When You Need More Time To Finish Your Tax Return

Filing a tax extension request using IRS Form 4868 asks the Internal Revenue Service to give you additional time to file your personal tax return.

An extension moves the filing deadline from April 15 to October 15, but it doesnt give you extra time to pay taxes you might owe on that return.

Is taking one always a wise move?

Residents and business owners in Louisiana and parts of Mississippi, New York, and New Jersey were granted extensions on their deadlines for filings and payments to the IRS due to Hurricane Ida. Due to the tornado in December 2021, taxpayers in parts of Kentucky were also granted extensions. You can consult IRS disaster relief announcements to determine your eligibility.

Determining If A Taxpayer Is Doing Business In California

The economic nexus thresholds for determining if a taxpayer is doing business in California for the 2019 taxable year were released by the California Franchise Tax Board. A taxpayer is considered to be doing business in California if it is organized or commercially domiciled in California its sales in California exceed a threshold amount or 25% of its total sales its real property and tangible personal property in California exceed a threshold amount or 25% of its total real property and tangible personal property or the amount paid in California by the taxpayer for compensation exceeds a threshold amount or 25% of the total compensation paid by the taxpayer. The threshold values for the 2019 tax year are as follows: sales, $601,967 property, $60,197 and compensation, $60,197.

California Provides Financial Relief To Small Businesses

Starting November 1, 2021, small business employers can apply for the 2021 Main Street Small Business Tax Credit to obtain financial relief due to COVID-19. Small businesses can utilize this credit to offset their income or sales and use taxes when they file their returns. The California Department of Tax and Fee Administration will accept online applications through November 30, 2021.

Qualifications

A small business may qualify for the credit if it:

Small businesses may receive up to $1,000 per additional net qualifying employee, not to exceed $150,000.

Recommended Reading: Where Can I Mail My Tax Return

Filing An Amended Return

If you file your income tax return and later become aware of any changes you must make to income, deductions, or credits, you must file an amended Louisiana return. To file a paper amended return:

- Mail an amended return that includes a payment to the following address: Louisiana Department of Revenue

You May Like: States That Have No Income Tax

How Can A Business Avoid Missing A Federal Or State Income Tax Filing Deadline

No business owner wants to miss federal or state income tax filing deadlines. However, it is not always easy to stay on top of those filing due dates while trying to manage day-to-day operations, finances, and everything else that goes into running a business.

There are several best practices you can implement to make sure your companyâs legal health remains strong.

Working with a qualified tax professional can provide added guidance and assurance as you navigate the tax filing obligations specific to you or your small business. A tax professional can also help you confirm that your Corporate Records are complete and that you are meeting your other business obligations.

Read Also: When Do You Have To Have Your Taxes Done By

California Amending Regs To Clarify How Petitions For Alternative Apportionment Are To Be Considered By The Ftb

The California Franchise Tax Board voted to proceed with adopting certain proposed amendments to California Code of Regulations, Title 18, section 25137 which permits a taxpayer to petition for the use of an alternative apportionment method, if the standard allocation and apportionment provisions do not fairly reflect the extent of a taxpayerâs business activity in California. There was limited formal guidance as to how such petitions were to be considered by the FTB, so the proposed amendments are aimed at addressing that issue.

May 2, 2020

California Enacts Salt Limitation Workaround

California Governor Gavin Newsom has signed a budget trailer bill that creates an elective pass-through entity tax. For taxable years beginning on or after January 1, 2021, and before January 1, 2026, qualified entity doing business in California can make an annual, irrevocable election to pay a pass-through entity tax similar to the New York PTET. The tax is computed at the rate of 9.3% for the taxable year for which the election is made.

Entities eligible to make the California PTET election include entities taxed as partnerships and S Corporations. This elective tax is in addition to, and not in place of, any other tax required to be paid under Californiaâs personal income tax or corporation tax laws. As such, owners of pass-through entities making the election claim a credit for their share of the pass-through entityâs PTE tax on their respective returns. If this results in an overpayment, excess credit may be carried forward for five years.

For taxable years beginning on or after January 1, 2021, and before January 1, 2022, the elective tax is due and payable on or before the due date of the original return that the entity is required to file, without regard to any extension of time for filing the return, for the taxable year of the extension. For future tax years, the Department will establish new due dates for making the election and payment of the tax.

Read Also: What Are The Income Tax Brackets

General Tax Return Information

Due Date – Individual Returns – April 15, or same as IRS

Extensions – California has an automatic six-month extension to file an individual tax return. No form is required to request an extension.

Form FTB 3519, Payment for Automatic Extension for Individuals. Form FTB 3519 is used to make payment only if a return cannot be filed by the return due date and the taxpayer owes tax. To access Form FTB 3519 in the program from the main menu of the CA return, select Personal Information > Other Categories > File CA Extension . Note: This form cannot be electronically filed. Mail Form FTB 3519 with payment to the appropriate mailing address. .

Drivers License/Government Issued Photo Identification: California does not require Driver’s License or Government Issued Photo ID information to be included in the tax return in order to electronically file. It is recommended by the state that before preparing returns or accepting returns for electronic transmission, you should review two pieces of identification from each new client and retain a copy of this information in your files for four years from the due date of the return or four years from the date the return is filed, whichever is later.

Does California Accept Federal Extension For Llc

Business. We automatically allow a 7-month extension for businesses to file Form 100 that are not suspended. This includes exempt organizations. We automatically allow a 6-month extension for businesses to file Form 100S that are not suspended.

Will there be a tax extension in 2022?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. We cant process extension requests filed electronically after April 18, 2022. Find out where to mail your form.

What happens if you miss the tax deadline 2022?

Do I need to file an extension for LLC?

Corporations, LLCs and more expansive businesses use IRS form 7004. As with an individual return, submitting this form is an automatic request for a six-month extension to file your businesss income taxes. Federal tax extension forms can be submitted electronically.

Also Check: How To Not Pay Taxes Legally

California Filing Due Date: Individual Income Tax Returns Are Due By April 15 In Most Years Or By The 15th Day Of The 4th Month Following The End Of The Taxable Year

Extended Deadline with California Tax Extension: California offers a 6-month extension, which moves the filing deadline to October 15 .

California Tax Extension Form: Californias tax extensions are paperless, which means there is no application or written request to submit. As long as your California tax is properly paid on time, you will automatically receive a state tax extension.

California Extension Payment Requirement: An extension of time to file is not an extension of time to pay your California income tax. All state tax payments are due by the original deadline of the return. Any tax not paid by the proper due date will be subject to penalties and interest. You can make a California extension payment online, by credit card, or by check with Form FTB 3519.

To pay online, go to California Web Pay for Individuals: ftb.ca.gov/online/webpay

California Tax Extension Tip: If your California tax liability is zero or youre owed a state tax refund, California will automatically grant you a filing extension. In this case, you dont need to do anything in order to obtain a California tax extension.

Californians Reject Imposing Additional Taxes On Millionaires

Jonathan Weinberg, JD, LLM, Principal

Authored by: Justin Howe, JD and Jessie Racioppi

Effective September 29, 2022, settlement claims received by wildfire victims from the 2015 Butte Fire, 2017 North Bay and Thomas Fires, and 2018 Woolsey and Camp Fires are excluded from California taxable income. Taxpayers who qualify for this exclusion include those that owned, resided in, or had a place of business in one of the affected counties, incurred expenses, and received settlements related to the fires. The taxpayer must provide supporting documentation to the California Franchise Tax Board, if requested.

Also enacted, employers with more than 25 employees must continue to provide up to 80 hours of COVID-19 supplemental sick pay to all employees. This mandate was initially set to expire September 30, 2022, but now has been extended to December 31, 2022. Qualified businesses can receive up to $50,000 in Small Business and Nonprofit COVID-19 Supplemental Paid Sick Leave Grants to reimburse them for the cost of the supplemental paid sick leave incurred by employees. If you have questions about how these California changes affect your business, please contact a member of the Withum SALT Team.

Authored by: Brandon Vance and Bonnie Susmano, JD, MBA

Authored by: Jessie Racioppi and Courtney Easterday, MSA

Authored by: Justin Howe, JD and Breea Boylan, MSA

A holder is ineligible for the voluntary compliance program if:

Authored by: Justin Howe, JD and Breea Boylan, MSA

Read Also: When Will The Child Tax Credit Payments Start

Special Rules For Tax Extensions

The IRS allows certain taxpayers extra time to file their taxes without needing to file for an extension, including:

- U.S. citizens and resident aliens residing and working outside of the United States and Puerto Rico: Individuals in this group automatically receive a two-month extension and a tax deadline of June 15. Still, any tax due must be paid by the April tax deadline to avoid interest charges.

- Active duty military personnel serving outside of the U.S. or Puerto Rico: These servicemembers qualify for an automatic two-month extension and do not need to file Form 4868.

- Taxpayers affected by disaster: If the President declares a disaster in a particular area, the IRS can postpone deadlines for the people and businesses in the impacted area.

Ca Franchise Tax Board Issues Relief Provisions For Taxpayers Amid Covid

This relief includes changes to the various tax filing and payment deadlines that occur on March 15, 2020, through , to July 15, 2020. âThis includes:

- Partnerships and LLCs who are taxed as partnerships whose tax returns are due on March 15 now have a 90-day extension to file and pay by June 15.

- Individual filers whose tax returns are due on April 15 now have a 60-day extension to file and pay by June 15.

- Quarterly estimated tax payments due on April 15 now have a 60-day extension to pay by June 15.â

Taxpayers claiming COVID-19 relief should write the name of the state of emergency in black ink at the top of their tax return to notify FTB of the extension period provided by the relief. If taxpayers are e-filing, they should follow the software instructions to enter disaster information.

In addition, the FTB will also waive interest and any late filing or late payment penalties that would normally apply.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

Don’t Miss: Why Raising Taxes On The Rich Is Bad

Why Should I File A Tax Extension

- Youve got a few things left to organize before you can file

- A sudden change in your life that needs your full attention

- Youre still waiting for tax forms or documents

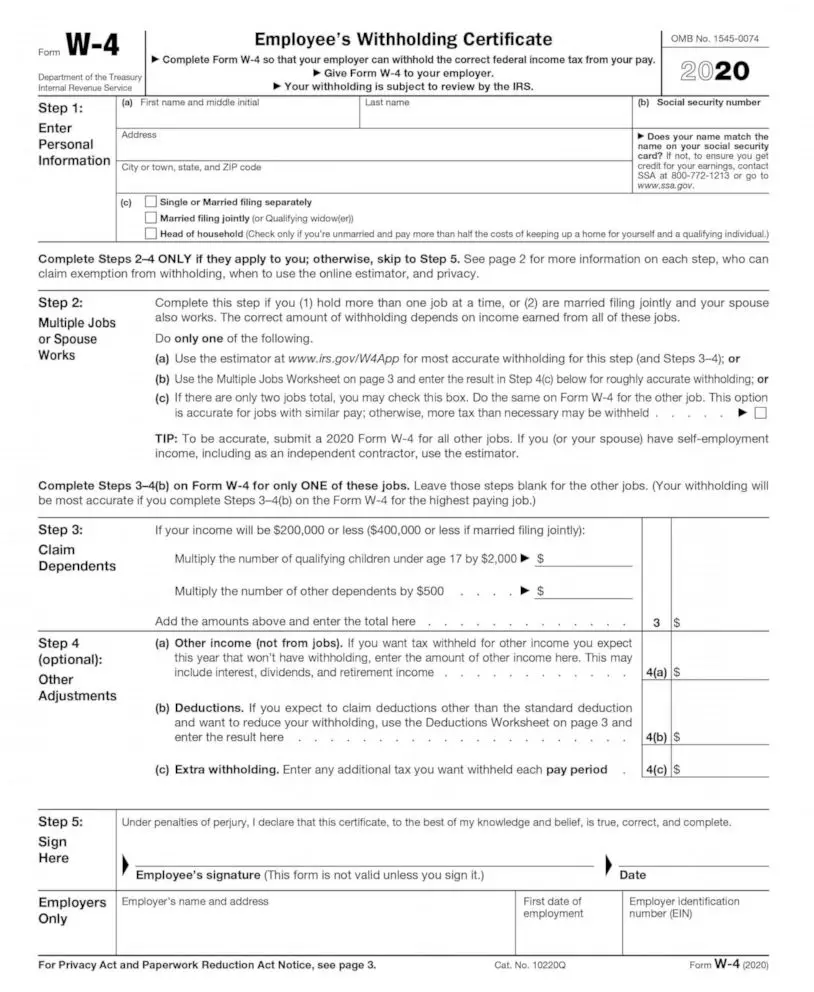

- Your W-2 or other forms need to be replaced

- Extreme weather or another event delays your tax filing

- Filing later has tax planning advantages

- You want to avoid late filing penalties

You May Like: What Percent Of Your Income Should Go To Mortgage

Using Turbotax Easy Extension To File A Tax Extension

TurboTax EasyExtension is a simple, online tool that allows you to file a tax extension in minutes. Try it here.

Heads up filing Form 4868 only provides you with an extension of time to file. You must still pay 100% of the tax you owe by the original filing deadline to avoid interest and late-payment penalties.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: How To Apply For Tax Id

Californias Cannabis Businesses Eligible For Income Tax Credits

On June 30, 2022, California will provide income tax credits for cannabis businesses. For tax years beginning January 1, 2023 through and before January 1, 2028, qualified licensed commercial cannabis businesses may receive a credit equal to 25% of the total amount of qualified expenditures in the taxable year, capped at $250,000.

In order to claim the credit:

- The business must provide full-time employees with certain benefits

- Qualified expenditures means the amount paid or incurred by the business for employment compensation for full-time employees safety-related equipment, training, and services or workforce development and safety training for employees and

- The business must request a credit reservation from the California Franchise Tax Board during the month of July for each taxable year.

May 13, 2022

Whats The Irs Penalty If I Miss The October 17 Extension Filing Deadline

The IRS applies late penalties and interest on a case-by-case basis and will send a separate bill if penalties apply.

Because the IRS has the last word on penalties, we cant calculate the exact amount if your return is late. But the info below will give you an idea of what to expect in a worst-case scenario .

There are two types of fees that may apply, plus interest on any unpaid taxes:

- Late filing penalties apply if you owe taxes and didnt file your return or extension by April 18, 2022, or if you filed an extension but failed to file your return by October 17, 2022.

- The late filing penalty is 5% of the additional taxes owed amount for every month your return is late, up to a maximum of 25%.

- If you file more than 60 days after the due date, the minimum penalty is $435 or 100% of your unpaid tax, whichever is less.

You wont face a penalty if:

Also Check: Is The Solar Tax Credit Refundable

Also Check: How Do I Amend My Tax Return

Small Business Resiliency Fund

Due to the disruptions caused by COVID-19 to the small business community, the COVID-19 Small Business Resiliency Fund was created. It allows impacted small business owners to access up to $10,000 for employee salaries and rent. This program is administered in partnership with Northeast Community Federal Credit Union.

To be eligible for the COVID-19 Small Businesses Resiliency Fund, small businesses must:

Applications must be completed and submitted via email to or they can be mailed or delivered to:Attn: Judy Lee â COVID 19 Small Business Resiliency Fund1 Dr. Carlton B. Goodlett PL. Rm# 448San Francisco, CA 94102

Please review the application for all needed documents to be submitted. In addition, the following will be required: