Federal Income Tax Return Calculator

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

How Do I Know If I Qualify As A Contract Worker

You qualify as self-employed and must pay the self-employment tax if you are:

- A Sole Proprietor of a business or trade

- An Independent Contractor

- Part of a Partnership that carries on a business or trade

Additionally, youâll need to meet a few other criteria:

- Behavioral Control: You need to direct and control your own work.

- Financial Control: You need to have direct control over business and financial aspects of your job, setting your own rates for example.

- Type of Relationship: The company that pays you mustnât give you employee benefits or deduct taxes from what they pay you. Nor can your service be an essential, regular part of their business.

If you meet these requirements, you may qualify as an independent contractor. Your income from self-employment will also need to be at least $400, after deductions, for you to be required to pay the self-employment tax. Once youâve determined that you need to pay taxes as a contract worker, youâll need to figure out your tax obligations.

The 6 Steps Explained

Step 1: Identification and other information

Enter personal information about yourself so the Canada Revenue Agency can identify you and accurately calculate the benefits and credits you may be entitled to.

Step 2: Total income

Report your income from all sources that you earned or received during the year. The taxes you might owe are calculated based on your income.

Step 3: Net income

Claim various deductions to reduce your total income to your net income.

Claim other deductions to further reduce your net income to your taxable income.

- Taxable income

Step 5: Federal tax

Calculate the federal tax you owe on your taxable income by using your taxable income, the applicable tax rate and the nonrefundable tax credits you’re entitled to.

- ×multiplied by Federal tax rate

- minus Federal non-refundable tax credits

- =equals Federal tax

Note: Federal tax will show up as Net federal tax on the paper return.

You will do a similar calculation to figure out the provincial or territorial taxes you might owe. You will report this amount in Step 6.

Note: If you lived in Quebec on December 31 of the tax year, you will calculate your provincial taxes by completing a separate provincial tax return for Revenu Québec.

Step 6: Refund or balance owing

Determine the final result of your tax return by subtracting your total credits from your total payable. You will either be entitled to a refund or have a balance owing.

- =equals Refund or balance owing

You May Like: When Was Income Tax Started

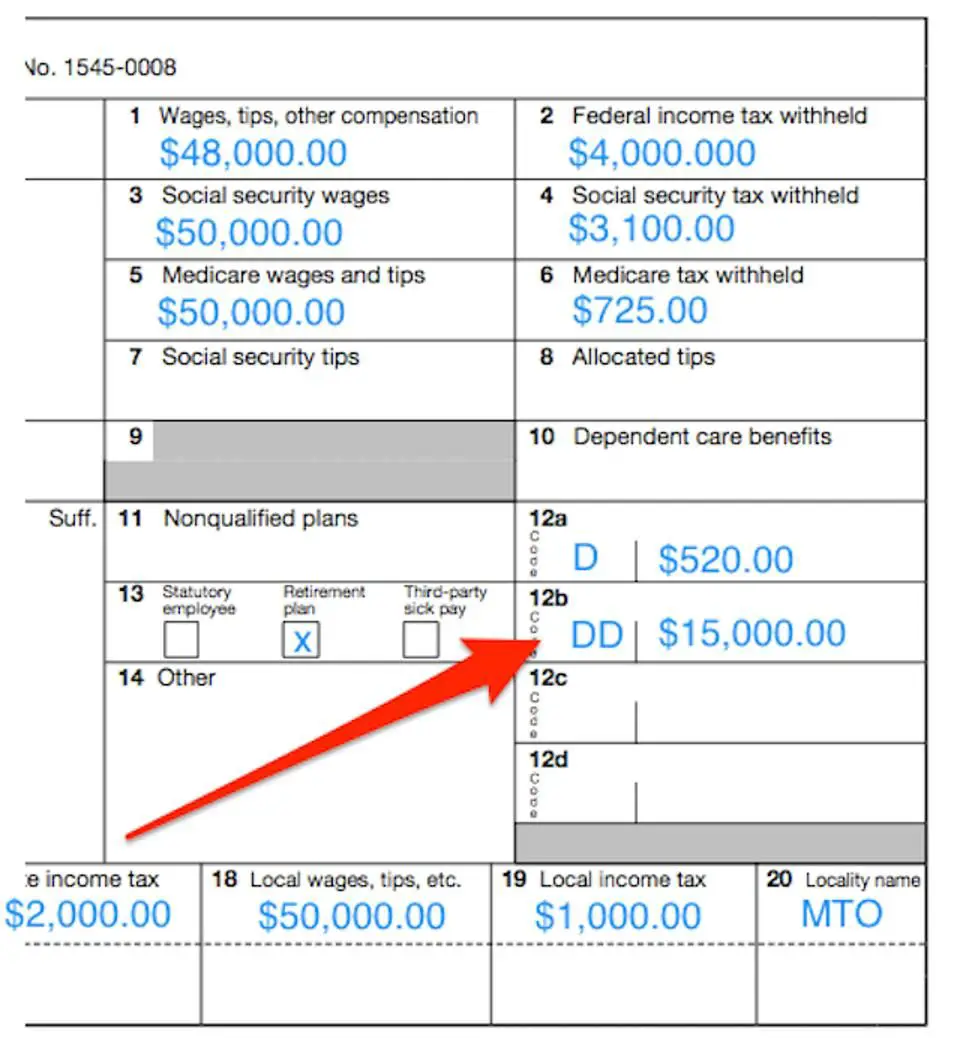

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

Don’t Miss: When Should I Get My Federal Tax Return

Making Use Of Tax Credits

A tax credit reduces the taxes you owe dollar for dollar. A credit is more valuable than a deduction. A $100 credit means that you pay $100 less in taxes. A deduction simply reduces your taxable income.

There are a number of tax credits available, depending on your income and personal situation. A few examples include:

- Child and dependent care credit

- Residential energy credit

- American Opportunity education tax credit for qualified expenses during the first four years of college.

- Lifetime learning credit for expenses related to improving job skills and for pursuing an undergraduate, graduate or professional degree. Learn more at IRS.gov.

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Also Check: How Much Income Need To File Tax Return

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

How Are Dividends Taxed In Canada

There are two types of dividends in Canada: “Eligible Dividends” and “Other Than Eligible Dividends”. Corporations will designate their dividends as either âeligibleâ or âother than eligibleâ for tax purposes.

Dividends are paid out of a corporation’s after-tax profits. This means that tax has already been paid on the dividend amount. However, not all corporations have the same tax rate.

Canadian Controlled Private Corporation are eligible for the small business deduction, which reduces their corporate income tax rate. Dividends paid out by them are “other than eligible”. Since a lower amount of tax has already been paid on them, you will receive a smaller tax credit rate.

Public corporations are not eligible for the small business deduction, and so their dividends are designated as eligible dividends. As a higher tax rate applies to these public corporations, your dividend tax credit amount will be larger.

A dividend gross-up multiples your actual dividend amount by a certain multiplier, which attempts to replicate what the dividend-paying corporation had to earn in order to pay out the dividend after taxes.

You May Like: Can I Pay Property Tax Online

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: What Are The Different Tax Forms

How Do I Calculate My Taxes As An Independent Contractor

Youâll need to pay all the taxes you paid as a regular employee. In addition, youâll need to pay the employer portion of the Social Security tax and the Medicare tax. As the name may suggest, the employer normally pays this tax. However, because you donât technically have an employer, as an independent contractor, you are responsible for that portion of the tax.

Your total obligations for Social Security is 12.4% of your income. This includes both your employer and your employee portion. Your Medicare obligation is 2.9%. As mentioned, normally your employer is responsible for half of the 15.3%, total, of these two taxes. Note that the âemployerâ portion of these taxes can be deducted as an expense. And youâll need to calculate your income before you determine the actual dollar amount that you owe.

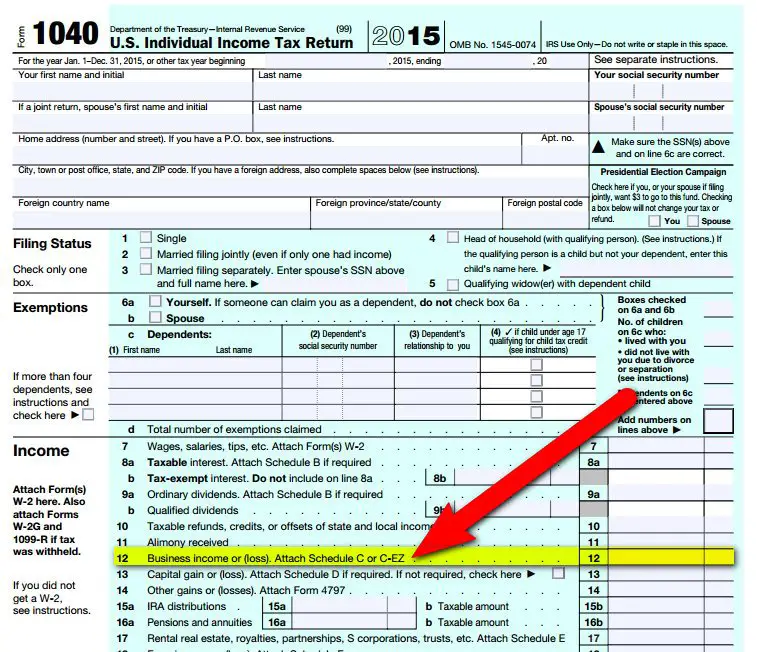

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Don’t Miss: Can You Write Off Refinance Closing Costs On Taxes

Example Of Calculating Tax In The Third Tax Bracket

When Maria does her taxes, the federal taxes she owes on her income are calculated like this:

Both Giovanni and Maria have calculated only the first part of the net federal tax calculation. The amounts calculated here will be reduced as the process continues.

What Records To Keep

Doing your taxes will be a lot easier if you keep the right recordsand keep them easily accessible. It’s wise to keep:

- All of your tax returns for seven years. This includes all supporting documents such as forms that show your income and validate your deductions: W-2, 1099s, canceled checks, receipts for charitable contributions, etc.

- All home ownership documents, including records of home improvements.

- Investment records, including what you paid and when you sold.

- Statements for retirement accounts. In particular, you will need to have records of after-tax contributions.

Recommended Reading: Where To Mail Taxes To Irs

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

Determining The Amount Of Federal Tax On Your Taxable Income

Canada has a progressive income tax system, which means you pay more tax as your income increases.

The taxes you pay are determined by which of the 5 tax brackets your income falls into. A different tax rate applies to each tax bracket but only to the income within that bracket. The higher tax rate does not apply to all your taxable income. The same tax brackets are used for all types of income, such as employment income or occasional earnings.

Test yourself

Sorry, that’s incorrect.

In this type of tax system, the larger your income is, the less tax you pay.

Canada has a progressive tax system. In this type of tax system, you pay a higher tax rate as your income increases. Each higher tax rate applies only to the income in its respective tax bracket.

That’s correct.

Answer: “A progressive tax system”

In this type of tax system, you pay a higher tax rate as your income increases. Each higher tax rate applies only to the income in its respective tax bracket.

Sorry, that’s incorrect.

In this type of tax system, you pay the same tax rate as everyone, no matter how much income you earn.

Canada has a progressive tax system. In this type of tax system, you pay a higher tax rate as your income increases. Each higher tax rate applies only to the income in its respective tax bracket.

The federal income tax rates apply to all provinces and territories.

Current federal tax rate and income tax brackets

Recommended Reading: Where Do You Go To File Taxes

Provincial Or Territorial Non

You claim federal non-refundable tax credits to reduce your federal tax owing. Many of these credits have an equivalent that reduces your provincial or territorial tax owing.

These credits will usually have the same eligibility criteria. Some provinces and territories may also have other nonrefundable tax credits you can claim.

Claiming provincial or territorial non-refundable tax credits is part of Step 6 in filling out your tax return.

Note: If you lived in Quebec on December 31 of the tax year, you will calculate your provincial taxes by completing a separate provincial tax return for Revenu Québec.

Resources are available

After you finish this lesson, this resource link will be available:

- Provincial and territorial tax and credits