Last Years Property Tax Amount

This amount indicates the previous years municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

Also Check: Turbo Tax 1099q

What Should I Do If I Owe Back Taxes

Back taxes are taxes to a national government owed from previous years. Because they were not paid when they were due, the taxes will also typically incur interest and fines until they are dealt with. It is highly advisable to deal with back taxes as quickly as possible, because many tax agencies have the authority to enforce liens and other actions on you, thereby forcing you to pay your unpaid taxes.

There are a number of reasons for back taxes to accumulate. Some taxpayers, for example, may not realize that they owe taxes, or they may have been given erroneous information. Some taxpayers simply do not file tax forms, while others choose to deliberately evade their taxes. Both individuals and businesses can owe back taxes, and the consequences can be very serious if the taxes are not dealt with.

If you owe back taxes, it is better to approach your tax agency than to sit and wait for the tax agency to approach you. Many tax agencies, such as the Internal Revenue Service in the United States, will offer amnesty to tax payers who demonstrate the intent to pay off their unpaid taxes. A taxpayer who asks for help may be offered a payment plan or another form of assistance. If the tax agency has to sent out representatives, however, the agency can and will get nasty.

Also Check: How Do I File My City Taxes

How Do I Know If Im Owed A Tax Refund

If you are due a tax rebate HMRC will let you know by sending you a letter called a P800 or a simple assessment letter.

However, P800 letters can also tell you that you haven’t paid enough tax, and you’ll have to repay it.

You will only get a P800 after the tax year has ended, which will arrive between April and November.

This letter will tell you if you can claim online through the government’s website.

If you claim online the money will be sent to your account in about five days.

Or you can wait for 45 days and the government will send you a cheque in the post.

Read Also: Can You Claim Child Support On Taxes

When To Expect Your Refund

Filing online changes when you expect your refund. CRAs works to process refunds within:

- 8 business days, when filed online

- 8 weeks when a paper return arrives by mail

These timelines apply to returns received on or before the due date.

Some returns take longer to process, especially when selected for a detailed review. Detailed review of your tax return.

Using direct deposit gets you your refund faster. This is where you set up direct deposit.

So, if youre wondering how to check your income tax refund status, follow these simple directions. CloudTax makes sure you get the refund you deserve.

Getting Tax Information From Lender

If youve looked through your records and cant find the information, the next step will be to directly contact your mortgage company for the information. You should be able to easily find the mortgage department of your lender, but once you get through, youll probably need to have your account number. If you cant find a payment coupon book or a bill, the information should be in your closing paperwork from the date you bought your home.

You should also look back in your emails to see if you have information on getting your account information online. Most lenders now allow you to set up an account and access updated information online. Using this method, you can get a better handle on your finances without having to pick up the phone or wait for a monthly bill to arrive.

Don’t Miss: How Are Property Taxes Calculated In Texas

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for previous years tax returns or amended returns.

You May Like: How To Find Unpaid Property Taxes

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Why Do I Owe

Let us help resolve your compliance or collections problem. Learn about reasons why we think you owe us taxes, how we discover the information, what types of notices we send, and what to do about it.

Below you will find links for the most common reasons you may have a Maryland Individual tax liability. You may have received a notice in the mail from us and want more information about it.

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland. If you do not respond to the first notice, an assessment notice will be issued.

Once you receive an assessment notice you will be billed for the amount of the assessment in addition to a substantial penalty and interest charge on the tax owed.

Use the links below if youd like to learn more about the notice you received, how we determined that there was a problem, and what you need to do about it.

In all cases, if you have questions about the notice you received, or you cant find your notice defined here, call the phone number on the notice promptly. By calling the number on your notice, you can find out how to resolve the dispute or file an appeal and Dispute It! Failure to respond to the notice may cause us to assess additional penalty and interest charges and result in further collections efforts.

This notice is to advise that a Notice of Lien of Judgment has been satisfied.

Recommended Reading: When Are Property Taxes Due

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

How Long Do You Have To Pay Back Taxes

On average, the IRS gives you up to 72 months to pay off your back taxes in installments. This doesn’t mean that you have 72 months to do nothing. You will have to reach out to the IRS from one of the methods listed above and set up some kind of payment plan.

If the IRS reaches out to you and you do not respond or make any effort in clearing out your balances come on the IRS will have to take action on its own. This is something you don’t want to happen.

So make sure you provide any information they request promptly. Also make sure that, if you are able to, pay any of the outstanding tax balances. It will make life so much easier.

Don’t Miss: What Is Total Tax Liability Mean

How Long Does It Take To Receive Your Tax Refund

The CRA issues tax refunds in a long timeline it can take anywhere from two weeks to 16 weeks. It depends on the type of return and when you filed it. They will send a Notice of Assessment and any applicable refund within:

- Two weeks of obtaining an electronically filed return

- Eight weeks of obtaining a paper-filed return

- 16 weeks of obtaining a nonresident paper-filed return

The fastest way to get your tax return processed is to file it electronically, and if you choose direct deposit, you will receive the refund quicker, too.

Protecting Your Tax Refund

Although we try to process your refund within the timeframes stated above, it may take longer due to our rigorous fraud detection procedures. Each year, the Department detects new schemes to commit tax refund fraud, and our staff works hard to stop criminals from stealing your refund.

The Department employs many review and fraud prevention measures to safeguard taxpayer funds. These measures may result in refund wait times of more than of 10 weeks. We apologize for this inconvenience and are actively working to release these refunds.

Recommended Reading: How To File Federal Taxes For Free

How Long Should I Wait If I Filed An Amended Tax Return

Amended returns can take up to three weeks to show up in the system, and processing can take 20 weeks or longer, depending on whether your amended return requires additional review.

You can track the status of your amended tax return via the aptly-titled âWhereâs My Amended Return?â tool:

Just like in the âWhereâs My Return?â tool, your amended return will go through three stages while itâs being processed:

Received means your amended return has been received, and itâs being processed.

Adjusted means the IRS made an adjustment to your account.

Completed means the IRS has processed your return, and will mail you all of the information connected to its processing.

If you mailed an amended return to the IRS more than three weeks ago and it hasnât appeared in the system, call the IRS automated toll-free number +1 464 2050 to resolve the issue.

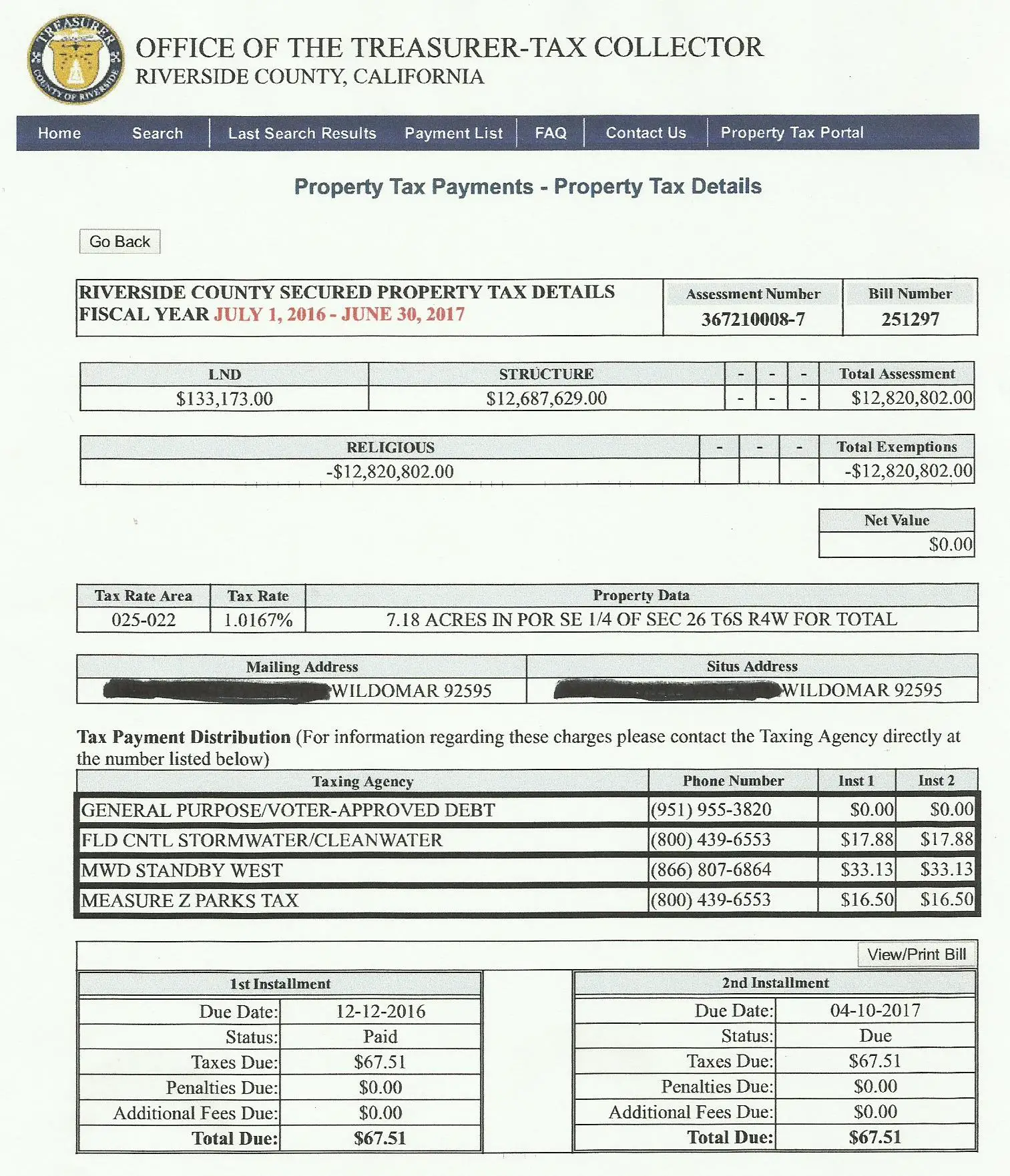

Addremove I Have A Question On The Assessed Value Of My Property And The Exemptions I May Be Entitled To Who Do I Call

For general information on assessed values and exemptions, you may go to the Assessor Department website at www.oc.ca.gov/assessor, or you may call the Assessor at 834-2941. For specific information on exemptions, call: Homeowners Exemptions at 834-3821, Veterans Exemptions at 834-7689, Institutional Exemptions at 834-2779.

Recommended Reading: How Can I Make Payments For My Taxes

Also Check: Why Have I Not Gotten My Federal Tax Return

Howcan I Check The Status Of My Tax Return

To check with CRA on the status of your tax return, you need the following information:

your social insurance number your date of birth the Total Income amount that you calculated and entered on line 150 of your tax return for the current year or the past year .

The methods to check on the status of your return or your refund are:

| using the MyCRA app on your mobile device, such as a smartphone or tablet, and there is also a “web” link if you don’t have a smartphone or tablet. With this service, you can get information about your |

| tax return status – only for 2014 and later years |

| RRSP deduction limit |

| TFSA contribution room as of the past January 1st, once financial institutions have reported all transactions for the prior year |

Quick Access e-service automated Tax Information Phone Service

| see the CRA web page Contact Information including toll-free telephone numbers and approximate wait times |

Will I Receive A Document To Verify The Purchase

The purchaser will receive an unsigned copy of the Final Decree Confirming Sale from the Metro Legal Department when it is submitted to the Chancery Court. Approximately two weeks later, the purchaser will need to obtain a certified copy of the signed Final Decree Confirming sale from the Chancery Court. This document will serve as the deed of record and should be recorded with the Davidson County Register of Deeds.

Read Also: How Much Is The Earned Income Tax Credit

How To Support Your Immunity

Strengthening an immune system is a little more complex than just eating clean, healthy foods. There are specific dietary choices that are known to boost your immune response and maintain it as you age. Every step the body takes during an immune response utilizes many different micronutrients. Some of these include vitamin C, zinc, vitamin D, iron, protein, and selenium. Thankfully, each of these is a part of a wide range of fruits, vegetables, and animal products.

Ensuring your immunity is operating at its best requires consistently incorporating these micronutrients into your diet. Although the immune system can be pretty strong, it doesn’t take too much to weaken it. There is also a wide range of dietary choices that can have an adverse effect on your immune system, leaving your body more exposed to outside pathogens and potential illnesses.

Moreover, our bodies contain a microbiome that consists of trillions of microorganisms that play an important role in the functionality of our immune system. A majority of these microorganisms live in our gut, which is a major aspect of our immune system as well. So, the foods that reach your gut can have a positive or negative effect on its microbiome, thus affecting and influencing the strength and functionality of your immune health.

My Bank Account Number Has Changed I Want To Change The Bank Account Number Which I Mentioned In My Income Tax Return

You can only change your Bank Account Number if you had a refund failure i.e your IT Return is processed and a refund was generated for you but you did not receive it. If you wish to change the Bank Account Number for Refund failure case, then login in the Income Tax e-Filing website and go to My Account â Refund re-issue request. Select the mode through which you wish to receive the refund- ECS or Cheque. Enter the new Bank Account Number and provide address details. Submit the request.

Once the request is submitted, your new Address is updated with the Income Tax Department.

Don’t Miss: Where To Find Tax Liability

How The Calculation Works For A Single Taxpayer

One notable thing about this kind of tax setup is that the amount of taxes owed by someone steadily increases as that personâs amount of income increases. Itâs not a monumental change when people jump from one tax bracket to another.

Answers to your tax questions

Letâs run through how this would work for an imaginary person calculating taxes for 2020: John, who earns $40,000. To keep it simple, letâs say he makes all his money from his work salary, has no dependents, and no itemized deductions.

For his 2020 taxes, John would subtract the standard deduction and take zero personal exemptions, since they were eliminated with the GOP tax law

That makes his taxable income $27,600, putting him in both the 10% and 12% tax brackets.

Hereâs how to estimate how much he would owe in taxes:

Can You Transfer Your Refund To Another Person

No, you cannot ask the CRA to transfer your refund to pay another persons amount owing. This includes your spouse or common-law partner.

Residents of Quebec can transfer their Revenu Quebec refunds to their spouse. For more detailed information on how to proceed, please review the following link from Revenu Quebec: REFUND TRANSFERRED TO YOUR SPOUSE

Also Check: How Much Can You Make And Not File Taxes

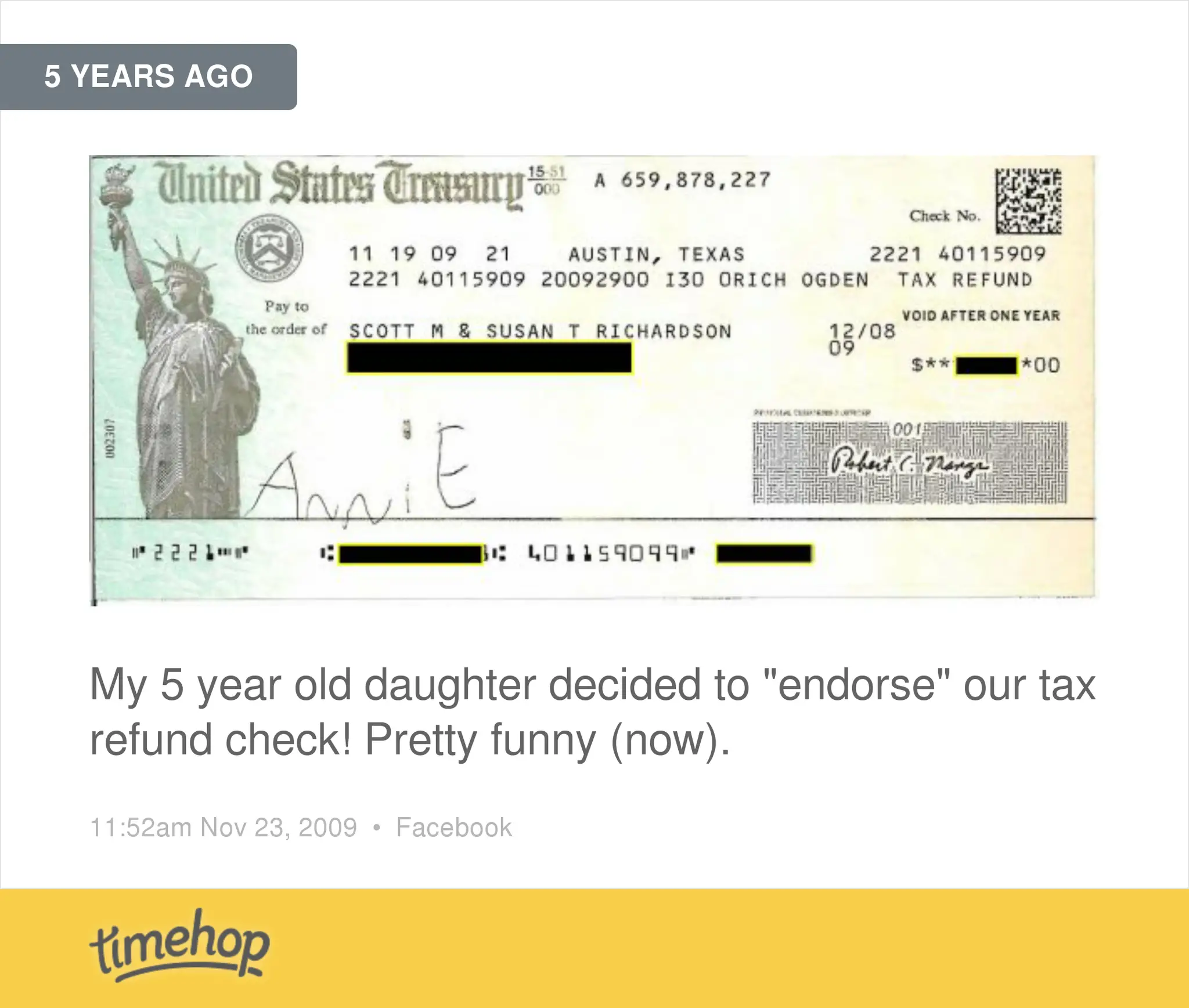

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Pay With A Credit Or Debit Card

You can also use a debit card to pay from your checking account or use a credit card to settle your bill. This is an option even if you dont have the funds available today. Since the IRS doesnt accept credit or debit payments directly, youll need to use one of the agencys approved third-party services.

While each service charges a flat fee for debit cards, they all charge a percentage for credit cards. Be sure to confirm the fee in advance so you know exactly how much youll need to pay. Since the IRS also limits the frequency of credit and debit card payments, confirm that you are eligible for this service before initiating a payment.

Read Also: How To File Stock Taxes