How To Check Your Earning Records

You can access your Social Security earning records from the age of 18 and above by creating a MySocialSecurity account which will be linked to your payment history.

To access your records, you must first log into www.ssa.gov/myaccount, where you will find estimates of your retirement, disability and survivors benefits for the future.

Errors on your account must be corrected within just over three years or they could prevent Social Security funds being given to you.

To give some context as to where in the US you are likely to receive the most and least amount of Social Security benefits, the list below details the five states that are expected to see the highest average Social Security benefits in the following year.

How To File Taxes When Receiving Social Security Disability Payments

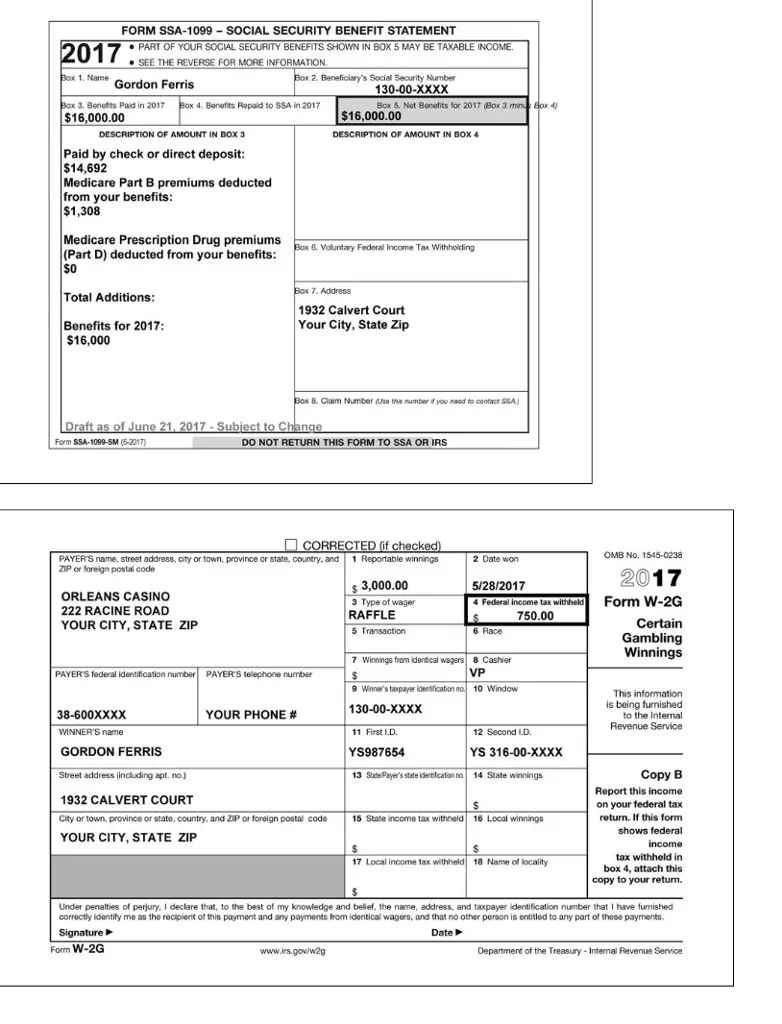

Each and every year U.S. citizens have to file taxes with the Internal Revenue Service . When you work for an employer, tax season is rather simple and straightforward. Your employer deducts taxes from your weekly paychecks and, at the end of the year, provides you with a W-2 telling you how much money you made and how much of that money went to the government. That information is then used to file your taxes with the IRS. Tax season isn’t so simple and straightforward for Social Security Disability beneficiaries, but it doesn’t have to be a financial nightmare. If you have begun receiving payments from the Social Security Administration , the following information will help you get through the upcoming tax season and will help you understand how to file your IRS tax return.

Where Do I Enter An Ssa

Forms SSA-1099, SSA-1099-SM, and SSA-1099-R-OP1 report retirement, disability, and survivor benefits from the Social Security Administration .

Don’t confuse the SSA-1099 with the 1099-R that reports retirement benefits from non-SSA sources like pensions, 401s, and IRAs. 1099-Rs are entered elsewhere in TurboTax.

All SSA-1099 forms get entered in the same place:

We’ll calculate what portion, if any, of your Social Security benefits are taxable. If your only income is from Social Security, you aren’t required to file a return.

Related Information:

Read Also: How To Buy Tax Forfeited Land

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 13 states that collect taxes on at least some Social Security income. Four of those states follow the same taxation rules as the federal government. So if you live in one of those four states then you will pay the states regular income tax rates on all of your taxable benefits .

The other nine states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 37 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, North Dakota, Vermont, West Virginia |

| Partially Taxed | Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah |

| No State Tax on Social Security Benefits | Alabama, Alaska, Arizona, Arkansas, California, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, Wisconsin, Wyoming |

Need A Copy Of Your Social Security Form For Tax Season Heres How To Get One

Getty

Looking for your tax forms, like your W-2 or 1099-MISC? Most tax forms should be in your mailbox or on their way – but if you dont have them in hand just yet, there are steps that you can take to make sure that you have what you need when its time to file.

If youre looking for your annual Benefit Statement from the Social Security Administration , youre in luck: things just got a little easier. Your form SSA-1099, Social Security Benefit Statement, or form SSA-1042S, Social Security Benefit Statement , should land in your mailbox by the end of January. But if you havent received your form yet and you live in the United States, you can print a replacement form online.

Simply click over to my Social Security on the SSA website. If you dont already have an account, click the button to start. If you already have an account, simply log in to your account to view and print the form.

To create an account, youll need to have the following information handy:

- A valid email address

- Your Social Security number and

- A U.S. mailing address.

Recommended Reading: Www Michigan Gov Collectionseservice

Get Ssa Benefits While Living Overseas

U.S. citizens can travel to or live in most, but not all, foreign countries and still receive their Social Security benefits. You can find out if you can receive benefits overseas by using the Social Security Administrations payment verification tool. Once you access the tool, pick the country you’re visiting or living in from the drop-down menu options.

As An Ihss Employee Who Do I Contact To Request A Duplicate/corrected W

The State Controllers Office does not provide W-2s for IHSS employees. Please contact the social worker or the local IHSS personnel/payroll office of the county where you work or worked to request a duplicate W-2. Go online and search for the county IHSS personnel/payroll office you service to get their phone number.

Read Also: How To Buy Tax Lien Certificates In California

Make Payments To The Federal Government

Learn how to use Pay.gov to make secure, electronic payments to government agencies from your checking or savings account. You can use the online service for VA medical care copayments, U.S. district court tickets, U.S. Coast Guard merchant mariner user fee payments, and more.

If you need help, contact Pay.gov customer service.

How Can I Get My Ssi Statement

Get a Copy of Your Social Security Statement

In respect to this, can I see my Social Security statement online?

You can get your personal Social Security Statement online by using your my Social Security account. If you don’t yet have an account, you can easily create one. Your online Statement gives you secure and convenient access to your earnings records.

Also, what is Social Security benefits statement? The Benefit Statement is also known as the SSA-1099 or the SSA-1042S. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return.

Hereof, why dont I get a Social Security statement anymore?

Last week the Social Security Administration announced it would no longer mail annual statements to workers in an effort to save money and drive citizens to its website. One answer is to wait: The SSA is working to provide these statements online, possibly by the end of the year.

How do I find my Social Security earnings record?

If you’re 18 years old or older, you can create a my Social Security account. At www.socialsecurity.gov/ myaccount, you can get your Social Security Statement to check your earnings record, and see estimates of future retirement, disability, and survivor benefits.

Read Also: What Does Locality Mean On Taxes

Find Out What’s Happening In Augustawith Free Real

· Get your benefit verification letter.

· Check your benefit and payment information.

· Change your address and phone number.

· Change your direct deposit information.

· Request a replacement Medicare card.

· Report your wages if you work and receive Social Security disability insurance or Supplemental Security Income benefits.

If you’re a non-citizen who lives outside of the United States and you received or repaid Social Security benefits last year, we will send you form SSA-1042S in the mail. The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income benefits.

Visit www.ssa.gov to find more about our online services.

What Wages Are Reflected On The Form W

The Form W-2 reflects wages paid by warrants/direct deposit payments issued during the 2020 tax year, regardless of the pay period wages were earned. The 2020 Form W-2 includes warrants/payments with issue dates of January 1, 2020 through December 31, 2020. The Form W-2 contains all wages and tax information for an employee regardless of the number of state agencies/campuses for which he or she worked during the tax year.

You May Like: How Much Does H& r Block Charge To Do Taxes

The Back Payment Issue

If you have just begun receiving Social Security Disability payments and you received a back payment from the SSA, you need to be very careful when filing taxes and claiming your back payment amount as income on your tax return. Back payments are usually paid as a lump-sum amount by the SSA. This does not mean, however, that you should claim the full amount on the tax return for a single year. If you do claim your back pay as a single year’s income, it will put you in a higher tax bracket and you may end up paying more taxes than you are actually liable for. Instead, you should file amended returns for the years that the back payment covered and only claim this year’s payment on your current year’s income tax return.

How Can I Get A Social Security Statement That Shows A Record Of My Earnings And An Estimate Of My Future Benefits

You can get your personal Social Security Statement online by using your mySocial Security account. If you dont yet have an account, you can easily create one. Your online Statement gives you secure and convenient access to your earnings records. It also shows estimates for retirement, disability and survivors benefits you and your family may be eligible for. To set up or use your account to get your online Social Security Statement, go to . We also mail paper Statements to workers age 60 and older three months before their birthday if they dont receive Social Security benefits and dont yet have a mySocial Security account. Workers who dont want to wait for their scheduled mailing can request their Social Security Statement by following these instructions. The Statement will arrive by mail in four to six weeks.

Important Information:

You May Like: How Much Does H& r Block Charge To Do Taxes

State Taxes On Social Security

There are 13 states which tax Social Security benefits in some cases. If you live in one of those statesColorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginiacheck with the state tax agency. As with the federal tax, how these agencies tax Social Security varies by income and other criteria.

If You Only Qualify For A Teachers Retirement System Pension

If you have never paid Social Security tax and only qualify for your teachers retirement, its likely youll never receive a Social Security benefit.

Although this makes perfect sense to some, others think its still pretty unfair that this isnt true for everyone. For example, if you had chosen to stay at home as the household manager, you would not have paid into the Social Security system. However, you would be eligible for spousal and survivor benefits.

These intricate Social Security regulations and how differently they may affect a workers retirement income make it critical that you plan ahead and prepare. Before you make your elections on your teachers pension, you must consider how your monthly cash flow would change with a spouses death.

As a teacher, you have plenty to keep up with and these complex rules on Social Security dont make it any easier. Thats why its important to have a quick and easy source of information at your disposal so can make the best decisions for you and your family.

You May Like: 1040paytax.com Safe

Social Security Statement: How To Get The Statement Online

All you need to know

Social Security benefits provide a partial replacement of income for those who are retired or disabled. Employers generally send a wage and tax statement on behalf of their employees tot he Social Security Administration.

While most people decide to wait until they’ve hit 70 to claim their benefits in order to maximise payments, it is possible to do so earlier, or to get a Social Security Statement in advance,

What You Can Do

As with many business problems, the best way to deal with a missing 1099 or lost W-2 is to not lose them to begin with. Of course, not much can be done to keep document issuers from making mistakes such as attempting to send a tax form to the wrong address. And, given human forgetfulness and the volume of documents required to operate a business, it’s likely that some lost paperwork will always be a feature of tax time.

However, there is much you can do to reduce the frequency and seriousness of the consequences of misplacing key forms. Scanning and digitizing paper receipts, backing up files and using cloud-based storage and remote servers can all help keep occasionally forgetful business owners from experiencing more than brief inconvenience from lost paperwork.

Even if flood or other disaster wipes out all a business’s records, these data safety practices can keep April from being any crueler than necessary. With that in mind, Hockenberry advises, Business owners should seriously consider off-site storage of important documents.”

A version of this article was originally published on March 13, 2014.

Read more articles on taxes.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

What Is The Ffcra And/or Efmla Reported In Box 14

Under the Families First Coronavirus Response Act , employers are required to provide paid leave for specified reasons related to the Coronavirus Disease 2019 through two separate provisions: the Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act . The FFCRAs paid leave provisions are effective April 1, 2020, and apply to leave taken between April 1, 2020, and December 31, 2020. The Internal Revenue Service issued guidance IRS Notice 2020-54 to employers on the required reporting of qualified sick leave and family leave wages paid under the FFCRA. The guidance requires employers to report separately the amount of emergency sick and family leave paid to employees under FFCRA on either 2020 Forms W-2, Box 14, or on a separate statement. This required reporting provides employees who are also self-employed with amounts they may need to figure their qualified sick leave equivalent or equivalent family leave equivalent credits under FFCRA when they file their taxes.

INFORMATION FOR FFCRA AND/OR EFMLA REPORTED IN BOX 14

Included in Box 14, if applicable, are amounts paid as qualified sick leave wages or qualified family leave wages under the Families First Coronavirus Response Act. Specifically, up to two types of paid qualified sick leave wages or qualified family leave wages are reported in Box 14:

- Sick leave wages subject to $511 per day limit because of care you required and

- Emergency family leave wages.

Box 1: Retirement Plan

Indicates employees eligibility for pension plan membership. The IRS defines an employee as belonging to a pension plan if that employee is eligible to join a pension plan regardless of whether the plan is joined.

The Retirement Plan checkbox in Box 13 will be checked, except for the following:

- Retirees receiving W-2s for legal service fringe

- Hearing Officers with wages only from the Department of Finance

- Retirees who retired prior to that calendar year and are drawing a City pension and receiving wages from City employment

- Terminated employees who have no wage record for that calendar year but received other types of pay requiring a W-2.

Don’t Miss: Efstatus Taxact Com Login

If You Were Employed But Werent Covered By Social Security

In the beginning, Social Security didnt cover any public sector employees. But as many states dropped their own pension plans and adopted coverage agreements with the Social Security Administration, things have changed.

Today there are still 15 states that participate solely in their own pension plans instead of Social Security:

Those states are:

- Rhode Island

- Texas

If you are a teacher in one of those states, the rules for collecting a Teachers Retirement System pension and Social Security can be confusing and maddening to try and figure out.

Thats especially true if youve paid into the Social Security system for enough quarters to qualify for a benefit, which is fairly common among teachers.

Many teachers find themselves in this situation for a variety of reasons. For some, teaching is a second career, after theyve spent years working in a job or a state where Social Security taxes were withheld.

Others may have taught in a state where teachers do participate in Social Security. For example, teachers in my town, which is divided between the states of Arkansas and Texas, could qualify for both.

If they worked in Arkansas for at least 10 years and then taught in Texas , they would qualify for both Social Security and the Teacher Retirement System of Texas.