Public Records: What Are They

Public records can be documents, emails, photographs, recordings, or any other form of information that’s retained by an agency.

Many public records are available on the Tax Commission’s website. In addition to general information, we provide details on these topics and more:

- Comparative statement

- City revenue sharing

- Sales tax distribution by county

- Personal property reimbursement by district

- Property tax reduction statistics

Getting An Irs Copy Of Tax Return Transcripts

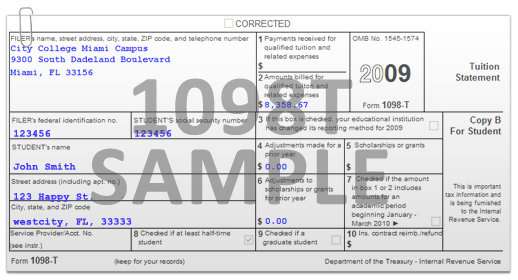

The IRS will provide “tax return transcripts” for any of the previous 3 years of returns free of charge. Tax return transcripts show most line items from the originally filed tax return . It won’t display any adjustments or corrections made after the original return was processed. These requests are usually processed within 10 days.

You can easily get a tax return transcript by using the online request system, calling the IRS to request the transcript, or mailing your request form to the IRS. To use the online system, go to IRS.gov and click on the link which reads “Order a Return or Account Transcript”. This is a self-service system that will walk you through the steps needed to complete the request. If you would rather call to request the transcript, you can call 1-800-908-9946. And lastly, you can also mail in your request by filing out IRS Form 4506T. Mailing instructions are included with the form. Note that only one spouse needs to make the request – by phone or mail – therefore this can be done unilaterally.

The IRS can also provide copies of tax returns for a fee of $57 per return, which may take up to 60 days to process. When you request a copy of your tax return, you will also receive all accompanying forms, W2’s, and amended returns. The advantage of this method is that the last 7 years of returns are available for copy. But, barring some specific need, transcripts are a cheaper and faster way to obtain tax information.

Determine Who Manages The Records

To start, you should figure out who manages the property records where the house is located. Whatever office has the land records will be who theyll want to contact first, says Marty Oaks, manager of official records for Duval County, Florida.

A few places or entities that keep county records:

- County courthouse

- County clerk recorders office

- City hall

- Other county or city department

In any case, you wont have to travel far, and most agencies house their records online. According to Oaks, every county keeps records differently. Some counties only house a few decades of records online. Typically the older the area, the more research would need to be done in person, he says. You can do a search here to figure out which office has the records.

You May Like: Do You Report Roth Ira Contributions Your Tax Return

How To Find Tax Records For A Business

Every company is required to keep business records for several years. Ownership records, for example, should be permanently retained. Accounting experts recommend keeping your tax returns for at least seven years. In some cases, these documents are publicly available, so anyone can access them. Whether you need information on a potential business partner, a competitor or a supplier, it may be worth checking their tax records. This will give you a better idea of their financial situation and overall performance.

TL DR

If it’s a publicly traded company, you may be able to find their financial statements on their website or on sites like Edgar.

How Long Do I Need To Keep Old Tax Returns

Drowning in paperwork? How long must you keep old tax records?

Getty

After being stuck at home for months, thanks to the Coronavirus, you might be wondering what to do with those stacks of old tax returns and other tax records. Can you just throw them away? Do you need to keep the hard copies? How can you get them out of sight and out of the way?

Few people know how long they must keep various tax records, receipts, and full tax returns. Another question is how to safely store these documents without feeling like you are living like a hoarder. Over the years, Ive met quite a few people who had stacks and stacks of boxes full of receipts, documents, old tax returns, even countless papers. While some of those documents were important and needed to be kept, most should have been shredded and thrown away long ago.

According to the Internal Revenue Service , the length of time you should keep your tax documents will depend on the type of file you are talking about and what kind of transaction to which it relates. You will want to keep any tax records to support your income, various tax deductions, tax credit, and exemptions until at least the period of limitations for each tax return ends. If you arent a certified public accountant or a financial planner, you are likely wondering, what the heck does that mean for me? Keep reading, and we will explain.

As you file your 2019 taxes, you may wonder if you need to keep your old tax returns.

Getty

Also Check: How To File Missouri State Taxes For Free

Why Should You Keep Some Tax Records Longer Than Seven Years

As a money nerd, I am planning to keep my older tax records indefinitely. Partially, because I think it is a good idea to have them. Also, because Ive managed to make all the files digital, and once they are scanned and saved, I have more important things to do with my time rather than delete old files on my computer. Also, as a business owner, I have found it interesting to revisit my income and even business expenses throughout my career as a financial planner.

Do You Have Tax Records Connected to Property?

When you own property , you should keep all tax records for at least three years after selling that property and filing the corresponding tax returns. That may include records for depreciation, amortization, or depletion deduction, all of which will figure into whether you are going to realize a gain or loss when you sell the property. Your taxable gain when selling a home, or disposing of property, is not necessarily the same as the difference between the purchase and sale prices.

Depending on where you live, you may need to keep state tax records longer than the IRS requires for … federal tax returns.

Getty

State Tax Record Retention Requirements

What Should I Do with My Old Tax Returns?

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

Also Check: 1040paytax.com Safe

How To Organize Your Tax Records

As youre working on your taxes, its crucial to remember that you may need to access them again in the event of an audit by the IRS. With that in mind, a shoebox with loads of papers or files scattered throughout your hard drive is not a good move.

Instead, start a filing system that organizes all your records by year and by category, such as bank statements, income forms and receipts. Throughout the year, make sure youre maintaining that system so that everything makes sense when you file and if the IRS requests something from the past, youll be able to track it down quickly.

If youre still dealing with a heavy amount of paper, there are plenty of apps to digitize and simplify your life, such as Expensify or CamScanner.

How Can I Get A Copy Of My Tax Return

Taxpayers may request copies of any tax return or other previously filed document by completing a Tax Information Disclosure Authorization, Form R-7004. Instructions for the form can be found here.

As of July 17, 2015, the research fee for copies of tax returns authorized by R.S. 47:1507 are as follows:

- $15.00 for a copy of any tax return or other document for each year or tax period requested, regardless of whether the requested return or document is located.

- $25.00 for each certified copy of any return or other document for each year or tax period requested, regardless of whether the requested return or document is located.

All research fees for copies must be paid when you submit the Tax Information Disclosure Authorization, Form R-7004. Payments can be by check or money order made payable to the Louisiana Department of Revenue. Cash cannot be accepted. Credit card payments can be submitted in Louisiana File Online.

Recommended Reading: How Much Does H& r Block Charge For Doing Taxes

Public Records Request Requirements

All records kept by state and local agencies are available for public inspection unless the law specifically exempts them. You’re entitled to access public records under reasonable conditions, and to get copies of those records.

In most cases, you don’t have to explain why you want the records. However, specific information might be necessary to process your request, and the Tax Commission can require more information to determine whether filling your request would violate certain provisions of law.

Exceptions to public records requests

While Idaho strongly encourages disclosure of public records, the law requires some information to be withheld. Read more in:

- Idaho Code section 74-101 through 74-126

Compiling records

Generally, the Tax Commission must provide access to existing public records in our possession however, we aren’t required to collect information or organize data to create a record that didn’t exist at the time of the request.

Our goal is to respond to a request within three work days of receiving it. When we respond, we’ll either:

- Provide the records requested,

- Let you know we need more time to fill the request*, or

- Deny the request in writing, including the reason for the denial.

In some cases, we may grant part of a request, but deny the remainder.

Notifying affected parties

We may notify people identified in the requested record to inform them of the request and release of information.

TAX REBATE

What Happens If I Dont Like What I Find

If youre conducting the research on your own prior to making an offer, simply walk away. If youve discovered the issues during escrow, discuss with your agent the details of whats involved with obtaining a clear title from the seller to determine whether you want to proceed with the purchase.

Title and property records searches can be time-consuming and confusing. If you dont want to do all the work on your own, ask your real estate agent to recommend a great title company to help you out.

Header Image Source:

Also Check: How Much Is H& r Block Charge

How Do I Get A Copy Of My State Tax Return

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account.

You may also request a copy of your tax return by submitting a Request for Copy of Tax Return or written request.

There is a $20.00 fee for each tax return year you request. There is no charge for a copy of your return if you’re requesting a return for a tax year in which you were the victim of a designated California state disaster or federal disaster.

Include a check or money order for the total amount due, made out to the Franchise Tax Board.

It may take up to four weeks from the date of your request to receive a copy of your return.

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. For example, if you e-filed with Credit Karma Tax® in prior years, you can get your prior-year returns for free after accessing this years free tax product. Other online filing services may also allow you to access past returns you filed with them. But be aware they may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

You May Like: How Do I Get My Pin For My Taxes

Tax Tips: Obtaining Prior

Tax season may be over, but you still need to hang onto your tax returns and other tax records for at least three years. However, if the IRS believes you have significantly underreported your income , or believes there may be an indication of fraud they have the authority to go back six years in an audit. Furthermore, some documents including those related to real estate sales should be kept for three years after filing the return on which they reported the transaction.

In certain instances, such as when filling out financial aid forms for college, you may be required to upload your tax documents from prior years. If you havent kept copies of your tax returns, you can obtain them through the IRS, but youll have to pay a fee for them.

If you need an actual copy of a tax return you can get one from the IRS for the current tax year and as far back as six years. The fee per copy is $50. Taxpayers can complete and mail Form 4506, Request for Copy of Tax Return to request a copy of a tax return and mail the request to the appropriate IRS office listed on the form.

If taxpayers need information to verify payments within the last 18 months or a tax amount owed, they can view their tax account using the View your account tool on the IRS website. The tool is only available during certain hours, and your balance updates no more than once every 24 hours, usually overnight. You will also need to allow 1 to 3 weeks for payments to appear in the payment history.

Copies Of Tax Returns

Taxpayers who need an actual copy of a tax return can get one for the current tax year and as far back as six years. The fee per copy is $50. A taxpayer will complete and mail Form 4506 to request a copy of a tax return. They should mail the request to the appropriate IRS office listed on the form.

Taxpayers who live in a federally declared disaster area can get a free copy of their tax return. More disaster relief information is available on IRS.gov.

You May Like: How To Buy Tax Liens In California

How Long Should You Keep Your Tax Returns

Once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return.

You can also keep them for two years if you are calculating from the date you paid the tax, whichever comes later. However, if you file a claim for a loss from securities or bad debt deduction, then you should plan to keep your records for at least seven years.

Request Employment History From Social Security

You can receive a statement of your employment history from the Social Security Administration by completing a “Request for Social Security Earnings Information” form. You’ll receive detailed information about your work history, including employment dates, employer names and addresses, and earnings.

The SSA charges a fee for detailed information based on the length of time for which you would like to receive records.

Don’t Miss: Mcl 206.707

Check With Your State Tax Department Or Unemployment Office

State tax departments and unemployment agencies can often release employment histories for individuals, as long as they worked for in-state employers. In Washington State, for example, it’s called a “Self-Request for Records,” and you can request as far back as10 years. In New York, you can request a transcript of your New York State wages and tax withholding. Most states have similar resources available.

How Far Back Can The Cra Go For Personal Income Taxes

The thought of reassessment for tax returns gone by makes anyone a little nervous an average taxpayer wont remember the how and whys of decisions made years ago, particularly under the worry of a big and retroactive tax bill.

Thankfully, CRA guidelines protect you from reviews of the distant past, and complying with record-keeping requirements ensures you have the information you need to support your returns.

Read Also: What Does Locality Mean On Taxes