Claim Your Business Write

If you have freelance income or a side hustle, business write-offs are the only way to directly lower your self-employment taxes. The simple definition of a write-off is any work-related cost thatâs ordinary in your industry and necessary for completing the job.

Oftentimes, people hesitate to claim business write-offs because they picture conventional things like computers, software, and office supplies that might not apply to them. But whatâs traditional in one industry might not be traditional in another.

A pet groomer, for instance, probably doesnât need a postage scale, but they do need shears, pet shampoo, and treats. Similarly, a freelance photographer probably doesnât need a fax machine, but they might need ring lights, props, and multiple camera lenses.

Donât miss out on write-offs because youâve boxed yourself in. You know what you need to get the job done, so write-off those costs! And if you need some inspiration, check out our freelance tax deductions tool that lists common write-offs for more than 25 different jobs, from real estate agents to bloggers.

What Is A Tax Credit And How Does It Work How Do You Get A Tax Credit

Tax credits differ from deductions and exemptions because credits reduce your tax bill directly. After calculating your total taxes, you can subtract any credits for which you qualify. Some credits address social concerns for taxpayers, like The Child Tax Credit, and others can influence behavior, like education credits that help with the costs of continuing your education.

There are numerous credits available for a wide range of causes, and all reduce your tax liability dollar for dollar. That means a $1,000 tax credit reduces your tax bill by $1,000. Reviewing all the options may be time-consuming, but could also prove to be profitable.

Some major tax credits are:

- Foreign tax credit

- Residential energy credits

Overpayment To The Irs

If you realized you made a mistake when you filed your taxes and overpaid, you can fix this problem. The first thing you do is a double check that you did overpay. If you found out you did overpay on your taxes, start the process of amending your tax return. You should fill out and submit a Form 1040X if you filed individually. Once this is submitted, fax or mail this into the IRS. The IRS will double check that this information is correct and if it is they will send you a check for the overpayment amount. It will take 8 to 12 weeks for you to get this check. There are three things to keep in mind when you’re filing an amended return, and they are listed below.

- You have three years to file an amended return

- Your amended return must be filed on paper electronic filing is not allowed.

- If you’re filing a return for the current year, wait to get that back before you file an amendment.

Don’t Miss: What Does Tax Topic 152 Mean

H& r Block Tax Refund Calculator

An increasing number of people are turning to H& R Block to get their income tax prepared and filed every year. Their user-friendly tax tools take all the hard work and stress out of tax form preparation and will always get you the largest refund.

One popular tool is the H& R Block Tax Refund Calculator. This online calculator will help you see what amount you can expect back in your tax refund.

Just answer a few simple questions about your life, income, W2, and expenses, and our free tax refund estimator will give you an idea of how much youll get as a tax refund.

H& R Block has been helping Americans with their taxes since 1955. Their online tax software is rated #1.

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

Also Check: What Is Tax Resolution Services

Why The Irs Issues Refunds

Your employer determines the rate of your withholding tax by calculating your income, personal allowances, and other taxes you want to be withheld, as listed on your W-4 form.

Sometimes, however, your rate of withholding tax is greater than your actual tax liability, or the amount of tax you have to pay. This is why the IRS issues tax refunds to taxpayers, who qualify at the end of each tax season.

Work Out How Big Your Tax Refund Will Be When You Submit Your Return To Sars

INCOMEOTHER INCOMETAX PAIDTo get this refund you need to fill out your tax return 100% correctly.Please note that this is only an indicator of an estimated refund.TaxTim cannot be held liable for this refund not being received.Get SARS Tax Dates and Deadlines in your InboxDo your Tax Return in 20 minutes or less!TaxTim will help you:

Also Check: Where Can I Drop Off My Taxes

In Person Tax Preparation Agencies & Tools

If you’re leery of filing your taxes on your own, several agencies will submit them for you. You call and schedule an appointment and bring all of your required tax documents with you. The tax preparer will look everything over and input it into their system. They will ask you questions about your filing status and any dependents, along with deductions.

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.

Read Also: When Should I Get My Taxes

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

You May Like: How To File 2 Different State Taxes

General Information Tips And Tools For Successfully Filing Taxes

It’s tax time once again, and for many people, this can mean anxiety. Thousands of people each year file their taxes for the first time. This task can be very daunting to anyone who has never had to file or has never filed on their own before this year. There is a multitude of tools and websites available to make this process an easy one, no matter what your technical knowledge is. This article will act as your ultimate guide to successfully filing your taxes. We will go over the documents you will need, tools you can use to file, tax experts who can help you, what forms to fill out, and how to handle things like overpayments, overdue amounts, and filing extensions.

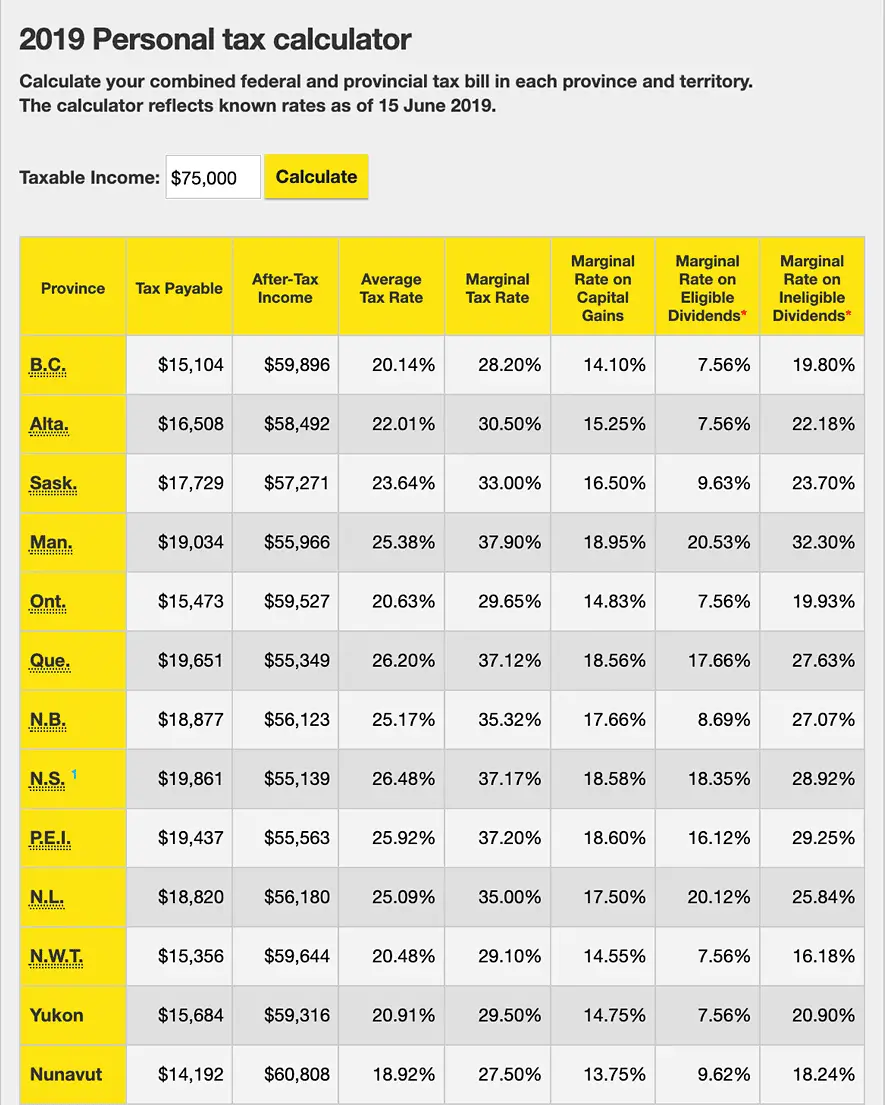

How Do State And Federal Taxes Affect Your Refund

In addition to federal income tax, you may also pay state income taxes depending on where you live. You wont pay state income tax if you live in one of these eight states: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

New Hampshire doesnt tax wages, but does tax dividends and interest, though recent legislation has been passed to phase out this tax beginning in 2024.

If you live in one of the other 41 states, youll need to file a state tax return in addition to your federal tax return. The IRS website contains a directory to help you find information on your states tax requirements.

Key Differences Between State and Federal Taxes

- State tax rates are typically lower than federal tax rates.

- States can have different types of tax credits and deductions.

- The amount of tax withholdings will vary for state and federal taxes.

Read Also: What To Bring To The Tax Preparer

Notable Factors Included In Our Calculations

This calculator only considers your W-2 and self-employment income. It doesnât factor in income from other sources, like investments, rental income, or retirement income.

Note that the calculator:

- Includes a projected Qualified Business Income Deduction on your self-employed earnings

- Doesnât account for tax deductions or credits

How The Progressive Tax System Works

âThe easiest way to understand the progressive tax system is to think of income in terms of buckets. The first bucket of income is taxed at 10%, the second at 12%, the third at 22%, and so on.

For example, letâs say you have gross wages of $50,000. The first $10,275 is taxed at 10%, the next $31,500 is taxed at 12%, and the remainder of your salary is taxed at 22%. So your total tax liability would be broken down like this:

These buckets are called âtax brackets.â The idea is to treat everyone equally while still requiring higher taxes from higher earners.

For instance, the first $10,275 that Jeff Bezos makes is taxed at 10%, just like everyone else. The only chunk of his income that is taxed at the highest rate is the income in excess of half a million dollars.

You may have heard the terms âmarginalâ and âeffectiveâ tax rates thrown around. Your tax rate simply refers to the highest tax bracket your income is exposed to. So using the example above, where you made $50,000, your marginal tax rate would be 22%.

But as weâve learned, the majority of your income isnât taxed at 22%. So the effective tax rate is used to describe the average rate that you actually pay. Using the example above, your effective tax rate would be 14%. Thatâs the average of 10, 12, and 22: 10 + 12 + 22) / 3 = 14.

Recommended Reading: How To Live Without Paying Property Taxes

Turbotax Tax Refund Calculator

An excellent tool is the TurboTax tax refund calculator. Just enter your information and get an estimate of your tax refund. The graphics and sliders make understanding taxes very easy, and it updates your estimate as you add in information.

Estimating your tax refund or balance owed does not have to be complicated. Online tax calculators make it easy for anyone. All you have to do is answer some basic questions, and the calculators provide you with an estimate. Most people find that using the tax refund calculator only takes them about 5 minutes.

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Read Also: What Is The Property Tax In New York

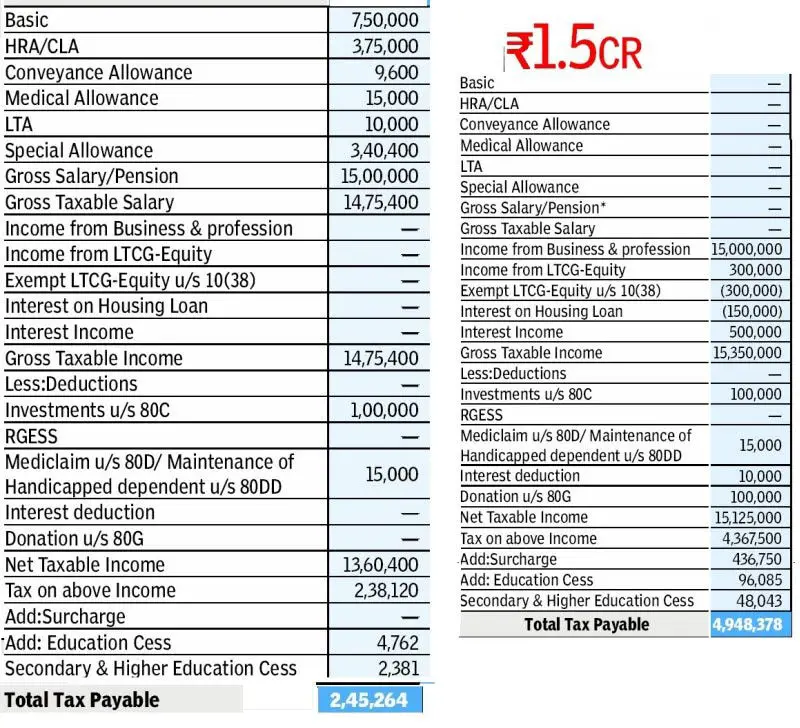

Will I Get A Tax Refund If I Make 60000

What is the average tax refund for a single person making $60,000? A single person making $60,000 per year will also receive an average refund of $2,593 based on the 2017 tax brackets. Taxpayers with a $50,000 or $60,000 salary remain in the same bracket.

How do I calculate my 2020 refund?

You can also use the Wheres My Refund tool on the IRS website. To check your refund status, you will need your social security number or ITIN, your filing status and the exact refund amount you are expecting.

How To Make An Estimated Payment

We offer multiple options to pay estimated taxes.

- Individual online services account. If you don’t have an account, enroll here. You’ll need a copy of your most recently filed Virginia tax return to enroll.

- 760ES eForm. No login or password is required. Make sure you choose the correct voucher number.

- ACH credit. Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

See all options to file and pay estimated taxes.

Electronic filing requirement

You must submit all of your income tax payments electronically if:

- Any installment payment of estimated tax exceeds $1,500 or

- Any payment made for an extension of time to file exceeds $1,500 or

- The total income tax liability for the year exceeds $6,000

If any of the thresholds above apply to you, all future income tax payments must be made electronically.This includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed.

You May Like: How To File An Extension Online For Taxes

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

Recommended Reading: When Are Taxes Due For 2021