Determining The Value Of Your Home

The first part of property taxes is determining the value of your property.

First, an assessor or appraiser determines the market value of your home. An appraiser typically handles all the homes in a county and when they assess your home value depends on where you live.

Property appraisals may happen once per year, once every three years, or even less frequently. They usually consider the values of similar homes that were recently sold in your area. They may also adjust your home’s value based on things like construction permits you got from your city or general home appreciation in the area.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

is the amount you could sell your property for on the open market. Most places do not tax you on the full market value of your home. You may also see the terms fair market value or FMV.

After finding market value, tax assessors apply an assessment ratio. The assessment ratio is the percentage of your propertyâs market value that is actually subject to tax. Ratios vary by location. For example, West Virginia generally only taxes homeowners on 60% of their homeâs market value, and Ohio has an assessment ratio of around 35%.

Assessment ratios also differ based on the type of property you have. The rate for personal property is probably different from business property. Different types of property may be called classes.

How Do You Pay Texas Real Property Tax

If you pay your mortgage, you are likely already paying your Texas property taxes. A standard mortgage payment usually includes:

- Principal

- Homeowners insurance

- Texas real property taxes

Look at your current mortgage statement and determine if your Texas real property taxes are paid as part of your monthly mortgage. It will likely be listed as a line item on the statement.

You can check with the Texas government at for more information.

Property Taxes In Texas

Property taxes are based on the assessed current market value of real estate and income-producing tangible personal property.

“Income” is the key word when it comes to personal property. Your vehicle might be considered tangible personal property, but it’s not subject to a tax as long as you never use it to earn a living. Driving it back and forth to your place of employment is okay.

For real estate, appraisals are performed by county districts. The appraiser will compare your home to other similar homes that have recently sold in the area, and it will determine the value from there.

The appraised value of your real estate is then multiplied by the local tax rate to determine your tax bill. These rates are set by counties and school districts. They’re based on yearly budgets and how much revenue the districts need to cover their costs.

Local governments regularly hold public hearings to discuss tax increases, and citizens of Texas can petition for a public vote on an increase if it exceeds certain limits.;

Owners of agricultural or timberland property can apply for special appraisals;based on the value of crops, livestock, and timber produced by the land. This can result in lower appraisals and lower taxes.;

Read Also: What Age Do You Have To File Taxes

Donotpay Can Do Your Paperwork For You

Feeling like youre in bureaucratic hell? Our app will draft the paperwork you need and get you out of any hurdle before you know it!;

We can compose most of the documents that you require for any administrative purpose in your jurisdiction, most notably:

- Legal forms for the small claims court disputes in your state

- Court scripts so you dont get lost for words in front of the judge

Arguments Against A Consumption Tax

Some critics of a consumption tax argue it would shift more of the tax burden over to poorer members of the community, since they have to spend more of their income on goods and services. White countered that all taxes are regressive at heart.

When I look at my district, a lot of good, hardworking families may rent or lease a home or a place to live. Well, guess what? That property tax is embedded into that rent or least payment, okay? How much you tax is very much an issue, but how you tax is as well, he said.

Another often heard complaint about a consumption tax is the fact that it could be susceptible to economic downturns, which the COVID-19 pandemic has made us all painfully aware of.;

White said sales tax revenue did take a hit during the worst of the pandemic but has since recovered. He argued that since a consumption tax would track with population and economic growth, it might give elected officials more pause before shutting down an economy.

The East Texas Republican represents District 19, which includes Jasper, Livingston and Woodville. He said continuing on with the current system would be far worse than trying something new. In fact, he told Yall-itics one of his constituents was recently complaining about a property that had just increased in value by nearly 1,600%.

Someone whos paid off their home probably should be able to live in their home without having to pay for it again and again and again every year.

Don’t Miss: How To Correct State Tax Return

Do Seniors Pay Property Taxes In Texas

Even though property taxes are a burden on most seniors in Texas, elderly citizens dont automatically get property tax relief in this state. As with any other exemption, you need to complete certain forms, file your application, and wait for the response. If you qualify, youll get one of the senior property tax exemptions and a lower tax bill.

Welcome To Tarrant County Property Tax Division

Tarrant County has the highest number of property tax accounts in the State of Texas. In keeping with our Mission Statement, we strive for excellence in all areas of property tax collections.;

Our primary focus is on taking care of citizens.; Please complete a blue comment card and drop in the designated location when you visit our offices, or use our electronic form to let us know how we are doing.

Please be aware that there is no fee to apply for exemptions through Tarrant Appraisal District or apply for refunds for overpayment or adjustments to your taxes.; Please contact us if you have questions before paying a third party to assist you.; Texas Attorney General Paxton has issued an alert on misleading tax exemption offers.

Don’t Miss: How Much Do I Need To Make To File Taxes

Limited Liability Company Taxes

LLC is the other common designation for small businesses. In most states, LLCs are entities that protect business owners from certain legal liabilities but pass their incomes to those owners, who pay personal income tax rather than business income tax on their proceeds.

As with S corporations, Texas bucks the national trend and charges the franchise tax to LLCs, with the same rules that apply to all business types. However, the income that passes to the owners as personal income is not subject to state income tax in Texas.

Are Tiny Homes Relatively Cheap To Own

Sure, tiny houses are mobile and light. They are in demand. They are also relatively more inexpensive than regular houses to maintain. Despite those qualities, they are not always cheap to own.;

Owning a tiny house involves many hidden costs, which may be surprising to many people. If youre not careful or savvy enough, you might spend on external storage and unnecessary upgrades.

Also Check: How To Pay Back Taxes Online

How Do Texas Property Taxes Work

Residential property in Texas is appraised annually by county appraisal districts. The appraisal districts are responsible for determining the current market value of all property within the county, on which tax payments are based. Disagreements about any findings are brought to an appraisal review board made up of local citizens.

Homes are appraised at the beginning of the year, and appraisal review board hearings generally begin in May. Tax bills are sent out beginning on Oct. 1, and are due by Jan. 31 of the following year.

There are a number of exemptions that help lower your property taxes in Texas. The most common is the homestead exemption, which is available to homeowners in their primary residence. It exempts at least $25,000 of a propertys value from taxation.

However, only school districts are required to offer this exemption . So if your home is worth $150,000 and you receive the homestead exemption, the school district tax rate will only apply to $125,000 of you home value.

Persons who are at least 65 or who are disabled can claim an additional exemption of $10,000. Like the homestead exemption, only school districts are required to offer this exemption.

Real Estate Broker From Lake Oswego Or Summerlin Nv

Originally posted by :

Theyre not taxed differently. Its just that the tax appraisal on a homestead can only be increased by 10% a year. That doesnt apply to rentals. If you have a home thats appreciated for 5-10 years as a homestead, the taxes could go up significantly as soon as that exemption is removed. This can also be a trap for investors…you cant look at what a homeowner is paying in taxes because the taxes will potentially go up a ton as soon as you buy it.

this is quite common .. and a real shocker to many out of state investors who look at a proforma and it has owner occ tax’s on it run their numbers then they buy and the tax’s then increase when the next bill comes out and some times substantially wiping out all cash flow.;

Recommended Reading: Can You Change Your Taxes After Filing

Are Texas Property Taxes Too High

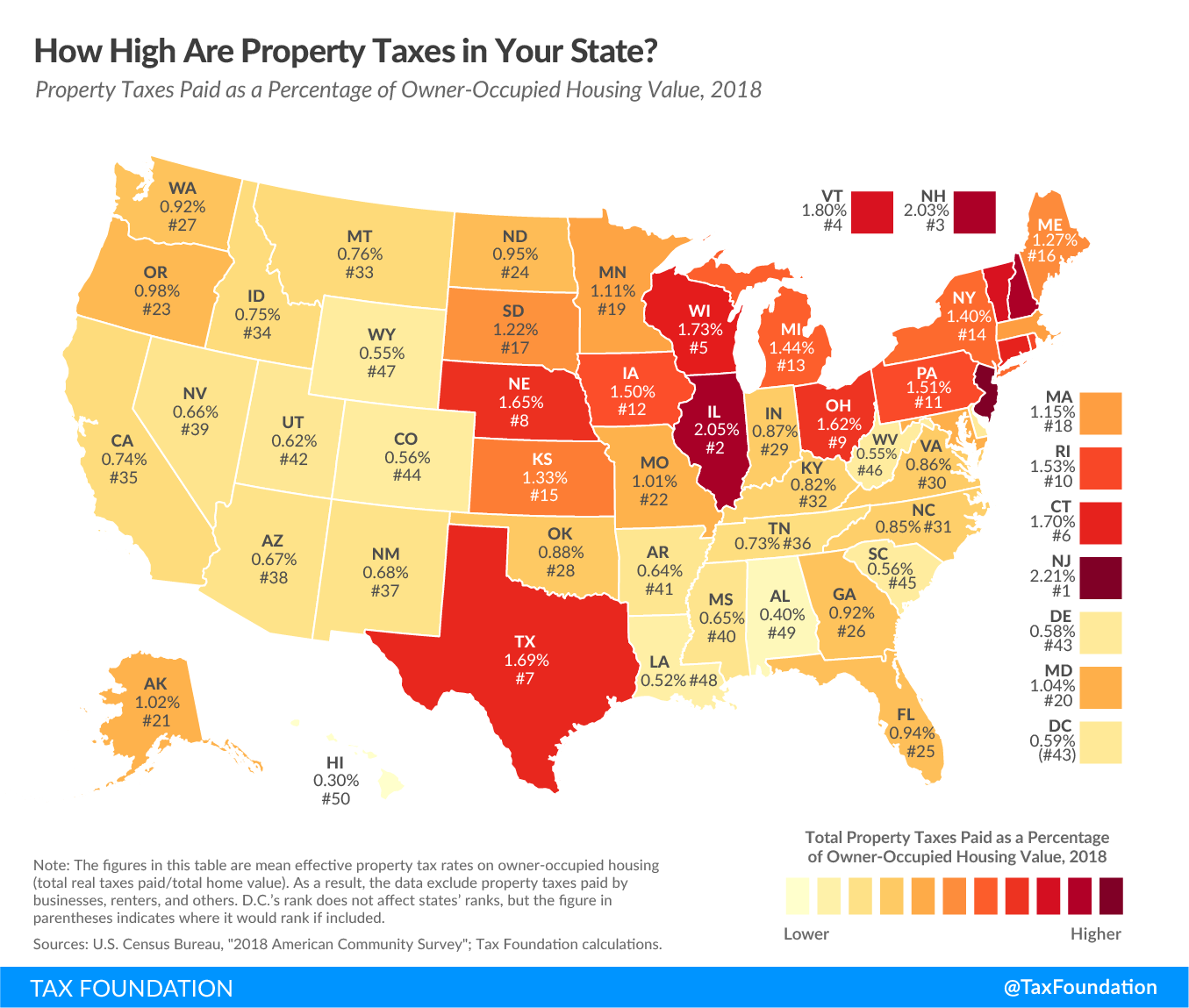

When compared to other states, Texas property taxes are significantly higher. While the national average tends to fall between 1.08% and 1.21%, Texas average effective property tax rate is above 1.83%. On top of that, the state sales tax rate is 6.25%. According to the Tax Foundation, that makes the overall state and local tax burden for Texas 7.6%. So, are Texas property taxes too high? Thats a matter of perspective, but theyre undoubtedly high, and theres a reason so many residents are concerned about facing delinquency.

A Tax Deed Sale Is A Sale Indeed A Tax Lien Sale More An Investment

That first method well discuss is a tax sale. That occurs when the property tax has not been paid for a long enough period of time that the tax collector — usually a county but that can vary from place to place — slaps a tax lien on it and eventually puts it up for sale if the lien is not satisfied.

A tax deed sale gives the winning bidder ownership of the property.

Then theres a tax lien sale, which grants the winning bidder a tax lien certificate, entitling them to pay the back taxes themselves in return for collecting the unpaid taxes, interest, and penalties from the property owner.

The ownership remains with the property owner, unless it otherwise ends up in foreclosure or is sold.

Recommended Reading: Will I Get Any Money Back From My Taxes

Who Owes Texas State Property Taxes

If you own real property in Texas, you will be required to pay taxes on it. So, if you own any real property as an individual or a business, you pay real property tax on it. Even if the property was gifted to you through an estate or you own a rental real property, you are still required to pay tax for it.

There is no minimum or maximum amount of real property taxes you could owe in Texas. Whether you have a $50,000 or $5,000,000 house, you will owe real property taxes in Texas.

If your real property was purchased mid-year, there is a chance your realtor will work it out that you and the seller split the cost of real property taxes within the calendar year. Your mortgage interest statement provides documentation if this is the case or not.

Community Property In Texas Inheritance Law

If youre married, any property you received during your marriage is considered community property and is therefore jointly owned by you and your spouse. However, inheritances and gifts acquired during your marriage do not automatically become community property. Commingling an inheritance or gift in a joint bank account with your spouse can void personal property rights, though, and turn the assets into into community property.

Also Check: How To File Taxes With No Income

Contesting Property Taxes On New Construction Homes

Home Buyers who are purchasing a pre-owned home which is an investment property will have higher property taxes.

- Mortgage underwriters will calculate the higher tax amount when calculating borrowers debt to income ratios

- However, once home buyers move in on their home purchase, they can claim owner occupant and get the taxes reduced

- Owner occupant tax rates are significantly lower than investment tax rates on real estate

- However, it does take time

- There are many counties where they exempt property taxes from disabled veterans

Homeowners who think they are paying higher property taxes than their neighbors can always contest their property taxes. There are many attorneys who specialize in property tax appeals. No money upfront is needed. Attorneys will charge a percentage of the savings.

Does A Property Tax Apply To Tiny Houses

The property tax for regular houses does not apply to tiny houses. However, if you will live in a state that collects personal property taxes for motor vehicles, then you still might have to pay it. Tiny houses towed by a car is considered a recreational vehicle in many states, so the same taxation rules might apply to them as well.;

You May Like: How To Pay Federal And State Taxes

Assessment On Rentals Versus Owner Occupant Homes

Not all single family homes are owner occupant homes.

- Many homeowners do not necessarily sell their owner occupant homes when they upgrade to a larger home

- They may decide in keeping their exiting home as a rental

- Or homeowners who recently purchased a home may get a job transfer to another state without notice and may need to rent out their owner-occupant home

- There are homeowners who rather rent out their exiting home and keeping it as an investment home than selling it

- County Assessors can use the income assessment method on investment rental properties

- Way on how the income assessment method works are it takes into consideration on what the property owner makes after they have satisfied maintenance and other costs of the rental property

- The assessment value of the subject income property is derived after the assessor analyzes the investment property

Investment property owners normally pay higher property taxes than owner occupant homeowners.

Texas Property Tax Rates

Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. They are calculated based on the total property value and total revenue need. In a given area, however, they typically do not change drastically year to year.

Texas levies property taxes as a percentage of each homes appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.

In the table below, we look at each countys effective tax rate, which is equal to the amount of property tax that homeowners actually pay as a percentage of their homes value. The table also includes the average annual tax payment and average home value in each Texas county.

| County |

|---|

Looking to calculate your potential monthly mortgage payment? Check out our mortgage calculator.

Read Also: How To Buy Gold Without Paying Sales Tax

Texas Property Tax Due Dates

County appraisal districts are required to appraise all properties within their jurisdiction as of January 1 every year. Appraisal districts send notices of appraised value to homeowners in April/May. In August/September, local taxing units adopt tax rates. The county tax assessor-collector, acting on behalf of the taxing units, sends out property tax bills to homeowners on October 1. It is noteworthy that failure to receive a tax bill does not shield you from penalties and interest for late payment of Texas property taxes.

But when are property taxes due in Texas? In most cases, your Texas property tax bill is due on January 31 of the following year after assessment. Unpaid taxes become delinquent on February 1. You are advised to consult your local appraisal district if the due dates fall on a weekend or holiday.

Taxes that remain unpaid after Texas property tax due dates result in interest and penalties charged on the original amount. Penalties are computed at 6% while interest is charged at 1% on February 1. The penalty accrues at 1% per month until July 1 when the penalty increases to 12%. Interest continues to accrue at 1% per month with no maximum. However, attorneys hired by taxing units to claim delinquent taxes can charge an additional penalty of up to 20% to cover their legal fees.

Tips For Lowering Your Property Taxes In Texas

You dont have to live in one of the states with low property taxes to pay less. Here are some money-saving tips:

- Research the neighboring propertiesfind comparable homes and see if there are any discrepancies

- Postpone home renovations after your property tax assessment so as not to increase your homes value

- Be present during the in-person property assessment to ensure a fair assessment

- Examine your tax bill for errors and negotiate with your tax assessor

- Check property tax exemptions ofteneligibility factors may change over time

- File a property tax appeal if you believe your home was overvalued

Recommended Reading: How To Review My Tax Return Online