Determine Your California Businesss Withholding Taxes

Other than income taxes, the other important filing is your California small business withholding taxes. Payroll and withholding taxes must be paid if your company has employees. If your company employs workers, payroll and withholding taxes need to be paid. The amount of the employees income and the number of allowances on the employees Withholding Allowance Certificate dictates the amount of tax to withhold.

As of 2021, Californias withholding tax percentage is 7% of qualified income. Pay your California withholding taxes online. Pay withholding taxes each quarter the employee earns money. More information about the payment of withholding taxes can be found on the Franchise Tax Boards website.

Exceptions To The First Year Annual Tax

For tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year.

Short form cancellation

If you cancel your LLC within one year of organizing, you can file Short form cancellation with the SOS. Your LLC will not be subject to the annual $800 tax for its first tax year.

Filing In California For An Llc

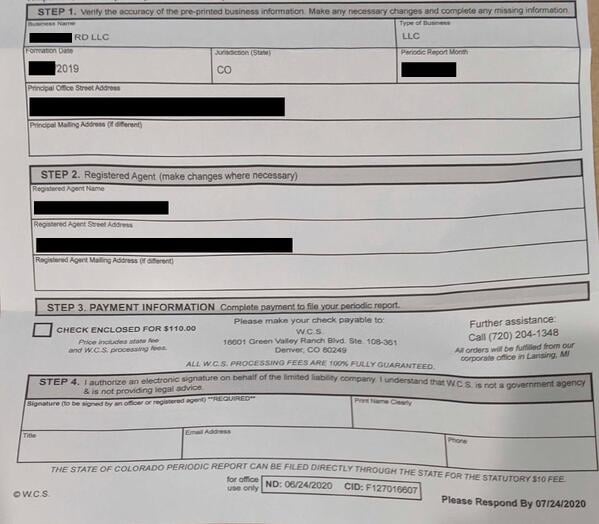

To form an LLC in California, you will need to register with the Secretary of State. The Secretary of States office defines the fees and rules. Below are seven steps to follow to complete the process.

The name of any business cannot be so similar to another companys name that it confuses or misleads customers. It is possible to search business names that are currently on file with the Secretary of State at www.sos.ca.gov. Every LLC in the state is required to have a business name ending in LLC or Limited Liability Company. A business can abbreviate limited to Ltd. It can also condense Company to Co. In addition, the name may not contain the words Bank, Incorporated, Trustee, Inc., Corp, Corporation, Insurance Company, or Insurer.

The law requires each LLC in California to have its own registered agent. Registered agents are companies or individuals that accept official and legal documents on behalf of the business. If you are filing in California, that agent is required to be a resident of California. The agent must also have a physical address within the state.

All California businesses require a business license. The most basic form of license is the business tax certificate or general business license. Counties and cities are responsible for issuing those licenses. Therefore, if your business operates in several locations, it will need several licenses.

Read Also: How Are Gambling Winnings Taxed

Create An Llc Operating Agreement

While you wont need to file an operating agreement with the Secretary of State, you are still required to have one. An operating agreement is essential to running your LLC, as it sets out the organizational or ownership structure of your LLC and its operating rules. A detailed operating agreement also lends legitimacy to your LLC. Once youve created an operating agreement, you should keep it with all your other LLC records.

Filing Requirements Forms And Mailing Addresses

Although California law uses the same entity classification as federal, LLCs classified as partnerships and disregarded LLCs must do all of the following:

- Pay an annual tax of $800 and

- Pay an annual LLC fee based on total income from all sources derived from or attributable to California

LLCs must file and pay the annual tax and fee if any of the following conditions apply:

- They organized in California.

- They registered with the SOS to do business in California.

- They do business in California . Refer to Doing Business in California section for more information.

Under R& TC Section 23101, a foreign nonregistered LLC that is a member of an LLC that is doing business in California is also doing business in California. In addition under R& TC Section 23101, a general partner in a limited partnership doing business in California by virtue of its activities in this state, is also doing business in California. For tax years that begin on or after January 1, 2011, LLCs that are limited partners in a limited partnership may be doing business in California. Refer to Doing Business in California section for more information.

An LLC classified as a partnership that does not meet the conditions above, but has California source income or files to report an election on behalf of a California resident, must file Form 565, Partnership Return of Income.

FTB 3522, LLC Tax Voucher. File and pay the annual tax payment by the 15th day of the 4th month of the LLCâs tax year.

Also Check: How To Calculate Taxes On Check

Does An Llc Pay Taxes

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesnt pay taxes on business income. All LLC members are responsible for paying income tax on any income they earn from the LLC as well as self-employment taxes.

California State Income Tax

Self-employed workers, independent contractors and unincorporated businesses in California might not have to pay state corporate or franchise taxes, but most still have to pay state income taxes. Same goes for people who earn income from pass-through entities like S Corporations and LLCs.

The California state income tax rate ranges from 1 to 12.3 percent. Your income tax rate is based on which of the nine California tax brackets you fall into, and also your filing status.

If your filing status is âSingleâ or âMarried Filing Separately,â youâll calculate your 2020 California income tax based on the following schedule:

| Over | Enter on Form 540, line 31 | |

|---|---|---|

| $0 | $0.00 + 1.00% of the amount over $0 | |

| $8,932 | $89.32 + 2.00% of the amount over $8,932 | |

| $21,175 | $334.18 + 4.00% of the amount over $21,175 | |

| $33,421 | $824.02 + 6.00% of the amount over $33,421 | |

| $46,394 | $1,602.40 + 8.00% of the amount over $46,394 | |

| $58,634 | $2,581.60 + 9.30% of the amount over $58,634 | |

| $299,508 | $24,982.88 + 10.30% of the amount over $299,508 | |

| $359,407 | $31,152.48 + 11.30% of the amount over $359,407 | |

| $599,012 | And over | $58,227.85 + 12.30% of the amount over $599,012 |

Consult the FTBâs schedules here if youâre filing your taxes jointly with a spouse, are a qualifying widow, or are using the âHead of Householdâ filing status.

You May Like: How Can I Find My Tax Return

What Is The California Annual Llc Fee

Liking the sound of a flat franchise tax rate for California LLCs? Dont get too excited. High-earning LLCs dont actually have much of a tax advantage over corporations because of something called the Annual LLC Fee.

The California Annual LLC Fee is imposed on any California LLC that brings in more than $250K annually. It starts at $900 and goes up from there:

| Net Income |

|---|

| $11,790 |

Quarterly State Tax Payments

Similar to the quarterly estimated tax payments you must make to the IRS for federal taxes, you must also make quarterly payments to the FTB for state taxes. This only applies if you expect to owe at least $500 in California state taxes this year .

You can calculate your estimated state taxes for the year using the worksheet on the bottom of FTB Form 540-ES, which you can request a PDF copy of using this page.

For 2022, quarterly state tax payments are due on the following dates. Unlike IRS payments, which split your estimated taxes into four even amounts across the year, the FTB follows a 30%, 40%, 0%, 30% scheme:

| Payment |

|---|

Read Also: How To Report Stock Sales On Tax Return

What Is Form 568

Form 568 is a California tax return form, and its typical due date is March 15 or April 15 each tax year. All California LLCs must file Form 568.

Filing a Limited Liability Company Return of Income to the California Franchise Tax Board registers your California LLC with California.

California collects LLC fees, California taxes, California LLC fees, California LLC taxes, California Secretary of State filing fees, and more.

All California Limited Liability Companies are required to file Form 568. If your company has done business or had a taxable income source in California during the calendar tax year, even if your California company did not make a profit during the tax year, you must file California Form 568.

How To Make Tax Payments To The California Franchise Tax Board

Have you ever asked how to pay the Franchise Tax Board online or if you can pay by credit card?

Individual and business taxpayers can make payments to the Franchise Tax Board in many ways.

Starting in May 2014, a credit card payment option for businesses was added. Corporations, partnerships, and limited liability companies now have the option to pay the California Franchise Tax Board by credit card. Discover, MasterCard, Visa, or American Express Card can be used.The FTB uses a thirdparty credit card processor, Official Payments Corporation, who charges a convenience fee for this service. The fee is based on the amount of your tax payment.The California Franchise Tax Board offers taxpayers four ways to pay their estimated tax payments, extension payments, or the amount due on their back taxes or current year tax returns.

- In-Person at Franchise Tax Board Field Offices

- Credit Card Online through Official Payments Corporation at: www.officialpayments.com.

NOTE: Taxpayers subject to the mandatory electronic funds transfer requirement can use credit card payments to meet this EFT requirement.

See: More Tax Tips

For immediate assistance with California Franchise Tax Board payments or any other tax matter contact us now for a confidential no-obligation consultation with our former IRS Agents. Landmark Tax Group is licensed in all 50 States and U.S. Territories. We look forward to serving you.

You May Like: What Is Massachusetts Sales Tax

Finding A California Accountant

We strongly encourage you to work with an accountant and/or a tax attorney after you form an LLC in California. Its also a good idea to speak with a few accountants before your LLC is even formed.

You see, unlike most states, where an LLCs annual report is filed with the Secretary of State , your California LLCs annual reports are essentially tax filings paid to the states tax authority, the Franchise Tax Board. Said another way, they are far more complicated!

So not only will an accountant help you file your federal, state, and local returns properly, but theyll be available to discuss tax strategies, such as if and when it makes sense to have your LLC taxed as an S-Corp, among other things.

We have a strategy called knights of the roundtable which you can use to find and interview potential accountants. You can read about that here: how to find an accountant for your LLC.

Tax Treatment Of An Llc

The IRS assumes that LLCs with more than one member are partnerships for tax purposes. That means the LLC itself pays no tax, but taxable profits and deductible losses are passed through to the members, who are treated as partners under the tax rules.

So at tax time, to keep the IRS happy, an LLC that chooses to be taxed as a partnership files Form 1065: Partnership Return of Income. The annual Form 1065 must also include a Schedule K-1 for each member. Schedule K-1 reports the members share of LLC income, deductions, and other items. These amounts are then included on the members personal tax return.

If you choose to have your LLC file taxes as a corporation, you must tell the IRS by filing Form 8832: Entity Classification Election. At tax time you’ll use Form 1120: Corporation Income Tax Return, or 1120S if you choose to be taxed as an S-corporation.

If you have a single-member LLC, you’ll typically file as a sole proprietorship using Schedule C .

A rather sticky issue for LLC members is whether they owe self-employment tax on their share of the company’s earnings. In general, members who are actively engaged in the business must pay this tax.

There is a special rule for LLC members who are the equivalent of Limited Partners and don’t take an active role in the business: They typically don’t pay self-employment tax on profits the company passes through to them, only on compensation they receive for any services they provide to the LLC.

Don’t Miss: What Form Do I Need To File My Taxes Late

Paying State Business Taxes In California: A Summary

Hereâs a summary of which California state taxes apply to which business entity type.

Keep in mind this table doesnât include the income taxes that sole proprietors, general partners and pass-through entity owners must pay on their share of business income, which weâll cover in the next section.

| What kind of business do you have? | Did it report a net income ? | What state taxes do you have to pay? |

|---|---|---|

| C Corporation | ||

| AMT , $800 Franchise Tax | ||

| LLC taxed like a corporation | Y | |

| LLC taxed like a corporation | N | AMT , $800 Franchise Tax |

| S Corporation | ||

| Franchise Tax | ||

| LLC | ||

| No business taxes |

What If I Change Entity Types

You may decide that youd like to convert your California corporation into an LLC or vice versa. Its important to understand that if you do, youll owe a separate California Franchise Tax for both entities, even though its the same business.

That means if you convert your California corporation into an LLC, your corporations tax year will automatically end on the date of conversion. Your LLCs tax year will begin the next day. This means that youll owe a minimum of $800 for the corporation and the flat fee of $800 for the LLC.

Recommended Reading: Do Disabled Veterans Pay Property Taxes

Be Sure To Pay All California Fees On Time

Keeping track of the multiple fees, associated due dates, and where payments should be sent, can be a hassle. Fortunately, when you work with the experts at incorporate.com to set up your , we will include these fees in your purchase price. We will also make sure fees are paid in a timely manner to the correct state or local offices, and that all applicable licenses are applied for. Start working with us today!

Prepare An Operating Agreement

An LLC operating agreement is not required by the Secretary of State, but is highly advisable. If you’ve already formed an LLC, Nolo offers an LLC operating agreement that you can create online. For help creating an LLC and an operating agreement, see Form Your Own Limited Liability Company, by Anthony Mancuso or use Nolo’s Online LLC.

Read Also: Can You File Taxes If You Get Unemployment

Watch Out For Californias Late

Editor: Anthony S. Bakale, CPA, M.Tax

State& Local Taxes

Recently, many LLCs owning an interest in an LLC that conducts business in California have been receiving billing notices with high penalties for failing to timely file California Form 568, Limited Liability Company Return of Income. Commonly, California identifies an LLC member of an LLC conducting business in California and sends a notice requesting the filing of Form 568 if the entity has not already done so.

Many LLCs that are not connected to California other than via investment interests in LLCs that are conducting business in California are unknowingly not complying with California’s filing requirements, especially if the California apportioned net income is small or a loss. Once the return is filed, California sends a billing notice that includes a penalty that may be substantially higher than the original amount due with the return. How can this be? An analysis of this issue requires a review of California’s treatment of LLCs.

Furthermore, an LLC doing business in California that does not register to do business in California or whose right to do business in California has been suspended or revoked is now subject to a penalty of $2,000. The “failure to register” penalty is effective for tax years beginning on or after Jan. 1, 2013. This penalty can be assessed by the Franchise Tax Board annually .

EditorNotes

Legislative Update Gives Exemption To New California Limited Liability Companies

LLCs registered to do business in California must pay an annual franchise tax of $800 to the states Franchise Tax Board . However, to relieve some of the financial pressures amid the pandemic for newly formed businesses, California Governor Gavin Newsome signed legislation in 2020 to exempt startups from paying the LLC franchise tax during their first year in business.

This is welcome news for aspiring business owners in the Golden State!

The new rules established by the states 2020 Budget Act exempt any LLC that organizes, registers, or files with the California Secretary of State on or after January 1, 2021 and before January 1, 2024, from paying the $800 minimum tax in their first taxable year.

This exemption also applies to newly formed Limited Partnerships and Limited Liability Partnerships . Previously, only corporations were exempt from paying the franchise tax in their first tax year.

Read Also: What Percentage Do Federal Taxes Take Out

California Llc Gross Receipts Tax

The California LLC gross receipts tax was instituted in the state in 2010 and the fee is based on the total income of the LLC.5 min read

The California LLC gross receipts tax was instituted in the state in 2010. The fee is based on the total income of an LLC. Along with the annual franchise tax fee of $800 that is imposed on all LLCs and corporations operating in the state, the additional gross receipts tax applies to LLCs. However, corporations are not required to pay the gross receipts tax.