What Are Tax Brackets

Tax brackets were created by the IRS to implement Americas progressive tax system, which taxes higher levels of income at the progressively higher rates we mentioned earlier. The brackets help determine how much money you need to pay the IRS annually.

The amount you pay in taxes is dependent on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above. For example, if youre single and your 2022 taxable income is $50,000, not all of that will be taxed at 22%, the top bracket for a single person making $50,000. Some of that will be taxed in lower brackets.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

You May Like: When Is The Last Day To File Taxes This Year

Standard Vs Itemized Deductions

To visualize the difference between standard and itemized deductions, take the example of a restaurant with two options for a meal. The first is the a la carte, which is similar to an itemized deduction, and allows the consolidation of a number of items, culminating in a final price. The second option is the standard fixed-price dinner, which is similar to the standard deduction in that most items are already preselected for convenience. Although it isn’t as simple as it is portrayed here, this is a general comparison of itemized and standard deductions.

Most people that choose to itemize do so because the total of their itemized deductions is greater than the standard deduction the higher the deduction, the lower the taxes paid. However, this is generally more tedious and requires saving a lot of receipts. Instead of painstakingly itemizing many of the possible deductions listed above, there is an option for all taxpayers to choose the standard deduction – which the majority of the population opts to do. Some people go for the standard deduction mainly because it is the least complicated and saves time. The annual standard deduction is a static amount determined by Congress. In 2022, it is $12,950 for single taxpayers and $25,900 for married taxpayers filing jointly, slightly increased from 2021 .

How To Calculate Your 2022 Federal Income Tax

If youre looking at that table and thinking, What in the world does any of this mean?dont worry! The first thing to remember is that the rates on the table only apply to your taxable income. So take out deductions before you start doing the math.

Heres an example: Lets say youre a single filer who made $60,000 in 2022 and are taking the standard deduction of $12,950. Youd first subtract the $12,950 from $60,000, leaving you $47,050 of taxable income. That means only $47,450 is going to be taxed. Yeah, baby!

Now if you give that tax chart another look, youll notice $47,450 falls into the 22% bracket. But the whole amount isnt going to be taxed at 22%just a portion of it. Heres how it breaks down:

2022 Tax Brackets on $47,450 of Taxable Income

|

Tax Bracket |

|

|

Total Taxes Due |

$5,968 |

And remember that these are the federal income tax rates. Some states might have either a flat income tax, different tax brackets, or no income tax at all.

Oh, and dont forget to claim any tax credits you might be eligible for after you find out how much you owe in taxes! Tax credits are extremely valuable, because they lower your tax bill dollar for dollar.

For example, the child tax credit allows taxpayers to claim up to $2,000 per qualified child. So in the scenario above, if you had one child under 6 years old, you could claim that credit and knock your tax bill down to $3,967.90.3

Recommended Reading: How To File Taxes On Stock Gains

Where Tax Brackets Apply

| “Taxable Income” above is really Regularly Taxed Income minus Adjustments, Deductions, and Exemptions. |

Payroll Tax , andQualified Dividends and Long Term Capital Gains are separate calculations.

The obvious way to lower your tax bill is to increase the untaxed area at the bottom of the diagram.Contributions to deductible retirement accounts count as adjustments mortgage interest and contributions to charity count as deductions.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Also Check: How To Get Copy Of Tax Return

Gross Wages For Exempt Employees Paid On A Salaried Basis

Because most salaried employees are exempt from the FLSA and not eligible for overtime, calculating their gross pay is a bit simpler, as long as they arent paid any additional compensation or other value. For example, if an employee is paid semi-monthly, or 24 times per year, and the annual salary is $72,000, then the employees gross pay per pay period would be $72,000/24 = $3,000.

Estimate Your Effective Tax Rate

Important Note: Equitable has designed this material to serve as an informational and educational resource it does not offer or constitute investment advice and makes no direct or indirect recommendation regarding the appropriateness of any particular product or investment-related option. Your unique needs, goals and circumstances require and deserve the individualized attention of your financial professional.

Tax-efficient distributions refers to options where a portion of the distribution is a return of cost basis and thus excludable from taxes.

What is a variable annuity?

A variable annuity is a tax-deferred financial product designed to allow investors to invest for growth potential and provide income for retirement or other long-term life goals. In essence, an annuity is a contractual agreement in which payment are made to an insurance company, which agrees to pay out income or a lump sum amount at a later date. Variable annuities are subject to market risk including loss of principal. There are fees and charges associated with a variable annuity contract, which include, but are not limited to, operations charges, sales and withdrawal charges and administrative fees. The withdrawal charge declines from 6% to 3% over five years for Investment Edge®. Earnings are taxable as ordinary income when distributed and may be subject to an additional 10% federal tax if withdrawn before age 59 ½.

Not every contract is available through the same selling broker/dealer.

Recommended Reading: How To Calculate Crypto Taxes

How To Claim The Eitc On Your Tax Return

To claim the EITC, you must file a Form 1040 or 1040-SR federal tax return with the IRS. You are also required to complete Schedule EIC, which requires you to provide your qualifying childs name , Social Security number, date of birth, age, relationship and residency information. If youre using an online tax software provider, it will help complete the form for you.

Get Forbes Advisors ratings of the best overall tax software, as well as the best for self-employed individuals and small business owners. Get all the resources you need to help you through the 2022-2023 tax filing season.

An Example Of Effective Tax Rate

Heres an example. If your gross income is $80,000 in 2022, you would pay the 22% rate on $38,225 of your income in 2022. If you earned $60,000 in gross income, you would pay 22% rate on only $18,225 of your income. In both cases, part of your income would be taxed at 22%, but your effective tax rates would be different.

When your taxable income is $80,000, your effective tax rate is 13.23%, while the rate is 10.31% when your taxable income is $60,000. What makes the tax rates so different? You earned considerably more money in the 22% tax bracket, which pushed your effective tax rate higher.

Also Check: How To Lower Your Taxes Big Time

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Choosing Standard Or Itemized Deductions

Once you know your AGI, you have the opportunity to lower your taxable income even more by subtracting either the standard deduction or your itemized deductionswhichever is greater.

When to consider the standard deduction

If your financial situation is straightforward, the standard deduction might be the best and simplest choice. The standard deduction for 2014 is $6,200 for single filers, $12,400 for married filing jointly and $9,100 for head of household.

When to consider itemizing deductions

If you pay a lot in state income taxes, have a mortgage on your home, give a lot to charity, have paid extensive medical bills or manage a lot of investments, you might be better off taking the extra time to itemize your deductions.

Examples of legitimate itemized deductions:

- State and local income taxes

- Specified medical and dental expenses that exceed 10 percent of your AGI , including limited amount of premiums paid for long-term care policies

- Mortgage interest on first and secondary residences , plus interest on home equity loans

- Charitable contributions to tax-exempt organizations

- Casualty and theft losses

- Investment interest expense

- Miscellaneous expenses, including impairment-related expenses for persons with disabilities and gambling losses to the extent of gambling winnings

- In addition, the following can be itemized if the cumulative total is more than 2 percent of your AGI:

- Business expenses not paid by your employer

Read Also: How Much Taxes Deducted From Paycheck Mn

Calculate Your Gross Income

Add up all sources of taxable income, such as wages from a job, income from a side hustle, investment returns, etc.

To illustrate, say your income for 2022 includes the following:

- $75,000 in wages

- $1,000 in taxable interest and dividends

- $10,000 from a side hustle

- $5,000 in gifts from your grandparents

Of those sources, only the gift is non-taxable. So for tax purposes, your gross income is $86,000.

How Tax Brackets Work

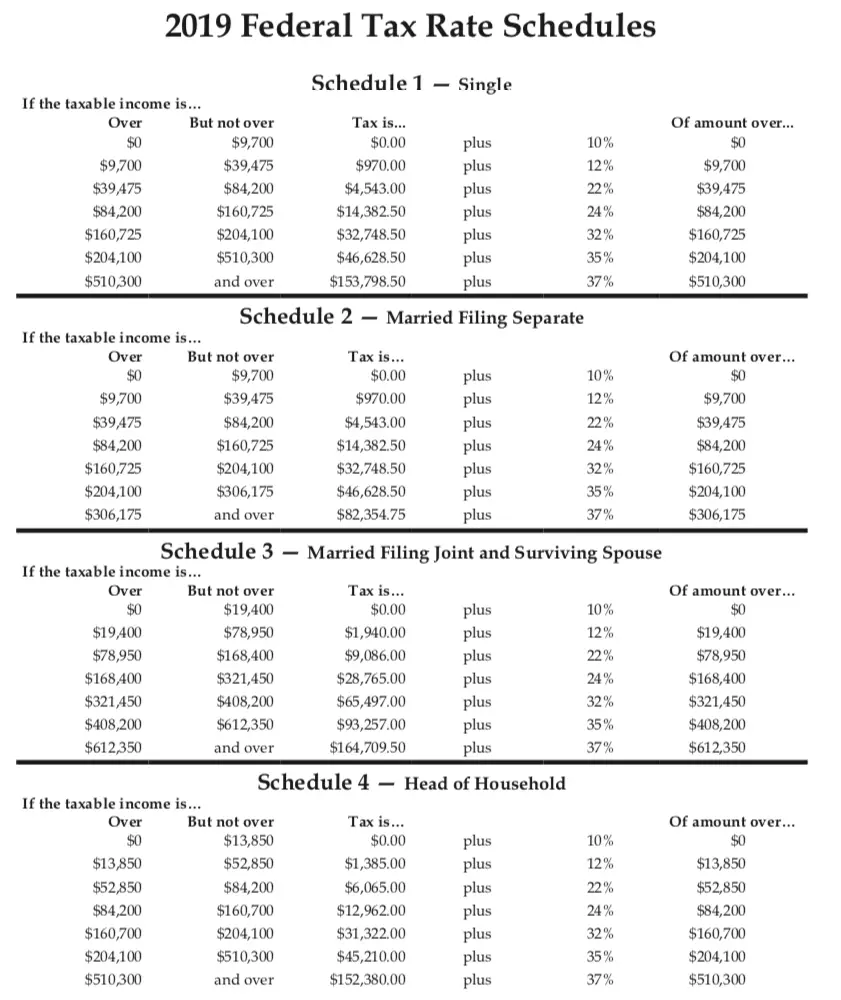

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine effective tax rate, divide your total tax owed on Form 1040 by your total taxable income .

-

Income thresholds for tax brackets are updated annually. Several provisions in the tax code, including the income thresholds that inform the federal tax brackets, are adjusted annually to reflect the rate of inflation. This indexing aims to prevent taxpayers from experiencing “bracket creep,” or the process of being pushed into a higher tax bracket because of inflation.

-

That’s the deal only for federal income taxes. Your state might have different brackets, a flat income tax or no income tax at all.

» Learn more:See state income tax brackets here

Recommended Reading: Does Wyoming Have State Income Tax

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

Calculator Variables And Results

Choose the year that you want to calculate your US Federal Tax

Filing Status

Choose one of the following: Single, Married Filing Jointly, Married Filing Separately, or Head of Household

Taxable Income

The income amount that will be taxed

Estimated Tax

The estimated tax you will pay

Tax Bracket

The tax bracket you fall into based on your filing status and level of taxable income

Tax as a percentage of your taxable income

Since taxes are calculated in tiers, the actual tax you pay as a percentage of your taxable income will always be less than your tax bracket.

Net Income after Tax is paid

This is the amount you have left over after you pay your Federal taxes. This does not account for state and local taxes.

Don’t Miss: When Do I Pay Taxes On Stocks

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

What Is The Earned Income Tax Credit

The EITC is a refundable tax credit, which means it can reduce the amount of taxes you owe and generate a refund.

It was enacted in 1975 to provide financial assistance to working families with children. Today, the credit has evolved and now helps taxpayers with or without children.

The EITC is based on a percentage of your earned income. Examples of earned income include wages, tip income and net self-employment income. Unemployment income, alimony, child support or interest arent considered earned income for EITC requirement purposes. Generally, you wont qualify for the credit if you dont have earned income.

Read Also: How To Pay Your Property Taxes Online