Extension Filers: File Your Tax Return By October 15

Your extension of time to file is not an extension of time to pay your taxes. Pay the tax you owe as soon as possible to avoid future penalties and interest.

If you didn’t get a first and second Economic Impact Payment or got less than the full amounts, use Free File to claim the 2020 Recovery Rebate Credit.

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via Irs.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

How To Use A W

If your objective is to engineer your paycheck withholdings so that you end up with a $0 tax bill when you file your annual return, then the accuracy of your W-4 is crucial.

Make sure:

-

You indicate the correct tax-filing status. If you file as head of household and haven’t updated your W-4 for a few years, for example, you may want to consider filling out the 2021 W-4 if you want the amount of taxes withheld from your pay to more accurately align with your tax liability.

-

Your W-4 reflects you current family situation. If you had a baby or had a teenager turn 18 this year, your tax situation is changing and you may want to update your W-4.

-

You accurately estimate your other sources of income. Capital gains, interest on investments, rental properties and freelancing are just some of the many other sources of non-job income that might be taxable and worth updating on line 4 of your W-4.

-

You accurately estimate your deductions. The W-4 assumes you’re taking the standard deduction when you file your tax return. If you plan to itemize , you’ll want to estimate those extra deductions and change what’s on line 4. Need more help? There are worksheets in the Form W-4 instructions to help you estimate certain tax deductions you might have coming. The IRS W-4 calculator or NerdWallet’s tax estimator can also help.

-

You take advantage of the line for extra withholding. If you want to have a specific number of extra dollars withheld from each check for taxes, you can put that on line 4.

Charity Donations On Tax Returns

Donations by individuals to charity or to community amateur sports clubs attract tax relief, so make sure you include all charitable donations in your return.

The tax relief goes to you or to the charity depending on whether you donate through Gift Aid straight from your wages or pension through a Payroll Giving scheme give land, property or shares or donate in your will.

There are different rules for limited companies as they pay less corporation tax when they give to charity.

To qualify for tax relief, you must keep a record of your donations.

You May Like: Www.myillinoistax

How To File A Self Assessment Tax Return Online: A Step

Tim is an award-winning freelance financial journalist with 20 years’ experience. He has written regularly for a wide range of publications. He has also written for many organisations from large blue chips to small sole traders.

Thinking about how to file a tax return online so you can make the Self Assessment deadline of 31 January? Youre not alone.

According to Google Trends, searches for tax return start increasing towards the end of December, while HMRC revealed 12,057 returns were submitted on Christmas Day and Boxing Day in 2019.

However, while 11.1 million people filed by 31 January in 2020 , more than 958,000 missed the deadline, incurring a fine. Meanwhile, just over 702,000 filed their returns on deadline day.

Filing a tax return online can seem daunting but good preparation can take the pain out of this task and help you complete it ahead of the deadline.

This article discusses whether you need to file a tax return and how to do it. It will also provide you with details about dates, penalties and allowable expenses, and look at why many businesses use an accountant.

That last part is important because this article doesnt replace legal or professional advice. If youre in any doubt, contact HMRC or a professional.

This guide to filing a Self Assessment tax return covers the following topics:

Look Through Possible Taxes And Credits

Once youve made necessary adjustments and found your AGI, there are some other taxes and credits to consider. First of all, you need to enter on Line 9 either your standard deduction or the amount of your itemized deductions. If you have a qualified business income deduction, you will enter that on Line 10.

Lines 11 through 14 allow you to enter the amounts of certain credits if you qualify for them. For instance, you can enter the amount of your child tax credit on Line 13a.

If you already had some federal tax withheld from your income, you can enter that amount on Line 17. You will also need to attach Schedule 4 if you have paid other taxes.

Don’t Miss: Notice Of Tax Return Change Revised Balance

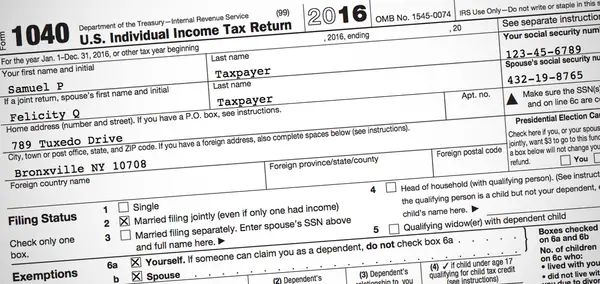

What Is The Purpose Of A 1040 Tax Form

Form 1040 is the standard federal income tax form people use to report income to the IRS, claim tax deductions and credits, and calculate their tax refund or tax bill for the year. The formal name of the form 1040 is “U.S. Individual Income Tax Return.”

There used to be three varieties that covered simple to complex tax situations. Now theres just form 1040 and 1040-SR.

Page 1 of form 1040

Here’s what the 1040 form does:

-

Asks who you are: The top of form 1040 gathers basic information about who you are, what tax filing status you’re going to use, and how many tax dependents you have.

-

Calculates taxable income: Next, form 1040 gets busy tallying all of your income for the year and all the deductions you’d like to claim. The objective is to calculate your taxable income, which is the amount of your income that’s subject to income tax. You consult the federal tax brackets to do that math.

-

Calculates your tax liability: Near the bottom of form 1040, you’ll write down how much income tax you’re responsible for. At that point, you get to subtract any tax credits that you might qualify for, as well as any taxes you’ve already paid via withholding taxes on your paychecks during the year.

-

Determines whether you’ve already paid some or all of your tax bill: Form 1040 also helps you calculate whether those tax credits and withholding taxes cover the bill. If they don’t, you may need to pay the rest when you file your form 1040. If you’ve paid too much, you’ll get a tax refund.

More Info For Explore Filing Options For Massachusetts Personal Income Tax Returns

Payment Agreements

If you cant make your tax payment in full, pay as much as you can with your tax return. After you are billed for the balance, you can set up a payment plan online through MassTaxConnect or by calling 887-6367.

To set up a payment plan with MassTaxConnect, you need to:

If you owe $5001 or greater, a payment agreement cannot be set up with MassTaxConnect. You would need to set up a payment agreement by calling Collections at 887-6400.

You May Like: Www Michigan Gov Collectionseservice

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

How Often Do I Need To Fill Out A Sales & Use Tax Return

When you sign up for your State Sales Tax ID, youll be asked a series of questions about your business. Then the Tax Department will decide when you have to complete and submit the tax return and the send them the Sales Tax youve collected, it could be:

- monthly

- semi-annually

- yearly

Youre always given roughly a month to complete the Sales Tax return , so if you have to file:

- Monthly the form is due the following month

- Quarterly the form is due in April, July, October, and January

- Semi-Annually the form is due in July and January

- Yearly the form is due in January

Read Also: How Much Does H & R Block Charge For Taxes

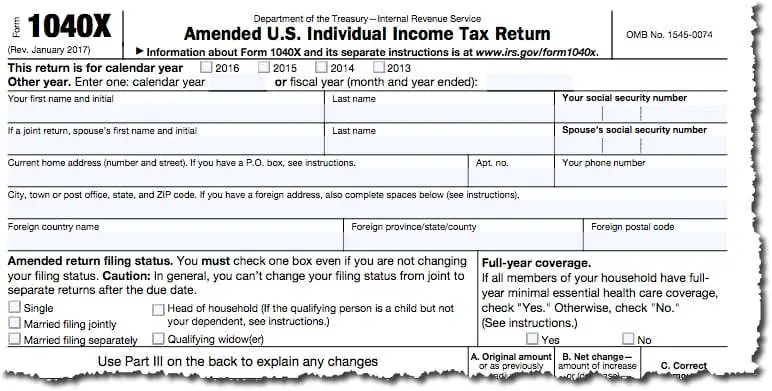

Paper Returns Have Vulnerabilities Too

Its also important to consider how safe it is to submit your tax return by mail. Paper returns can be lost or stolen. Theyre also more susceptible to error. Unfortunately, your private information is vulnerable no matter how you submit your return.

Certain forms cant be e-filed no matter how you complete them. However, most people wont need to file these forms. The most common circumstance when you might have to submit a paper return is if you need to file an amended return.

Besides the possible security riskswhich may be outweighed by features such as convenience and receiving your refund fasterare there any other cons of filing your tax forms electronically?

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Also Check: How Much Does H& r Block Charge To Do Taxes

File Your Self Assessment Tax Return Online

You can file your Self Assessment tax return online if you:

- are self-employed

- are not self-employed but you still send a tax return, for example because you receive income from renting out a property

This service is also available in Welsh .

You can also use the online service to:

- view returns youve made before

- check your details

You must register for Self Assessment before using this service if:

- youre filing for the first time

- youve sent a tax return in the past but did not send one last tax year

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

You May Like: How Can I Make Payments For My Taxes

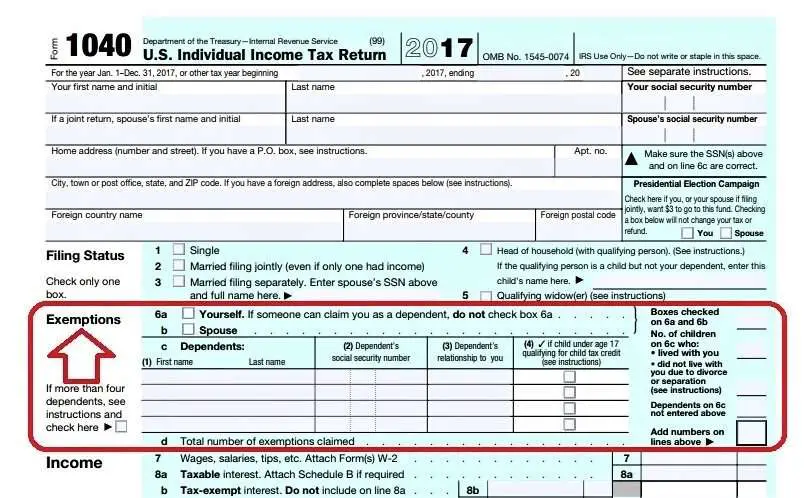

Schedule C: Profit Or Loss From Business

As an unincorporated engineering consultant, Samuel must file Schedule C for a sole proprietorship.

He had gross income of $131,250 , and expenses of $39,689 and deducted $4,398 for driving his car 8,145 miles for business. For 2016, business mileage is deductible at 54 cents a mile. The largest expense, detailed in Part II, was $12,000 for office rent . Having bought office furniture and equipment in recent years, Samuel did not purchase anything last year that qualifies for an immediate write-off known as a Section 179 deduction, as opposed to depreciating the equipment over several years .

Returns containing Schedule C have above-average audit rates, and filers who are audited must substantiate deductions, so detailed records are important. Samuel reported net earnings of $91,561 .

Even For Online Filing Gather Your Paper

The Internal Revenue Service encourages taxpayers to file electronically. However, people who prepare their own returns may mail in paper forms. Either way, the preparation is the same.

First, gather papers related to income and deductions, including the official forms: W-2, 1099, 1098, K-1 and others sent by employers, banks, brokerage firms and anyone else who paid you. Payers must also send copies to the I.R.S. The agencys computers compare returns with what the payers report. If you are missing a W-2 or a 1099 go to the source for a new copy.

Read Also: How To Buy Tax Lien Properties In California

Filling Out A Tax Return For The First Time

Filing your taxes for the first time involves getting a lot of rules just right, and they’re points that you might not be familiar with. It takes patience and attention to detail, but it really isn’t all that difficult when you have a basic understanding of the process, including what you’ll need to get started and what all the terms mean.

You Received Income Earned From French Sources Before Arriving In France

Individuals receiving French earnings prior to their move to France must declare this income using form no. 2042-NR.

Income from French and foreign sources received following an individuals arrival in France must be declared using form no. 2042.

You must send completed income tax returns to the Non-Resident Personal Income Tax Office

Find the relevant tax office of your place of residence

The Tax4Business help desk service, run by the French governments Public Finances Directorate , is a single contact point for all tax queries involving foreign nationals.

The help desk can be contacted by email at the following address:

You May Like: How To Correct State Tax Return

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Why Business Owners May Use An Accountant And How Much They Cost

The main reason for doing your own tax return is to save money on accountancy bills. However, many business owners are too busy to do it themselves or lack a detailed understanding of the different allowances that they can claim and find that using an accountant pays for itself quickly.

Chas Roy-Chowdhury, head of taxation at the Association of Chartered Certified Accountants , says: Business people can come unstuck if they cut corners to save money. Consulting an accountant should save money in tax savings, and in avoiding mistakes and penalties.

Also tax rules change regularly so using an accountant is a good way to ensure you are up to date. Plus professionally qualified accountants have codes of conduct and ethics, continuing professional development requirements and you will also have recourse if something goes wrong.

Roy-Chowdhury recommends shopping around to ensure you are paying the right amount for an accountant. A typical fee would be between £100 and £200 an hour for a small to medium-sized practice.

Charges can also depend on where the business is situated and the complexity of the work. A smaller accountant might charge around £250 to £300 all-in for a straightforward tax return.

Sole traders and other self-employed people might be able to claim the costs for their accountant as an expense and, appropriately, the accountant themselves will know if this is allowable.

The ICAEW and ACCA websites allow you to search for members in your area.

Recommended Reading: How Does H& r Block Charge

How Irs Form 1040

Here are some quick facts about the 1040-SR:

-

It’s for people who are 65 or older.

-

You can itemize or take the standard deduction.

-

The basic differences between the 1040-SR and the regular 1040 tax form are cosmetic: the 1040-SR has a different color scheme, a larger font and an embedded standard deduction table

Here’s what IRS form 1040-SR does:

» MORE:Make sure you’re not overlooking these 5 tax breaks for retirees

How An Accountant Helped Strategist Kerry Needs Focus On Her Core Strengths

Kerry Needs, a writer and marketing strategist at kerryneeds.com, set up her business as a sole trader in 2015 and works remotely with clients around the world.

She did her own tax return in the first year but then started using an accountant from the second year.

I could do it myself but I like to focus on my craft rather than things that Im not strong at, says Needs. And as my business gets more complex, its a lot easier to outsource and one less administrative task to do.

My accountant is knowledgeable. I send my books to him and he completes my Self Assessment and submits the returns for me. He keeps on top of things, chases up information and provides me copies of everything.

The cost is reasonable at £250 and it pays for itself in saved time. Using an accountant also minimises the risk of making a mistake.

Doing her own Self Assessment in the first year also means she has a good understanding of the process. To anyone doing it themselves, she recommends doing HMRCs free training and webinars on Self Assessment.

Its important to get to know HMRC and what they require in as much detail as possible, including allowable expenses and things like how to record mileage, she says.

Make sure that you document everything, file your receipts carefully, and pay for as much as you can on your business card. You must keep copies of receipts as HMRC can ask for them.

Also Check: How Much Time To File Taxes