Gst/hst When You Buy A Business

For GST/HST purposes, if you buy a business or part of a business and acquire all or substantially all of the property that can reasonably be regarded as necessary to carry on the business, you and the vendor may be able to jointly elect to have no GST/HST payable on the sale by completing Form GST44, Election Concerning the Acquisition of a Business or Part of a Business. You cannot use this election if the seller is a registrant and you are not a registrant. In addition, you must buy all or substantially all of the property, not only individual assets.

For the election to apply to the sale, you have to be able to continue to operate the business with the property acquired under the sale agreement. You have to file Form GST44 on or before the day you have to file the GST/HST return for the first reporting period in which you would have otherwise had to pay GST/HST on the purchase.

Even when you use the election, GST/HST will still apply to a taxable supply of a service made by the seller a taxable supply of property made by way of lease, licence, or similar arrangement and, if the buyer is not a GST/HST registrant, a taxable sale of real property.

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

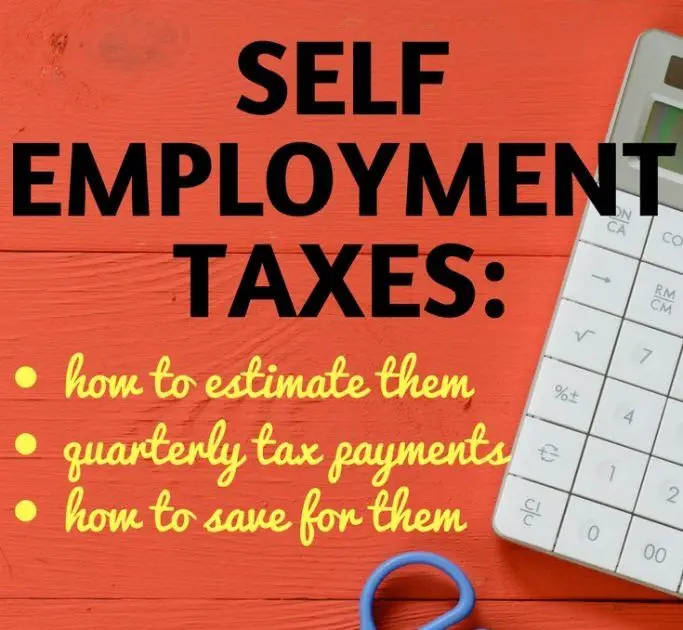

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Read Also: How To Avoid Property Tax

How To Know If Youre Self

Self-employed income must be reported at tax time, under the self-employed category. Which is different from your traditional T-4 income process if you were an employee of a company.

Heres a quick checklist you can use:

- Are you selling products and being paid for your products or services?

- Are you driving for a rideshare company?

- Are you working as a part time freelancer?

- Do you walk dogs on the weekend as a side hustle?

If you said yes to any one of these, youre considered self-employed!

TIP: Another word for Self-Employed Income is Business Income. This is what the CRA uses to define self-employed individuals who earn money from any activity they carry out with an expectation to earn a profit.

Do You Have To Register As Self

If you start working as self-employed, you must register with HMRC. You can do this at any time up to 5 October of your business’ second tax year. … So, for example, if you started working as a sole trader in January 2021, you must register as self-employed with HMRC by 5th October, 2021 at the very latest.

Recommended Reading: Do I Have To Pay Taxes For Babysitting

What To Claim As Business Expenses

The CRA provides a list of deductible expenses. Generally, you can get a tax break for most things you bought for work. The most common include:

- Equipment like a laptop, camera, or microphone

- Software subscriptions

- Your cellphone, mobile plan, and internet bill

- Travel, meals, and entertainment costs related to your business, such as taking a client out for dinner

- Training and professional development

- Business insurance, legal fees, and accounting costs.

More considerable expenses, like equipment, are classified under capital cost allowances . Depending on its category, these items have their costs expensed over several years.

For example: If you buy a $1,000 camera, you cant deduct that whole amount in your year of purchase. Cameras are usually a Class 8 CCA deduction, so 20% or $200 becomes deductible every year over the next five years. For some Class of assets, due to the half year rule, only fifty percent of the maximum allowed CCA can be claimed in the first year.

Lastly, you should maintain proper records of your expenses. Whether youre purchasing a new computer or paying for a quick client lunch, you must keep the appropriate receipts to claim it as a tax deduction when you file.

Online Tools To Help You File

Don’t waste time! Sign up for direct deposit and file online to get any refund you may be entitled to faster and to avoid delays.

Using the CRA’s digital services is the fastest and easiest way to view and manage your tax and benefit information. The CRA also encourages you to sign up for My Account and My Business Account ahead of time, and gather all your information for filing your return.

The CRA’s Get ready to do your taxes page has information on online filing, deadlines, and other helpful links.

Read Also: How Do I Calculate My State Taxes

How To Avoid Paying Tax As A Freelancer

Theres no way to avoid paying taxes as a self-employed individual. The good news is that you have a wide range of possible expenses you can claim to lower your tax owing by maximizing your tax deductions which will ultimately save you money. So be sure to claim all of your eligible costs.

TIP: To claim your business expenses, you have to keep proof of the expenses. The CRA may ask you to provide that proof in the future.

Protect Your Income And Your Business

Without sick leave, getting sick or injured can mean financial difficulties. Income protection insurance can help you pay your bills if you can’t work. If you have a super fund, find out whether they offer income protection insurance as part of the package.

If youâre moving from employee to self-employed, check if this affects the insurance cover through your super. Insurance terms and conditions vary from fund to fund.

Consider other types of insurance that can protect you and your business, such as public liability insurance and workers compensation insurance. See business.gov.au for information about insurance for business.

You May Like: How Much Do You Have To Make To Report Taxes

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Figure Out Your Pay Schedule

Many people arenât aware of this, but taxes arenât technically due April 15th. Theyâre due at the time the income is earned. This is why employers remit payroll taxes throughout the year. Freelancers and independent contractors, of course, donât have employers to do this for them. Consequently, many of them are required to pay their taxes quarterly, in the form of âestimated tax payments.â These payments are due by the 15th business day in the month following the end of a quarter:

- ð· Quarter 1 is due April 15th

- ðï¸ Quarter 2 is due July 15th

- ð Quarter 3 is due October 15th

- ð² Quarter 4 is due January 15th

Anyone who expects to owe more than $1,000 to the IRS is required to make quarterly payments or face underpayment penalties.

Think that might be you? Use our quarterly tax calculator to figure out exactly how much you should pay by the next estimated due date .

Your quarterly payments can be made directly to the IRS through their free payment portal.

Read Also: How To Keep Receipts For Taxes

Penalties For Filing Late Or Not At All

The CRA charges interest on those that fail to pay their taxes by April 30th each year. Interest rates compound daily and are based on the prescribed interest rates, which may change every three months.

If you file your tax return after June 15th, as a self-employed freelancer, the CRA charges a late-filing penalty. This penalty is 5% of your tax balance plus an additional 1% for each month you file after the due date, capped at a maximum of 12 months.

Those that dont file at all may be liable to criminal charges. These charges could land you with substantial fines or even jail time.

What If I Am A Lone Proprietor With A Corporation Or Partnership

The answer might surprise you.

In fact, it could save you money and help protect your personal assets.

If youre a self-employed person or part of a small business, you may benefit from being registered as a Limited Liability Company , Limited Partnerships or Sole Trader .

But what are the differences between each type of entity? And how do they affect your tax affairs?

Weve put together some handy information about LLCs, LPs and STs, including:

What they are, and why theyre useful for different types of businesses

How they work, and what happens when things go wrong

Don’t Miss: How Much Tax Per Dollar

Fair Market Value For Your Assets

You might transfer your personal assets to your business.

If you are operating a sole proprietorship, this is a reasonably simple process. The Income Tax Act requires that you transfer these assets to the business at their fair market value . This means that we consider you to have sold the assets at a price equal to their FMV at that time. If this amount is greater than your original purchase price, you must report the difference as a capital gain on your income tax and benefit return.

Your business will show a purchase of these assets, with a cost equal to the FMV at the time of the transfer. This is the value that you will add to the capital cost allowance schedule for income tax purposes.

For income tax purposes, when you transfer the property to a Canadian partnership or a Canadian corporation, you can transfer the property for an elected amount. This amount may be different from the FMV, as long as you meet certain conditions. The elected amount then becomes your proceeds for the property transferred, as well as the cost of the property to the corporation or partnership.

The rules regarding these transfers of property are technical. They allow you to change your business type from a sole proprietorship to a corporation or a partnership, or from a partnership to a corporation, on a tax-free basis.

Universal Social Charge Prsi And Vat

USC: Everyone must pay the Universal Social Charge iftheir gross income is over 13,000 in a year.

An extra charge of 3% applies to any self-employed income over 100,000regardless of age. This means that self-employed people pay a total of 11% USCon any income over 100,000. The USC does not apply to social welfare orsimilar payments. You pay your USC with your preliminary tax payment.

PRSI: Self-employed people pay ClassS PRSI on their income.

Value Added Tax

You must register forValue Added Tax if your annual turnover is more than or is likely tobe more than 75,000 for supply of goods or 37,500 for supply of service.As a trader you pay VAT on goods andservices acquired for the business and charge VAT on goods and servicessupplied by the business. The difference between the VAT charged by you and theVAT you were charged must be paid to Revenue. If the amount of VAT paid by youexceeds the VAT charged by you, Revenue will repay the excess. This ensuresthat VAT is paid by the ultimate customer and not by the business.

Revenue has information on how toaccount for and pay VAT.

Recommended Reading: Do My Taxes Myself Online

Health Insurance Premiums Deduction

If you are self-employed, pay for your health insurance premiums, and are not eligible to participate in a plan through your spouses employer, then you can deduct all of your health, dental, and qualified long-term care insurance premiums.

You can also deduct premiums that you paid to provide coverage for your spouse, your dependents, and your children who were younger than 27 at years end, even if they arent dependents on your taxes. Calculate the deduction using the Self-Employed Health Insurance Deduction Worksheet in IRS Publication 535.

How Can I Best Prepare For My Tax Bill

For most people, setting aside a rough percentage of their net income each time they are paid , will help make sure that their tax bill, along with the payments on account, can be met. Our table may help you work out your rough % using 2022/23 rates assuming you are using the cash basis or if using the accruals basis you get paid promptly. Please note this does not include Class 2 NIC and that these are based on UK income tax rates see our webpages for information on Scottish rates of income tax and the Welsh rates of income tax:

|

Net income |

Example: Hugh

Hugh began trading as an electrician in April 2022. He estimates that in the 2022/23 tax year he will invoice approximately £22,000 and expects his expenses to be around £2,500, resulting in profits of £19,500. Hugh looks at the table above and decides to put aside 19% of his net income each time his invoices were paid, meaning at the end of the tax year, he had saved £3,705 towards his tax bill.

On competition of his accounts and tax return Hugh calculates his actual profits to be £19,000 instead of £19,500 and his 2022/23 tax bill looks like this:

Total due by 31 January 2024 £3,183.19.

|

Net profit from self-employment |

Recommended Reading: How Can I Check My Income Tax Refund Status

Is A C Corporation Eligible For The Qualified Business Income Deduction

No. According to the Internal Revenue Service , income earned through a C corporation or by providing services as an employee is not eligible for the deduction. A C corporation files a Form 1120: U.S. Corporation Income Tax Return, and it is not eligible for the deduction.

You also cannot deduct any portion of wages paid to you by an employer and reported on a Form W-2: Wage and Tax Statement. Independent contractors and pass-through businesses are eligible for the deduction. They report their percentage of business income on a Schedule C: Profit or Loss from Business that accompanies the Form 1040: U.S. Individual Tax Return.

File Your Income Tax Returns For Free

If your income is $73,000 or less, you can electronically prepare and file your federal and state income tax returns for free.

To make sure you arent charged a fee, see Free File your income tax return.

- E-filing is the fastest, easiest, and safest way to file your return.

- Most e-filers get their refund two weeks sooner than paper filers.

Recommended Reading: How To Lower Property Taxes In Florida

What To Deduct When Youre Self

To be able to deduct residential expenses, you need to meet at least one of the following two criteria:

If either applies to you, you can deduct a number of residential expenses, such as:

But not your mortgage! Only the interest on your mortgage is considered an eligible expense.

Youll need to calculate the percentage of your home that you use for work. For example, if you work in your office and it takes up about 15% of your total home space, you can deduct 15% of eligible home-related expenses.

Good to know: In some situations, an expense thats entirely related to working from home can be 100% deductible, such as renovating your home office.

How Much Can You Earn Tax

Disguised Remuneration Schemes

Were you paid through a loan from your employer, and havent yet paid the tax you owe in full or agreed a payment plan by September 2020? Then its important that you contact HMRC as soon as possible.

Find out more about what you should do on the GOV.UK website

If youre self-employed, youre entitled to the same tax-free Personal Allowance as someone whos employed.

For the 2021-22 tax year, the standard Personal Allowance is £12,570. Your personal allowance is how much you can earn before you start paying Income Tax.

If you earn over £100,000, the standard Personal Allowance of £12,570 is reduced by £1 for every £2 of income you earn over the £100,000 limit for the 2021-22 tax year.

However, if you have two jobs and one is self-employed, things are a little more complicated.

You only get one Personal Allowance, which is usually applied to what HMRC see as your main employment.

Its usual to have your Personal Allowance is applied to the job paying you the most.

Find out more in our guide Second job tax and pay

The easiest way to find this out is to look at the tax code. Your main job should have the tax code 1250L for the 2021-22 tax year. Your secondary job will have the tax code BR, D0 or D1.

Find out more about what the different tax codes mean on theGOV.UK website

Recommended Reading: How To Solve Sales Tax