Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

Bills Paid By Mortgage Companies Agents Or Tenants

If your bills are to be paid by a mortgage company, agent or tenant:

- Forward your interim tax bill to the mortgage company, agent or tenant.

- Email the City at to have future bills redirected.

If paid by a mortgage company, you will receive a receipt after payment of your final bill in July. If your tax bills are not paid by the due dates, you will receive reminder notices. It is your responsibility to inform the City in writing when a mortgage company, agent or tenant will no longer be paying your tax bill.

If you have registered for payment through your mortgage, and you receive a bill, we have no record of your mortgage company on your account. Contact your bank for instructions. You should request that your bank contact us to ensure we record their interest on your account. This will ensure all future bills will be sent to them. To avoid a penalty on your account you should contact your bank immediately.

Pay Directly To The City

to pay property tax directly to The City of Calgary. See for more information.

The Tax Instalment Payment Plan is a monthly instalment plan that allows you to pay your property taxes by monthly pre-authorized debit, rather than in a single annual payment. Find out more about the Tax Instalment Payment Plan .

Reduce the risk of late payment penalties by requesting and returning your TIPP agreement early.

TIPP payment not honoured by your bank – making a replacement instalment

Making a replacement instalment, like all other tax payments, can be made through one of the other property tax payment options listed on this page. Replacing a payment before it becomes dishonoured will not stop the next monthly TIPP instalment from being withdrawn or prevent service fees. For more information on replacement instalments, see non-payment and service charges.

Making a lump sum payment to lower your monthly payment amount

Your monthly TIPP payments can be lowered by making a lump sum payment and requesting a recalculation. If you decide to make a lump sum payment, it cannot be automatically withdrawn. A lump sum payment, like all other tax payments, can be made through one of the other property tax payment options listed on this page.

Third floor, Calgary Municipal Building800 Macleod Trail S.E.

Cheque or money order

Avoid last minute lineups and late payment penalties by bringing your cheque to Corporate Cashiers today, post-dated on or before the due date.

Don’t Miss: Where’s My Tax Refund Ga

Paying At The Automatic Banking Machine

Pay through the ABM at your bank. Keep your receipt for your payment records.

Pay by Mail

Mail your cheque or money order payment and remittance stub with Home Owner Grant application completed, if eligible.

Make cheques payable to City of Surrey and include your folio number on the cheque. Post-dated cheques are accepted. Make sure the cheque is dated on or before the property tax due date.

Send in your payment a minimum of 3 days before the property tax due date. We must receive your payment by or before the July 2 due date. If your mail is lost or delayed, and does not arrive by the due date, you may receive a penalty charge.If your payment cannot be processed due to an error on a cheque, insufficient bank funds or a returned item you will be charged a late payment penalty.

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor in your area can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

You May Like: How To Buy Tax Forfeited Land

What Are Property Tax Exemptions

Here’s a breakdown of some of the most common property tax exemptions:

- Homestead

- Senior Citizens

- Veterans/Disabled Veterans

Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. These specialized exemptions are usually a reduction of up to 50% of taxable value. However, rates can vary by location.

Some states offer exemptions structured as an automatic reduction without any participation by the homeowner if your property is your primary residence. Other states and counties require applications and proof for specific exemptions such as a homeowner whos a disabled veteran.

Lets look at an example with regard to the homestead exemption, which safeguards the surviving spouse and protects the value of a home from property taxes and creditors in the event a homeowner dies.

Say your state offers a homestead exemption for a homeowners primary residence that offers a 50% reduction of the home’s taxable value.

This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000. The millage rates would apply to that reduced number, rather than the full assessed value.

Its worth spending some time researching whether you qualify for any applicable exemptions in your area. If you do, you can save thousands over the years.

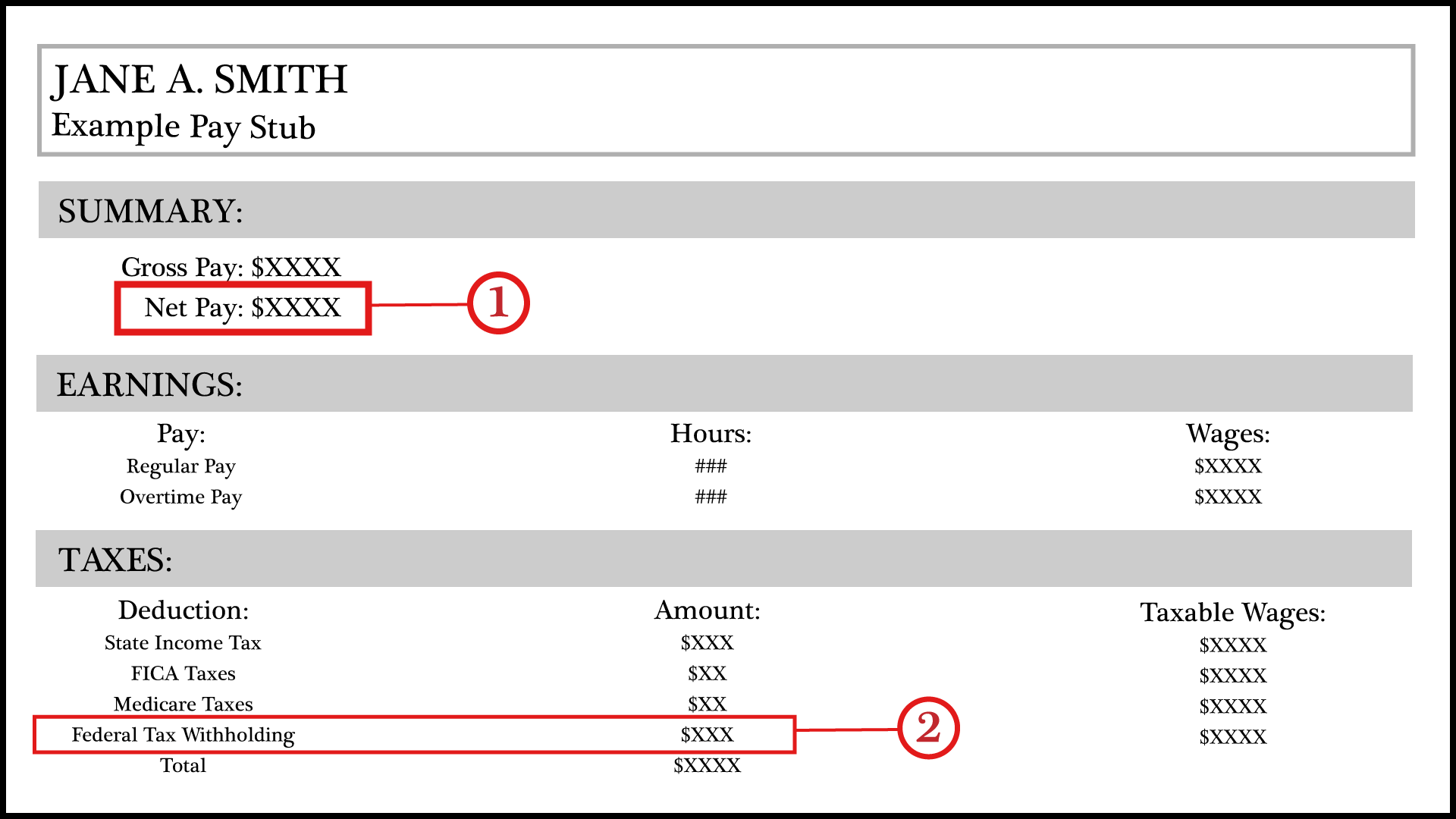

Form 1098 Tax Document

Obtain Form 1098 from your mortgage lender. This tax document lists the mortgage interest you pay during the year and also lists any real estate taxes your lender paid on your behalf through an escrow account. Your lender is authorized to pay only the actual amount of your property tax assessment through an escrow account, so in general, tax amounts shown are correct.

Examine Box 4 on Form 1098. Your lender uses this general information box to report information other than your mortgage interest to you. Any amounts shown should include a description, such as “Taxes” or “Property Tax.”

Compare Box 4 amounts with other sources. Your end-of-the-year mortgage statement may itemize taxes and other items paid through your escrow account. Compare any tax payments shown on this statement with the amount in Box 4. You may also contact your county assessor for confirmation of Box 4 amounts.

References

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S& P 500 with an average gain of +26% per year. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm.

Visit performance for information about the performance numbers displayed above.

Read Also: Where’s My Tax Refund Ga

Overview Of Property Taxes

Property taxes in America are collected by local governments and are usually based on the value of a property. The money collected is generally used to support community safety, schools, infrastructure and other public projects. Use SmartAsset’s tools to better understand the average cost of property taxes in your state and county.

| Enter Your Location |

| of Assessed Home Value |

Open Records & Archives

Records up to 5 years old, including the current tax roll, are available in the Johnson County Treasurer’s Office at 111 South Cherry Street, Suite 1500, Olathe, KS from 8 a.m. to 5 p.m. Monday through Friday, except holidays. Records older than 5 years are archived and due to age, deterioration, and off site storage, must be researched by our personnel. Three business days are required for research. If a request cannot be done in three business days a written explanation will be sent with an estimated date it can be completed. Pursuant to K.S.A. 45-219, requesters are responsible for payment of costs incurred by the County in providing access to or furnishing copies of public records. These fees are indicated on the form below.

Examples of public records maintained by the Treasurer’s Office*:

- Real Estate and Personal Property Tax Rolls

- Real Estate and Personal Property Tax Payments

- Tax Distribution Records

*If you are looking for public records including Mortgages and Deeds, please visit the Records and Tax Administration website to submit a request.

Associated Documents:

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

How To Pay Your Surrey Property Taxes Online

Pay by Pre-Authorized Pre-Payment Plan

Put money towards next year’s Annual Utilities and Property Taxes with a monthly withdrawal from your financial institution with the Pre-Authorized Pre-Payment Plan . With PAPP, you’ll start paying your taxes for 2021.

The pre-payment plan will accumulate 10 monthly withdrawals from your bank account, interest prescribed by the Province, and apply the funds towards your:

- annual utilities balance in February, due April 2 , and

- property taxes balance in May.

Be sure to get familiar with the payment withdrawal dates and details to avoid penalties. In particular, mark the July manual payment date in your calendar.

Metered utilities are not covered by PAPP. See your metered utilities payment options, or learn about the auto-debit payment plan.

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

Read Also: How Can I Make Payments For My Taxes

Which Payment Method Is Best For Me

My payment is due today:

Online, telephone or in-person payments made via your financial institution that are completed before your banks cut-off time if it is before your due date will be reflected as payments made on time. Check with your financial institution to find out the cut-off time applicable to you.

Online payments by card through Paymentus made on weekdays do not have a cut-off time until 10PM. This means payments made on a due date before 10PM via Paymentus should be reflected as payments made on time.

I want a payment receipt:

You will receive a physical receipt when paying in-person at one of our Client Service Centres and an electronic confirmation when paying online by card.

I want to pay online:

You can pay your property tax bills online by payment card.

I am house-bound:

You can pay via your financial institution online or by telebanking, online by payment card, through our PAD plan or by mail.

I have no computer:

You can pay via your financial institution in-person or by telebanking, through our PAD plan, by mail or by dropping off a chequeat one of the secure payment drop-boxes located outside the main entrance of the Kanata Client Service Centre at 580 Terry Fox Drive or the Orleans Client Service Centre at 255 Centrum Boulevard.

How Do Property Taxes Work

Let’s define a couple of key terms before we get into the details of how property taxes work. First, you must become familiar with the “assessment ratio.” The assessment ratio is the ratio of the home value as determined by an official appraisal and the value as determined by the market. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Wondering how the county assessor appraises your property? Again, this will depend on your countys practices, but its common for appraisals to occur once a year, once every five years or somewhere in between. The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

To put it all together, take your assessed value and subtract any applicable exemptions for which you’re eligible and you get the taxable value of your property.

Read Also: How Much Does H& r Block Charge To Do Taxes

Where Do Your Tax Dollars Go

Your total property tax bill provides for more than just the cost of city services. Like the city, Halton Region prepares a budget each year, with a large part of their operating expenditures funded through property taxes. The Province determines education tax rates.

The City’s portion of the overall 2021 residential tax bill is 45.4 cents of every tax dollar and the remaining 54.6 cents goes to Halton Region and the Province of Ontario for education taxes.

The city considers it very important for taxpayers to understand what city services they receive for their property tax dollars. For 2021, an urban residential property assessed at $500,000 amounts to approximately $1,770 in property taxes for city services.

Ways To Find What We Paid On Property Taxes

Related Articles

Property tax payment details are available in one of four ways: your own records, the county assessor’s office, your mortgage tax documentation or on the property tax bill. Obtaining and keeping good records of your payment will help with deductions on your tax return. Paid property taxes are deductible on your income taxes.

You May Like: Tax Lien Investing California

Avoid The Line Pay Online

Using your MyPropertyAccount you can register your property tax, utilities and dog licensing accounts for eBilling. Pay via online or phone banking with your financial institution.

Sign up for eBilling

Log in to MyPropertyAccounts and change your bill delivery method to email by May 1st of the year to get your bill online.

General Questions About Property Taxes

In order for the amount of your taxes to be determined, the County Assessor must first assess the value of your property as of January 1. Generally, the assessed value is the cash or market value at the time of purchase. This value increases not more than 2% per year until the property is sold or any new construction is completed, at which time it must be reassessed.

For more information on how the assessed value is determined, see the County Assessor’s website.

After the Assessor has determined the property value, the County Controller applies the appropriate tax rates, which include the general tax levy, voter approved special taxes, and any city or district direct assessments.

For more information on the applied tax rates, see the County Controller’s website.

The general tax levy is determined in accordance with State Law and is limited to 1% assessed value of your property. After applying tax rates, the County Controller calculates the total tax amount. Finally, the Tax Collector prepares property tax bills based on the County Controller’s calculations, distributes the bills, and then collects the taxes. Neither the County Board of Supervisors nor the Tax Collector determines the amount of taxes.

The annual tax bill identifies the following:

If your bill bears the statement”Prior Years Taxes Unpaid,” this is an indication that there are delinquent taxes from prior years, which are not included in your bill. Please call 808-7900 for more information.

You May Like: How Much Time To File Taxes