Payments Must Be Received By The Due Date

Starting 2021, property tax and utility payments must be received by the due date, in our office, to be considered on time.

It is your responsibility to make payments early enough so that we receive them on time. Payments received after midnight on the due date will be considered late. Postmarks are not accepted as proof of on-time payment.

How Much Is My Tax Bill

Your annual tax statement includes the amount of taxes owing as of the date of the statement. If you are making a late payment, you may have been charged with monthly interest. Please contact our office for the up-to-date outstanding amount by toll free number at 1-888-677-6621 or email and remember to include the roll number of the property.

Avoid The Line Pay Online

Using your MyPropertyAccount you can register your property tax, utilities and dog licensing accounts for eBilling. Pay via online or phone banking with your financial institution.;;

Sign up for eBilling

Log in to MyPropertyAccounts and change your bill delivery method to email by May 1st of the year to get your bill online.

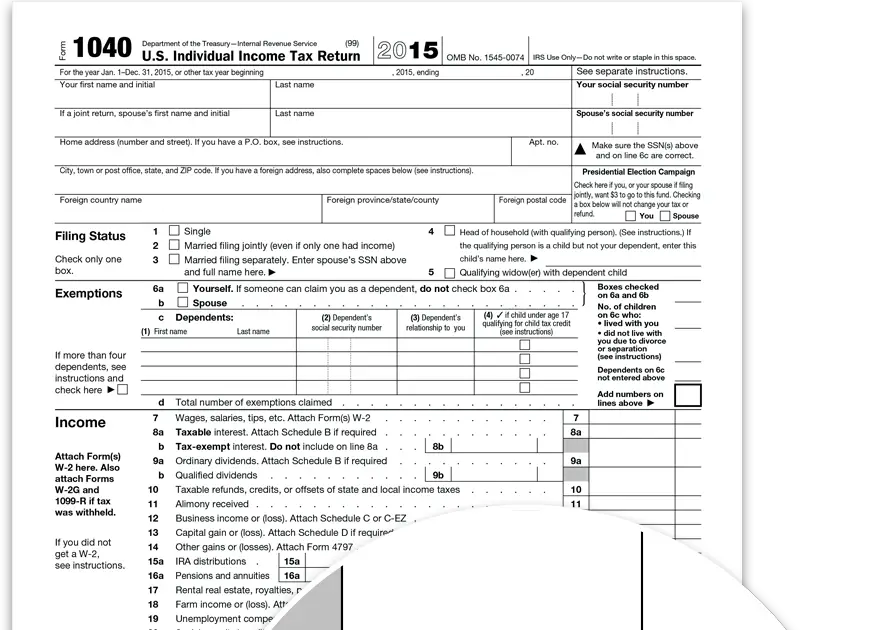

Don’t Miss: How Do You File An Amendment To Your Tax Return

Effective Date Of Payment

Property tax payments can be made through most chartered banks, trust companies, credit unions, and Alberta Treasury Branches. Know your bank’s policies regarding the effective date of payment. Its important to pay at least three business days prior to the property tax payment due date to meet the payment deadline and avoid a late payment penalty. Please keep in mind that most bank transactions are based on Eastern Standard Time.

What Is The Secured Roll; Secured Taxes

The listing of property which, in the opinion of the assessor, has sufficient value to guarantee payment of taxes levied on the property. “Secured taxes” are those which, if unpaid, can be satisfied by sale of realty against which they are levied. Realty/Real Estate is land, including timber and minerals, and anything permanently affixed to the land , such as planted trees and vines, buildings, fences, and those things permanently attached to buildings, such as light fixtures, plumbing and heating fixtures, or other such items which would be personal property if not attached. The term is generally synonymous with real property.

Read Also: Why Do I Owe So Much State Taxes

Are There Any Exemptions And Assistance Programs Available To Property Owners Which Help Defray The Amount Of Taxes Due

Application for the homeowners, veterans, church, welfare and other exemptions may be obtained from the Assessors Office. These programs allow, under specific qualifications, for assessment exemptions, which result in tax savings. Additional information maybe obtained from the Assessors Office, 600.3534.

Property Tax Assistance for Senior Citizens, Blind, or Disabled Persons:;The state budget did not include funding for the Gonsalves-Deukmejian-Petris Senior Citizens Property Tax Assistance Law, which provides direct cash assistance. The Franchise Tax Board will not issue Homeowner and Renter Assistance program instruction booklets and will not accept HRA claims for the 2015 claim year. For the most current information on the HRA program, go to ftb.ca.gov and search for HRA.

Property Tax Postponement Program for Senior Citizens, Blind, or Disabled Persons: The State Controllers Office administers the PTP, which allows eligible homeowners to postpone payment of current-year property taxes on their primary residence, if certain eligibility requirements are met.; A postponement of property taxes is a deferment of current-year property taxes that must eventually be repaid, with interest of 5% per year.; Repayment is also secured by a lien against the property.; PTP applications are accepted by the SCO beginning on October 1 of each year through February 10 of the following year.

- Phone – 952-5661

Bcs Homeowner Grant Centralization

B.C. municipalities are no longer accepting home owner grant applications. All property owners must now claim their home owner grants with the Province.

How to apply?

- Apply online at gov.bc.ca/homeownergrant

It is quick, easy and secure. Be sure to have your social insurance number, jurisdiction number for Maple Ridge and your folio / roll number .

Also Check: What Will My Property Taxes Be

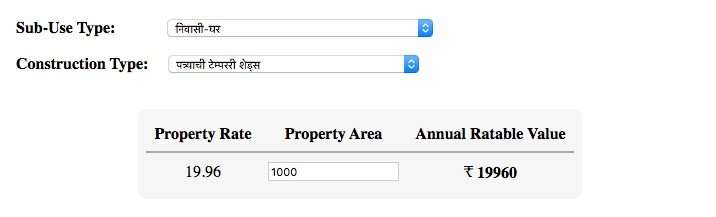

How Is My Property Tax Calculated

Property tax is based on the assessed value of your property. Manitoba Municipal Relations, Assessment Services branch assesses each property for both the land and the buildings of that property by comparing lot sizes, location, local improvements, building age, size, condition and the quality of the construction.

Property taxes that are collected are provided to school divisions for school taxes and the northern affairs communities to cover the cost of municipal service provided to property owners.

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.;

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

You May Like: Can I Pay Quarterly Taxes Online

How Is My Assessment Used To Calculate My Property Taxes

Property taxes are used to pay the levies set by local taxing bodies. Your assessed value;determines your share of those levies relative to the total assessed value of your area. The levies and the total assessed value of an area determine your local;tax rate.

After the assessor determines the Fair Market Value of your home, the Assessed Value of your home is calculated.;For residential property owners, the assessed value equals 10% of the fair market value of the home. For most commercial property owners, the assessed value is 25% of the fair market value. This level of assessed value is the taxable amount of the property, as determined by Cook County ordinance.

Then the;State Equalization Factor/Multiplier; is applied to the assessed value;and this creates the;Equalized Assessed Value; for the property.

Any Exemptions;earned by the home are then subtracted from the EAV. Then the Tax Rate is applied to the tax levies for your community. Once those levies are added up, the total is the amount of property taxes you owe.

After any qualified property tax exemptions are deducted from the EAV, your;local tax rate;and levies are applied to compute the dollar amount of your property taxes. Please remember: each Tax Year’s property taxes are billed and due the;following;year. For instance, 2019;taxes are billed and due in 2020.

| $100,000 |

Bc Speculation And Vacancy Tax Due March 31 2021

The Provincial Speculation and Vacancy Tax is part of the BC Governments affordable housing plan. All owners of residential property in Maple Ridge must complete an annual declaration, either by phone or on-line. The information you need will be mailed by mid-February; if you have not received one by late February, please contact the Province.

For information about the tax and the process, please contact:

Don’t Miss: Do I Pay Taxes On Stimulus Check

Walk The Home With The Assessor

Many people allow the tax assessor to wander about their homes unguided during the evaluation process. This can be a mistake. Some assessors will only see the good points in the home;such as the new fireplace or marble-topped counters in the kitchen. They’ll overlook the fact that several appliances are out of date, or that some small cracks are appearing in the ceiling.

To prevent this from happening, be sure to walk the home with the assessor and point out the good points as well as the deficiencies. This will ensure you receive the fairest possible valuation for your home.

Will I Receive A Tax Bill If I Pay Taxes Through An Impound Account

If your taxes are paid through an impound account, your lender will receive your annual tax bill and you will receive an information/assessee copy. Supplemental tax bills, however, are not sent to your lender; they are mailed directly to you. It is your responsibility to contact your lender to determine who will pay the supplemental tax bill, you or your lender.

You May Like: What Is California State Tax Rate

All Deferment Applications Must Be Submitted Online Through The Service Bc Provincial Website

Renewal and New Deferment applications will not be accepted or given out at Maple Ridge City Hall. All deferment applications must be submitted on-line through the Service BC Website.

Remember you will still need to:

- Claim your Home Owner Grant and

- Pay the Total Utility Services amount to the City of Maple Ridge

Property Tax Payment Options

We encourage you to pay your taxes and utilities online or via telephone banking.

Our customer service team is happy to assist you over the phone or via email if you have any questions.;For property tax and utility information, call 604-591-4181 or email;.

You can also mail your payment to City Hall or pay;in person. Appointments to pay in person are encouraged to avoid wait times.;

You May Like: How Do Property Taxes Work In Texas

Allow The Assessor Access To Your Home

You do not have to allow the tax assessor into your home. However, what typically happens if you do not permit access to the interior is that the assessor assumes you’ve made certain improvements such as added fixtures or made exorbitant refurbishments. This could result in a bigger tax bill.

Many towns have a policy that if the homeowner does not grant full access to the property, the assessor will automatically assign the highest assessed value possible for that type of propertyfair or not. At this point, it’s up to the individual to dispute the evaluation with the town, which will be nearly impossible unless you grant access to the interior.

The lesson: Allow the assessor to access your home. If you took out permits for all improvements you’ve made to the property, you should be fine.

Paying Through Your Mortgage Company

If you’re paying your property taxes through your mortgage company, claim your Home Owner Grant online by the due date, to avoid late penalty fees.

You are responsible for communicating with your mortgage company and managing this service to ensure the balance owing is paid by the due date to avoid late penalty charges.

Also Check: Where Do I Get Paperwork To File Taxes

Add Calgary Property Tax As A Payee

Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online, by phone or in person at a branch.

Add Calgary Property Tax payee to your bank accounts bill payment profile:Search keywords: Calgary property tax and select the payee name closest to Calgary Property Tax or Calgary Property Tax.

Cant find Calgary property tax as a payee or are unsure which payee to select?

Contact your bank for more information.

I Paid My Property Tax Bill But I Have Not Received My Receipt

Effective August 2020, tax receipts will be provided only for in-person payments . We will no longer be providing tax receipts for other types of payments . For these payments, please keep your banking confirmation number for records, as that will be your proof of payment. If you require a receipt for a specific purpose , please contact our office by toll free number at 1-888-677-6621 or email .

You May Like: Does California Have An Inheritance Tax

How Do I Make A Property Tax Payment

You can choose one of the following methods of payment:

- Internet/Online Banking and Telpay through your local bank or credit union.

Payee name:Manitoba IMR Property Tax. The account number would be your municipality number plus your roll number which you can find on your tax bill. It should be a total of 12 digits. Example:Municipality number: 702, Roll number: 0123456.000, In this case, delete the first zero in the roll number. Account number is 702123456000.

The most efficient way to pay your property tax bill is to make an online payment. Some payments may take 2-3 days. If you have questions about the on-line banking process, please contact your bank for further assistance.

- Chequesand Money Orders by Mail, including postdated cheques. Please make cheques payable to Minister of Finance as well as indicating your roll number to where the payment is being applied. Please send your cheques to:

Property TaxationManitoba Indigenous Reconciliation;and Northern Relations400-352 Donald Street

- In office payments such as:

- Cash:Please do not mail

- Debit:No credit cards are accepted

- Cheques and Post dated Cheques:Payable to the Minister of Finance

- Address:;;Manitoba Indigenous Reconciliation;and Northern Relations, 59 Elizabeth Drive, Thompson MB

Please note that, as a result of social distancing due to the pandemic, the office may not be open to in-person payments without an appointment. Please call our office by toll free number at 1-888-677-6621.

Pay Directly To The City

to pay property tax directly to The City of Calgary. See;;for more information.

The Tax Instalment Payment Plan is a monthly instalment plan that allows you to pay your property taxes by monthly pre-authorized debit, rather than in a single annual payment. Find out more about the;Tax Instalment Payment Plan .

Reduce the risk of late payment penalties by requesting and returning your TIPP agreement early.

TIPP payment not honoured by your bank – making a replacement instalment

Making a replacement instalment, like all other tax payments, can be made through one of the other property tax payment options listed on this page. Replacing a payment before it becomes dishonoured will not stop the next monthly TIPP instalment from being withdrawn or prevent service fees. For more information on replacement instalments, see non-payment and service charges.

Making a lump sum payment to lower your monthly payment amount

Your monthly TIPP payments can be lowered by making a lump sum payment and requesting a recalculation.; If you decide to make a lump sum payment, it cannot be automatically withdrawn.; A lump sum payment, like all other tax payments, can be made through one of the other property tax payment options listed on this page.

Third floor, Calgary Municipal Building800 Macleod Trail S.E.

Cheque or money order

Avoid last minute lineups and late payment penalties by bringing your cheque to Corporate Cashiers today, post-dated on or before the due date.

You May Like: Do I Have To Pay Taxes On My Unemployment

What Are My Responsibilities As A Taxpayer For Payment Of Property Taxes

As the owner of property in Fresno County, you are responsible for the timely payment of your property taxes. If you are a new owner, there was most likely a proration made between the buyer and seller during escrow, however the funds may not have been withheld and payment made. You should refer to your escrow papers if there is a question.

Annual tax bills, which can be paid in two installments, are mailed once a year by November 1. Since the bill contains payment stubs for both installments, this is the only bill regularly mailed each year by the Auditor-Controller/Treasurer-Tax Collector. Depending on when the ownership change is placed on the tax roll, the annual tax bill may have been sent either to the previous owner or directly to you. It is your responsibility to obtain tax information. State law stipulates that failure to receive a tax bill does not permit the Tax Collector to waive penalties for late payments.

In addition to annual taxes, you may be responsible for payment of supplemental property taxes. Any time property is sold, or new construction completed, the value of the changed property is reassessed. If the property has been reassessed at a high value, you will receive one or more supplemental tax statements in addition to the annual tax bill. If the property has been reassessed to a lower value, you may receive a refund.

If I Believe The Information On This Notice Is Incorrect How Do I Appeal

If the characteristics listed for your home are wrong, if you think your home is worth less than the fair market value on this notice, or if you think there is information about your home that was not taken into account, you can file an appeal of your assessment.

Appeals can be filed with our office or with the Cook County Board of Review. Please see our Appeals section for information on how and when to file an appeal with our office. Visit cookcountyboardofreview.com for information and deadlines about appeals with their office.

Also Check: How Much Taxes To Pay On Stocks

How Often Is My Property Reassessed

Cook County is reassessed triennially, which means one-third of the county is reassessed each year. This year, the south suburbs will be reassessed. The City of Chicago will be reassessed in 2021. The northern suburbs will be reassessed in 2022. Your property may also be reassessed if there are significant changes due to a permit application, property division, demolition, or other special application.

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

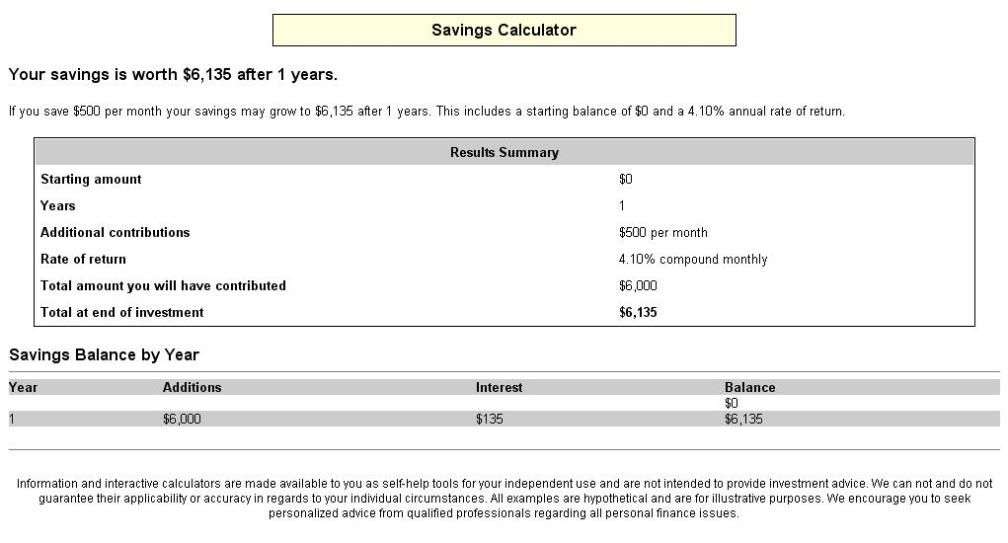

A financial advisor in your area can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

You May Like: What Is Tax In Nevada