Need Help With Your 1030 Exchange Contact 1031 Crowdfunding

Now that you know the basics of capital gains taxes and how to minimize them, you may be ready to start exercising the recommended techniques for calculating and minimizing your capital gains taxes. To learn how to use a capital gains tax calculator to assess selling a rental property or whether you should attempt a 1031 exchange, 1031 Crowdfundings 1031 exchange services can help you handle the logistics and assess your options.

The experienced management team at 1031 Crowdfunding can help you figure out how a 1031 exchange could benefit you by reducing your capital gains taxes. Joining the Crowd will also give you access to an online marketplace of fully vetted 1031 exchange properties chosen by qualified real estate professionals, simplifying the 1031 exchange process for you and decreasing the closing risk.

Register with 1031 Crowdfunding or contact us today to learn more about how you can minimize your capital tax gains this tax season.

While the information provided above has been researched and is thought to be reasonable and accurate, 1031 Crowdfunding are not lawyers or tax professionals. Its important to consult with a licensed tax professional regarding your personal tax situation.

How To Avoid Capital Gains Tax On A Home Sale

Capital gains taxes can greatly affect your bottom line. Fortunately, there are ways to reduce the tax bill, or avoid capital gains taxes on a home sale altogether. It depends on the property type and your filing status. The IRS offers a few scenarios to avoid capital gains taxes when selling your house.

What’s The Difference Between A Short

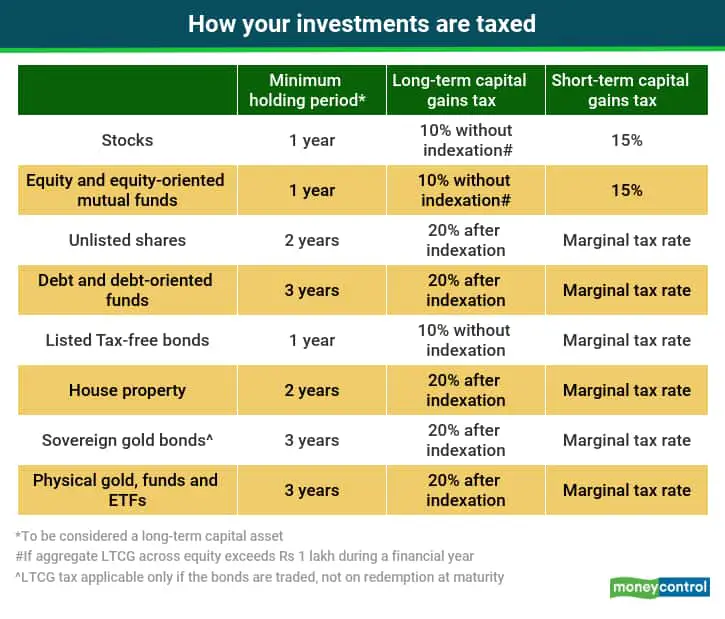

Generally, capital gains and losses are handled according to how long you’ve held a particular asset known as the holding period. Profits you make from selling assets youve held for a year or less are called short-term capital gains. Alternatively, gains from assets youve held for longer than a year are known as long-term capital gains. Typically, there are specific rules and different tax rates applied to short-term and long-term capital gains. In general, you will pay less in taxes on long-term capital gains than you will on short-term capital gains. Likewise, capital losses are also typically categorized as short term or long term using the same criteria.

Read Also: Can You Get The Child Tax Credit With No Income

State Capital Gains Tax Rates

| Rank | |

|---|---|

| 0.00% | 0.00% |

Real estate, retirement savings accounts, livestock, and timber are exempt for capital gain taxation in the state of Washington.

- Values shown do not include depreciation recapture taxes.

- AK, FL, NV, NH, SD, TN, TX, WA, and WY have no state capital gains tax.

- AL, AR, DE, HI, IN, IA, KY, MD, MO, MT, NJ, NM, NY, ND, OR, OH, PA, SC, and WI either allow taxpayer to deduct their federal taxes from state taxable income, have local income taxes, or have special tax treatment of capital gains income.

- This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

- Realized does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Need to figure out your Capital Gains Tax liability on a sale of an asset? The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Managing The Tax Impact

Read Also: How To Claim Stimulus Check On Taxes

What Is Capital Gains Tax Understanding Short And Long Term

First, it is essential to understand what a capital asset is before calculating its tax burden.

Capital gains can apply to investments such as stocks, bonds, real estate, cars, boats, cryptocurrency, collectibles, home sale, and other tangible items. If an investment is worth more than your cost basis then, you have a capital gain in that investment. If an investment is worth less than your cost basis, you incur a capital loss.

While you still own that investment, the gain is said to be unrealized. Presently, you do not incur a tax liability on unrealized capital gains.

For example, if you paid $100 for a stock that is now worth $125. You have an unrealized gain of $25.

However, if you sell the investment, the gain transitions from unrealized to realized realized capital gains drive capital gains taxes. Your tax bill is based on the realized gain and not simply the amount of your investment. So, if your purchase price was $100 and the sale price was $125, youd have to pay capital gains tax on $25.

The length of time you hold the investment before you realize the gain makes a significant difference in your tax bill, too. Your gain can be taxed as either a long-term or short-term capital gain.

Here are the 2022 Federal tax brackets that apply to short-term capital gains in 2022:

Both the net investment income tax and IRMAA can potentially cost you tens of thousands of dollars in additional taxes if you aren’t careful with how you calculate capital gains taxes.

Tax Loss Harvesting And Carryover Of Capital Losses

What if you lose money on your investments? A tax loss can be a valuable asset if you use a strategy called “tax loss harvesting,” which is based on the ability to offset capital gains with capital losses so that you only pay tax on your net capital gains. However, there’s a certain sequence you have to follow when offsetting gains with losses. First, short-term losses are used to offset short-term gains, and long-term losses are used to offset long-term gains. Then, if there are any losses remaining, they can be used to offset the opposite type of gain.

For example, let’s say this year you have the following gains and losses:

- $80 long-term gain from selling A Corp. stock

- $10 long-term loss from selling B Corp. stock

- $20 short-term gain from selling C Corp. stock and

- $50 short-term loss from selling D Corp. stock.

You first offset your $50 short-term capital loss against your $20 short-term capital gain, resulting in a $30 net short-term loss. Then use your $10 long-term loss to offset your $80 long-term gain, resulting in a $70 net long-term gain. The $30 net short-term loss can then be applied against your $70 net long-term gain, resulting in an overall net long-term capital gain of $40.

You May Like: What Federal Tax Forms Do I Need

Californias Overall Tax Picture

California is generally considered to be a high-tax state, and the numbers bear that out. There is a progressive income tax with rates ranging from 1% to 13.3%, which are the same tax rates that apply to capital gains. The Golden State also has a sales tax of 7.25%, the highest in the country. With local sales taxes added on, the sales tax rate in some municipalities can climb as high as 10.25%.

Property taxes in California cant exceed 1% by law. There is no estate tax or inheritance tax.

Hold Assets More Than One Year

As we mentioned, assets held for less than one year are subject to short-term capital gains taxes, while those held for more than one year are subject to long-term capital gains taxes.

Currently, long-term capital gains have a more favorable tax treatment, with many taxpayers paying a rate of 0%, and even the highest earners paying a maximum rate of 20%. Meanwhile, the highest tax bracket for short-term capital gains taxes is 37%. As a result, one easy way to reduce your capital gains taxes is to hold investments for at least one year before you sell them.

Don’t Miss: How To File Taxes For Free On Turbotax

How Do I Avoid The Capital Gains Tax On Real Estate

If you have owned and occupied your property for at least 2 of the last 5 years, you can avoid paying capital gains taxes on the first $250,000 for single-filers and $500,000 for married people filing jointly.

Visit the IRS website to review additional rules that may help you qualify for the capital gains tax exemption.

What Is A Principal Residence

Your principal residence is where you and your family normally live in Canada during the year. You must own or jointly own the home. However, in some cases, a vacation property that you own and only you and close relatives use may be considered as your principal residence as long as you donât earn any rental income from it. You donât even have to live in the residence for the whole year. However, you can only claim one home as a principal residence in any calendar year for your family unit .

Your principal residence can be any number of different property types according to the Canada Revenue Agency. It can be a house, a duplex, a condo, a cottage, a cabin, a mobile home, a trailer or a houseboat. You can generally only have half a hectare of land on which your residence sits. However, there are exceptions to this. For instance, if the municipality you bought your property in has a minimum lot size that is already greater than half a hectare, then you may prove the increased lot size is solely for enjoyment purposes.

Also Check: How To Buy Property For Back Taxes

Adjusted Cost Base For Financial Instruments

For financial instruments such as stocks, the adjusted cost base is calculated as the number of shares multiplied by the share price at the time the shares were bought. For instance, if 100 shares of XYZ Company were purchased at a price of $30 each, then the ACB would be $3,000. If more shares of the same corporation are purchased in the future, the adjusted cost base would be the total cost of all the shares purchased at their respective prices. The adjusted cost base per share would be the average purchase price for all the shares. For instance, if you purchased 50 more shares of XYZ Company at a price of $35, the ACB per share would be $31.67. The adjusted cost base also includes any costs incurred to acquire the stock, such as trading commissions. Since commissions increase your cost, investors and active traders may benefit from low-commission andfree trading platforms.

How To Avoid Capital Gains Tax On Real Estate

Appreciation of real estate is a great thing, depending on how you look at it. However, as a seller, that could translate to thousands, or even hundreds of thousands, of dollars in taxes after a home sale.

Fortunately, there are a few things homeowners and investors can do to offset their capital gains tax on real estate:

Offset Gains With Losses

Convert Rental Property To Primary Residence

Read Also: How To Know How Much Taxes You Owe

B Other Costs Related To Property

There may be many other costs associated with the property that an owner-seller might have incurred. These are allowed to be reduced from the sales proceedings

Settlement fees or closing costs xxxxReal estate taxes or other costs you paid xxxx Any amounts you spent on the construction or other improvements xxxx Any amounts you spent to repair damage to your home or the land on which it sits xxxx Any special assessments for local improvements xxxxTotal of Other Costs xxxxx

C. Adjustments to Costs

Following adjustments to your other cost must be done. If any of the following benefits have occurred to you, aggregate them and reduce it from Other Cost.

Costs after Adjustments = Other costs -adjustment to costs

Consider Using A Retirement Account

-

Owning dividend-paying investments inside one could shelter dividends from taxes or defer taxes on them. Think ahead, though. Do you need the income now?

-

Also, the type of retirement account matters when it comes to determining the tax bill. When you eventually withdraw money from a traditional IRA, for example, it may be taxed at your ordinary income tax rate rather than at those lower qualified dividend tax rates. If you qualify for a Roth IRA, you wont receive a tax break on the contribution, but your eventual withdrawals after age 59 ½ may be tax-free.

Recommended Reading: How Do You Calculate Your Tax Bracket

State And Local Taxes On Capital Gains

Don’t forget to consider state and local income taxes when you sell a capital asset. Some states and municipalities tax capital gains and others don’t. Whether or not you must pay capital gains tax in a particular state depends not only on where you live but also on the type of asset you’re selling. For example, if you sell real estate, the relevant taxing state is generally the location of the property. However, if you sell stock, it’s your state of residence.

If your capital gain is subject to tax in a state other than where you live, find out if that state will also tax the gain. If so, your state of residence may grant you a credit for any taxes paid to the other state.

Check with the state tax agency where you live to learn more about how your state taxes capital gains.

A Guide To The Capital Gains Tax Rate: Short

OVERVIEW

This guide can help you better understand the different rules that apply to various types of capital gains, which are typically profits made from taxpayers sale of assets and investments.

|

Key Takeaways Profits you make from selling most assets are known as capital gains, and they are generally taxed at different rates depending on how long you have held the asset. Gains you make from selling assets youve held for a year or less are called short-term capital gains, and they generally are taxed at the same rate as your ordinary income, anywhere from 10% to 37%. Gains from the sale of assets youve held for longer than a year are known as long-term capital gains, and they are typically taxed at lower rates than short-term gains and ordinary income, from 0% to 20%, depending on your taxable income. If your investments end up losing money rather than generating gains, you can typically use those losses to reduce your taxes. |

The U.S. Government taxes different kinds of income at different rates. Some types of capital gains, such as profits from the sale of a stock that you have held for a long time, are generally taxed at a more favorable rate than your salary or interest income. However, not all capital gains are treated equally. The tax rate can vary dramatically between short-term and long-term gains. Understanding the capital gains tax rate is an important step for most investors.

Read Also: When Is The Deadline To File Your Income Tax

Capital Gains On Gifted Property

You may transfer capital property to your spouse if they are at a lower income tax bracket to save on capital gains tax as a family. Depending on the type of property, you will transfer them to your spouse at either the Adjusted Cost Base or the Undepreciated Capital Cost . After the transfer, you will not incur capital gains tax but when your spouse sells the capital property, they will pay capital gains tax.

If the capital property you transferred to your spouse is eligible for theLifetime Capital Gains Exemption, then your spouse can use their remaining LCGE limit when selling the capital property to reduce their capital gains tax. Eligible properties for the LCGE include qualified small business corporation shares and qualified farm or fishing properties .

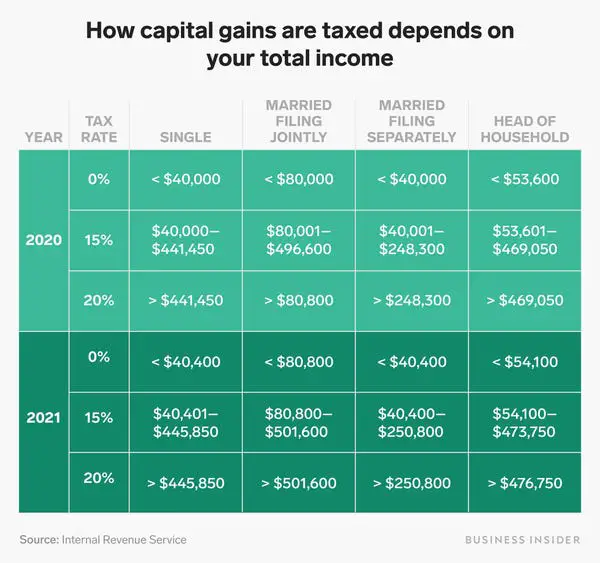

Capital Gain Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow.

A capital gain rate of 15% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single more than $80,800 but less than or equal to $501,600 for married filing jointly or qualifying widow more than $54,100 but less than or equal to $473,750 for head of household or more than $40,400 but less than or equal to $250,800 for married filing separately.

However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Read Also: Do You Have To Pay Taxes On Home Equity