Up To Date On All Credits And Deductions

TurboTax Free contains all the federal and provincial forms you need to get your Canada income taxes done including the newest credits and deductions. From the Family Tax Cut to the now-refundable Childrens Fitness Credit, find all your deductions with TurboTax Free. Checklists for:Students ,Dependant Credits,Seniors and Investors

The Tutorial: Doing Your Taxes With Turbotax Free Software

INSIDE: Filing your taxes online doesnt have to be overly complicated, especially with the TurboTax free version online. Heres a Turbo Tax step by step guide!

Oh, hi tax season. Even though I cover personal finance topics for a living, tax season still sneaks up on me every year. Even ifyou dont run your own business or have complicated taxes, filing online can be intimidating. While more of a hassle than say, returning a package, filing your income tax online doesnt have to be overly complicated, if you plan properly and leverage great technology, such asTurboTax free filing online.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Do I Need W2 To File Taxes

Highly Discourage If You Invest

This app is great for standard working income and I have used it for years for that purpose, but very quickly the app falls short if you are trading often in stocks or other forms of frequent trade investment. There is an extra charge for filing with trading income that you then have to painstakingly manually enter, despite the data being very clear and concise on all tax documentation. For me this very extremely takes away from the core purpose of the app to make filing your taxes quicker and easier. So in this regard it falls very short. Having to constantly switch back and fourth between this app and a PDF of your tax doc to copy and paste every date and amount takes away also from the security of being sure that your taxes are being done correctly, as you are at that point, for the most part, just doing it yourself. AND being charged an extra 70 dollars to do so. This with the fact that the app constantly closes in the background while you try to copy over your tax info, forcing you to reload the app, and go back through several menus before you can actually begin entering your tax info again. It would seem to take a good hour to enter in roughly 20 trades with having to copy over, amount, cost, proceeds and 2 dates one at a time for every single trade. For this reason I have to highly discourage this for any new or also experienced traders and investors thinking that this will make filing easier. It will be very time consuming.

When Should I Consider Turbotax Live

If you think your taxes are.uhm. a bit more complicated , TurboTax has a product, TurboTax Live, designed to provide live assistance from a credentialed tax expert, on demand. . TurboTax Live Basic is for simple returns only. There are also Live Deluxe, Premier and Self-Employed versions.

If youre the learn as you go type , you can go through the software and then sign up for Expert Review at the end. What this means is that once youre done preparing your taxes, you can have a tax expert review your tax return for accuracy, then sign and file.

Having an expert review generates peace of mind for you, and it comes with theTurboTax Maximum Refund Guarantee plus a 100% Accuracy Guarantee if you use Expert Review.

Heres what the screen looks like.

Also Check: How Much Does H& r Block Charge To Do Taxes

How Easy Is It To Use Turbotax

Is it easier than just handing off papers to an accountant? No, but the cost savings are pretty significant because you can file your taxes, even if youre self-employed, for as little as $90. You can even choose to pay for your tax preparation costs out of your federal tax refund. You may also benefit from TurboTax tips and articles, such as an interesting one about tax myths.

Irs Free File Program Delivered By Turbotax

The IRS Free File Program is a public-private partnership that provides free tax preparation and filing services for eligible taxpayers at no cost to the taxpayer or the government. Participation in this program is a part of Intuits broader efforts to help more Americans file their taxes for free.

As a founding member of the Free File Alliance, Intuit has provided free tax preparation to millions of Americans through the IRS Free File program over two decades. Last year alone, approximately 2 million taxpayers filed for completely free using the TurboTax IRS Free File offer.

This year, taxpayers with an adjusted gross income of $39,000 or less, military personnel with adjusted gross income of $72,000 or less, or those who qualify for the Earned Income Tax Credit can prepare and file their federal and state tax returns for free with the IRS Free File Program delivered by TurboTax. TurboTax makes its Free File program offering available to the maximum number of eligible taxpayers allowed by the IRS. IRS Free File Program is now available at IRS.gov.

Recommended Reading: How To Look Up Employer Tax Id Number

How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

Enter In Business Income

Heres where it gets a little more involved. As a business owner, you should keep a simple Profit & Loss sheet totaling up how much you made and how much you spent on the business for each month of the calendar year. If you use online accounting software for invoicing and expense tracking, it should do this for you. I like to keep my own record, and I update it monthly.Heres a great template, if you dont already have one.

Pro Tip: If you freelance or own a blog business, enter all of the income you receive a 1099 for, then subtract that from your total annual income. Then claim the remainder as General Income.

Also Check: How Much Does H& r Block Charge To Do Taxes

How Do I File My 2019 Taxes

You can complete the 2019 tax return at any time.

Note that when you are e-filing the 2020 tax return you will be asked to enter the 2019 AGI. Since the 2019 tax return will be processed late by the IRS, enter a 0 for the 2019 AGI

To complete and file a 2019 tax return using TurboTax you would need to purchase, download and install on a personal computer one of the 2019 desktop editions from this website –

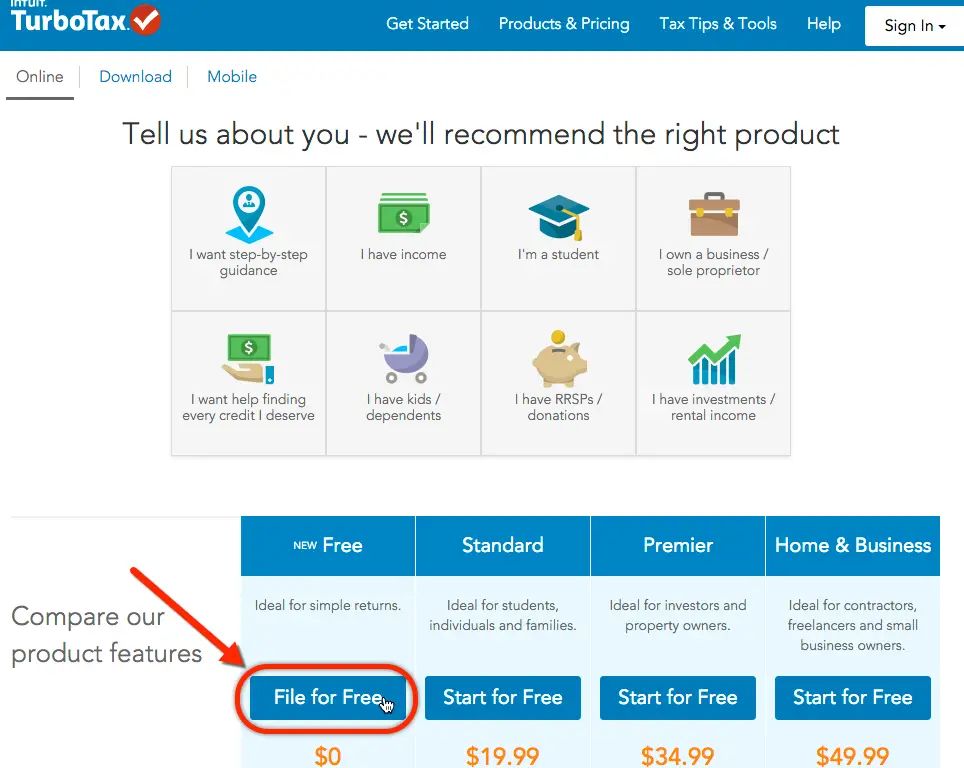

Who Qualifies For Turbotax Free Edition

If you make less than $34,000 per year, you can file your taxes for free with TurboTax Free File. This edition is required as part of the industrys deal with the IRS. You can access the TurboTax Free File program here.

TurboTax also offers a Free Edition for people who are filing very simple returns. Warning: The Free Edition puts many people on track to pay is not part of the IRS Free File program.

Remember: If you make under $66,000 per year, you are still eligible to prepare and file your taxes for free under the IRS Free File program.

If you make under $66,000 per year, to find another free tax preparation offer from IRS Free File.

Don’t Miss: Buying Tax Liens California

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

How To File With Turbotax Free

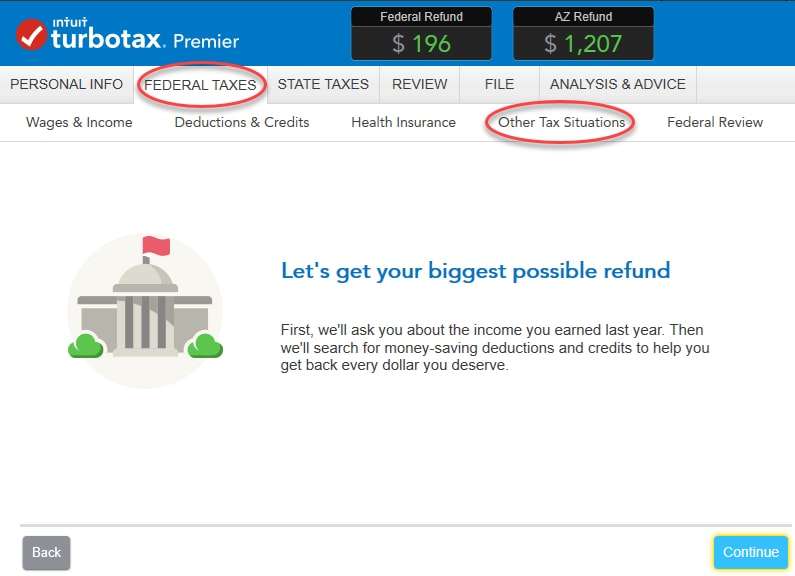

First, create an account. Youll be asked to fill in personal information and then to answer questions about your tax situation this year.

Youll go through screen by screen, filling in the information related to you:

- Wages and income

- Other tax situations

- And finally a federal review.

Pro Tip: Youll have to fill out information and answer all of TurboTaxs questions, even if youre certain you want to take the standard deduction. Its a few screens, but they just want to double-check and make sure you arent missing out on any money.

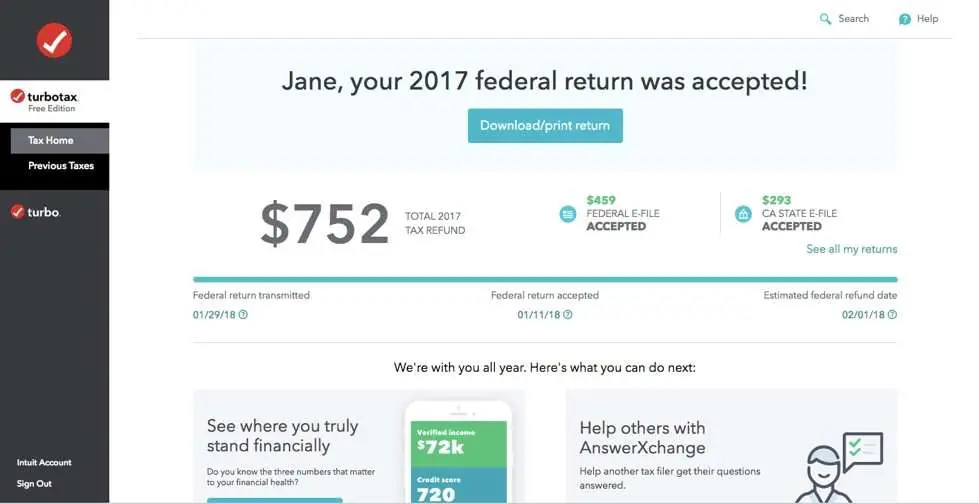

Once youre finished with your federal return, the software will use that information to pre-populate all the information on your state tax form. After double-checking all of that information, you should see a screen like this.

Then a final screen to double-check the results.

And then youre clear to file!

Okay all done! Skip to the conclusion of this article.

Don’t Miss: What Does Locality Mean On Taxes

Ways To File Your Taxes With Turbotax For Free

What could be better than paying $0 to do your taxes? Over the last six years Americans filed approximately 70 million tax returns completely free of charge using TurboTax, more than all other tax prep software companies combined. Last tax season, more people filed their taxes with TurboTax and paid absolutely nothing than in any year in company history.

Find out all the ways you may be eligible for free tax filing with TurboTax!

Free Turbotax For Enlisted Military

Intuit is a proud supporter of US military members, veterans and their families in their communities and overseas. As a part of this commitment, we at TurboTax are proud to provide free federal and state tax preparation to all enlisted active duty and reservists E1-E9.

Military members can file through any TurboTax Online product, including Free Edition, Deluxe, Premier, and Self-Employed. You just need to enter your W-2 and verify your military rank when prompted within TurboTax Online and your discount will be applied when you are ready to file.

Don’t Miss: Where Is My Tax Refund Ga

Can I Netfile My Tax Return For The Years 2010201120122013201420152016 2017 Do I File My 2016 Return Using 2016 Turbotaxdo I Use 2017turbotax To File 2017 James

I am trying to file tax returns for a friend . I have to file for the years 2010,2011,2012, 2013,2014,2015,2016,2017,2018. Can I netfile my tax return for all of these years? How do I net file for prior years? Do I file my 2016 return using 2016 TurboTax? Then move to 2017 TurboTax tofile the 2017 Income Tax Return? James 5 June 2019

Why Is Va Tax Refund Taking So Long

How long will it take to get your refund? As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund.

Also Check: Where’s My Tax Refund Ga

Qualifying To Free File

Tip: If you’re active duty military, you can use the TurboTax Free File Program if you have a family income of up to $66,000 for the year.

Filing Your Taxes Day 2

Next up on this Turbo Tax step by step is day 2. After youve gathered up all the information youll need, its time to begin filing your taxes.Log on to your TurboTax account to get started. Below Im going to go through how to file for beginners, and then do a second tutorial for people who are self-employed.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Stop Late Filing And Payment Penalties And Interest

Filing a tax return on time is key to avoid penalties, even if you can’t pay the balance you owe. If you don’t pay your balance, you may have to pay an additional 5% of the unpaid tax you were required to report for each month your tax return is late, up to five months. Minimum penalty limits also apply.

The IRS assesses another penalty for a failure to pay your taxes owed. If you do file on time, but you can’t pay what you owe in full by the due date, you’ll be fined an additional 0.5% of the amount of the tax not paid on time for each month or part of a month you are late. These fees will accrue until your balance is paid in full or the penalty reaches 25%, whichever comes first.

The IRS also charges interest on overdue taxes. Unlike penalties, interest does not stop accruing after a particular period goes by.

You Call That Free What Turbotax And The Free File Alliance Cost One Millennial

This is a story about taxes. Not just any taxes, my taxes. More precisely, this is a story about why, despite technically qualifying for free filing, it cost me $118.64 to file my 2014 tax return with Intuit s TurboTax in 2015. It is also a story of how the same thing could easily happen to you.

A few basics should tell you Im a fairly standard Millennial taxpayer. Im not married and I have no children. I do have student loans. My living comes from one job at a company that counts me as an employee and thus reports my wages to the Internal Revenue Service on a W-2 and provides me with access to health insurance. I have no investments outside of my 401 and my apartment is a rental.

But the most important thing to know for this story is that my 2014 income was less than $60,000.

That detail and my plain vanilla finances seemed, as far as I understood things, to easily qualify me to e-file my federal return for free. This was because of something called The Free File Alliance, which is comprised of 13 tax software companies. The companies, Intuit included, launched a nonprofit in 2003 under threat of free tax preparation by the IRS. They agreed to provide free filing for low- and moderate-income taxpayers, but maintained the right to each set eligibility criteria around an income threshold.

WATCH: How to choose what preparer to use this tax season

Read Also: Michigan.gov/collectionseservice