Consider Funding An Able Account

Do you have a child with special needs? So-called ABLE accounts are tax-advantaged savings accounts made available to people with disabilities. You can contribute up to $15,000 in post-tax dollars to a single ABLE account per year. Although contributions are not tax-deductible at the federal level, they may be at the state level. Any growth in such an account is exempt from federal taxes, so long as the money is used for qualified expenses, such as education, housing, and supplemental medical costs.

What If You Dont Want Cash Payments

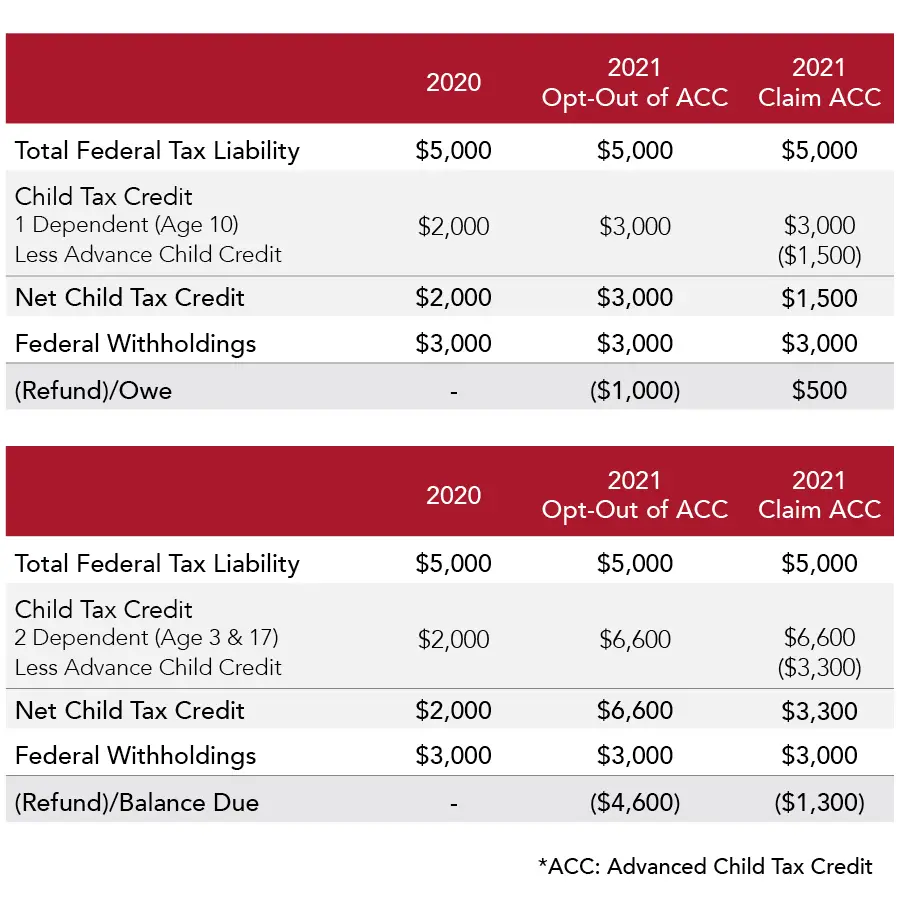

The IRS has set up a portal where you can opt out of these payments if you think they arent for yousay, if they would disrupt your tax plans, or you have eligibility concerns.

For example, if your tax plans for 2021 already assume youll receive a regular tax credit when you file next year, you may not want to receive any money in advance, as that could mean a smaller refund or even having to pay the IRS.

Finally, as noted above, if your income increased this year and would render you ineligible for any child tax credit, you should consider opting out so you dont end up having to pay it back at tax time.

The IRS has set up a portal where you can opt out of these payments if you think they arent for yousay, if they would disrupt your tax plans, or you have eligibility concerns.

For example, if your tax plans for 2021 already assume youll receive a regular tax credit when you file next year, you may not want to receive any money in advance, as that could mean a smaller refund or even having to pay the IRS.

Finally, as noted above, if your income increased this year and would render you ineligible for any child tax credit, you should consider opting out so you dont end up having to pay it back at tax time.

For example, if your tax plans for 2021 already assume youll receive a regular tax credit when you file next year, you may not want to receive any money in advance, as that could mean a smaller refund or even having to pay the IRS.

Will You Have To Pay Back The Child Tax Credit

First, some good news. The child tax credit is not considered taxable income. It’s a credit, which means it can lower your tax bill or potentially result in a refund. However, things get a little tricky if it turns out that you were overpaid on your advance payment.

The advance payments were a prepayment of the 2021 tax credit you would normally claim in full during filing season. But because half of the credit was sent out early, the IRS likely used your most recent tax return to determine how much of an advance to send you each month. So, if your financial or personal circumstances have changed in 2021, there’s a chance you might have received more of an advance than you’re actually eligible for. A few ways this could play out:

-

Let’s say you received advance payments totaling $1,500 for your qualifying dependent based on your 2020 income. However, your income has increased significantly in 2021, making you eligible only for a reduced credit. The excess paid out to you is considered an overpayment.

-

Another example: You’re a single filer with one dependent who lived in the U.S. in 2020. The IRS then sent you advance payments based on that information, which you accepted. However, in 2021, you actually lived outside of the U.S. for more than half the year, making you ineligible for the child tax credit. Accepting the payment would also be considered an overpayment.

Also Check: How To Track Your State Tax Refund

Why Life Changes Affect Child Tax Credit Payments

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Changes in income, filing status, the birth or death of a child, or having a child move into or out of your household may have affected the amount that you are eligible to receive when you file your 2021 tax return.

This section will help you understand how certain life events will impact your Child Tax Credit eligibility.

Theres Still Time To Claim Your 2021 Child Tax Credit

Halfpoint Images / Getty Images

The Child Tax Credit has been available to taxpayers since 1997 when it was first launched under the terms of the Taxpayer Relief Act. Its undergone a few tweaks and changes since then, but none as significant as those that affected 2021. The American Rescue Plan made the credit particularly advantageous for the most recent tax year, but, unfortunately, the changes arent permanent. The credit is slated to revert back to its previous terms in 2022 unless Congress takes steps to intervene.

The changes for tax year 2021 allowed eligible Americans with children to receive half their credits in advance. They didnt have to wait until 2022 to file their tax returns to claim that money. Payments were sent out from July through December of 2021. Taxpayers can claim the balance of the tax credit when they file their 2021 returns in 2022.

You May Like: Should I File Taxes Now Or Wait

Consider Funding A Roth Ira For Your Child

Does your child have a summer job? If they have earned income this year, you can open a tax-advantaged custodial Roth IRA account on their behalf, and help them make what could be a down payment on an early retirement. As with a custodial account, contributions are made with after-tax dollars, but with a Roth IRA, contributions and earnings then grow tax-freeand you can withdraw them tax- and penalty-free after age 59½, assuming the account has been open for five years. You can contribute up to $6,000 in 2021, or the total of earned income for the year, whichever is less.

You could offer to use the child tax credit funds to match any contributions your child makes, or even just put them in as a gift, says Hayden. Investing in a Roth IRA when youre young and likely to have a very low tax rate means you can put more money to work for a much longer time.

Your child may laugh at the idea of saving for retirement during their teenage years, he adds. But imagine how happy theyll be knowing they have a pot of tax-free withdrawals waiting for them when theyre older.

What If I Dont Have A Permanent Address

You can receive monthly Child Tax Credit payments even if you dont have a permanent address. You can list a trusted address where you would like to temporarily receive your monthly checks, such as the address of a friend, relative, or trusted service provider like a shelter, drop-in day center, or transitional housing program.

You May Like: How To Do Your Taxes If You Are Self Employed

Can I Add A Dependent For The Child Tax Credit

Unless you and your spouse file jointly, a child can only be claimed as a dependent by one parent. Generally, the custodial parent claims the credit, but the one exception that would allow a non-custodial parent to claim their child as a dependent is if the custodial parent agrees not to on their own tax return.

You Can Get More When You File

When filing your taxes, you will get the full amount of Child Tax Credit, even if you received less in monthly payments last year than you may have been eligible for.

You will be able claim the full amount of any remaining Child Tax Credit benefits you are eligible for against any 2021 tax liability you owe and receive any leftover amount as a refund payment.

Any amount of monthly Child Tax Credit payments received last year will reduce the amount of remaining Child Tax Credit benefit you are eligible for when tax filing.

Also Check: What Do Taxes Pay For

Residents Of American Samoa The Commonwealth Of The Northern Mariana Islands Guam And The Us Virgin Islands

Residents of American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, or the U.S. Virgin Islands may be eligible for advance Child Tax Credit payments and the Child Tax Credit. The credit is being administered by the tax agencies of each U.S. territory, not the IRS. Please contact your local U.S. territory tax agency regarding your eligibility, and for additional information about any other changes to the Child Tax Credit.

How Much Will I Receive In Child Tax Credit Payments

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

This amount may vary by income. These people qualify for the full Child Tax Credit:

- Families with a single parent with income under $112,500

- Everyone else with income under $75,000

These people qualify for at least $2,000 of Child Tax Credit, which comes out to $166 per child each month:

- Families with a single parent with income under $200,000

- Everyone else with income under $200,000

Families with even higher incomes may receive smaller amounts or no credit at all.

You May Like: How To Use Pay Stub For Taxes

To Get The Expanded Child Tax Credit

- File your taxes, even if you dont file them normally. This will tell the IRS where to send your payment and how many children you take care of. Also, if you dont file, you might miss out on other tax credits.

- To self-file or make an appointment for free tax preparation help, visit GetTheTaxFacts.org.

Social Security Numbers And Individual Taxpayer Identification Numbers

You and your spouse, if married and filing a joint return must have either a Social Security Number or an Individual Taxpayer Identification Number issued by the Internal Revenue Service to be eligible to claim the Child Tax Credit.

In order for you to qualify for the Child Tax Credit, your child must have an SSN that is valid for employment. An SSN is valid for employment if your child is able to legally work in the United States, even if they are currently too young to work or do not work.

If your childs Social Security card has the words NOT VALID FOR EMPLOYMENT on it then you cannot claim the Child Tax Credit for them. If those words do not appear on your childs Social Security card, and their immigration status hasnt changed since it was issued, then your childs SSN is valid for employment.

If your child is not a qualifying child for the Child Tax Credit, you may be able to claim the $500 Credit for Other Dependents for that child when you file 2021 your tax return. For more information about the Credit for Other Dependents, see the Instructions for Schedule 8812 .

Heres how to get an ITIN if you do not currently have one.

Don’t Miss: Can You File For Previous Years Taxes

This Year More Workers Without Dependent Children Can Claim The Credit And Can Receive Up To Three Times More Money Than In 2020

Before the American Rescue Plan, people with no dependent children were eligible for the Earned Income Tax Credit only if they were age 25 to 64 and they could receive only up to $538. The maximum amount of Earned Income Tax Credit is nearly tripled for these taxpayers up to $1,502.

In addition, the American Rescue Plan made new workers eligible for the Earned Income Tax Credit:

- If you are 19 or older, you could be eligible to claim the Earned Income Tax Credit.

- If you are 18 years old and were formerly in foster care or are experiencing homelessness, you could be eligible for the credit.

- Certain full-time students age 24 and older can qualify.

- There is no upper age limit for claiming the credit if you have earned income.

- Singles and couples who have Social Security numbers can claim the credit, even if their children dont have SSNs.

- More workers and working families who have income from retirement accounts or other investments can still get the credit. The limit on investment income is now $10,000 and will now rise every year with inflation.

During 2021 The Vast Majority Of Eligible Families Received Half Of Their Child Tax Credit Through Monthly Payments

The changes made for 2021 gave tens of millions of families a portion of their 2021 Child Tax Credit through monthly paymentsup to half the total estimated amount. In prior years, families could only receive their Child Tax Credit in a lump sum when they filed tax returns.

Whether they received monthly advance payments or not, eligible families can claim their remaining Child Tax Credit benefits when they file a tax return this year.

Don’t Miss: Can You File State Taxes Before Federal

Information You Share With Irs

Signing up to receive Child Tax Credit payments, or filing a 2021 tax return, does not mean information about you or your family will be shared with immigration enforcement. Taxpayer confidentiality laws prevent Internal Revenue Service employees, except in very limited circumstances, from legally sharing information with other federal agencies. It can be a crime for an IRS employee to improperly share taxpayer information with immigration enforcement.

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Also Check: Do Retirees Pay Income Tax

How To Tell If Someone Is A Qualifying Child

To be a qualifying child for the purpose of claiming them under the Earned Income Tax Credit, your child must:

- Be your own child, adopted child, stepchild, or foster child. You can also claim a sibling, step-sibling, half-sibling, or a descendent of any of them and

- Have lived with you for more than half of 2021.

- Any age and permanently and totally disabled at any time during 2021

The IRS provides detailed information on other, less common factors that may impact whether a child is a qualifying child for the Earned Income Tax Credit.

If The Parents Are Undocumented Immigrants How Can They Receive The Child Tax Credit Advance

If a family has at least one qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number they may receive the advance Child Tax Credit, regardless of the immigration documentation status of the parents.

For more information about how to qualify for the credit and prepayments, how to register to receive prepayment, or how to opt-out of receiving prepayments, you can visit the IRS website at or the GetCTC website at or .

Don’t Miss: What Can I Write Off On My Taxes For Instacart

What To Do If You Are Missing Payments

If you were late applying or for some other reason did not get a July, August, September, October, or November payment, your December payment should have been the full advance amount . This means that instead of up to 6 payments, you received just one in December.

Alternatively, you can claim your full 2021 Child Tax Credit when you file your income tax return in 2022. You will be filing for half of your credit anyway and, if you didn’t receive your full advance payment, you can claim whatever is due to you in April.

How Do I Opt Out Of The Child Tax Credit

You had the choice of opting out of the 2021 CTC advance payments if you didnt want to roll the dice that you would be entitled to the full amount when you file your 2021 tax return, or if you wanted to claim the full 100% of the credit on your 2021 tax return for some other reason. The IRS provided a CTC Update Portal online for this purpose, but you would have had to have opted out before the payments ended in December 2021.

Recommended Reading: How Do I Get My Tax Return Transcript

It’s Not Too Late To Claim

“The No. 1 message is it’s not too late,” said Roxy Caines, campaign director at Get It Back, an organization dedicated to helping people access free filing tax assistance and claim tax credits.

A website called GetCTC.org, which is provided by Code for America, provides a simple form through which people who do not typically file tax returns can claim their child tax credits and stimulus payments. The online form is available through Nov. 15.

“It will only take about 15 minutes for most families to go through and use it,” said Gabriel Zucker, associate policy director for tax benefits at Code for America.

If I Sign Up For The Child Tax Credit Will It Affect My Other Government Benefits

No. Receiving Child Tax Credit payments will not change the amount you receive in other Federal benefits like unemployment insurance, Medicaid, SNAP, SSI, TANF, WIC, Section 8, SSDI or Public Housing. The Child Tax Credit is not considered income for any family. So, these programs do not view tax credits as income.

Don’t Miss: How To Transfer Money From India To Usa Without Tax