Personal Property Tax Calculation Formula

The current statewide assessment rate for personal property is 33 1/3 %. To determine how much you owe, perform the following two-part calculation:

Heres an example of how this formula works

To calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation:

Massachusetts Property Tax Rates

Tax rates in Massachusetts are determined by cities and towns. They are expressed in dollars per $1,000 of assessed value . For example, if your assessed value is $200,000 and your tax rate is 10, your total annual tax would be $2,000.

An effective tax rate is the annual taxes paid as a percentage of home value. Effective tax rates are useful for comparing between areas and between states. The table below shows the median annual property tax payment, the median home value and average effective property tax rate for every county in Massachusetts.

| County |

|---|

| 1.49% |

How Do Property Taxes Work

State, county and local governments rely on tax funds to pay for services like schools, road maintenance and police and fire, among many other services. Depending on where you live, you may receive tax bills from the county, city and school district, but most areas provide one superbill for you to pay.

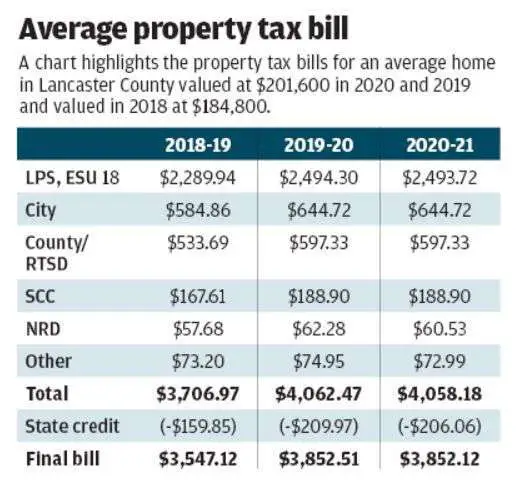

Every homeowner pays taxes based on their homes value and the property tax rates for the county or city. Most areas charge property taxes semiannually, and you pay them in arrears. For example, in 2021, youd pay the property taxes for 2020.

Recommended Reading: When Will I Get My Federal Tax Refund 2021

How Do You Figure Out Taxes On A Mortgage

To estimate taxes on a mortgage, first find out what past owners of the property paid in taxes or get the current property tax rate for the area and calculate it based on the homes assessed value.

How are property taxes calculated for a home?

The amount you pay in property tax is based on two things: your local governments tax rate and your propertys assessed value. All you have to do is take your homes assessed value and multiply it by the tax rate. Lets say your home has an assessed value of $100,000.

How much do you pay in property taxes on a mortgage?

The typical mortgage payment includes principal, interest, homeowners insurance and property taxes. Lets go back to Jim and Pam. After thinking carefully, they choose the home in the town with the lower tax rate and their mortgage lender estimates theyll owe $1,600 in property taxes each year.

How Your Property Value Is Assessed

Most property tax assessments are done either annually or every five years, depending on the community where the property is located. After the owner has received their assessment with its property valuation, a property tax bill is mailed separately.

The information that the assessor has is considered part of the public record. Owners can see how much they must pay by going to the assessors website and entering their address. Sometimes they may be charged a small fee for accessing this material. Another option is to go to the assessors office in the county courthouse. Once you are at the county courthouse, you can look up the information and print out a copy for a nominal fee.

Recommended Reading: Does Ebay Collect Sales Tax For Sellers

Submitting Your Tax Declaration

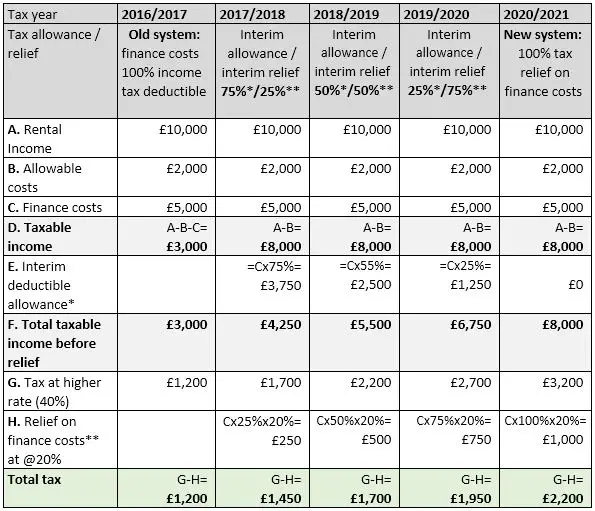

Tax can be complicated, and there is no doubt about that. Calculating your gross income is the simple part, but then applying all the allowances and deductions to generate a final net income figure is tricky.

Just discovering all the allowances you are entitled to can be hard enough, but on top of that, many of them have complicated methods to work out your entitlement.

For relatively simple situations, such as an employee that has a small secondary income, then using one of the many online tax calculators is sufficient.

If you are self-employed, then it may be time to consider using a tax professional. Our blog on submitting a tax return in Germany may help you here.

Where To Find Property Taxes Plus How To Estimate Property Taxes

Thankfully, in many cases, you may not have to calculate your own property taxes. You can often find the exact amount youll pay on listings at realtor.com®, or else you can enter a homes location and price into an online home affordability calculator, which will not only estimate your yearly taxes but also how much you can anticipate paying for your mortgage, home insurance, and other expenses.

Recommended Reading: Is Real Estate Tax The Same As Property Tax

How Do Florida Property Taxes Work

The first step in the Florida property tax process is property appraisal, which is the act of placing a value on a piece of real estate. Every county in Florida has a property appraiser, which is an elected official who’s responsible for the annual appraisal of every lot in the county. In general, this person does this through a mass appraisal, or a systematic analysis of market data in order to assign values to multiple properties at once.

Property tax rates are applied to the assessed value, not the appraised value, of a home. Assessed value takes into account exemptions, including the Save Our Homes assessment limitation.

The most widely claimed exemption is the homestead exemption, which you can claim on owner-occupied residences to protect the value of the home from property taxes, creditors and challenges that arise from the death of a homeowner spouse. It frees the first $25,000 of the homes assessed value from all property taxes, and it exempts another $25,000 from non-school property taxes. This can get confusing, so heres an example:

Lets say you have a home with an assessed value of $80,000. The first $25,000 would be exempt from all property taxes. The next $25,000 is subject to taxes. Then, the next $25,000 is exempt from all taxes except school district taxes. The remaining $5,000 in assessed value is taxable, though.

Residential Real Estate Tax Calculation Formula

The current statewide assessment rate for residential real estate property is 19%. To determine how much you owe, perform the following two-part calculation:

Heres an example of how this formula works

To calculate taxes owed on a $100,000 home at a 6.5694 total tax rate per $100 of assessed valuation:

Also Check: How To Calculate Payroll Taxes In Texas

What Is The Difference Between Property Taxes And Real Estate Taxes

Property taxes are taxes based on the value of the property. The government imposes this tax to help cover the cost of public services and infrastructure, such as roads, schools, police, and fire departments. There is no limit to the amount of property tax you may pay. In other words, it does not matter how much money you earn or how big your house is.

A good tip to remember about the property tax is that it is not usually paid yearly. Instead, you only pay this tax once in a period of time, usually five years. Property taxes are based on the value of your home. The more valuable your home is, the higher the property tax rate is.

If you own a business, you may have to pay a separate business tax based on your business’s profit. Business taxes are not assessed yearly but every three years. If you own a second home, you may have to pay a separate second home tax. This is also calculated based on the value of your home. Real estate taxes are different from property taxes and business taxes. These types of taxes are imposed on the land owner being taxed. The main difference between the property tax and the second home tax is that the second home tax is a tax on the value of your house.

What Is My Tax Rate

Tax rates are comprised of individual rates for the different taxing jurisdictions in your Levy Code Area. The Levy Code Area number can be found at the top middle of your tax bill between the legal description and account number.

Once you have located the Levy Code Area number, refer to the Rate Sheet for your tax rate.

Don’t Miss: Is Interest From Home Equity Loan Tax Deductible

How To Calculate Property Tax

This article was co-authored by Alan Mehdiani, CPA. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 394,452 times.

Property taxes are taxes that are usually assessed locally by municipalities to raise operating revenue for the city or town. In some cases, states can also levy property taxes. Property taxes are usually levied on any piece of privately-owned real estate, from empty lots to houses, based on the assessed value of the property.XExpert SourceAlan Mehdiani, CPACertified Public AccountantExpert Interview. 9 July 2020. They can also be levied on possessions like cars, but often according to different rules. If you own these types of property, knowing how to calculate your property tax liability is an important skill for financial planning.

Find The Assessed Value Of The Property

To find your propertys assessed value, the local government will order an appraisal on the property. Some areas conduct annual appraisals. Others do them every 3 years or less frequently .

Some localities use the market value and others use the appraised value . Either way, they take a percentage of this value to come up with the assessed value.

The percentage they use is called the assessment ratio or the percentage of the homes value thats taxable. The ratios vary drastically around the country.

For example, if your homes market value is $300,000 and your local government taxes 60% of the value, youd pay taxes on $180,000 rather than $300,000.

Read Also: How To Check Your Tax Status

How To Calculate Property Taxes

Property tax is a charge levied by local governments on property owners. It is a tax that you pay on your home or land. You can only pay this tax once a year. It is because the property tax is based on the value of the land. The amount of property taxes is determined by the value of the land. The tax rate is a percentage of the assessed value of the land. So, how to calculate property taxes is not a big deal for a person who has to sell or purchase the property.

What Is A Mill Levy

An assessment mill levy is a tax on real property assessed at $1,000. Property taxes are calculated by multiplying the assessed value by the mill rate and dividing by 1,000. Property tax bills for a $50,000 assessed property would be $1,000 with a mill rate of 20 mills. Calculating property taxes is not too difficult, it just needs a few tricks and formulas.

Don’t Miss: Can You Pay Taxes In Installments

How Property Taxes Are Assessed And Calculated

Property tax is assessed through an assessment ratio. This is the ratio of the home value as determined by an official appraisal and the value as determined by the market.

As an example, if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

The assessment of your property will depend on your countys practices. But its common for appraisals to occur once a year, once every five years or somewhere in between.

The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

Another crucial term to understand is millage rates. The millage rate is the amount per $1,000 of assessed value that’s levied in taxes. Millage rates are expressed in tenths of a penny, meaning one mill is $0.001. For example, on a $300,000 home, a millage rate of $0.003 will equal $900 in taxes owed .

Calculating Property Taxes :

What is an ad valorem tax? In Latin, ad valorem means according to the value. Taxes based upon the value of the property are commonly referred to as property taxes.

What is the millage rate? The millage rate is the amount of property tax charged per $1,000 of taxable property value. For example, if the Villages current millage rate for general services is $1.6304 per $1,000 of taxable value, a property with a taxable value of $100,000 would pay $163.04 for Village services.

What is a TRIM notice? TRIM is an acronym for the Truth In Millage Law, passed in 1980 by the Florida State Legislature. It was designed to keep the public informed about the taxes proposed by local taxing authorities. The TRIM notice is the Notice of Proposed Property Taxes required by this law. All property owners should receive a TRIM notice each August. Other taxing authorities that will appear on this TRIM notice for Indiantown property owners include the Martin County School District, Martin County, South Florida Water Management District, Childrens Services Council and the Florida Inland Navigation District. Each of those taxing authorities charges their own millage rate separate from the Village.

Determine the adjusted taxable value of the property:

- Assessed Value of Home: $150,000

- Less Homestead Exemption: -$50,000

You May Like: Where Do I Pay My Taxes

What Are The Kiddie Tax Rules For 2022

According to IRS tax topic 553, the Kiddie Tax rules require that unearned income over $2,300 under your childs name is subject to the parents margin tax rate. The first $1,150 on unearned income isn’t taxed at all and the next $1,150 is taxed at the childs income tax rate which will be typically be lower than the parent’s.

After the initial $2,300 in unearned income, the rest of it is reported and taxed at the parents marginal tax rate. Your child would be responsible for paying the increased tax rate, which would probably bum them out.

But, you can elect to report your childs unearned income on your income tax return and pay the taxes yourself if they earned less than $11,000 in gross income for the year, and the only unearned income is from interest, ordinary dividends, and capital gains distributions.

What Are Property Taxes

When you buy a home, you’ll need to factor in property taxes as an ongoing cost. Its an expense that doesnt go away over time and generally increases as your home appreciates in value.

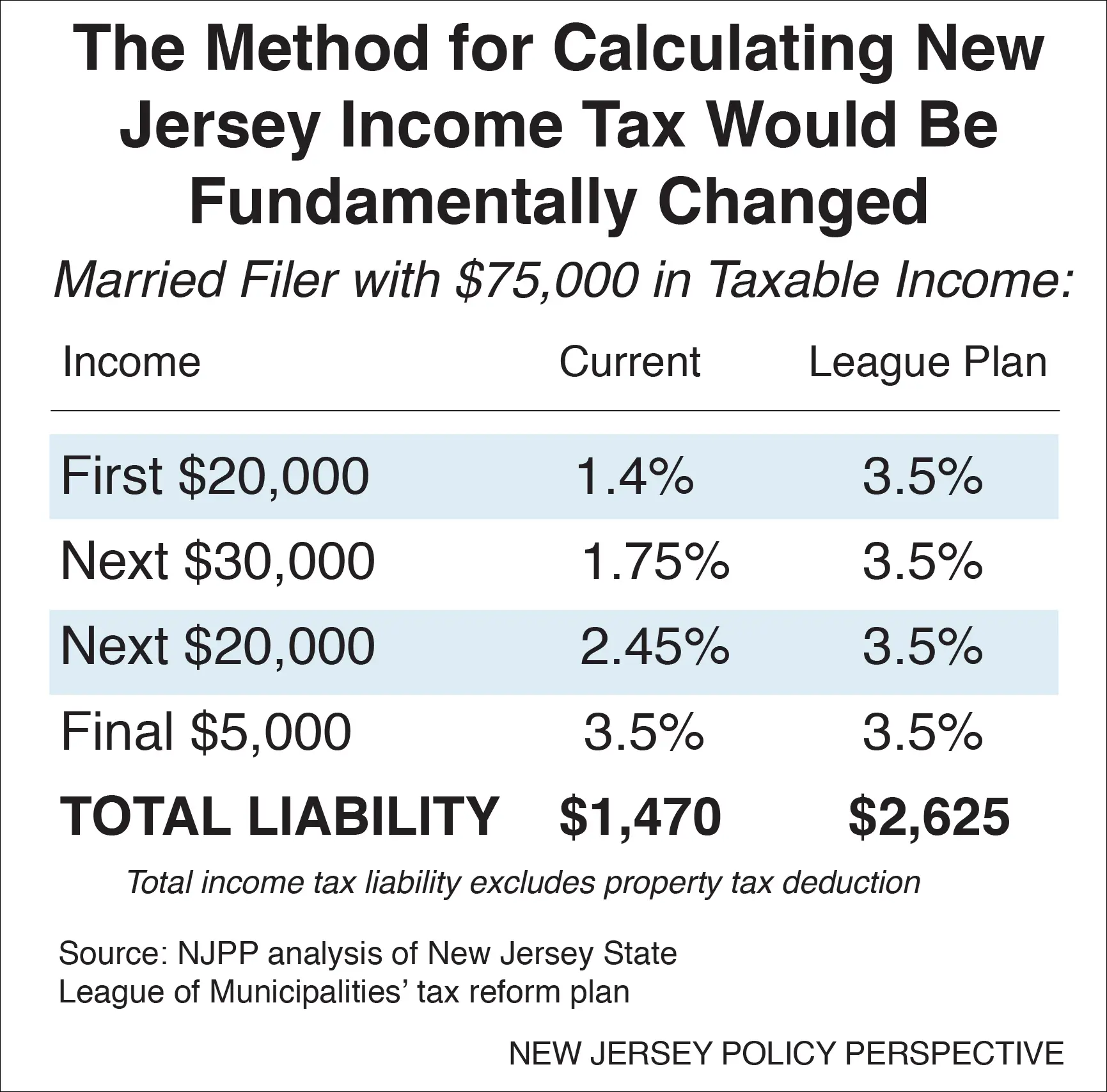

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor can help you understand how homeownership fits into your overall financial goals. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Also Check: How To Figure Tax On An Item

Property Tax: What It Is How It Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

How Do You Pay Property Taxes

You can pay property taxes directly to your local tax authority, but you will want to confirm accepted forms of payment.

You can also add them to your monthly mortgage payments after youve bought a home. Its easier for some people to pay their property taxes this way because it means they dont owe a big lump sum once a year. Since it is separate from your mortgage payment, the property tax money is placed in an escrow account and sent to your local tax authority on your behalf when the bill is due. A mortgage lender also might require a borrower to pay their taxes this way.

Don’t Miss: How Do You Find Your Federal Tax Id Number