Where Can You Find A Trustworthy Tax Advisor

Think of the cost of tax preparation like the cost of getting a haircutyou can get a simple haircut for a very low price. Sure, it may not be the best haircut youve ever had, but for $10, you cant complain.

Now, if you want to use a skillful stylistsomeone who puts a warm towel on the back of your neck, massages your scalp, gives you a great haircut and fully styles it before you walk outyou have to pay more.

The same goes for tax advisors. If you pay around $220, youll probably get an average tax preparer who may or may not help you get all the deductions you deserve. But for a little bit more, you can get a trustworthy tax advisor who cares about your situation, helps you understand tax changes, and ensures you get the maximum refund back this year.

If youd like to find a tax advisor, we can put you in touch with a professional in your area whos earned our seal of trust. Find a tax pro now!

Interested in becoming an Endorsed Local Provider? Let us know.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Before You Pay For Tax Preparation Services You Have A Right To Receive:

- A written list of the refund options and tax services offered by the tax preparer.

- A written estimate of the total cost for all charges related to each service offered by the tax preparer, including basic filing fees, interest rates, RAL, RAC, and Refund Transfer processing fees, and any other related fees or charges.

- A written estimate of how long you can expect to wait for your refund based on the selected methods of payment and/or refund delivery.

- A written estimated interest rate for a RAL or any other loan service offered by the tax preparer.

What Portion Of Fees Is Deductible

The next hurdle is determining exactly what portion of your tax preparation fees you can deduct. Youre covered for the cost of meeting with a tax professional for advice, as well as for having them prepare your return. Youre also covered if you opt to make use of tax preparation software. Legal fees and audit representation qualify as deductible, as do any publications or books you might buy for a better understanding of your tax situation, and even the cost of e-filing.

You might not be able to deduct the entire expense, however. An accountant might charge you $500 to prepare your tax return, but you can only claim the portion of the fee thats attributable to preparing your Schedule C, E, or Fin other words, the business portion of your taxes. Everything else falls into the category of a personal miscellaneous expense, so its no longer tax-deductible.

You must deduct these tax preparation costs and fees in the same tax year in which you pay them.

Don’t Miss: How Much Does H And R Block Charge To Do Your Taxes

How Long They’ve Been Doing Taxes

Did you know that just about anybody can be a paid tax preparer? Literally, anybody. There are very limited requirements for any type of certification, training, registration, or competency testing.

The IRS tried to put new measures into place, but the courts have an injunction in place for the time being. While many big companies like H& R Block send their employees through in-house training, that may not always be the case with franchised tax preparation companies.

That means the first thing you want to consider is how long the paid preparer has been doing taxes. Since there is no mandatory qualifications that must be done, you need to check their experience. Is this their first year doing taxes, or are they a seasoned professional with 20 years under their belt?

Have they even filed their own taxes before? Seriously…there is nothing stopping a high school student from being a paid tax preparer.

Now, there is nothing wrong with using a new tax preparer. In fact, they may be cheaper, or more tech savvy than someone who’s been doing it a long time. But, if you have a complex return, you may want someone who has experience doing that type of return to help you with your taxes.

Reduce Your Tax Preparation Cost

Whether you have a tax preparer handling your taxes or you are doing them yourself, it helps to be organized. If you are, it can cut down on the time you or your advisor spends filing your taxes, thus reducing the tax preparation cost and your tax preparation fees in 2021. With our online tools, you can create pay stubs, as well as W-2 and 1099 forms.These tools will help you keep everything in one place when it comes time to do your taxes. Are you ready to organize your finances? Fill out one of our amazing paystub templates to discover how simple it can be! Try our professional pay stub maker now!

- 1. Enter Your Information

- 2. Select Your Favorite Theme

- 3. Download Your Stub!

You May Like: Where Is My Federal Tax Refund Ga

How Complicated Are Your Taxes

Lets be honest for a second: If you want a plain vanilla tax filing, you could probably get away with paying a fee close to the minimum range. But the more complicated your tax situation is, the more time itll take to prepare your return. And we all know time is money.

For example, lets say you have a side business. Youll want to itemize deductions and file a Schedule C form in addition to your basic 1040. In that case, the average cost is around $515.4

Look For Friends In High Places

Membership in a professional organization such as the National Association of Tax Professionals, the National Association of Enrolled Agents, the American Institute of Certified Public Accountants, or the American Academy of Attorney CPAs is always a good thing to have in a tax advisor, as most have codes of ethics, professional conduct requirements and various certification programs.

Read Also: Can You File Missouri State Taxes Online

Average Small Business Tax Prep Fees

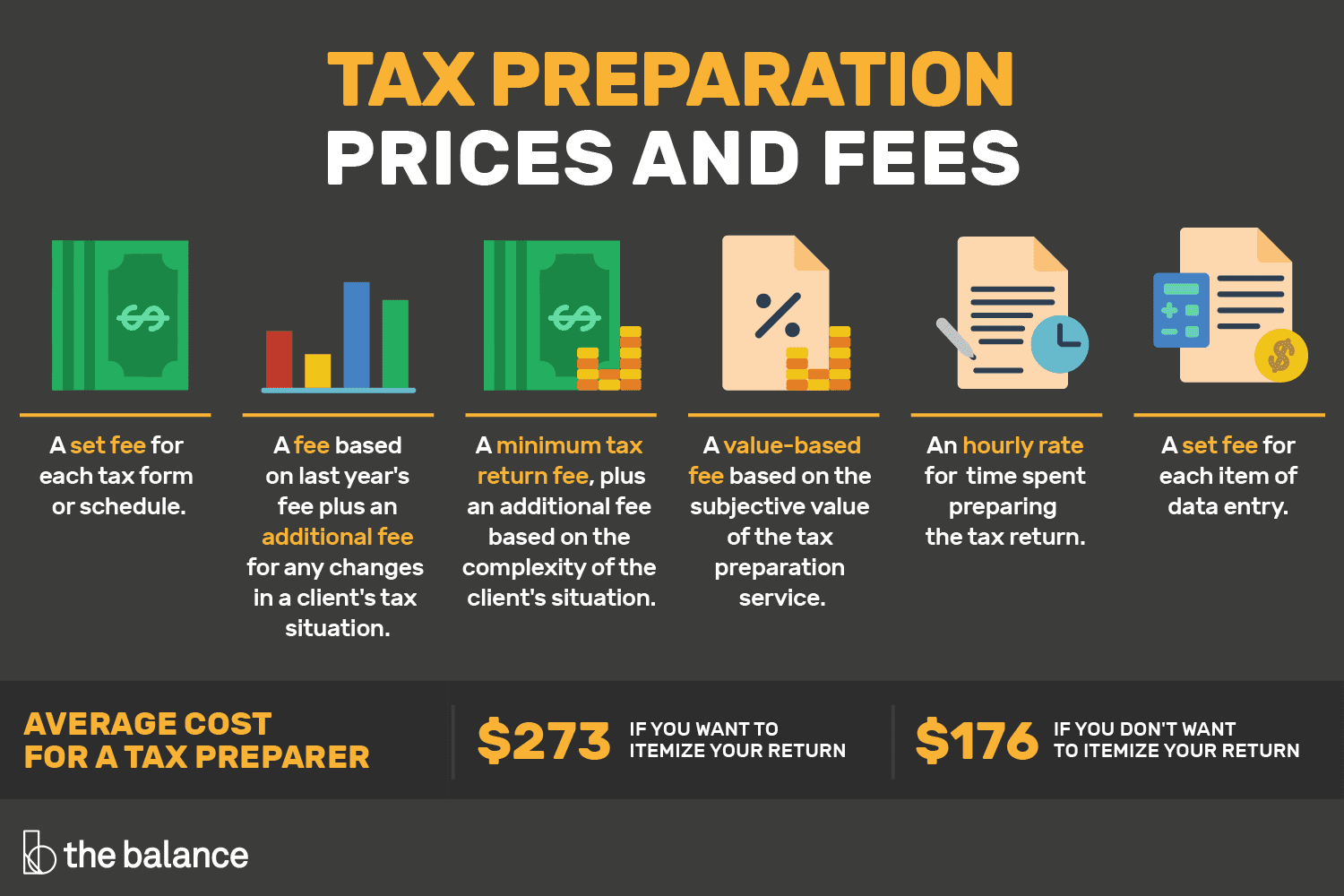

Many business owners opt to hire a tax professional to help them file and prepare their taxes. Each tax preparer may structure their service pricing differently, but according a survey from the National Society of Accountants, in 2014 the average cost to hire a tax prep professional to complete an itemized IRS Form 1040 was $273. Business owners will want to keep in mind that they may need to file other forms in addition to Form 1040, which may impact how much you can expect to pay for tax preparation services.

In addition to the cost of preparing Form 1040, the National Society of Accountants reported the average cost of hiring a tax professional to file the following IRS forms:

- $174 for a Form 1040 Schedule C

- $634 for a Form 1065

- $817 for a Form 1120

- $778 for a Form 1120S

- $457 for a Form 1041

- $688 for a Form 990

- $68 for a Form 940

- $115 for Schedule D

Again, keep in mind these fees are averages and may vary depending on your region, industry, and business size. Consulting with a tax professional can help you determine which IRS forms apply to your small business.

How Do I Keep Up With New Tax Law Changes

Keeping up with tax law changes is imperative for both new and experienced preparers. As a result, most preparers invest some time each day checking on any IRS changes, technical corrections, or any other state or local changes that might impact their business.

An excellent first stop is the IRS website, which is full of publications and instructions that will help new and experienced preparers navigate changes to the tax code, as well as commonly asked questions and other useful tips.Checkpoint Edge from Thomson Reuters is another resource for tax professionals who are looking to do their jobs with more accuracy, confidence, and daily news updates. Checkpoint Edge provides you with up-to-date research materials, editorial insight, productivity tools, online learning, and marketing resources that add value to your firm immediately.

Alternatively, if youre on a tight budget, a few well-chosen tax books may be sufficient to begin with.

“Understand that you cannot possibly know every tax law ever written, especially in times of sweeping tax law changes as we are experiencing today. Make yourself valuable by honing your tax research skills. If you don’t know the answer, you must know how to find the answer.”

Recommended Reading: Tax Lien Investing California

Should You Use Free Tax

The average cost of having a professional prepare a federal Form 1040 income tax return for the 2018-2019 tax season was nearly $200 for the simplest returns, according to the National Society of Accountants. And the more complex your tax situation, or the more forms you need to file, the higher the cost can run.

Lets look at how much it could cost to pay someone else to do your taxes, and what your options are if you choose to save money by going DIY.

Claiming The Deduction On Schedule F

Schedule F is Profit or Loss From Farming. Tax preparation fees fall into the category of other expenses on this form, which appear at Lines 32 a) through f). The IRS wants you to break down what these expenses were for on the lettered lines. For example, you might enter tax prep fees on Line 32a and office expenses on Line 32b. Again, these tax costs must directly relate to your farming business, not personal tax issues.

You May Like: How To Look Up Employer Tax Id Number

How Much Should I Pay My Tax Preparer

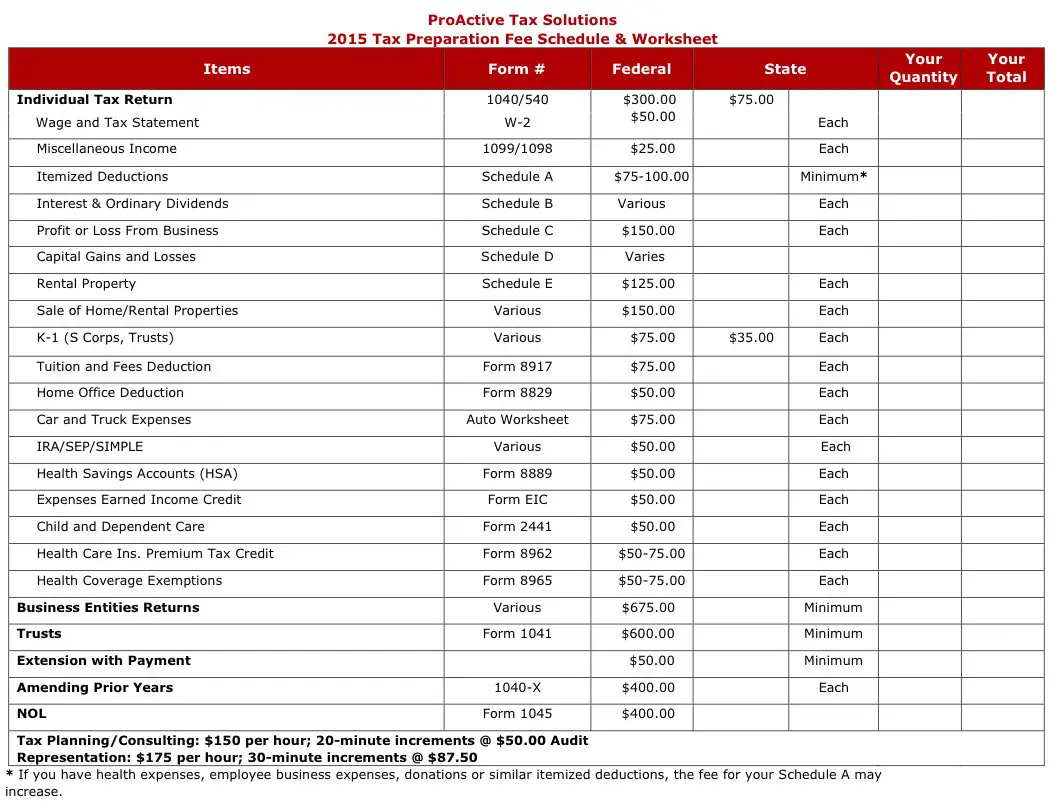

If you are wondering: “How much should I pay my tax preparer?” this section is for you. There are various ways to calculate tax preparation fees in 2021. Of course, you wouldn’t want to be surprised when you get the bill from your tax advisor, so when you sit down with them, make sure to ask how they will charge you. Typically, tax professionals use one of these methods to determine their fees.

- A separate fee for each form and schedule

- Match the rate you paid last year unless your taxes have become more complicated

- Value-based payments, which are based on how difficult they feel your taxes will be to file

- Hourly rate, which can be expensive if they take several hours to finish

- A minimum fee, plus extra compensation if your taxes are complicated

If you don’t fully understand how much should I pay my tax preparer or don’t feel completely comfortable with the method they use, let them know. They may be able to fill you in on why they use this particular method. If not, look for an advisor with whom you feel at ease.

Do I Have To Pay Someone To Do My Taxes

Many Americans lean heavily on professionals to do their taxes. Paid tax preparers filed about 59% of the more than 134.2 million individual income tax returns e-filed in 2018, according to the IRS. Keep in mind that number doesnt include paper returns or more-complex returns like ones for estates, trusts or tax-exempt organizations, so the actual percentage of returns done by paid preparers is probably higher.

While some people with complex financial situations may benefit from getting professional help filing their taxes, many people can file their own taxes and skip the professional-preparation fee.

Online tax preparation services, like , offer a do-it-together approach to tax filing that can help you avoid the filing preparation fees and still get it right. Here are some points to keep in mind if youre debating whether to use online tax preparation software or shoulder the cost of tax preparation by a professional.

You May Like: How Does H& r Block Charge

How Do Tax Preparersprocess A Bank Product

Step 1:Prepare your clients taxes. Check if they are eligible for a tax refund. If yes, you may offer a bank product as a disbursement option.

Step 2:If your client chooses a bank product, your client must sign Due Diligence forms, which is a part of the 7216 Guidance.

Step 3:Ask your client to choose whether to get their refund via check, direct deposit, or debit card. If your client chooses a debit card, they can get their refund on the day. Checks are typically released the day before a direct deposit would be available in the clients bank account.

Step 4:Fill out the bank product application in your professional tax software, UltimateTax. Print the documents and have your client sign all of all the documents.

REMINDER: At this point, its essential that your client understands that choosing a tax refund bank product means they would pay additional fees. Explain clearly that the product is an additional service that you are providing them. Your client is free to either choose or refuse this service.

Step 5:After your client agrees and signs ALL documents, you can proceed to file their tax return.

NOTE: By selecting a bank product in your tax program, filling out the forms, and transmitting the completed return, you are essentially done with the bank product.

What Does A Tax Preparer Do

Most tax preparers prepare, file, or assist with general tax forms. Beyond these basic services, a tax preparer can also defend a taxpayer with the IRS. This includes audits and tax court issues. However, the extent of what a tax preparer can do is based on their credentials and whether they have representation rights.

In a way, tax preparers are asked to serve two masters their clients and the IRS. They must assist their clients in complying with the state and federal tax codes, while simultaneously minimizing the clients tax burden. While they are hired to serve their client, they must also diligently remember their obligation to the IRS and not break any laws or help others file a fraudulent return.

Read Also: How Do I Get My Pin For My Taxes

Where Do You Live

The fees for hiring a tax professional differ across the country. For instance, you can expect to pay more than average on the Pacific Coast and less in the good ol South.2

Here are the average tax preparation fees for an itemized 1040 with a Schedule A and state return in each region:

- New England : $285

- Middle Atlantic : $303

- South Atlantic : $339

- East South Central : $217

- West South Central : $313

- East North Central : $273

- West North Central : $267

- Mountain : $310

- Pacific : $4323

Youll notice all these averages are higher than the $220 mentioned above, but thats because many people who use a tax pro have more complicated situations than the standard 1040 can cover. Either way, expect a slight fluctuation in cost based on the quality of the pro, the region and your specific needs.

Start Early Get Organized

Tax preparers often charge more as the April filing deadline nears, so the earlier you get your documents to them, the more you could save. Many preparers draw a line in the sand somewhere around the last week of March, Freeland says. After that, fees often start rising.

Furthermore, even though the complexity of the return and the quantity of records heavily influence the cost of human tax preparation, so does your level of organization, Labant says.

Are they coming to you April 14 with a box of receipts? OK, that persons not organized. It would be reasonable to expect a preparer to charge them more, as opposed to someone who had all of their forms, they completed the organizer reached out in January, she says.

More From NerdWallet

Recommended Reading: Do You Have To Report Roth Ira On Taxes

Let Us Do The Work For You

TPG contacts your unfunded clients*

Once a taxpayer that selected a Refund Transfer is at least 1 month past their expected IRS funding date TPG will contact your client

Convenient payment options offered

Clients are given the option to conveniently pay your fees with a credit card or bank account

Fees are direct debited

If your client does not respond, TPG will debit your fees from your client’s bank account

Payment issued to you

TPG collects our processing fee of 25% of the amount debited and the remainder is deposited into your bank account upon completion of the Auto Collect program2

* Participating EROs have the option to not collect on certain taxpayers and will have the option to make this determination on a case-by-case basis.

See If You Can Get Free Help

The IRS programs Volunteer Income Tax Assistance and Tax Counseling for the Elderly provide free tax prep services generally to people who make $54,000 or less, have disabilities, are older than 60 or speak limited English. This can be a huge money-saver if you qualify. To find locations in your area, go to irs.treasury.gov/freetaxprep.

Don’t Miss: How To Buy Tax Lien Certificates In California

The Health Or State Of Your Taxes

Depending on the state of your tax filing record and any complications with tax situations, tax preparation fees will reflect the amount of time spent working on them by professionals. Better service also calls for higher prices, and the minimum labor or tax records organization will incur somewhere near the national average rate of $176.

Circumstances such as additional businesses will need a Schedule C and itemized deduction on top of the basic 1040, bringing the tax preparation fee to an average of about $450.