Do I Need To File Using The Same Filing Status As My Federal Return

Generally, you should use the same filing status as what is listed on your federal return. However, there are a few exceptions:

- If you file a joint federal return and you are an injured spouse , you should file separate Illinois returns using the married filing separately filing status.

- If you file a joint federal return and one spouse is a full-year Illinois resident while the other is a part-year resident or a nonresident , you may choose to file married filing separately.

If you are in a civil union, you must file your Illinois return using the same filing status as on your federal return.

For more information, see:

You May Like: When Do I Pay Taxes On Stocks

Should I Always Use The Ftc Or Should I Claim The Foreign Earned Income Exclusion

If you live and work abroad in a country where the foreign tax rate is higher than the US federal tax rate, then you are usually better off by claiming the FTC. Claiming the FTC is a much more simple process than claiming the FEIE, and it also opens you up to other tax breaks in the US like the child tax credit.

Generally, if you live in a country where the foreign tax rate is lower than the US federal tax rate, then you are usually better off by claiming the FEIE.

Some benefits of claiming the FTC over the FEIE include:

- If you claim the FEIE in a given year and you want to switch to FTC in a future year, you may not be able to claim the FEIE for 5 years unless you receive special persmissiom from the IRS to do so.

- If you paid more foreign taxes than US federal taxes, you can carry forward these as a credit to future years.

- If you claim the FEIE, you cannot claim the Additional Child Tax Credit . If you claim the FTC, you are allowed to take this credit.

File Your Virginia Return For Free

Made $73,000 or less in 2021? Use Free File

If you made $73,000 or less in 2021, you qualify to file both your federal and state return through free, easy to use tax preparation software.

Are you a member of the military? Try MilTax

MilTax is an approved tax preparation software that provides free tax services for members of the military.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

You May Like: Can I Still Do My Taxes

Register For A New Unemployment Insurance Account Number

Newly-created businesses must register with IDES within 30 days of start-up. .

a. Report to Determine Liability Under the Illinois Unemployment Insurance Act using the UI-1 form

b. Report to Determine Liability for Domestic Employment If you or your organization paid a domestic worker or combination of domestic workers cash wages totaling at least $1,000 in a calendar quarter during the current or preceding four years, you or your organization is an employer liable under the Illinois Unemployment Insurance Act. Common types of domestic employees are: live-in companions, housekeepers, butlers, maids, chauffeurs and baby sitters. Babysitting, laundry or other services performed outside the home of the person or organization for which the services are provided do not constitute domestic service. Use the UI-1 DOM form.

Your Illinois Sales Tax Filing Requirements

You have two choices for filing taxes in Illinois. You can file online at https://mytax.illinois.gov/_/, or by mail using form ST-1. Form ST-1 can downloaded and printed at http://www.revenue.state.il.us/TaxForms/Sales/ST-1.htm.If you have $0 in sales, but you maintain a business license, you are still required to file a zero sales tax return, despite the fact that you have no sales.In order to determine your tax obligation, total sales and total tax collected must first be determined. A series of calculations can then be applied to these numbers based on the type of tax obligation they require. Formulas and instructions are found on the Form ST-1 Instructions page located at http://tax.illinois.gov/TaxForms/Sales/ST-1-Instr.pdf .Taxes for prior months receipts are due on the 20th of each month, and late fees will accrue as follows:* 2% up to 30 days late * 10% after 30 daysA 1.75% discount is rewarded to those retailers who pay their sales tax on time.

Recommended Reading: Can I Do My Taxes Myself

Read Also: How To Pay Income Tax

Your Security Is A Top Priority Now And Always

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 10/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Edition Pricing: Actual prices are determined at the time of payment, print, or e-file and are subject to change without notice. Add sales tax for applicable orders. Offers may end at any time and promotional offers may not be combined.

How Do I Get My Efile Receipt

I’ve given up. If you go to this link

Do a search for ‘receipt’. I found two hits. But nothing on the page is highlighted. Now do a search for any word on the page that you see. Type in ‘recei’ and you will see words being highlighted. So…..why when you search on ‘receipt’ you get a return saying there are two occurrences of that word, yet nothing on the page is highlighted? DID THE PROGRAMMERS HIDE THE RECEIPT FUNCTION?

It appears they have. Click on the down arrow and it will open up more for viewing. The word “receipt” does indeed appear two times. Both times it is for YOU to attach YOUR receipt if you are returning TurboTax and are not happy with it. I guess that’s why they don’t want you to be able to find your receipt. Imagine that, a TAX program, that doesn’t think it’s important to provide a receipt.

Read Also: How Much Do Corporations Pay In Taxes

Sign In To File Your Tax Return

Youll need to prove your identity using Government Gateway. Youll be able to register for Government Gateway if you have not used it before.

You can no longer use GOV.UK Verify to prove your identity.

You do not have to complete your return in one go. You can save your entry and go back to it later if you need to.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

You May Like: How Do I Get My Pin For My Taxes

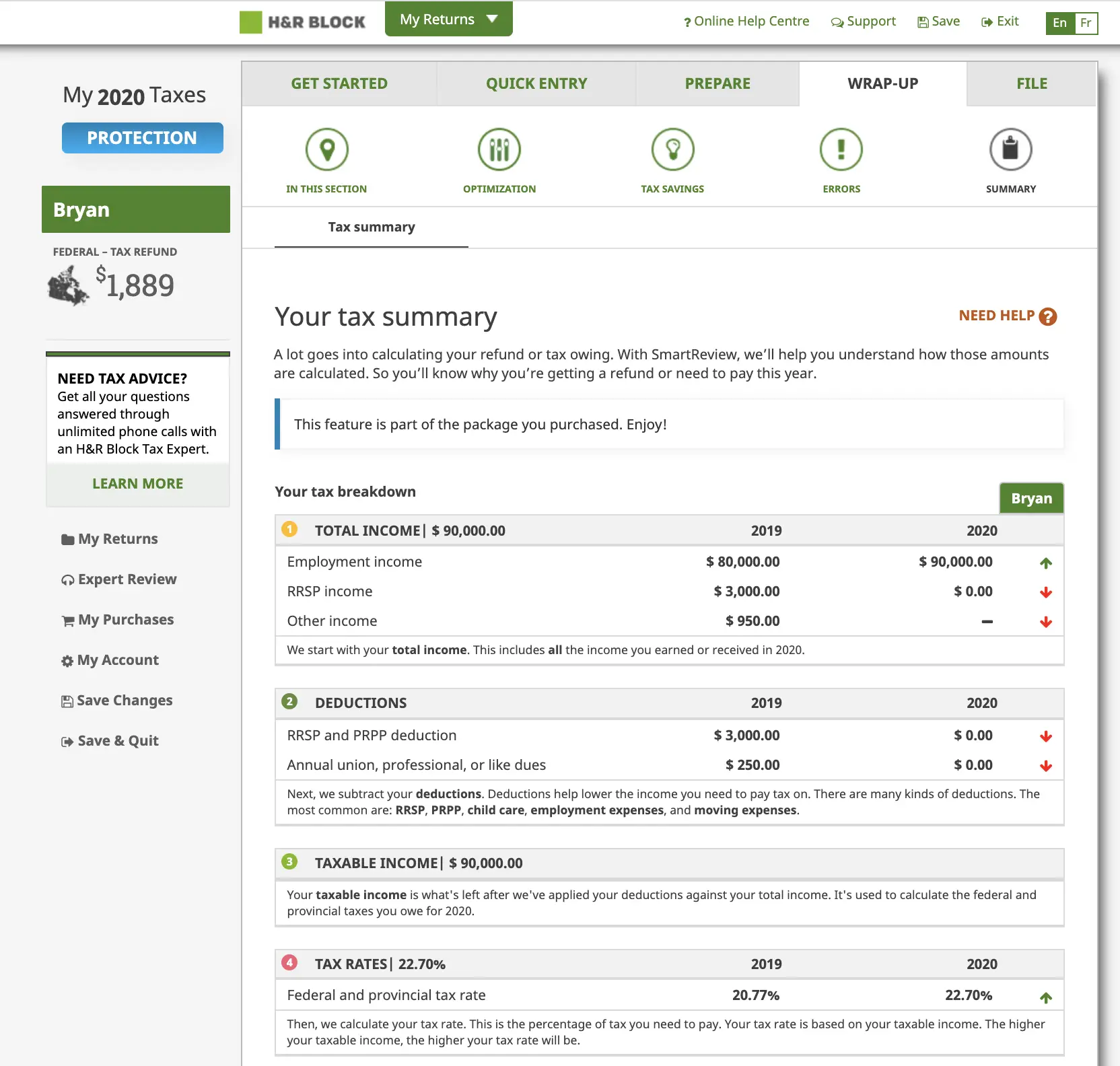

What Should I Expect When Filing Taxes Online

Filing taxes online should be a quicker process than completing your return by hand. If you have a simple tax situation, you shouldnt expect to spend a long time preparing your tax return.

For example, if you only have W-2 income and claim the standard deduction, your tax return shouldnt take long to prepare, review, and e-file.

On the other hand, if you have a more complex tax situation, you may still need to enter a good amount of data manually, especially if you are itemizing your deductions or claiming certain tax credits.

For example, if you have several investment and bank accounts, work for yourself, have rental property, claim tax credits, or need to account for the Alternative Minimum Tax , your tax return may take a while longer to prepare.

Tax software can assist with handling these finer details and also provide objective explanations on the impacts of taking certain tax positions. Should you need help, several tax software packages offer to connect you with a qualified tax professional to answer questions, guide you through preparing your return, and check for any missed deductions or credits you might qualify for.

How Do You Claim The Ftc

To claim the FTC, you need to file Form 1116 and attach this to your filed expat tax return.

Form 1116 can be complicated to an expat that is starting from scratch so we built Expatfile to immediately determine and fill out Form 1116 for you! Answer a few questions and Expatfiles expat tax software does the rest.

Read Also: What Is Federal Withholding Tax

What Tax Forms Do I Need For Online Tax Filing

Consider creating a folder for your tax return at the beginning of a tax year. Then, put any important tax information you receive in that folder until you’re ready to file your tax returns.

Most of these forms will show up after the end of a tax year in January or early February. However, some forms may show up even later. It’s important to wait until you receive all of the forms you’re expecting before you file your tax return or you may leave out an important item. Once you have all of your forms needed to prepare your tax return, consider working on it sooner than later as there are good reasons to file your tax return early.

Common forms to look out for include:

These forms might be mailed to you or you may be able to access them online. If you haven’t received your W-2, check with your employer, or even with the IRS. Some online tax filing software can import your W-2 electronically and even notify you when your W-2 is available.

Check your tax information from last year to see if you received the same forms this year. If you’re missing something, check to see if you no longer need that information. For instance, you won’t receive a Form 1099-INT if you closed your bank account that issued it last year.

How Long Does It Take To File Taxes Online

On average, the IRS estimates it takes individuals 13 hours to complete their tax returns each year. Of course, the time it takes to file your taxes depends on your unique tax situation, preparedness and familiarity with your information.

More complex situations can entail additional forms and questions youll need to answer on your tax return, such as if you:

- place trades in taxable investment accounts,

- become subject to the alternative minimum tax

Each additional situation can add more time to prepare and file your taxes online.

Just the same, simple tax situations often take less time to prepare taxes and file online. For example, if you only have W-2 income from your employer and claim the standard deduction, your tax return wont take as long to prepare. It can take as little as several minutes to complete with the right forms and information readily accessible to you and your tax software.

When you use tax software, it asks you all the questions necessary to capture your full tax situation, perform the required calculations, and enter the correct information on the relevant tax forms.

Filing online can also reduce the likelihood of arithmetic errors, lowering the chance of needing to file an amended return if theres an error on your return.

Also Check: How To Live Without Paying Property Taxes

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Don’t Miss: How To Calculate Withholding Tax

Some Private Sector Firms Have Offered Free E

IRS Free File program is a multi-year agreement between IRS and the Free File Alliance to provide free service to more taxpayers. To be true IRS Free File, the services must be accessed through IRS.gov.

With IRS Free File, taxpayers have easy access to IRS.gov/freefile, which offers a list of the participating free offerings on a single web page. Under our agreement, Free File Alliance companies offer both free preparation and free e-filing services. There is no cost for a federal tax return to qualifying taxpayers.

Note: The IRS does not endorse any individual Free File Alliance company. While the IRS manages the content of the IRS Free File pages accessible on IRS.gov/freefile, the IRS does not retain any taxpayer information entered on the Free File site.

Free Federal And State Tax Filing Sources

There are many free filing options available, even for taxpayers with higher incomes. Choose any of these for more information:

- TAP Taxpayer Access Point at tap.utah.gov: The Utah State Tax Commissions free online filing and payment system.

- Earn it. Keep it. Save it at utahtaxhelp.org: Provides free tax help.

- My Free Taxes at myfreetaxes.com: Sponsored by H& R Block and The United Way.

- The FreeFile Alliance at freefilealliance.org: Partnered with the IRS to help taxpayers e-file.

- : A service of the IRS.

You May Like: How To Become Tax Exempt

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Business Return Electronic Filing Information

Business Electronic Filing Mandate If an income tax return preparer prepares 25 or more acceptable, original corporate/partnership income tax returns using tax preparation software in a calendar year, then for that calendar year and for each subsequent calendar year thereafter, all acceptable corporate/partnership income tax returns prepared by that income tax preparer must be filed using electronic technology.

Complete the changes online at the MyTax Illinois website or the Notice of Change form UI-50 for:

- Phone Number Change/Name Change/Address Change/Miscellaneous Changes

- Business Name change without change in legal entity

- Reorganization, Sale or Other Organizational Change

- Request to Close UI Account

Complete the forms below for Wage/Name/Social Security Corrections

Report Entity Changes

Did you acquire your Illinois business or any portion of it by purchase, reorganization or a change in entity, for example, a change from sole proprietor to corporation? If yes, report the changes online at the MyTax Illinois website or complete the forms below:

Power of Attorney, Third Party Agent Grant Power of Attorney to a Third Party Agent and Register as a Third Party Agent for Multi-account Filers

Recommended Reading: How Can I Find My Previous Tax Returns

What If I Cant Pay My Taxes

Don’t panic you may qualify for a self-service, online payment plan that allows you to pay off an outstanding balance over time. Once your online application is complete, you’ll receive immediate notification of whether your payment plan has been approved without having to call or write to the IRS. Online payment plans are processed more quickly than requests submitted with electronically filed tax returns, even if the new tax is not yet assessed.

How To File Taxes Online

OVERVIEW

Filing your taxes online can seem daunting, but with a little organization and preparation, you can file on time and with accuracy.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Filing taxes online provides an easier, safer, and quicker way to complete your return. Not only does tax software stop most mistakes, it allows you to import previous tax information to speed up tax return preparation for the current year. 90% of American taxpayers choose to e-file their returns each year. Mailed in paper tax returns can take up to six weeks or more to process. |

You May Like: Where Can I Do My Taxes For Free