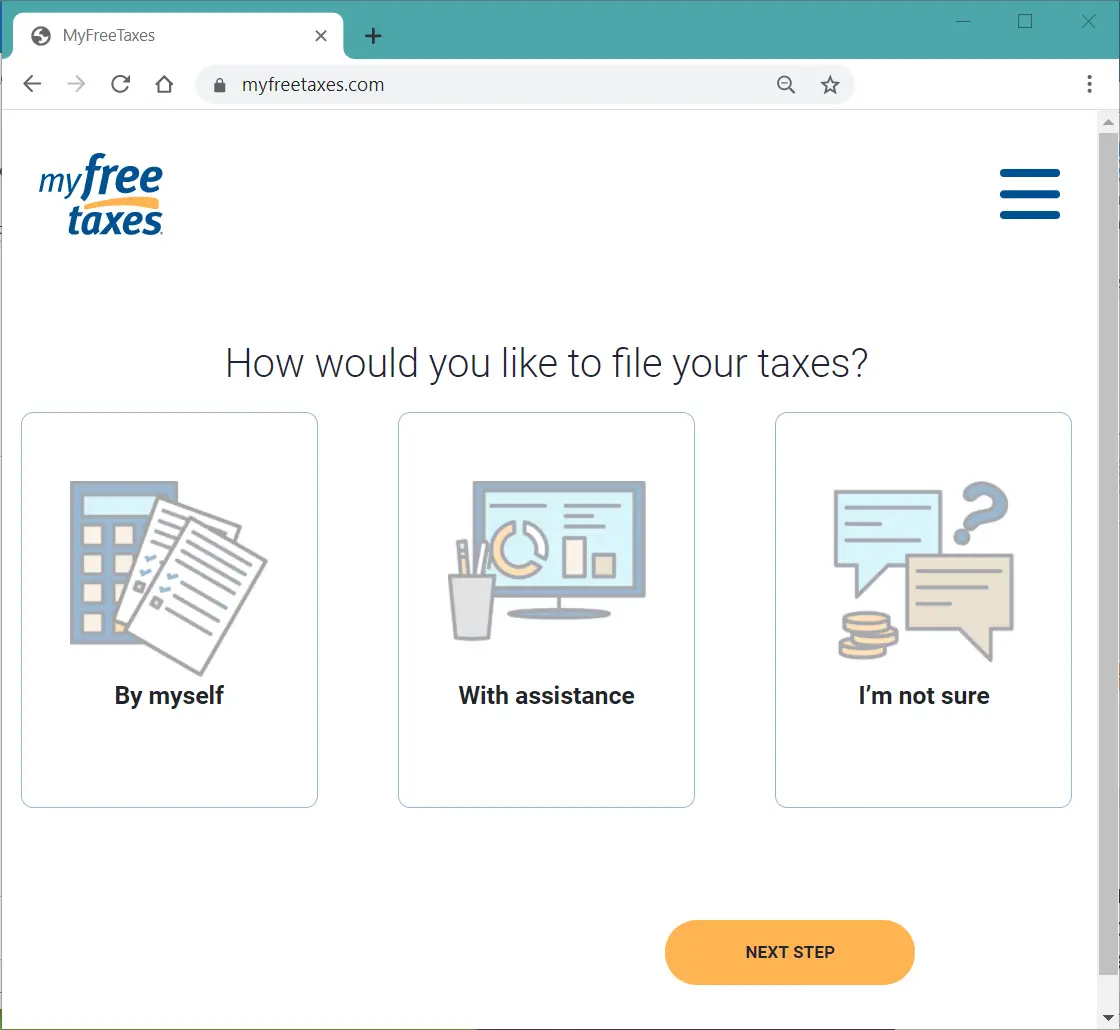

Dont miss out on claiming your credit! File your taxes online atMyFreeTaxes.comorfor more information on tax preparation services.

What Kind Of Returns Can Be Prepared By Free Tax Help

Free Tax Help can handle most returns, including self-employment and for international students. However, some returns are considered out-of-scope, per IRS regulations. Returns with the following cannot be prepared at Free Tax Help sites.

- Income/loss from rental property

- Affordable Care Act: Parts IV and V of Form 8962

- The following types of business returns:

- Business expenses in excess of $25,000

- Business showing a net loss

- Business use of home expenses

- Prior year disallowed passive activity loss

Don’t Miss: When Do My Taxes Have To Be Done

Lets Take Things Step

What if I want to do my own taxes?

Theres help for that, too. For people who want to prepare their own taxes, UWCA provides free software.

If theres someone whos got a simple return and is knowledgeable, we can connect them with free software to prepare their state and federal return. Many resources are only free for federal, but we have resources that are free for state as well.

Judy Allen

Theres more where that came from when it involves free tax assistance at UWCA

Your Household Qualifies If You Earned $66000 Or Less Last Year

United Way Worldwide and Cricket Wireless are partnering to offer FREE tax filing assistance via MyFreeTaxes.com at select Cricket authorized retail stores across the country throughout February and March. MyFreeTaxes is a free, safe and easy way for households earning less than $66,000 to file federal and state taxes. In addition to the in-store offering of MyFreeTaxes, Cricket is further supporting United Ways fight for the financial stability of every person in every community through a $50,000 donation.

We strive to alleviate some of the stress associated with tax filing by offering tools and support from United Way at some of our neighborhood stores, said Tiffany Baehman, Chief Marketing Officer, Cricket Wireless.

Since 2009, MyFreeTaxes has helped almost one million taxpayers claim every tax deduction and credit for which they are eligible. The website is mobile-optimized, enabling filers to do their taxes from their phone or tablet. Most filers complete their taxes in under an hour, and specialized forms are available for self-employed filers.

Recommended Reading: Do You Need Bank Statements To File Taxes

Here To Help: United Way Kicks Off Annual Free Tax Preparation Service

RICHMOND, Va. With the April 18 tax-filing deadline just 11 weeks away, United Way of Greater Richmond & Petersburgs Volunteer Income Tax Assistance program officially begins this week.

In its 19th year of operation, United Ways free tax preparation service is offered to area families with household incomes of less than $58,000. Because of the expanded Child Care Tax Credit and changes to the Earned Income Tax Credit, many households will be eligible for increased returns. This program will help low- and moderate-income families navigate the changes and maximize their tax refund.

Tax season can be a make-or-break time of the year for families and individuals making less than $58,000, said James Taylor, president and CEO of United Way of Greater Richmond & Petersburg. For nearly two decades, our Volunteer Income Tax Assistance program has been one of our organizations most impactful programs. We are ready for another busy tax season helping those in our community.

The program will use a combination of 13 tax sites across Chesterfield, Charles City, Goochland, Henrico, Petersburg and Richmond as well as online tax preparation services. Sites will follow social distancing guidelines and require masks. Hours of operation are subject to change in order to comply with CDC guidelines. The in-person tax sites will operate by appointment only, and spaces may be limited. The participating tax sites are listed on United Ways website.

About Free Tax Preparation

United Way’s Campaign for Working Families offers FREE income tax assistance through IRS trained and certified volunteers for low to moderate income families and individuals earning up to $54,000 annually. Last year over a half a million dollars worth of tax prep fees was saved by Volusia/Flagler residents thanks to Campaign for Working Families. Volunteer tax assistants are trained to help families get the most out of their return by checking for available credits and deductions including the EITC and child care credits.

You May Like: Where Can I Find My Real Estate Taxes

Frequently Asked Tax Questions:

Where can I file my taxes for free?

Our VITA Site will begin preparing returns on Monday January 31st 2022. To schedule an appointment simply dial 2-1-1 to schedule your appointment through our Scan N Go process.

File at home for FREE with myfreetaxes.com

Find other free filing options at getyourrefund.org or visit the IRS website

What do I need to bring to my VITA appointment?

After you’ve set up your appointment with VITA,make sure you bring the following documents with you.

How do I get a copy of my 2020/2021 tax return?

Existing VITA clients can contact the VITA Team, call the VITA Line at 734-258-1447, or email and we will mail you a copy of your tax return.

You can also request a transcript through the IRS website if your return has already been processed.

How can I get proof that I filed previous tax years?

Existing VITA clients can contact the VITA Team, call the VITA Line at 734-258-1447, or email and we will mail you a copy of your tax return.

You can also request a transcript through the IRS website.

Where’s my refund?

The IRS is experiencing significant delays processing returns due to tax legislations updates in the American Rescue Plan.

Check the status of your Michigan tax return.

If we filed your return and you need assistance, please call 734-258-1447 and leave a message.

I received a letter from the IRS and/or Michigan Treasury, what do I do?

Visit the IRS Eligibility Assistant to find out if you qualify.

What If I Earn More Than The Income Limit

If you earn up to $73,000, you may be eligible to try preparing your taxes for free yourself at MyFreeTaxes.com

In accordance with federal law and the Department of the Treasury Internal Revenue Service policy, discrimination against taxpayers on the basis of race, color, national origin , disability, sex , age or reprisal is prohibited in programs and activities receiving federal financial assistance.Taxpayers with a disability may request a reasonable accommodation and taxpayers with limited English proficiency may request language assistance to access service.

Volunteer Income Tax Assistance is a free tax preparation service provided by United Way of Denton County in partnership with: City of Denton, City of Pilot Point, City of Sanger, Denton Public Library, Pilot Point Community Library, Sanger Public Library, Texas Womans University, University of North Texas

Volunteer Income Tax Assistance is provided with the generous support of Wells Fargo Bank, the Internal Revenue Service, and Inwood National Bank.

Read Also: Does Walmart Offer Tax Services

About Free Tax Prep Services

Free Tax Prep, an initiative of United Way of Greater Cincinnati, provides free income tax preparation and filing services. Funded by the IRS and powered by volunteers.

We offer services including preparing and filing your taxes on your behalf or supporting you in preparing and filing your taxes on your own.You can connect with Free Tax Prep online or in person. All in-person services have been modified to limit contact and ensure safe distancing during the COVID-19 pandemic.

To determine the best Free Tax Prep Service for you, whether it’s in-person or virtual, call United Way of Greater Cincinnati’s or .

Simplify More Access More

At United Way for Southeastern Michigan, we work to help households become more stable. Part of that effort includes helping people boost their family finances and keep more of what they earn. Increased refunds can help families start a savings account, pay bills or make important purchases.

We found that a lot of people fail to claim the credits theyre entitled to simply because taxes are complicated, or because they dont know that they qualify, Megan said. We focus on simplifying the process so that families in our region can get more money back in refunds.

When we unite with other organizations toward common goals, were able to make a major difference in local communities, Megan said.

You May Like: How To Pay My Taxes

What Do I Need To Bring To Receive Free Tax Help

Required:

- Both spouses, if filing jointly

- Picture ID for taxpayer

- Social Security card for each person listed on the return

- Proof of income, like W2s and 1099s

- Documentation of expenses

- If anyone in the household is insured through the Marketplace, Form 1095-A and dependents proof of income

Recommended:

- Account and routing numbers for direct deposit of refunds

- Prior year tax return

Acceptable Alternatives for Social Security Card:

- Social Security Benefit Statement

- Military ID with Social Security number

- Any document issued by the Social Security Administration with Social Security number last four digits must be visible

- A printout from mySocialSecurity with the last four digits of your Social Security number visible

- Please note: Per IRS regulations, a return cannot be prepared without the required documents. Prior year tax returns do NOT satisfy document requirements.

Claim Your Refund Online

MyFreeTaxes creates a win-win for working families by eliminating tax prep fees and ensuring maximum refund amounts, said Megan Thibos, Director of Economic Mobility initiatives atUnited Way for Southeastern Michigan. With these savings, families can pay off debt, build a financial safety net or simply have more money to put toward basic needs like food and utilities.

The program is made available thanks to a partnershipwithUnited WayWorldwide.MyFreeTaxesis available free to individuals ofanyincome. It uses the sametax filing software that professionals use, in an easy, question-and-answer format. You can use MyFreeTaxes toe-fileyourstate,federal, and localreturns for free online,atyour convenience.

Also Check: Can You E File Arkansas State Taxes

Tax Filing Information For 2022

Your options include:

The new tax filing deadline is April 18, 2022

United Way of Central Ohio has teamed up with GetYourRefund.org/uwco to help you file your taxes online with the help of certified VITA volunteers.

GetYourRefund is a nonprofit service built by Code for America in partnership with IRS-certified Volunteer Income Tax Assistance sites nationally. Code for America is a nonprofit technology organization dedicated to making government work for the people who need it most.

Its easy and free:

Bookmark this page as we will have updated information on the status of free tax preparation services in central Ohio.