Submit Your Amended Forms

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the software’s instructions to e-file the amendment.

To amend a return for 2018 or earlier, you’ll need to print Form 1040-X and any other forms you’re amending. Attach any necessary supporting documentation, such as:

- Any new or amended W-2s or 1099 forms

- Other forms or schedules that changed, such as Schedule A if you updated your itemized deductions

- Your CP2000 notice if youre amending your tax return because of a notice you received from the IRS

Mail all the forms and documents to the address provided in the instructions.

If amending your tax return results in a higher tax bill, you will need to make an additional tax payment. For an e-filed amended return, you can make a payment electronically through TurboTax. Otherwise, you can mail a check with the amendment. By making a payment now instead of waiting for the IRS to send an invoice, you can minimize the interest and penalties you’ll owe.

Keep in mind that if you file an amended tax return on paper rather the e-filing, it can take the IRS eight to 12 weeks to process the amendment. You can check the status of your amended return using the IRS’ Where’s My Amended Return? Wait about three weeks from the date you mailed your return for the information to show up in the IRS system.

When Changing Your Tax Return Is Allowed And Isnt Allowed

You may only make changes to tax returns submitted in the last 10 calendar years. For example, in 2015, you can make changes to tax returns submitted from 2005 to 2014. There are several restrictions on changing your return, including tax years where there are nine reassessments, bankruptcy returns, a return filed in a year before bankruptcy, for carryback amounts and returns for non-residents.

Register for a CRA My Account.

Learn more about registering for a CRA My Account.

References & Resources

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Do I Need To Report Roth Ira Contributions On My Tax Return

How To Change Your Tax Filing Status

OVERVIEW

Choosing your filing status is an important first step for preparing your federal tax return. Your filing status determines your standard deduction, tax rates and brackets.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Apple Podcasts | Spotify | iHeartRadio

Ask If Your Preparer Charges For An Amended Tax Return

If you used a human tax preparer, dont assume he or she will amend your tax return for free or pay the extra taxes, interest or penalties from a mistake. If you forgot to give the preparer information or gave incorrect information, for example, youll likely have to pay for the extra work.

If the error is the preparers fault, who pays for an amended tax return may depend on the wording in your client agreement.

» MORE: How to get rid of your back taxes

Recommended Reading: Have My Taxes Been Accepted

How Do I Amend A 2018 Return

Yes, you can Amend through TurboTax.

Since you have already filed your returns and they have been Accepted, you need to wait until the IRS fully processes your return and you receive your refund.

Then, you can Amend your Tax Return by filing Form 1040-X to include your correct Form W2 information.

You can click here for instructions on Amending your tax return: How to Change a Tax Return You Already Filed.

Keep An Eye On The Calendar

Generally, the IRS audits only returns from the previous three tax years though there are major exceptions. So although it might be tempting to wait and see if the IRS will catch you in an error, it might be cheaper to fess up sooner rather than later.

The IRS charges interest and penalties on outstanding tax liabilities going all the way back to the original due date of the tax payment. So the longer you wait to fix a mistake, the more expensive that mistake can get.

You May Like: How To Buy Tax Lien Properties In California

Common Reasons Why You Need To Amend A Return

| Reason | |

|---|---|

|

|

| Update credits |

|

| Update deductions |

|

| Report federal income tax adjustments | You amended your federal tax return or recently audited by the IRS |

Questions Typically Asked About Filing An Amended Tax Return

Everybody makes mistakes there are no exceptions. If you discover an error or something you missed on your return after you filed it, don’t panic.

Fortunately, most mistakes in life can be fixed, and your tax return is no exception.

When should I file an amended tax return?

A Form 1099 that slipped under the couch, a substantial business deduction you forgot, or any other item that changes your tax return may mean you need to file an amended return.

Sometimes you need to file an amended return for something that is not your fault. For example, your employer may send a corrected form, which means the amounts you used when you filed your return need to be corrected.

Unless the change to your tax liability is inconsequential, it’s best to change your return.

In some cases, you should file an amended return even if the changes don’t impact the amount of tax you owe. For example, if you entered an incorrect Social Security number, you should amend your return to avoid future problems.

How to file an amended return

The most important thing to know about filing an amended return is that you should not start over and file Form 1040 and all the attached forms again. You only file your complete tax return once. After that, you file Form 1040X Amended U.S. Individual Income Tax Return and change only the items that are incorrect.

You cannot e-file your amended return. Instead, the IRS requires that you print the Form and file it by mail.

Am I in big trouble with the IRS?

Also Check: How Much Does H & R Block Charge To Do Taxes

Filing Business Tax Or Other Amended Returns

Most business and fiduciary taxpayers are able to simply:

- Adjust the amounts shown on the original return and

- Submit a revised return to DOR online through MassTaxConnect

Corporate excise filers can file amended returns electronically through third-party tax preparation software whether the amendment increases or decreases the tax due. Fiduciary filers may also be able to file amended returns using third-party software.

To learn more about third-party software options, read “DOR e-filing and payment requirements.”

Keep in mind that some taxpayers are required to file amended returns electronically.

Refer to TIR 16-9 to see if the electronic filing and payment requirements apply to you.

Filing electronically is always the quickest option, but if you are not required to file electronically you still have the option to check the amended return oval on your paper return and file it the way you usually do.

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

Also Check: What Does Agi Mean For Taxes

How Long Does It Take For The Irs To Amend My Return

Due to COVID-19, the IRS is taking longer to process mailed documents, such as paper tax returns. The IRS is processing mailed documents in the order that it is received.

Your amended return can take up to:

- 3 weeks from the date you mailed it to show up in the IRS system.

- 16 weeks to process.

Amended returns may take longer than 16 weeks to process if the return is incomplete, has errors, is unsigned, is associated with identity theft or fraud, or includes Form 8379, Injured Spouse Allocation. In some cases, the IRS may contact you if more information is needed to process your return.

You can track the status of your amended return starting three weeks after you have filed. Visit Wheres My Amended Return? or call 866-464-2050. Both these tools are available in English and Spanish.

Video: How To Amend Your Tax Return

OVERVIEW

What to do if you filed your tax return with TurboTax, and now need to change it. TurboTax makes it easy to amend your tax return and file it again.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Read Also: How Much Does H& r Block Charge To Do Taxes

Correcting A Ct Income Tax Return

ALERT: RECENTLY ENACTED FEDERAL LEGISLATION MAY IMPACT CERTAIN CONNECTICUT TAXPAYERS – for more information, .

If corrections are necessary, you must file Form CT-1040X, Amended Connecticut Income Tax Return. Do not submit a second Form CT-1040 or Form CT-1040NR/PY.

ON-LINE – Amend your return using the TSC-IND, our free, online filing system. Login to your account, select the CT-1040X filing option and choose the period you wish to amend. On-line amendments can only be filed after the original return has processed.

PAPER – If you cannot use the TSC-IND, download the amended return from our website, complete it, and then mail it to DRS.

NOTE: Amended returns do not have the option to choose direct deposit.

When must an amendment be filed in order to claim a refund?

Purpose: Use a Form CT-1040X to amend a previously filed Connecticut income tax return for individuals. Visit the DRS Taxpayer Service Center at portal.ct.gov/TSC to file Form CT-1040X online.

You must file Form CT-1040X in the following circumstances:

Do not file Form CT-1040X

Financial Disability

Consent To Extend The Time To Act On An Amended Return Treated As An Application For Abatement

In certain instances, an amended return showing a reduction of tax may be treated by DOR as an application for abatement. Under such circumstances, when you file your amended return, you give your consent for the Commissioner of Revenue to act upon the abatement application after six months from the date of filing. See TIR 16-11.

If you dont wish to grant us additional time beyond the statutory six-month period, or if the statutory period has passed and you want to withdraw your consent, you must tell us in writing that you wish to withdraw your consent to allow DOR additional time for review of your application for abatement. Be sure to include information such as:

- Your name

- The taxpayers name

- The Letter ID from the notice you received from us and

- A phone number or email address

Fax your statement to 626-3349, Attention: Office of Appeals, or mail it toDepartment of Revenue

Don’t Miss: Efstatus Taxact Com Return

How Do I Use Turbo To Amend My 2020 Return To Add My $2000 On Line 30 So I Can Get My Stimulus Money

The problem is that I only filed the 2020 return to get the stimulus check. I have not needed to file for several years. And, I have not received any stimulus money whatsoever.

When reading instructions on IRS.gov, they say the stimulus amount should be added to line 30. TurboTax did not add anything to line 30.

You are telling me that I should do nothing and I will still get my 2021 stimulus money based on the filing of my 2020 return??????

When that doesn’t happen, then what do I do?

Major Tax Breaks From Tax Reform

You pay income and capital gains taxes on any income earned or gains received, respectively. To lower this overall tax liability, Congress has created several tax breaks to entice taxpayers to make certain desirable actions. In doing so, you’re able to reduce your tax liability. If you decide to file an amended return, make sure you have a clear understanding of the tax changes, extensions, and credits.

Tax changes in 2018 include:

- Income phaseout on itemized deductions

- Moving expenses deduction

- Automobile mileage rate deductions for unreimbursed employee travel expenses

While most of these changes passed into law at the end of 2017, the majority went into effect in 2018. Due to the impermanent nature of the tax reform bill, all of these changes are set to revert to 2017 law after 2025 with the exception of the corporate tax rate. This change is not set to expire. The rate is 21%, down from 35% seen in 2017 prior to the law passing.

Finally, keep in mind that not every state adopted the new federal tax policies. Some, like California, Texas, Minnesota, North Carolina, South Carolina, and New Hampshire, opted to not change their own laws to be more favorable to residents.

You May Like: Where’s My Tax Refund Ga

How Long Do You Have To File An Amended Return

- If you or the IRS changes your federal return, you must file an amended Virginia return within one year of the final IRS determination.

- If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Interest on any amount due will still accrue from the original due date, so file the corrected return as soon as you can.

If Changes to Your Return Result in a Refund

We can only issue a refund if the amended return is filed within:

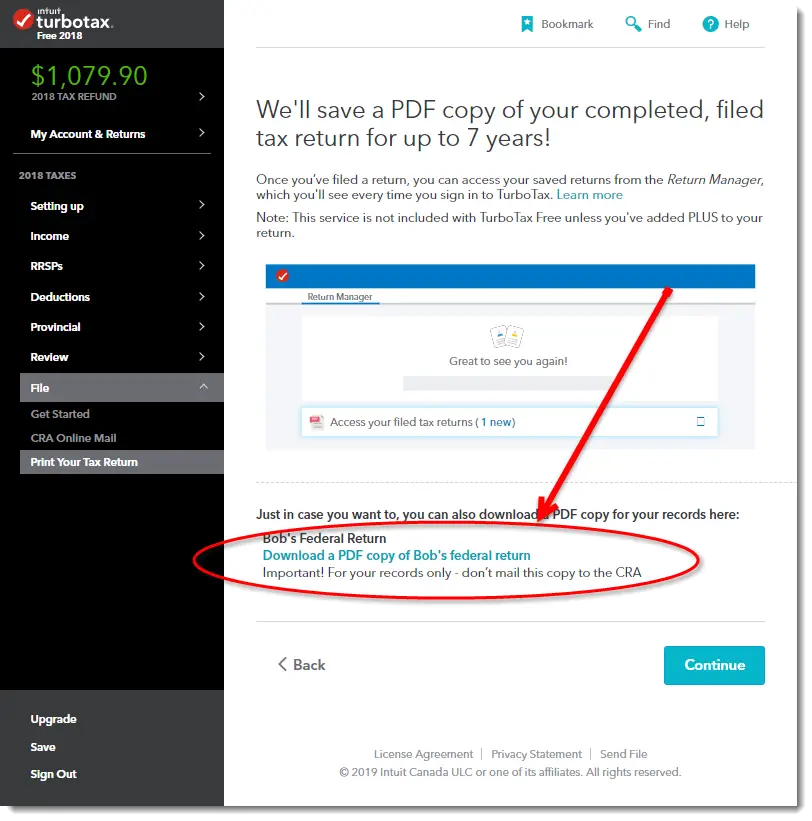

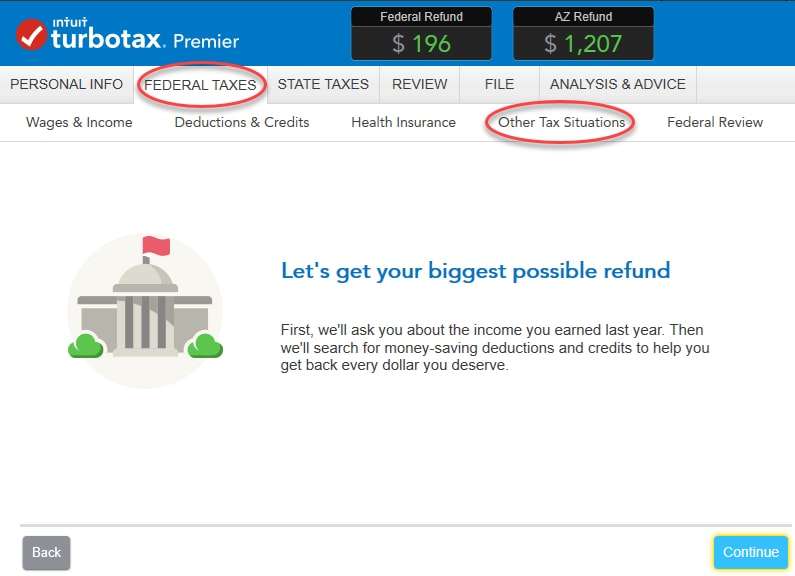

Filing An Amendment With Turbotax

If you originally filed your return with TurboTax, we can help streamline the steps outlined above. If you used TurboTax Online, simply log in to your account and select Amend a return that was filed and accepted. If you used our CD/download product, sign back into your return and select Amend a filed return.

Tips You must file a separate Form 1040X for each tax return you are amending.

Heads up Amended returns can take more than three months for the IRS to process.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

You May Like: How Do I Get My Pin For My Taxes

If You Owe Additional Tax With The Amended Return

Calculate the tax, penalty, and interest due, and include both your check and the amended payment voucher with the amended return. You may make your tax payment online through ePay on our website or with a credit or debit card.

No penalty for additional tax is due if you voluntarily file an amended return and pay all tax due prior to any contact by the Department. However, interest will be due.

Do not send amended returns with the current-year return.

How Can I Amend My Tax Return

Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return, do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

You May Like: Where’s My Tax Refund Ga