Lost Or Misplaced Your Ein

If you previously applied for and received an Employer Identification Number for your business, but have since misplaced it, try any or all of the following actions to locate the number:

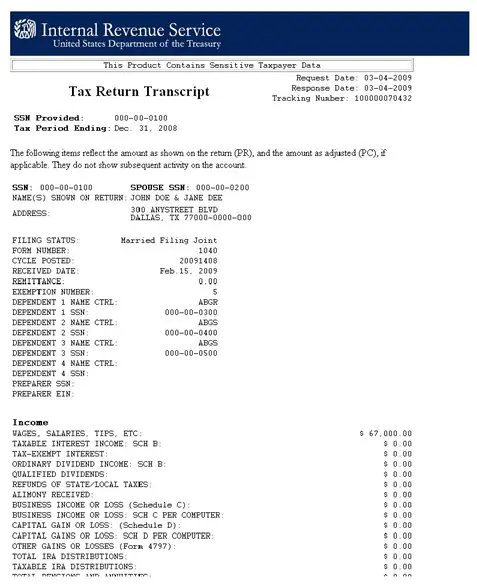

- Find the computer-generated notice that was issued by the IRS when you applied for your EIN. This notice is issued as a confirmation of your application for, and receipt of an EIN.

- If you used your EIN to open a bank account, or apply for any type of state or local license, you should contact the bank or agency to secure your EIN.

- Find a previously filed tax return for your existing entity for which you have your lost or misplaced EIN. Your previously filed return should be notated with your EIN.

- Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at . The hours of operation are 7:00 a.m. – 7:00 p.m. local time, Monday through Friday. An assistor will ask you for identifying information and provide the number to you over the telephone, as long as you are a person who is authorized to receive it. Examples of an authorized person include, but are not limited to, a sole proprietor, a partner in a partnership, a corporate officer, a trustee of a trust, or an executor of an estate.

Federal Tax Id Number Versus Ein

In short, a federal tax ID is the same as an EIN. As is often the case in business, though, youll hear several acronyms that all reflect the same concept. These acronyms can be confusing, but here is a clear breakdown of what each refers to and how they differ.

- The federal tax ID number is also known as the TIN.

- Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity.

- An EIN may also be called a FEIN .

How To Cancel An Ein

The IRS can close your business account and cancel your EIN upon request. You must send a letter to the IRS with the following details:

- Business legal name

- Mailing address of the business

- Reason you wish to close the account

You can mail your notice to the Internal Revenue Service, Cincinnati, OH 45999.

Note that even after you close a business, the EIN may still be associated with that entity. The IRS wont issue the same nine-digit identification number to a business in the future.

Read Also: Do Unemployment Benefits Get Taxed

Where Do I Send My Npt In Philadelphia

How to make a payment

- Filing a tax return by mail is an option. Send your tax return to: Philadelphia Department of Revenue, P.O. Box 1660

- make your payment by postal mail. All payments should be mailed to the following address: Philadelphia Department of Revenue, P.O. Box 1393

- Send an email to request a refund. Send your return and reimbursement request to the following address: Philadelphia Department of Revenue, P.O. Box 1137

Resources To Look Up A Tax Id And Verify Ein For A Business

The EIN for publicly traded companies can be found on the Investor Relations website. Almost every publicly traded company will possess a filings page.

On the filings page provided by the Securities and Exchange Commission, you can find the EIN number for a business by clicking the SEC filing and reading the first page of the document.

It is also possible to use the EDGAR Online Forms and Filings database to search for an EIN. Searching the EDGAR database is completely free of charge, and can be used to find a business EIN that is not listed in the online SEC filings.

If you frequently need to search for business EINs, then you may want to sign up for a commercial database service. With a Commercial EIN database, you may have access to special offers that provide you with a certain number of free searches before you will need to pay a fee.

Several methods exist for looking up a business’s tax ID. Generally, the searcher will need to provide a few basic details, including the type of entity for which they are searching.

You May Like: What Is Sales Tax Deduction

How To Find An Ein For Another Business

There may come a time when you need to look up another companys EIN for verification purposes, risk assessment or other reasons. Here are a few potential ways you might be able to find a business EIN when you need it:

- Ask for the information. The companys payroll or accounting department might be a good place to submit your request, though theres no guarantee a business will be willing to share those details.

- Check the companys credit report. Unlike consumer , which have more robust privacy protections, almost anyone can check a business credit report. Some business credit reports and scores may feature a companys EIN alongside other important details, like how the business manages its credit obligations.

- Search state and federal websites. You may be able to find information about a company, including its EIN, by searching various state and federal government websites. The secretary of states website may be a good place to start. You might also consider searching the Securities and Exchange Commissions website for SEC filings if the company is publicly traded.

- Pay a third party for help. Another option to consider is an EIN database. For a fee, these third-party services may be able to provide you with useful information about various businesses.

Finding The Id For Your Employer

Read Also: Where Can I File My Taxes

Why You Need To Know Your Business Tax Id Number

The IRS requires most types of businesses to apply for an EIN. The exceptions are some sole proprietors and owners of single-member LLCs, who can use their social security number instead of an EIN. But even small business owners who don’t have to get an EIN often opt to get one, so that they’re able to separate their business and personal finances.

If the IRS requires you to get an EIN or if you choose to get one, these are some of the situations where you’ll need to provide your business tax ID number:

-

When filing business tax returns or making business tax payments

-

When applying for a business loan

-

When opening a business bank account

-

When applying for a business credit card

-

When issuing Form 1099s to independent contractors

Although each of these transactions doesn’t happen regularly, when you consider all of them together, you’ll need to provide your EIN at least a few times per year. So, this is a number worth committing to memory and storing safely. Ideally, you should retrieve your business tax ID before you complete any of the transactions above.

Does My Business Need To Reapply For A New Ein

Sometimes, your business may need to reapply for a new EIN. The IRS requires you to reapply for one rather than amending your business’s existing EIN. According to the IRS, here are the most common reasons:

- You change the structure of your business, like incorporating or turning your sole proprietorship into a partnership.

- You purchase or inherit an existing business.

- You created a trust with funds from an estate.

- You are subject to a bankruptcy proceeding.

If your circumstances require you to reapply for an EIN, the application process is the same as if youre applying for one for the first time.

Recommended Reading: How Do You Figure Out Your Tax Liability

Obtain Federal Tax Id Number

Your Employer Identification Number is a nine-digit number issued by the IRS to identify your business and the type of tax returns you file. It is to be used for business purposes only. You should never use your social security number in its place.

An EIN is generally required for all businesses and it is used for all transactions and correspondence with the IRS and Social Security Administration . Download Understanding Your EIN for a complete guide to how your tax ID number works.

Tin Search: Finding Your Tin Number

If youre a Canadian business owner looking for your TIN number, weve got good news: its easy to find.

For individual residents of Canada , your TIN number is your nine-digit SIN.

So long as you know your SIN, youre good to go!

However, for corporations , your TIN is your nine-digit Business Number issued by the Canada Revenue Agency .

So, lets talk about how to find your BN.

Recommended Reading: How Much To Do Tax Return

Apply For Your Tax Id Number Online

Do you need your Tax ID Number fast? Applying for your Tax ID Number online is the best option. When you apply online through a third-party tax ID service, you can get your Tax ID Number in an hour. The tax ID service will collect and verify your information and give you a Tax ID Number that can then be used immediately on official forms and documents.

What Is My Tin Finding Out Your Own Tax Number

The IRS have to process huge amounts of data from millions of different US citizens. Organizing this is a real challenge, not only because of the sheer volume of data to be processed, but also because identifying people can be quite tricky without the right system. For example, according to the Whitepages name William Smith has over 1,000 entries in the State of Alabama alone. Across the USA this number increases, and the likelihood is that some of these individuals will have the same date of birth, for example, which is often used to identify people. This means that there needs to be another system for keeping track of individuals for tax purposes in the US other than just their names: A taxpayer identification number serves this purpose.

A Taxpayer Identification Number is often abbreviated to TIN and is used by the Internal Revenue Service to identify individuals efficiently. Where you get your TIN, how it is structured, and whether a TIN is the right form of identification for your purposes sometimes seems like it isnt as straightforward as it should be. However, this guide will look at exactly these issues which should show that finding out this information can be as easy as 1,2,3. In this article, we want to concentrate on the tax number that you as an employee will need for your income tax return or the number that you as an employer require for invoicing, and well explain exactly where you can get these numbers.

Contents

Don’t Miss: What Is Nys Tax Rate

How To Find The Ein For Your Business

More often than not, there will be an instance when you’re working through a business document or application, and you come upon a question asking for your EIN. What if you cant remember it? The three best places to find your business EIN are:

- Your business tax return from a previous year

- The original document of your receipt or the document you received from the IRS when you applied for your EIN

- Your states business division website, if you registered your partnership, LLC, or corporation with your state

You could also look for your EIN on other business documents or applications, including:

- A business bank account application

- An application for a business loan

- The application for a business credit card

- A copy of a state or local license or tax permit

- On a 1099-NEC form you received for your work as an independent contractor or freelancer

- On the 1099-MISC form or 1099-NEC form that you used to report payments by your business

What Is An Ein

An EIN serves as a unique identifier for your company. Its used mainly for tax purposes. The IRS requires an EIN for any registered business with employees, corporations, partnerships, and businesses that file employment, excise, or alcohol, tobacco and firearms tax returns.

Your EIN serves as the primary ID of a business to the government. It’s also commonly referred to as a “tax identification number ” or “federal tax ID number.” You might use it to:

- File business tax returns

- Open a business bank account

- Apply for small business loans

- Obtain a business license

- File various business legal documents

Recommended Reading: How Much Taxes Do I Pay On Unemployment

What Is A Tin

TIN stands for Taxpayer Identification Number. This is a nine-digit number issued by the Internal Revenue Service or Social Security Administration . It identifies an individual or business for tax purposes.

In actuality, TIN is an umbrella term. The acronym encompasses a variety of different tax identification numbers that fall under it.

Is A Federal Tax Id Number The Same As A Social Security Number

There is a lot of confusion out there about the difference between a federal tax ID number and a social security number. Here is a breakdown:

A federal tax ID number is a unique number that is assigned to each taxpayer by the Internal Revenue Service. It is important to keep your federal tax ID number current, as it will be needed to file your taxes in the future.

A social security number, on the other hand, is a number that is issued to you by social security Administration. It is also important to keep your social security number current, as it will be needed to receive benefits from social security Administration.

So, whats the difference between a federal tax ID number and a social security number?

A federal tax ID number is a unique number that is assigned to each taxpayer by the Internal Revenue Service. It is important to keep your federal tax ID number current, as it will be needed to file your taxes in the future. A social security number, on the other hand, is a number that is issued to you by social security Administration. It is also important to keep your social security number current, as it will be needed to receive benefits from social security Administration.

You May Like: How To Know If You Filed Taxes Last Year

How Do I Find My Tid Number

What is the process for finding your TID number?

First, you will need to obtain a current identification card. This card will contain your name, photograph, and contact information.

Once you have your identification card, you will need to go to the appropriate government office and provide your information. The government office will then issue you a TID number.

To find your TID number, you will need to use the following process:

1. Go to the government office that issued your identification card.

2. Provide your name, photograph, and contact information.

3. The government office will issue you a TID number.

4. Use the TID number to obtain your current Identification Card.

5. Keep your Identification Card and your TID number safe.

Apply For Your Tax Id Number Via Phone

You can apply for a Tax ID Number via phone if you call in with the relevant information. However, you will need to call in during business hours, and you will need to complete the process from start to finish over the phone. If you get disconnected, you will need to begin the process over again. While getting a Tax ID Number over the phone is possible, it also means you wont have any written or digital record of your Tax ID Number: it will be verbally given to you over the phone. Getting a Tax ID Number over the phone will take longer than getting a Tax ID Number online.

You May Like: When Will Irs Refund Unemployment Taxes

Q9 What Is Placement Documentation

A9. Placement documentation is the signed documentation placing the child in your care for legal adoption. In general, one of the following documents will satisfy this requirement:

- A placement agreement entered into between you and a public or private adoption agency.

- A document signed by a hospital official authorizing the release of a newborn child to you for legal adoption.

- A court order or other court document ordering or approving the placement of a child with you for legal adoption.

- An affidavit signed by an attorney, a government official, etc., placing the child with you pursuant to the states’ legal adoption laws.

The placement documentation is sometimes referred to as “Placement Agreement” “Surrender Papers” “Temporary Placement Paperwork” “Placement Order” etc. This documentation termed differently from state to state must clearly establish that the child was placed in your home for purposes of adoption by an authorized adoption agency , and must include the following information:

- Adoptive Parent full name

What Is Philadelphia City Tax

Everyone who lives in Philadelphia is subject to the City Wage Tax, regardless of where they work. In addition, non-residents who work in Philadelphia are required to pay the Wage Tax. The rate for residents will be 3.8398 percent as of July 1, 2021, while the rate for non-residents will be 3.4481 percent as of July 1, 2021.

Also Check: Does Puerto Rico Pay Taxes