How Do I Get An Agricultural Property Tax Exemption In Texas

What qualifies as ag exemption in Texas? Only land that is primarily being used and has been used for at least five of the past seven years for agricultural purposes may qualify for an ag exemption in Texas. Agricultural purposes include crop production, livestock, beekeeping, and similar activities.

What Are The Tax Benefits Of Owning Agricultural Land

California, like every other state, offers property tax breaks for agricultural land. Specifically, farmers are able to take 20 to 75 percent off their property tax bill if they agree not to develop their land for ten years and do so with at least 100 acres.

Minimize Your Property Taxes

As a farmland owner in Ontario, you may be eligible to apply for a property tax reduction through the Farm Property Class Tax Rate Program.

As an eligible applicant under the program:

- Your farm residence and one acre of surrounding land will be taxed at your municipalityâs residential tax rate

- The remainder of the farm assessment on the property will be taxed at 25% of the residential tax rate

Farm properties that do not qualify under the program will be taxed at the residential rate.

Farm Property Class Tax Rate Programc/o Agricorp 1 Stone Road West, PO Box 3660, Stn Central Guelph ON N1H 8M4

Donât Miss: How Do You File An Amendment To Your Tax Return

Recommended Reading: When Is California Accepting Tax Returns 2021

Ways To Get A Small Farm Tax Break

Many successful business people own homes in the country, with significant acreage around them. If youre one of these people, and youre tired of paying big taxes on that extra land, you may want to consider using it for a small farm. On a small farm, you can raise crops or livestock. Here are a few tips to making the most of a small farm on your land.

Before you do anything, make sure your local zoning department allows farming. If youre growing food for you and your family only, you dont have to worry. But once you start selling the food you grow, or livestock you raise, youll need a special business permit and potentially the okay from the health department.

While all 50 states provide tax breaks for agricultural land, their rules are different, depending on where you live and what youre farming. Most states require you put a certain amount of land in use, and some require a certain amount in profits, to show that youre actually in the small farm business.

In order to get the tax breaks, you need to prove to the IRS that your farm is an actual business not a hobby farm. A hobby farm is a farm typically a few horses, other livestock or crops used for leisure and enjoyment.

-

An extensive line of coverage for todayâs farm & ranch operations.

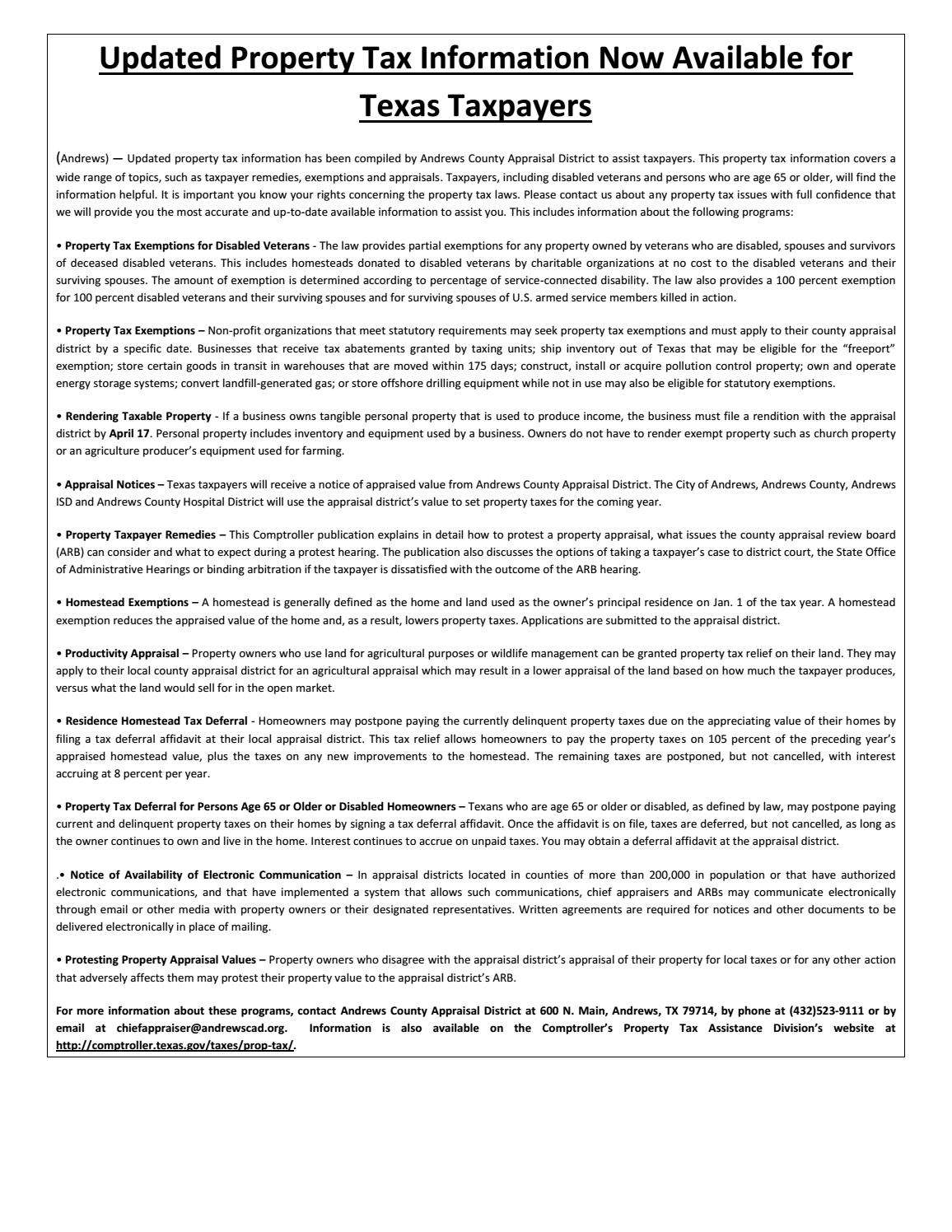

Other Exempt Purchases Sales And Use Tax Exemption Certificate Required

Some animals and their feed do not qualify for the ag/timber exemption, but do qualify for the standard sales and use tax exemption. You must give the retailer a properly completed Form 01-339, when purchasing them. The certificate must specifically explain the exempt purpose for which the animal or feed will be used. You do not need an Ag/Timber Number to buy them.

Work Animals Animals used exclusively in one of the following work activities qualify for exemption:

- herding dogs and animals raised for their products , if harvesting those products is their primary purpose

- aiding a person with a disability and

- performing protective services, if the animal has been professionally trained for that specific purpose.

Work animals do not include animals raised, trained or kept as pets or breeding stock or those kept for sport or for show. For example, tax is due on hunting dogs or other animals a game hunting operation purchases and on exotic animals a zoo or circus purchases.

Animal Feed Feed for work animals qualifies for exemption. Feed for animals being held for sale in the regular course of business also qualifies for exemption.

To qualify for exemption, the sales and use tax exemption certificate must clearly state the feed is for work animals, animals to be sold in the regular course of business or for breeding stock for animals that will be sold.

Also Check: Do You Need Previous Tax Return To File

Qualifying Farmer Or Conditional Farmer Exemption Certificate Number

Below are links to information, frequently asked questions, notices, and technical bulletins regarding exemptions from sales and use tax for certain purchases for farming purposes by a qualifying farmer or a person with a conditional farmer exemption certificate number. NCGS 105-164.28A authorizes the Secretary of Revenue to issue an exemption certificate bearing a qualifying farmer or conditional farmer exemption number to a person. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer to purchase qualifying items exempt from sales or use tax.

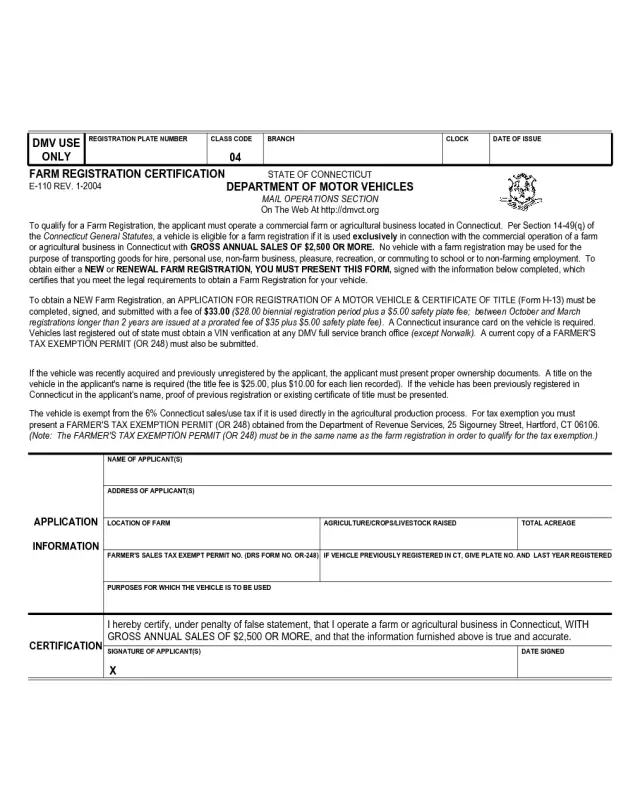

How To Claim The Exemption

To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the dealer a properly completed .

The exemption must also be claimed at the time of titling or registration with the local County Tax Assessor-Collector by entering your current Ag/Timber Number on Form 130-U, Application for Texas Title.

Farm Plates For information on registering a motor vehicle with farm plates, contact your local county tax assessor-collector or the Texas Department of Motor Vehicles at TxDMV.gov.

Read Also: Can You Pay Irs Taxes With Credit Card

Agricultural Buildings Tax Credit

For newly constructed or reconstructed agricultural structures, New Yorkâs Real Property Tax Law allows a ten-year property tax exemption. Application for the exemption must be made within one year after the completion of such construction. The agricultural structures and buildings will be exempt from any increase in the propertyâs assessed value resulting from the improvement.

Once granted, the exemption continues automatically for ten years. The exemption will terminate before the ten-year period if the building or structure ceases to be used for farming operations, or the building or structure or land is converted to a non-agricultural or non-horticultural use.

Learn more about this opportunity.

Continue

Read Also: When Do We Start Filing Taxes 2021

Farm Property Class Tax Rate Program

If you own a farm and you believe it could qualify for the Farm Property Class Tax Rate Program , you must submit an application to Agricorp. For more information about the program and the eligibility requirements, please visit agricorp.com.

If you qualify, we will place your farmland and associated outbuildings in the farm property tax class.

Your municipality applies the farm property tax class rate to your property tax bill and you will be taxed up to 25 per cent of your municipality’s residential property tax rate.

Read Also: When Can You File Your 2021 Taxes

Motor Vehicle Rental Tax Exemption

When claiming exemption from motor vehicle gross rental receipts tax when you rent qualifying farm or timber machines trailers, you must enter your Ag/Timber Number and expiration date on .

Motor fuel is taxed when it is removed from the terminal rack. The tax is included in the price you paid at the pump. You may qualify for a refund on your gasoline purchases, and you may be able to purchase dyed diesel fuel tax free.

You cannot use your agricultural and timber registration number to purchase motor fuel tax free.

Tax Information For Farmers

Farmers are exempt from Provincial Sales Tax when purchasing certain farm supplies and equipment. Some purchases are automatically exempt, while others require the farmer to certify that the goods purchased will be used solely in the operation of their farm.

Holders of a valid fuel tax exemption permit may purchase tax reduced marked diesel fuel for use in their farming, commercial fishing, trapping or logging activities.

Effective April 1, 2017, the partial Fuel Tax exemption for bulk purchases of gasoline is eliminated. Fuel Tax Exemption Permit holders are required to pay the full fuel tax on gasoline purchases.

You May Like: What State Has The Cheapest Taxes

Land Included In Agricultural Assessments

Agricultural assessments is limited to land used in agricultural production, defined to include cropland, pasture, orchards, vineyards, sugarbush, support land, and crop acreage either set aside or retired under Federal supply management or soil conservation programs. Up to 50 acres of farm woodland is eligible for an agricultural assessment per eligible tax parcel. Land and water used for aquacultural production are eligible, as is land under a structure within which crops, livestock or livestock products are produced. Land visibly associated with the ownerâs residence is ineligible.

Purchases By Farming Operations

Purchases by farmers may be exempt from Iowa sales and / or use tax. Just because something is purchased by a farmer, it is NOT automatically tax exempt. Anyone claiming exemption must be able to show they are entitled to it.

See Purchases and Sales: Taxable and Exempt below.

Use Tax

Taxable purchases from suppliers who do not collect Iowa sales tax are subject to Iowa use tax if the purchase is for use in Iowa. Anyone making these kinds of purchases regularly must register for a sales and use tax permit. A sales and use tax permit is not needed for occasional purchases of this type, but the use tax must still be paid to Iowa.

Also Check: How Much Do You Have To Make To Report Taxes

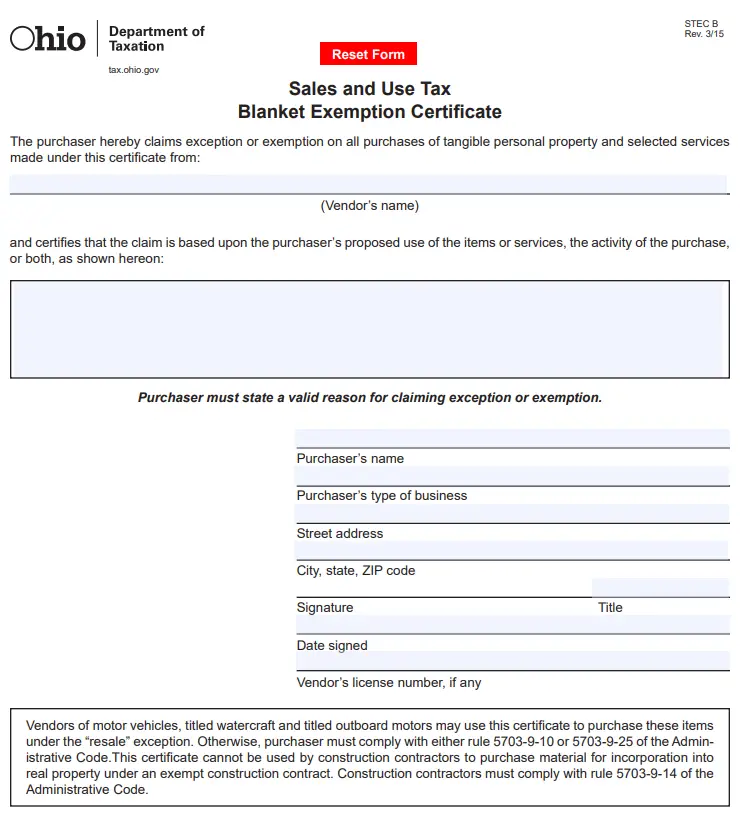

How To Claim Exempt Status

Farmers need to obtain either form STEC U or STEC B at tax.ohio.gov/Forms.aspx. The blanket certificate is used when dealing with a vendor where multiple purchases will be made over time while the unit certificate is used for a one time purchase from a vendor. A completed form requires the vendorâs name, the reason claimed for the sales tax exemption, and the purchaserâs name, address, signature, date, and vendorâs number, if the purchaser has one. An example reason for the purposes of completing the form could read âpurchases used for agriculture, horticulture, or floriculture production.â It is the buyerâs responsibility to provide the form to the vendor, although many vendors who frequently deal with farmers have blank forms available either in paper copy or electronically.

Donât Miss: How To File 2016 Taxes

Exemption Certificates And Refunds

To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out Form ST-125, Farmers and Commercial Horse Boarding Operators Exemption Certificate, and give it to the seller. See below for special rules for purchases of motor fuel and diesel motor fuel.Any sales tax paid on a purchase that otherwise qualifies for the exemption can be refunded. See Tax Bulletins How to Apply for a Refund of Sales and Use Tax , and Sales Tax Credits.

You May Like: How To Legally Avoid Taxes

Who Is Exempt From Paying Property Taxes In Oklahoma

You may qualify for a real and personal property tax exemption. You must be an Oklahoma resident and eligible for homestead exemption. An exemption from property tax on homesteads is available for 100% disabled veterans. The exemption would apply to 100% disability rated veterans and their surviving spouses.

Agricultural Taxes: The Basics

If youre a farmer, youre no doubt familiar with the complicated tax landscape for farmers in this country and you may even use a tax accountant to help you get as many tax breaks as youre eligible for. If you can prove that you farm as a business and not just for recreation, you can get both property tax breaks and income tax breaks.

But you dont have to be a full-time farmer to take advantage of agricultural tax breaks that will help you with your property taxes. In some cases, all you need is a piece of land thats not currently being used. You can say that the land is preserved wilderness, or put it to some kind of agricultural use to save on property taxes.

The size of agricultural property tax exemptions varies from state to state because property taxes arent administered at the federal level. Qualifications for agricultural tax exemptions vary from state to state, too. Some states base eligibility on the size of the property, while others set a minimum dollar amount for agricultural sales of goods produced on the property. Many use a combination of gross sales and acreage requirements. Grazing a single cow on your property can be enough to trigger series tax breaks in some places.

Don’t Miss: How To File State Taxes Online

Ohio Agricultural Sales Tax Exemption Rules

Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. However, this does not make all purchases by farmers exempt. Currently, Ohio sales tax is charged on all sales of tangible personal property and services unless there is an exception to this tax. Farming is one of the exceptions. Since the majority of exceptions or exemptions from the Ohio sales or use taxes are based on the use of the items or services purchased, it would be difficult for the Department of Taxation to provide a list of taxable and exempt items or services. For a farmer to claim exception or exemption, the farmer must be using the items or services in a manner eligible for the tax exemption.

Also Check: Where Do I Report 1099 Q On My Tax Return

Farm Tax Program Transitions From Omafra To Agricorp

The Farm Property Class Tax Rate Program is one of the ways the province of Ontario supports agriculture. Through the program, eligible farmland owners receive a reduced property tax rate. Beginning on February 25, 2019, program inquiries can be directed to Agricorp at: 1-888-247-4999 or by email at: . Any Farm Tax inquiries to OMAFRA’s Agricultural Information Contact Centre will be routed appropriately.

OMAFRA and Agricorp are committed to ensuring a seamless transition of the Farm Tax Program.

Don’t Miss: Do I Claim Stimulus Check On Taxes

Sales Tax Exemption For Farmers

A copy of the farmer tax exemption permit must be provided to the retailer at the time of each purchase or a blanket certificate may be issued for a continuing line of exempt purchases. A blanket certificate, which is a copy of the original permit with the words “blanket certificate” written across the top, is valid from the date of issuance until September 30 of the following year. If a copy of the exemption permit is not provided to the retailer at the time of purchase, the retailer must collect the applicable sale and use taxes. No sales tax will be refunded for purchases made before the permit is issued.

Who qualifies?

What farming activities are considered agricultural production?

The raising and harvesting of any agricultural or horticultural commodity, dairy farming, forestry, the raising of livestock and poultry, or the raising and harvesting of fish, oysters, clams, mussels or other molluscan shellfish.

Individuals engaged solely in the purchasing of agricultural products for resale are not engaged in agricultural production.

PURCHASES THAT CAN BE MADE TAX FREE WITH A FARMER TAX EXEMPTION PERMIT: A farmer tax exemption permit may be used to purchase goods that will be used exclusively in the agricultural production process. Qualifying purchases may include items such as a farm tractor, truck, or refrigeration equipment as long as the item purchased will be used exclusively in the agricultural production process.

Livestock And Domesticated Fowl

Exempt â Livestock

Livestock is domesticated animals to be raised on a farm for food or clothing. The following are examples of livestock that are exempt from tax:

- Fish and other animals which are products of aquaculture

* Farm deer includes fallow deer, red deer, elk, sika, whitetail, and mule deer but not free-ranging whitetail or mule deer. Farm deer does not include unmarked free-ranging elk.

Exempt â Domesticated Fowl

Domesticated fowl is fowl raised as a source of food, either meat or eggs. Examples of domesticated fowl are:

Taxable animals

The following are examples of animals that, even if raised on a farm as a source of food or clothing, are taxable:

You May Like: How Much Should You Set Aside For Taxes

Applying For Tax Exempt Status

Once you have followed the steps outlined on this page, you will need to determine what type of tax-exempt status you want.

Note: As of January 31, 2020, Form 1023 applications for recognition of exemption must be submitted electronically online at www.pay.gov. As of January 5, 2021, Form 1024-A applications for recognition of exemption must also be submitted electronically online at www.pay.gov. As of January 3, 2022, Form 1024 applications for recognition of exemption must be submitted electronically online at www.pay.gov as well. A grace period will extend until April 30, 2022, where paper versions of Form 1024 will continue to be accepted. For more information, please refer to the Form 1024 product page.

How Do I Apply For Farm Tax Exemption In Oklahoma

How do I apply for a farm exemption permit? You must list your farm equipment with the County Assessor between January 1st March 15th of each year, the County Assessor will fill out a farm exemption permit form provided by the Oklahoma Tax Commission.

- To begin an agriculture exemption application: 1. Click the Apply for Agriculture Exemption link on the OkTAP home page. Oklahoma Taxpayer Access Point Agriculture Exemption Application 2 2. Click the To Begin, Click Here to Select Your Countylink . 3. Select the county to send your application to from the drop-down menu .

You May Like: How Do I Calculate My State Taxes