Q& a: Is It Against The Law Not To File A Tax Return

If income taxes are owed, filing a tax return is required and failing to file is punishable by up to a year in jail. However, if no income taxes are owed or a refund is due, filing is not a requirement. So, the answer to this question really depends on if the taxpayer owes income taxes.

If your gross income amounts to more than the standard deduction amount for your filing status, then you are typically instructed to file a tax return. If you fail to file a tax return and you owe taxes, you can face failure-to-file penalties. There are also failure-to-pay penalties for not paying taxes owed in full, although they’re generally less than those penalties for failing to file. For this reason, even if you can’t afford to make your tax payment, you should still file your taxes in order to avoid late filing fees.

Popular Prior Year Forms Instructions & Publications

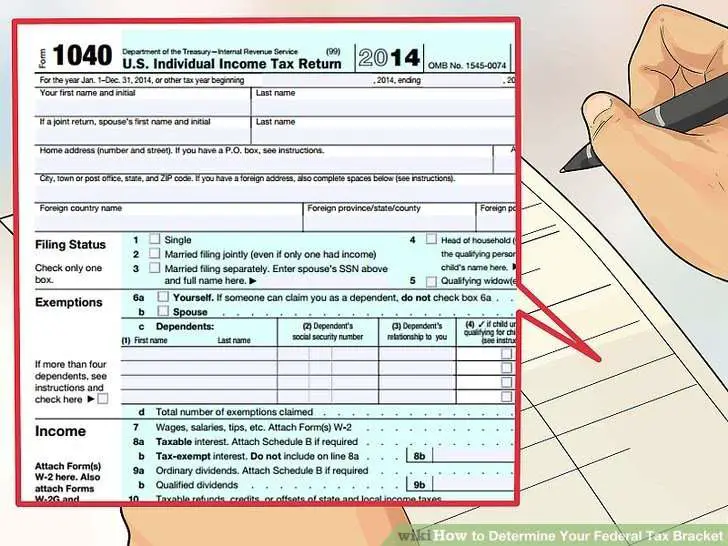

Form 1040

US Individual Income Tax Return for Tax Year 2021. Annual income tax return filed by citizens or residents of the United States.

Publication 17 PDF

Form 1040

US Individual Income Tax Return for Tax Year 2020. Annual income tax return filed by citizens or residents of the United States.

Form 941

Employer’s Quarterly Federal Tax Return for 2021.For Employers who withhold taxes from employee’s paychecks or who must pay the employer’s portion of social security or Medicare tax .

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Find Sales Tax

How Do I Request Prior Year Federal Tax Returns

OVERVIEW

You can request prior tax returns, for a fee, from the IRS.

If you cant find one of your old tax returns, theres no reason to worry. The IRS can provide you with a copy of it if you prepare Form 4506. The IRS keeps copies of all returns you file for at least seven years. However, if the tax return you want is older than this, theres a possibility it may not be available.

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

You May Like: Should I Itemize My Taxes

How About Checking The Status Of An Amended Tax Return

You can use the Wheres My Amended Return IRS tool. This tool shows updates for amended returns for current years and up to three prior years. However, it is recommended that you wait three weeks after mailing your return to retrieve the most accurate status update. Before opening the tool, youll want to make sure you have a few bits of information on hand:

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

You May Like: How Much Federal Income Tax Should Be Withheld

Create And File Prior Year Tax Returns

Go to our Access Prior Year Tax Returns webpage for a list of available Online and Desktop programs for previous years.

Note. TaxAct does not provide archived copies of returns filed through the TaxAct Desktop or TaxAct Professional Editions. If you no longer have access to your saved return file, you can receive a copy of a successfully-filed return from the IRS by calling 800-829-1040. For more information, go to the IRS Topic No. 156 Copy or Transcript of Your Tax Return How to Get One webpage.

If you were a prior year TaxAct Online user and did not finish your prior year return, or if you need to start a new return for a previous tax year, you can still prepare and print your return using our TaxAct Online service.

To access an existing return, you need to know the tax year, username, and password that you set up for your account at the time of registration. Go to the Prior Year Returns webpage and select the year you wish to access to start a new return or sign-in to an existing return.

Prior year returns may be electronically filed by those using the TaxAct Professional program or by those using the TaxAct Business Consumer program.

While the IRS now allows year-round electronic filing with the new MeF system, they do shut down for a short period for maintenance each year from later in November to some time around the end of January.

Was this helpful to you?

To Request A Copy Of Your Previously Filed Tax Return:

- Complete the Request for Copy of Tax Return

- There is a $5 fee for each return you request. Full payment must be included with your request. Make check or money order payable to the Virginia Department of Taxation. Do not send cash.

Send to:Richmond, VA 23218-1317

Please allow up to 30 days to receive a copy of your return.

All requests go through an approval process to be sure that copies are sent to the rightful taxpayer or authorized representative. If youre requesting a copy of a return for a business, be sure youre authorized to act on behalf of that business. We will send you a refund of the fee for any return we cant provide. Allow 30 days for the refund to be processed.

Don’t Miss: How To Get Your Unemployment Tax Form

What Is A T1 General Form

The T1 General Form is also called the Income Tax and Benefit Return. It is the document used by Canadians to file their personal income taxes. The form is a summary of all the other forms you complete for your income taxes and is made up of your provincial or territorial tax , your total income, your net income, your tax payable, your deductions, your non-refundable credits, and more. When you file your taxes, this form is used to apply for benefits like the Canada Child Benefit, or refundable , such as the GST/HST tax credit.

You may not recognize the name of the form because when youre using TurboTax to complete your income taxes, it fills out the form for you, without you actually having to print off the paper form and fill it out.

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

Don’t Miss: What Do College Students Need To File Taxes

How Do I Get My Actual Tax Return

IRS tax transcripts are not photocopies of your actual tax return with all the forms and attachments.

-

If you want an actual copy of an old tax return, youll need to complete IRS Form 4506 and mail it to the IRS.

-

Theres a $43 fee for copies of tax returns , and requests can take up to 75 days to process.

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Recommended Reading: Can I File Taxes Without All My W2s

Go Online And Use The Wheres My Refund Irs Tool It Works

Although the IRS Wheres My Refund tool is available to check the progress of your return, it only applies to the tax return you filed for the mostcurrent tax year.

For example, lets say you file your 2013 tax return and soon after remember to file your late 2012 return. Although you filed your 2013 taxes before your 2012, 2013 is going to be the one that the IRS site shows the status for since it is the most recent tax year in their database for you.

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

You May Like: What If I Already Paid Taxes On Unemployment

Let’s Track Your Tax Refund

Within 2 days of e-filing, the IRS may accept your return and begin processing it.

Within approximately 2 days of acceptance, the IRS will process your tax refund.

Refund sent or deposited by IRS

You should receive your tax refund from the IRS within 19 days* after acceptance. If you have not received it by this time, contact the IRS for assistance.

You can also check your refund status directly with the IRS’ Where’s My Refund Tool.

Still waiting on your refund?

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Don’t Miss: When The Last Day To File Taxes 2021

Transcript Of Return From The Irs

Cost: FreeProcessing Time: Instantly online or 5 to 10 business days by mail

You can request an IRS transcript of your tax return from the IRS website. A transcript includes items from your tax return as it was originally filed and will meet lending or immigration requirements.

There are three ways to request a transcript:

If you’d like to have a record of any changes made to your original tax return by the IRS or through subsequent amendments, you’ll need to request a Tax Account Transcript by calling the IRS at 1-800-908-9946.

If You Choose Direct Deposit

Your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

All timing is based on IRS estimates.

You May Like: When Can I Get My Tax Refund

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

So How Do You Check Your Prior Year Tax Refund Status After Mailing Your Return To The Irs

Brace yourselves as many of you arent going to like Plan B. Youll need to call the IRS. Of course, you dont want to mail your return and call on your lunch break the following day. The IRS insists that you wait it out for at least 6 weeks after mailing your return to call and check on the status. When you call, make sure you have the following handy:

- filing status

- exact refund amount

You can call 1-800-829-1040 and follow the prompts for a live representative. The person that you speak with will have direct access to your tax return and be able to provide you with a status update.

Tip: Request a tracking number when mailing your return. Itll give you peace of mind to know that it arrived safe and sound.

You May Like: Do You Pay Taxes On Social Security Disability

Get A Copy Of Your Notice Of Assessment

- Online:

-

View your notices of assessment and reassessment online. Sign in to access and print your NOA immediately.

Alternative:MyCRA web app

- Get a copy by phone

- Before you call

-

To verify your identify, you’ll need:

- Social Insurance Number

- Full name and date of birth

- Your complete address

- An assessed return, notice of assessment or reassessment, other tax document, or be signed in to My Account

If you are calling the CRA on behalf of someone else, you must be an

- Telephone number

-

Yukon, Northwest Territories and Nunavut:1-866-426-1527

Outside Canada and U.S. :613-940-8495

-

8 am to 8 pm Sat 9 am to 5 pm Sun Closed on public holidays

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

Don’t Miss: How To Know How Much Taxes You Owe

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.