Why Did I Receive An Irs Form 1099r

IRS Form 1099R reports a taxpayer’s distributions from pensions, annuities, IRAs, insurance contracts, profit sharing plans and other employer sponsored retirement plans.

You may receive more than one IRS form 1099-R, because distribution information on each form is limited to one account and one distribution code.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Can You Provide Tax Advice

No. For tax advice, please call your Tax Advisor or the IRS at 1-800-829-1040 or visit their website at .

Online Statements require Adobe® Acrobat® PDF reader. The length of time Online Statements are available to view and download varies depending on the product: up to 12 months for auto loans up to 2 years for credit cards, home equity lines of credit, and personal loans and lines of credit and up to 7 years for deposit accounts, home mortgage accounts, and trust and managed investment accounts. The length of time the specific product statements are available online can be found in Wells Fargo Online® in Statements & documents. Availability may be affected by your mobile carrier’s coverage area. Your mobile carriers message and data rates may apply.

Wells Fargo and Company and its Affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

CAR-0322-05602

Also Check: How To File Prior Year Taxes Turbotax

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Read Also: Do You Need Previous Tax Return To File

Personal Tax Account: Sign In Or Set Up

Use your personal tax account to check your records and manage your details with HM Revenue and Customs .

This service is also available in Welsh .

To use this service, youll need to prove your identity using Government Gateway. Youll be able to register for Government Gateway if you have not used it before.

You can no longer use GOV.UK Verify to prove your identity.

Why Can I See Only Some Of The Tax Documents I Am Expecting Through Wells Fargo Online

Some tax documents may be available online earlier than others. For example, your mortgage tax document may be available several weeks before your savings account tax document. All applicable IRS-required tax reporting documents will generally be available online on or before January 31 or by mid-February for brokerage accounts.

You May Like: How Do I Pay Estimated Taxes For 2020

Why Does My Form 1099 Include Interest From Multiple Accounts

If your deposit accounts have the same primary Taxpayer Identification Number and 5-digit ZIP code , we will report the interest collectively on a combined Form 1099.

If you’d like to receive separate Form 1099 documents in the future, you can call us at 1-800-TO-WELLS to make your request. For business accounts, call 1-800-225-5935.

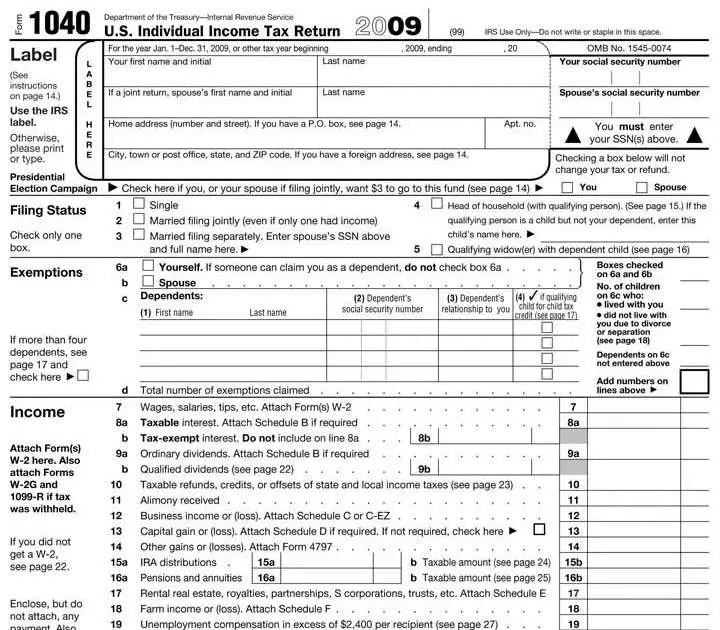

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. But be aware the service may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Recommended Reading: How Do You Get Your Tax Return

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

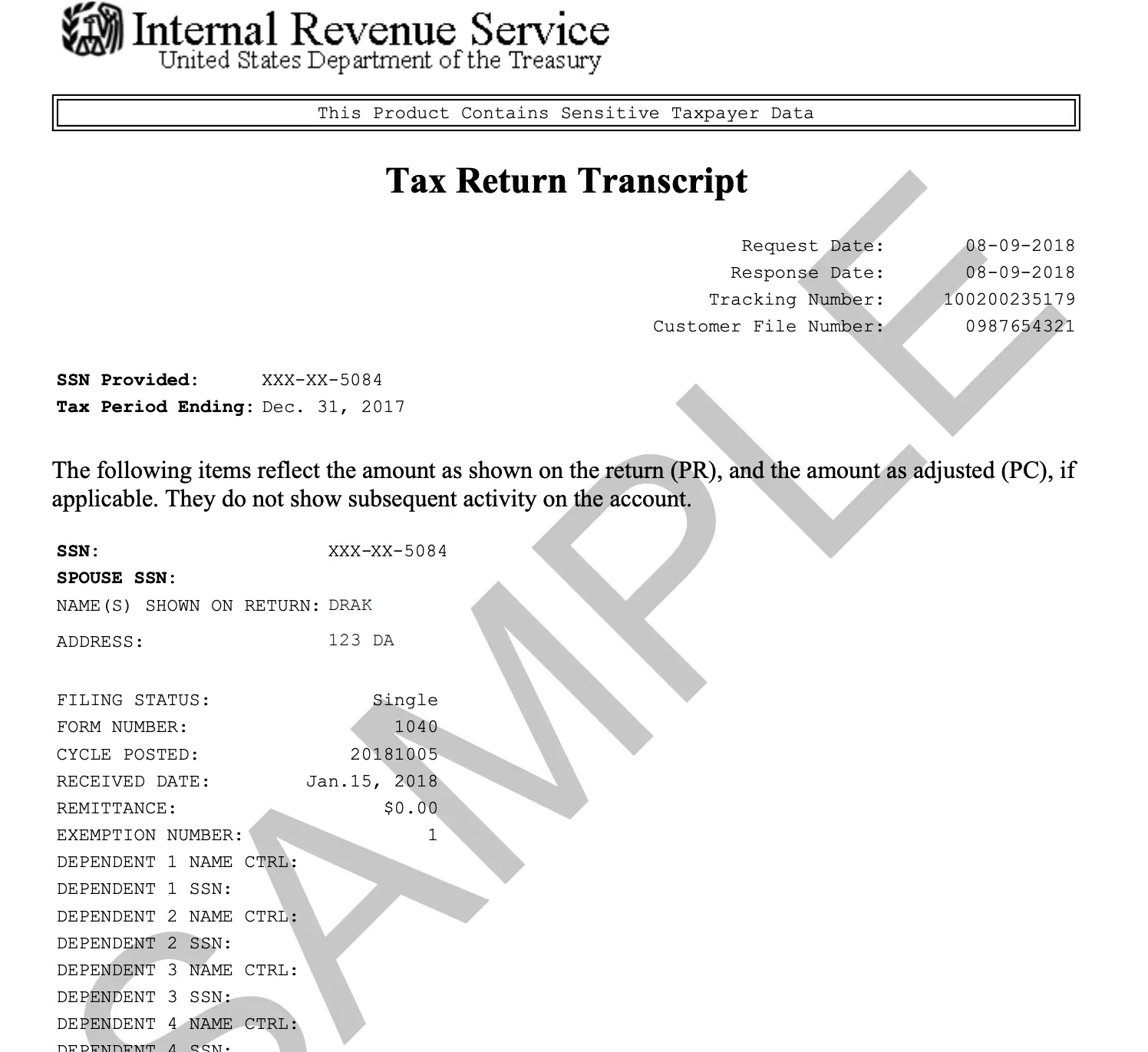

What Is A Tax Transcript

A tax transcript is basically a printout summary of the major data on your tax return, including a particularly important one: adjusted gross income, or AGI.

The IRS doesnt charge for tax transcripts, and you can get one online immediately . Youll need to register online with the IRS before you can access the Get Transcript online tool.

In most cases, when you need tax return info you can use a tax transcript. Ask whoever needs your tax information whether a tax transcript will be OK or if a copy of the return is required.

Recommended Reading: How To Do My Own Taxes On Turbotax

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

I Have A Joint Account Why Can’t I Access Our Tax Document Through Wells Fargo Online

We issue tax documents to the primary account owner. For security reasons, tax documents are available for online viewing only by the owner of the Taxpayer Identification Number associated with the IRS reporting. If you are the secondary signer or joint account owner for all other account types, you can contact 1-800-TO-WELLS 24 hours a day for a duplicate copy.

Also Check: How To Figure Out Your Tax Bracket

How To Log In With This Service

Select a partner with whom you already have an online account.

Enter the ID and password you use with the selected partner.

You are now logged in to the impots.gouv.fr website you can manage your account under the same conditions of confidentiality and security as if you had logged in directly.

If you do not yet have a personal account on impots.gouv.fr, you will need to create one the first time you log in by entering an e-mail address and choosing a password.

An e-mail will be sent to the address you have chosen. Within 24 hours, you must contained in this e-mail to finish activating your account.

If you do not receive this e-mail, please check your spam folder.

Once activated, you will be able to access your personal account.

For more information or to find out about all the sites you can log in to via FranceConnect, please visit the FranceConnect website.

How Do I Access My Tax Documents

There are multiple ways to retrieve your 1099 and crypto tax forms once they are made available to you. Please note that 2021 tax forms will be made available to Public members in February 2022. Once available, you can access them here, or by following the below instructions:

In the Public App:

Select your Profile Icon in the top left corner

Scroll down and select Account Settings

Scroll down to the Documents section

Tap Tax Documents to access your 1099 forms

Tap Crypto Statements to access your Annual Crypto Statement

Via Public for Web on your desktop browser.

Select your Profile Icon in the top right corner

Select Settings and Privacy from the dropdown menu

You can find your 1099 forms under Tax Documents and your Annual Crypto Statement under Crypto Statements

On Apex Online:

You can access your 1099 on the Apex Clearing website through the following steps.

Go to the Apex Clearing website at www.apexclearing.com.

Log in through the button in the top right.

Once logged in, your tax form are located under the Documents dropdown in the top right-hand corner of the website.

Partnership with TurboTax®

Public has partnered with TurboTax to help Public members save this tax season. Once your tax forms are available, you can eimport your 1099 forms directly into TurboTax and manually enter the information from your Annual Crypto Statement. Use this link to start filing, and save up to $20!

Entering your 1099 tax form details in TurboTax:

Recommended Reading: What Happens If I Forgot To File Taxes

Why Does Cost Basis And Holding Period Information Appear On Form 1099 For Some Of My Security Sales

IRS rules require us to report cost basis and holding period for some but not all sales of stocks and other securities. IRS regulations require us to report cost basis and holding period information on any security sold during a given tax year if that security was purchased or acquired on or after specific dates as put forth in “The Emergency Economic Stabilization Act of 2008.” Securities covered under these requirements include equities, mutual funds, and dividend reinvestment plans. Simple debt securities, such as fixed-rate bonds, zero coupon bonds, and original issue discount bonds, as well as some more complex debt securities, are also included.

How Do I Get A Copy Of The 2020 Return I Filed In Turbotax Online

If access to your 2020 return has expired, you’ll get a link with instructions on how to regain access.

Related Information:

Read Also: Do We Pay Taxes On Social Security

When Will I Receive My Tax Documents In The Mail

Wells Fargo generally mails original tax documents no later than January 31, or by the IRS deadline of February 15 for brokerage accounts. Depending on the postal service delivery, you can usually expect to receive your tax documents by the third week of February or by the end of February for brokerage accounts. If you dont receive your tax documents by then, please call us at 1-800-TO-WELLS or 1-866-281-7436 for brokerage customers.

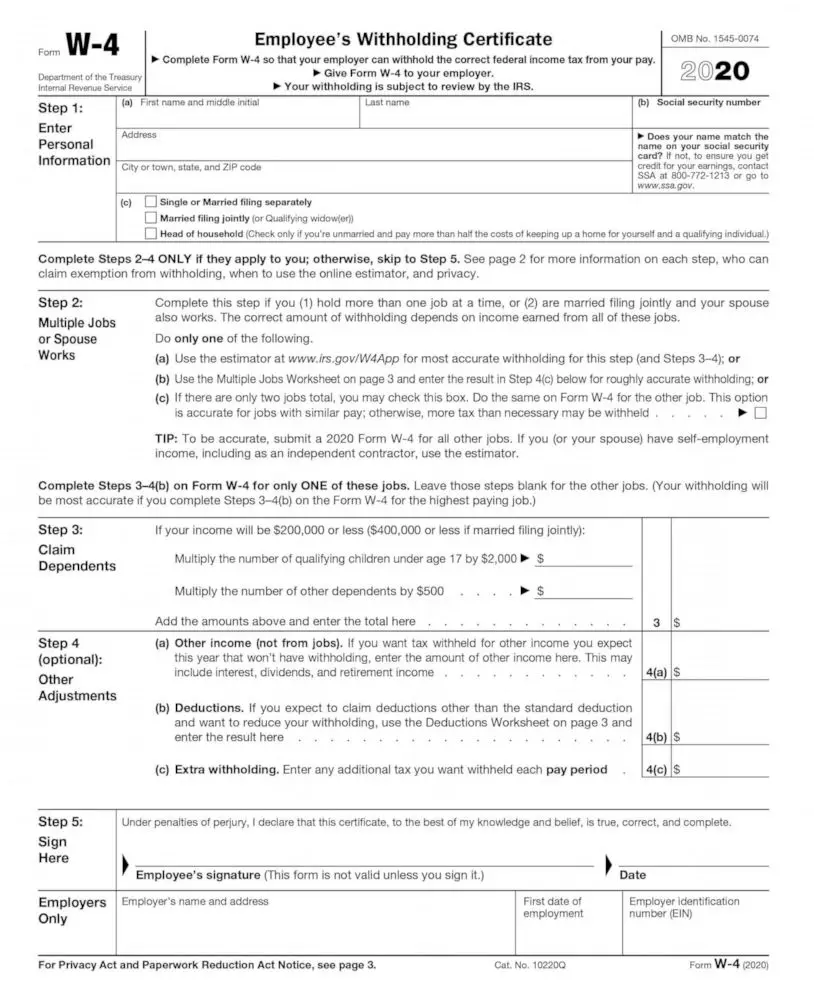

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: When Is The Last Day You Can File Your Taxes

Copies Of Tax Returns

A copy of your tax return is exactly that a duplicate of the return you mailed or e-filed with the IRS. For a fee, the IRS can provide up to six years back, plus the current years tax return, if youve already filed yours. Youll need to fill out and mail Form 4506 to the IRS to request a copy of a tax return.

You might need a copy of your old tax return, rather than a tax transcript, if more-detailed information from prior tax returns is required or if older tax information is needed.

How To Get A Copy Of Your Tax Transcript

There are three ways to get a copy of your tax transcript.

The easiest way is to use the IRSs online transcript portal, Get Transcript. To use this service to access your transcripts online, youll need to provide your Social Security number, filing status from your most recent return, date of birth and the mailing address from your most recent tax return. Youll also need a few other things: an email account, a mobile phone with your name on the account, and an account number from an eligible account to verify your identity.

You can also fill out and mail in a copy of Form 4506-T or use the Get Transcript by Mail option through the Get Transcript portal. But if you make your request that way, you should be prepared to wait 30 days to receive your copy. Finally, if youre a phone person, you can also get a copy of your transcript by calling the IRS at 1-800-908-9946. Phone orders typically take five to 10 business days.

One thing to note: The IRS is now issuing transcripts that block out portions of your Social Security number, telephone number, last name and address. Thats why youll have to provide an account number to verify your identity so they can use it to match up with your file. By limiting the amount of personal information on the transcript, the IRS hopes to help reduce the risk of identity theft.

You May Like: How To Pay Ny State Taxes

Will I Receive Any Tax Documents From Wells Fargo

If your accounts meet the criteria for reporting, you will receive the appropriate tax documents from us. The Internal Revenue Service requires us to report certain information regarding the amount of interest, dividend or miscellaneous income, or gross proceeds from sales our customers receive from us, as well as certain mortgage interest our customers pay to us. We use specific forms, such as IRS Forms 1099 and 1098, to annually report income and interest paid. You may have the option to set your delivery preferences for how you would like to receive your tax documents depending on the types of accounts you have. To update delivery preferences for your tax documents, sign on to Wells Fargo Online®.

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

Also Check: What Is The Employer Portion Of Payroll Taxes