How To Access Old Tax Returns

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006. This article has been viewed 50,242 times.

Accessing old tax returns may be necessary if you need to look up specific information about your income or your expenses. You can also use old tax returns as proof of your financial history for a mortgage or loan application. As a taxpayer, you are able to access a transcript or an official copy of old tax returns in just a few easy steps. A transcript is free to access, but each official copy of your old tax returns will cost you $50 USD as of March 2019.

How Do I Get My Actual Tax Return

IRS tax transcripts are not photocopies of your actual tax return with all the forms and attachments.

-

If you want an actual copy of an old tax return, youll need to complete IRS Form 4506 and mail it to the IRS.

-

Theres a $43 fee for copies of tax returns , and requests can take up to 75 days to process.

Did Not Receive A Qrlsp Form

You will only receive a QRLSP form if the payment is deemed to be a qualifying payment by the CRA.

QRLSP forms issued by Phoenix but undelivered by Canada Post, for any reason, will be returned to your last employing department or agency. They will make every effort to contact you or deliver your QRLSP form to you. However, if you do not receive your QRLSP form by the end of March of the following year in which the qualifying payment was issued to you, contact the Client Contact Centre.

Don’t Miss: Can You E File Taxes From Previous Years

Transcript Of Return From The Irs

Cost: FreeProcessing Time: Instantly online or 5 to 10 business days by mail

You can request an IRS transcript of your tax return from the IRS website. A transcript includes items from your tax return as it was originally filed and will meet lending or immigration requirements.

There are three ways to request a transcript:

If you’d like to have a record of any changes made to your original tax return by the IRS or through subsequent amendments, you’ll need to request a Tax Account Transcript by calling the IRS at 1-800-908-9946.

Here Is What’s Visible On Transcripts:

- Last four digits of any EIN: XX-XXX4321

- Last four digits of any account or telephone number

- First four characters of the first and last name for any individual

- First four characters of any name on the business name line

- First six characters of the street address, including spaces

- All money amounts, including wage and income, balance due, interest and penalties

The IRS will provide unmasked Wage and Income transcripts when needed for preparing and filing tax returns. Unmasked Wage and Income transcripts fully display personally identifiable information such as the taxpayer’s name, address, and Social Security number along with the employer’s name, address, and Employer Identification number.

You May Like: How To Keep Receipts For Taxes

How To Get An Irs Transcript Or Tax Return Copy

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You can easily get a free copy of your tax transcript online from the IRS. The process involves navigating to the “Tax Records” section of the agency’s website, and downloading your IRS transcript.

Other ways to get tax transcripts from the IRS include making a request by phone or mail. However, the agency’s online portal is the quickest way for most people to retrieve IRS transcripts.

Tax transcripts can be used to show proof of income to lenders, such as when you apply for a mortgage or an auto loan. You can also use a tax transcript to see detailed information on your previous tax returns. If you file estimated taxes, tax transcripts can help you figure out how much youll need to pay in the future.

Choose The Tax Years You Want Returns For

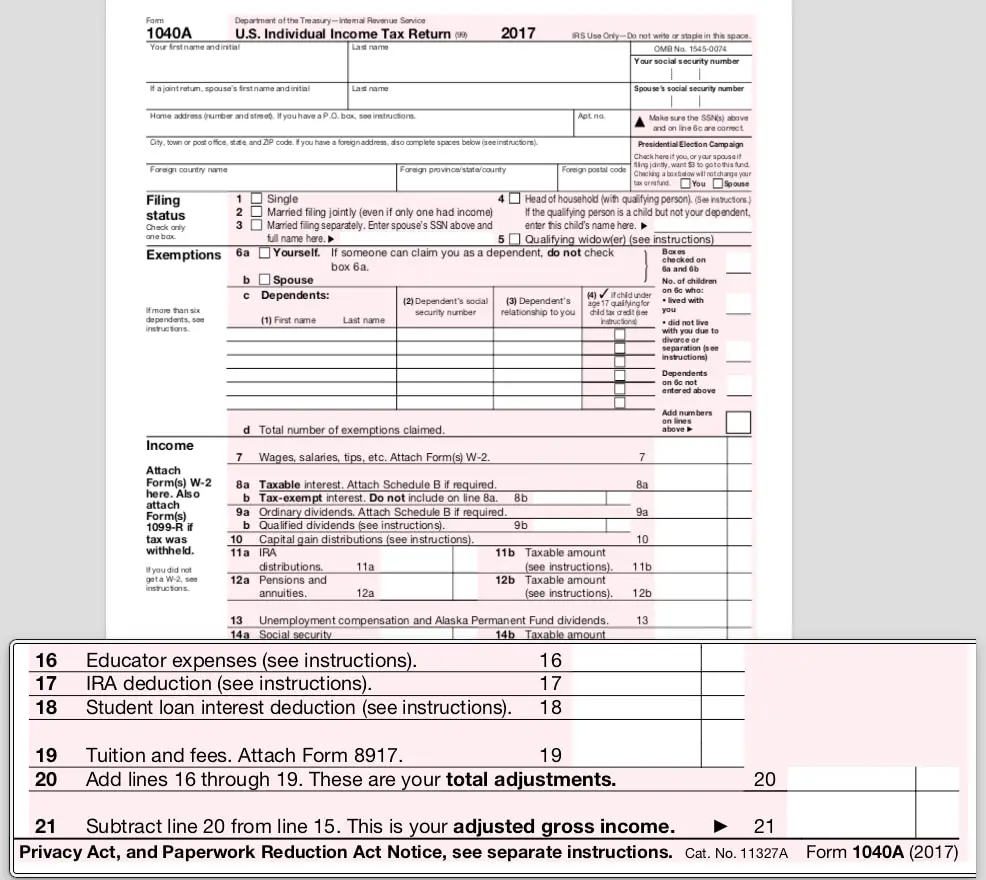

You can request more than one tax return on Form 4506 however, you must indicate the type of form you used to file each one, such as a Form 1040, 1040-SR, 1040A or 1040EZ. In the next section of Form 4506, you must provide the tax years you are requesting. For example, if you are requesting a tax return from 2018, the IRS asks you to enter 12/31/2019 rather than just 2019.

You May Like: Which Hybrid Cars Are Eligible For Tax Credits

Getting Your Transcript Electronically

You can also get your transcript electronically same day. It requires having a login on IRS.GOV please be sure you are on the .gov website. On the IRS homepage, top right corner there is a search option. If you type the single word transcript the first few results are exactly what you need. Click on Get Transcript . There will be displayed similar info to what I have included here, but on the left side is the option to get your transcript online. When logged in, it is very clear to see what year and what transcript you want, and it displays immediately . Word of caution however, while there is a forgot my password option the steps required to verify who you are will be very extensive so please do not forget your IRS login information.

It is possible for a tax office to request the transcripts for you and get the electronically but our experience is that the process takes weeks, sometimes longer. The taxpayer always has the most power, and you will get the quickest results with the IRS.

Can You Get Prior Year Tax Information From The Irs

There are a few times where you may run into a situation where you need to provide a copy of your prior year tax return. For instance, you could be applying for a home mortgage loan and need proof of income or maybe you misplaced it and would just sleep better at night knowing you have a copy in your filing cabinet. Either way, in most circumstances, a paper transcript of this information will do. Before venturing to the IRS website, be sure to have the following information ready:

- social security number

- street address currently on file with the IRS

- zip code currently on file with the IRS

- type of transcript needed

Happy hunting!

Tags: amended tax return, contact the IRS, progress of tax return, tax refund, wheres my refund tool

This entry was postedon Thursday, October 20th, 2016 at 3:22 pmand is filed under Taxes for Prior Years.You can follow any responses to this entry through the RSS 2.0 feed.You can leave a response, or trackback from your own site.

You May Like: How To Buy Tax Forfeited Land

Recommended Reading: What Is Wotc Tax Credit

How To Obtain Copies And Transcripts Of Past Tax Returns From The Irs

There are quite a few reasons why someone might need access to a previous years tax return. And unless youare highly organized, you might not be able to retrieve a copy from your personal filing cabinet. Neverfear, though, because in cases involving mortgages, student loans and citizenship, one is usually onlyrequired to provide the basic information that can be found on a tax return transcript.

How To Get A Tax Transcript

You get obtain a tax transcript online from the IRS website or by postal mail. There is no charge.

To order online, use the Get Transcript Online tool on IRS.gov. To use the online tool, you must first register with the IRS and obtain a password. Youre required to provide:

- Your social security number, date of birth, filing status, and mailing address from your latest tax return

- Access to your email account

- Your personal account number from a credit card, mortgage, home equity loan, home equity line of credit, or car loan

- A mobile phone number with your name on the account

Read Also: What Do I Need To Do My Taxes

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Read Also: Do You Have To Report Roth Ira On Taxes

How Far Back Can You Go To File Taxes In Canada

According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately. You may think that since you dont have the money to pay your taxes, its best to not file, but this isnt the right move.

The CRA does not forget about you over time. Every day that goes can cost you more money in late-filing penalties, interest, and other potential fees when you delay filing your taxes.

Irs Routine Access Procedures

Copy of a tax return

Send a completed Form 4506 to the address provided in the forms instructions to receive copies of your tax returns as originally filed. IRS charges a fee of $50.00 for each copy provided. Call the IRS Forms hotline at if you need a Form 4506 mailed to you

- Use the Get Transcript tool.

- Send a completed Form 4506-T. In addition to the tax return and account transcripts available through the Get Transcript tool, you may also request wage and income transcripts and a verification of non-filing letter.

Information from open case files

- Contact the Tax Exempt/Government Entities Hotline at .

- Send a completed Form 4506-A to the address printed on the form.

- Copies of approved applications for tax exempt status are also obtained via Form 4506-BPDF.

You May Like: How To Do Your Tax Return Online

Copy Of Actual Return From The Irs

Cost: $50 Processing Time: Up to 75 Days

To get an exact copy of your tax return from the IRS with all schedules and attachments , you’ll need to complete Form 4506. You’ll also need to write a $50 check or money order to “United States Treasury”. The IRS mailing address and request instructions are included on the form.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Read Also: How Long Should I Keep Tax Records

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. But be aware the service may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Read Also: How To Retrieve 1040 Tax Return

How To Get A Transcript Of An Old Tax Return

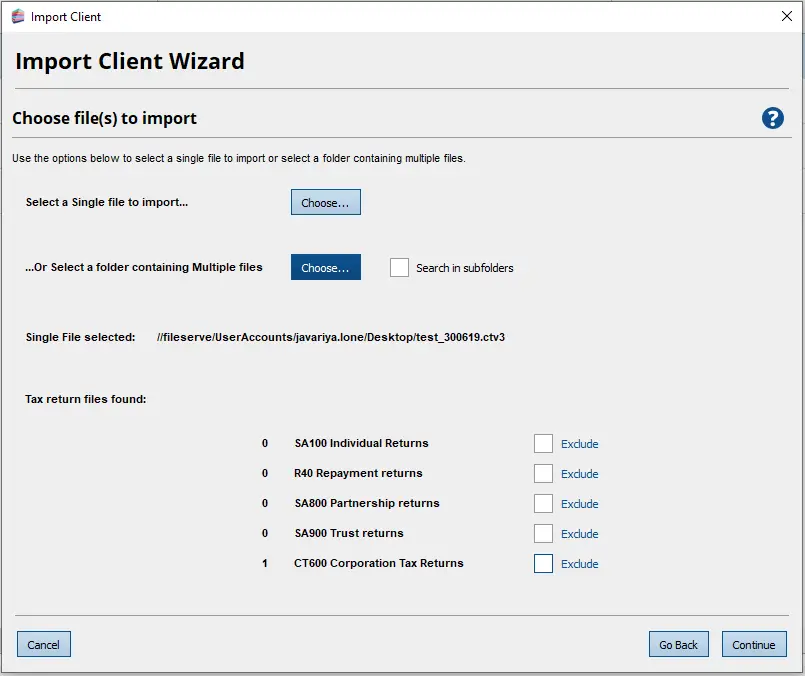

Accessing a Transcript of Old Tax Returns Determine which type of transcript you need. Register online with the IRS. Request a transcript of your old tax returns online. View the transcript online or receive it by mail.

How can I get a copy of my tax return?

Taxpayers can complete and mail Form 4506 to request a copy of a tax return and mail the request to the appropriate IRS office listed on the form. If taxpayers need information to verify payments within the last 18 months or a tax amount owed, they can view their tax account. Subscribe to IRS Tax Tips

You May Like: Is It Better To File Taxes Jointly

Read Also: How To Fill Out Taxes For Doordash

Ways To Get Transcripts

You may register to use Get Transcript Onlineto view, print, or download all transcript types listed below.

If you’re unable to register, or you prefer not to use Get Transcript Online, you may order a tax return transcriptand/or a tax account transcript through Get Transcript by Mailor by calling . Please allow 5 to 10 calendar days for delivery.

You may also request any transcript type listed below by submitting Form 4506-T, Request for Transcript of Tax Return.

How To Get Copies Of Tax Returns

Even though tax transcripts are free of charge and can be delivered much more quickly than copies of your tax return, there may be times when youll want the full return rather than just the transcript. While lenders will accept the transcript, you may prefer having a full copy of your previous returns for your own records.

- If so, you can request a copy of your tax return using IRS Form 4506, Request for a Copy of Tax Return.

- You can obtain copies of your tax returns for the current year and up to the six previous years. However, unlike tax transcripts, obtaining copies of your tax returns comes with a fee of $43 for each year requested.

- If youre filing the request by mail and plan to send a check, youll need to make your check payable to the United States Treasury. However, if youre impacted by a federally declared disaster, the IRS will waive the fee if the copies are needed to apply for disaster relief benefits or to file amended returns claiming disaster-related losses.

- For jointly filed returns, either spouse can request a copy. The signature for only the requesting spouse will be required on Form 4506.

- Heres a major reason why you should request tax transcripts, rather than copies of tax returns, if you can possibly avoid it: It can take the IRS, up to 75 days to provide copies of tax returns.

- If you need your tax information in less time, transcripts will arrive in only a fraction of the time.

Don’t Miss: What States Do Not Tax Your Pension Or Social Security

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.