How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

Is It Safe And Secure

Tax Prep companies are valuable targets for hackers seeking personal information. H& R Block uses encryption, multi-factor authentication, and web-browsing encryption to keep users financial information safe. However, the company is not perfect. In 2019, the company suffered a data breach in which some customer information was leaked.

When Should I Pay Extra To Get Live Assistance From Online Tax Software

The beauty of well-designed tax software is that most filers wont need to pay extra for expert help. All of the answers you need should only be a few clicks away, and if you need technical assistance , support should be easily accessible.

If you find yourself constantly wanting to speak with a human tax expert or if you know your tax situation is complicated, you may be better off selecting tax software with tax expert support or simply hiring a CPA, or certified public accountant, on your own.

Also Check: What Does Payroll Tax Mean

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up missing out on a tax refund because you can no longer claim the lucrative tax credits or any excess withholding from your paycheck.

Premium: Best For Investors Landlords Or Those Who Sold Cryptocurrency In 2021

The Premium plan costs $50 for your federal return plus $37 for each state return.

The third tier of H& R Block tax plan options adds several layers of tax services for those with more complicated tax situations. If you earned money from a rental property or have capital gains from the sale of stock, a house or other investments, you’ll need to pay for the H& R Block Premium plan.

Likewise, if you gained or lost money from the sale of cryptocurrency, you’ll need to use the Premium plan.

The cost for virtual professional help, including screen-sharing via Online Assist, goes up to $60 for the Premium plan. The Worry-Free Audit Support and Tax Identity Shield services are still available for $20 a piece.

Recommended Reading: How To File Delaware Franchise Tax

H& r Block Review 2022

H& R Block Free Online – Federal

H& R Block Free Online – State

- Extensive digital and in-person support

- Useful features like easy import, refund reveal, free storage

Cons

- More expensive than some competitors

- Upgrade necessary to get extensive help for forms

H& R Block has been making a name for itself as a consumer tax services provider since 1955. Based in Kansas City, it has more than 12,000 company-owned and retail tax offices worldwide. This includes U.S. territories, all 50 states and 100 military bases. The accessibility of H& R Block with an office located within five miles of most Americans makes it a convenient, reputable tax planning service.

Not only does H& R block have numerous brick-and-mortar stores, it also offers digital options. Using these do-it-yourself services, H& R Block has helped prepare millions of tax returns in the U.S. The service also offers extensive support options. The Tax Institute, H& R Blocks center of tax expertise, employs tax attorneys, certified public accountants , former IRS agents and others to give expert advice to H& R Block clients. You have access to thousands of tax professionals, making it a good resource for both tax professionals and clients. All tax professionals complete a certification program to earn their tax advisor status.

With a range of plans and dedication to support and guidance, H& R Block helps you navigate through tax season with ease and efficiency.

Who This Is For

The best way to file your tax return is electronically, and you should do it as soon as possible. It will get you your refund quickly, and it can help thwart identity theft. For the 2022 tax year, you should do this especially if youre missing any stimulus payments this also applies to households that dont normally have to file federal taxes. Need further convincing you should file electronically? The IRS still has a backlog of over 10 million mailed-in paper tax returns from the previous year, coupled with the nightmare of the pandemic.

Online tax software can simplify the chore of doing your taxes on your own and filing electronically, and its less expensive than hiring a pro. A few companies offer desktop tax software, but these packages tend to be more expensive and worth the investment only if you must work offline or have several returns to file . You would also need to buy the desktop software again each year to keep up with tax changes.

The online tax apps we recommend here are best for people with simple returns , as well as those who might benefit from itemizing common deductions such as home ownership, dependent care expenses, tuition or student loans, large charitable deductions, a health savings account, or medical expenses. Most people take the standard deduction, but if itemizing makes more sense, the software helps you fill in the appropriate forms and informs you when you need to upgrade in order to file for those deductions or credits.

Don’t Miss: When To File Quarterly Taxes

Where Does H& r Block Business Save Files

Usually, when an H& R Block data file is saved, it is located in a computer’s Documents folder. Inside the Documents folder, there is typically a subfolder titled HR Block. If the file is not there, perform a search on your computer for a folder with that name or a file with the .tXX extension.

On a Mac computer, this can be done by opening Finder and searching for .tXX*, swapping out XX with the last two digits of the year of the return. On a Windows computer, open Explorer and use the same search method as on a Mac.

If the file you are trying to access on your computer does not open, it is likely because the file is damaged or corrupted. This can happen for a variety of reasons. Your registry entries may be invalid, the necessary software may be outdated, or an issue occurred when you tried to remove the software from your computer. Along with repairing the registry, you can use the System Restore tool to fix the problem.

Why Do I Owe Taxes

If youre like many taxpayers, getting ready to file starts with a quick check with a tax calculator. You plug in your numbers and eagerly anticipate that final number. But when that last screen doesnt show a refund, you have to ask, why do I owe taxes? We get it. When you see you owe taxes, it can be somewhat of a shockespecially if you were planning on a nice refund. Well answer, why do I owe so much in taxes?. Then, well help outline what your next steps should be.

Don’t Miss: How To Find Tax Lien Properties

H& r Block File Extension

H& R Block files use the extension format “.tXX,” where XX is the last two digits of the year of the tax return. For example, a tax return for the year 2018 has a “.t18” extension. These files can be opened using H& R Block online or H& R Block software for Mac or Windows and can usually be printed directly.

How Much Does H& R Block Cost

Tax prep companies frequently offer discounts on products. The prices listed in this article do not include any discounts. Check the site »

The cost of filing with H& R Block is less than TurboTax, but more than TaxSlayer, TaxAct, or Credit Karma.

H& R Block offers four main ways to prepare and file taxes: do-it-yourself online packages, the option to add Online Assist , full service from a tax preparer, and downloadable computer software.

Each of these categories offers different price points, which are determined by which tax forms you need. With all versions except the computer software, you can prepare your return for free you only pay when its time to file.

|

$54.95 $89.95, plus $19.95 to e-file |

Prices do not include any discounts.

You May Like: How Much Money Can Be Gifted Tax Free

How Does H& R Block Work

H& R Block may be most recognized for its offices scattered throughout the US, but the company offers online filing and downloadable computer software, too. If you choose an online package, you can work on your taxes with the mobile app for Android and iOS devices.

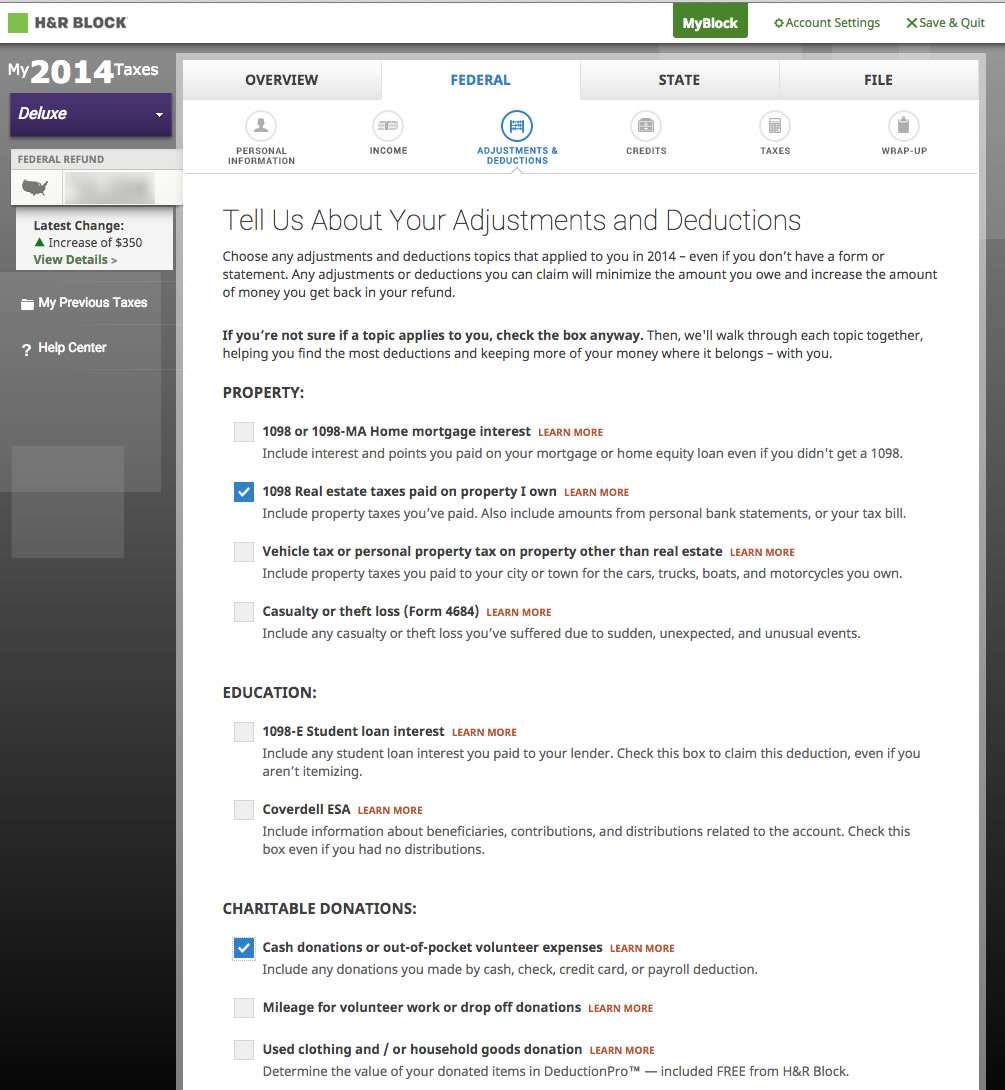

H& R Block caters to the vast majority of tax filers with a modern and easy-to-navigate interface. Like other tax-preparation services, the platform walks users through a series of questions about their household, income, and opportunities for deductions and .

In addition to answering these questions, youll need to add information from your employer, other income sources, and 1099, 1098, W-2, and other tax forms that may show up in your mailbox or inbox.

If youre concerned about making mistakes, missing deductions, or getting lost amidst the tax forms, H& R Block can connect you with a professional in its network for an additional fee.

You May Like: What Is The Tax Percentage Taken Out Of My Paycheck

Your Return Is Guaranteed

With the 100% Accuracy Guarantee, H& R Block promises that your return will be error-free. If there does happen to be a mistake in the softwares calculations that results in penalties from CRA or RQ, then H& R Block will reimburse you.

Additionally, the Maximum Refund Guarantee will ensure that if another software gives you a bigger refund, H& R Block will refund the price you paid for the competitions software.

Also Check: What Items Do You Need To File Taxes

Is H& r Block Online Assist Worth The Cost

Online Assist is an extra service that can be added on to any of the H& R Block tax preparation plans. It costs $40 for Free and Deluxe plans, and adds $60 to the price of Premium and Self-Employed Plans.

The service provides virtual tax assistance from a professional online. It lets you share your screen so the pro can see exactly what’s going on in order to solve your problem.

Most taxpayers with common tax situations won’t need online assistance. However, whether or not Online Assist is right for you depends on your comfort level with doing your taxes alone and the nature of your own specific tax situation.

You can always add Online Assist at any time during the tax filing process. If you run into questions you can’t answer yourself when running the H& R Block software, you might consider adding Online Assist to your plan.

About H& r Block Tax Service

Founded in 1955, H& R Block has grown to become one of the largest retail tax firms in the U.S. and has completed more than 800 million tax returns in its existence. The company employs more than 60,000 tax professionals who must take at least 60 hours of training and pass a rigorous certification program. The typical H& R Block tax pro has about 10 years of experience and can help customers either online or at one of the companys retail locations in all 50 states and U.S. territories, and on U.S. military bases around the world. For no-contact help, you can drop off your tax information at one of its offices without making an appointment.

Taxpayers can also prepare returns by logging in online or downloading tax-prep software. Each of the four online-filing programs walk you through a simple interview-style interface, where you answer questions about your tax situation. The program enters your information on the appropriate tax forms accordingly.

Don’t Miss: How To Amend Tax Return Online

Upload Tax Documents To Speed Up The Process

H& R Block is one of the easiest online filing software packages. It allows users to upload tons of forms including 1099-NEC, 1099-MISC, 1099-INT, W-2 forms, and much more. If the form is standard, you can upload it in H& R Block. Users can even snap pictures of their forms and upload them using H& R Blocks app. When they are ready to file, the software will glean what it can from the photos and automatically fill in the details.

H& R Block File Extension

H& R Block files use the extension format .tXX, where XX is the last two digits of the year of the tax return. For example, a tax return for the year 2018 has a .t18 extension. These files can be opened using H& R Block online or H& R Block software for Mac or Windows and can usually be printed directly.

Read Also: When Are Virginia Taxes Due

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

H& r Block Vs Turbotax: User

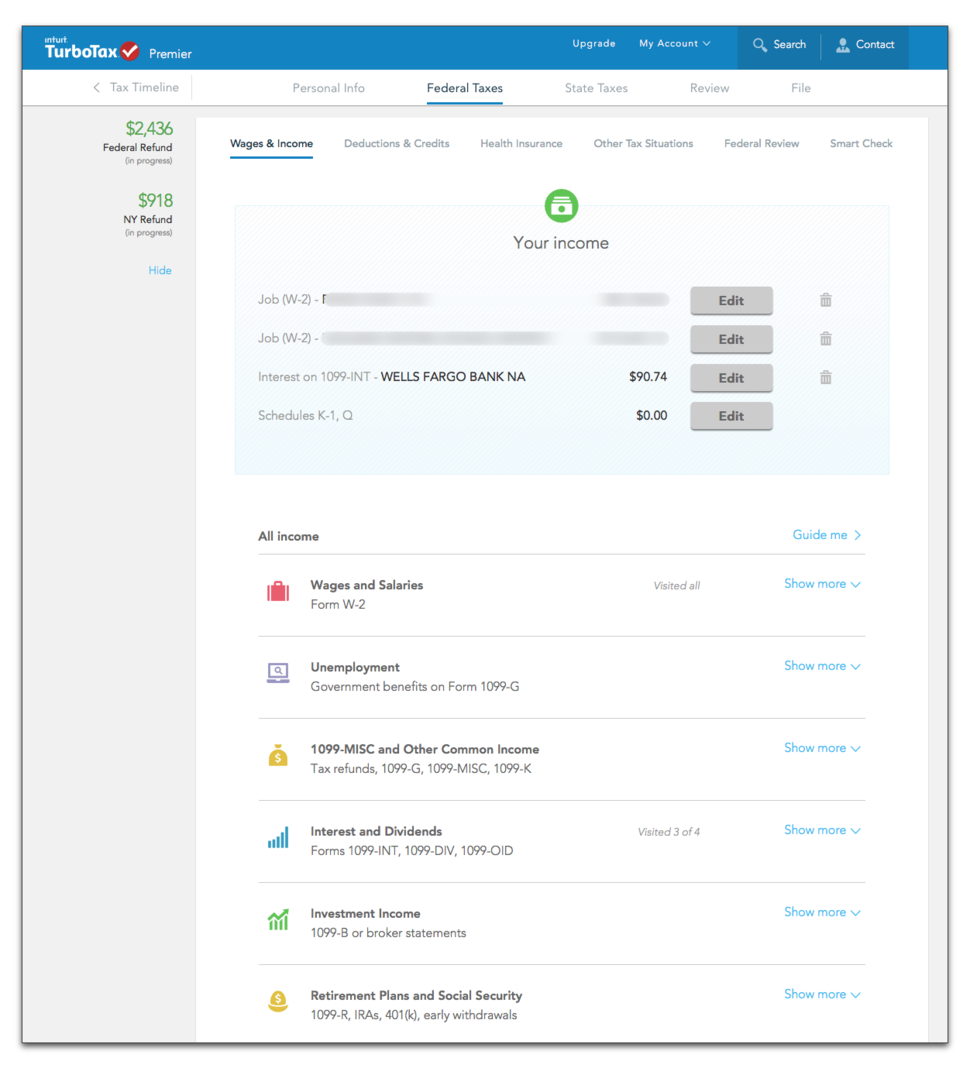

Both of these services are known for their ease of use but TurboTax is generally the more user-friendly of the two whether youre talking about mobile or desktop.

TurboTaxs interview-style approach will guide you through the filing process with simple and straightforward questions. There is minimal tax jargon. H& R Block is also user-friendly but its questions and explanations are not always as clear as you would hope.

The filing process with TurboTax also includes encouraging phrases throughout. This isnt a necessary feature, but taxes are stressful for many people. Seeing, You can do this, throughout the process may help to reduce some anxiety.

Another important consideration is how easy it is to upload documents. Both services do well on this front. H& R Block and TurboTax both let you upload your W-2 by taking a picture of it. Both services allow you to import your previous returns no matter which tax service you used . They also make it easy to fill out your state return after going through your federal return. Your information quickly transfers so you dont waste time retyping everything.

Also Check: Are Property Taxes Paid In Advance

Read Also: How Can I Make Payments For My Taxes

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Lots Of Filing Options

There’s no shortage of options when it comes to filing taxes with H& R Block.

Whether you want to work with a tax pro in person or go the DIY route, H& R Block has several options for you:

- File in person: Meet with a tax expert one on one at your local H& R Block office. There are more than 10,000 offices across the U.S.

- File online: Upload your documents to H& R Blocks browser-based platform. There are four main filing options.

- Get unlimited tax help: For a fee, H& R Blocks Online Assist gives you unlimited access to a professional who offers tax advice. You can chat by phone, video, or the MyBlock app.

- File using tax software: You can also to your computer and prepare your forms this way.

While other providers offer downloadable software, professional tax advice, and online filing options, H& R Block is one of the only providers to offer in-person support.

Also Check: Can I File My Taxes Over The Phone

Diy Tax Options For Expats

Last tax season, H& R Block debuted a package designed specifically for US citizens living abroad.

A federal return covering simple employment income costs $99, and a federal return covering investment and self-employment income runs $149. State returns are an additional $99 each. Reporting of non-US bank and financial accounts is an extra $49.

Theres also an option to file with a tax advisor, starting at $199 per federal return.

Recommended Reading: What If I File Taxes Late

H& r Block Will Also Work Out Which Deductions You’re Entitled To

As always, the more information you can provide the easier everything will be. Bring in receipts, bank statements and income information you can find at home or work – the more, the better. If you can’t find receipts for some deductions don’t worry. If you’re claiming deductions which total less than $300, you don’t need receipts to claim.

Read Also: When Are Louisiana State Taxes Due