Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Can I Track My California Inflation Relief Check

Posted: Oct 19, 2022 / 06:51 AM PDT

Posted: Oct 19, 2022 / 06:51 AM PDT

As the state continues to send out the direct payments, is there a way to track the progress of your check?

The short answer is no, the Franchise Tax Board says. But to combat frustration with the vague timelines originally laid out, the agency has released more details on when you can expect to receive your direct deposit or debit card.

To find out when youll see your tax refund, you first need to determine if youre getting a direct deposit or a debit card. If you filed your California state taxes electronically in 2020 and received a refund by direct deposit, youll likely get a direct deposit in this case, too. Pretty much everyone else will get a debit card, the state says.

Second, youll need to determine if you received a Golden State Stimulus payment last year, in either round 1 or round 2. Golden State Stimulus recipients of 2021 are first in line to get the Middle Class Tax Refund in 2022.

Theres one final complication: Debit cards are being sent out in smaller batches, organized in alphabetical order by last name. GSS recipients are first up, broken into four groups getting their debit cards in the mail between Oct. 24 and Dec. 10.

How Do I Check My State Tax Refund

Its possible to check you tax refund status by visiting the revenue departments Refund Information page. On that page you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

Also Check: 1040paytax.com Safe

Also Check: When Do I Have To Pay My Taxes By

How To Check Your Tax Refund Status

OVERVIEW

The IRS has made it easy to check the status of your income tax return online with their “Where’s My Refund” web page.

If you are anxiously awaiting your refund check to arrive or have it deposited into your checking account, theres no reason for it to remain a mystery. The IRS has an online tool called Wheres My Refund? that allows you to check the status of your refund. After providing some personal information, you can find out when it will arrive.

TurboTax also has a Where’s My Refund Tracking guide that explains each step of the efiling process and how to check the status of your federal tax refund.

How To Check Your Federal Tax Refund Status

If you paid U.S. taxes, you can check your refund status from 2019 through the present through the IRSs refund tracking site. To check your status provide your Social Security Number, your filing status, the tax year, and the expected refund amount.

Its relatively easy to check your refund status on a Federal level, and checking the status of your state return is also straightforward. However, each state has separate sites and requirements to check your refund status for the state.

Read Also: When Are Self Employment Taxes Due

How Do I Check My Refund Status

The IRS requires that you have some information from your tax return to check your refund status. Youll need the following information from it:

- Your Social Security number, which you include at the top of your tax return.

- Your filing status, which can be found near the top of the first page of your tax form.

- Your tax refund amount, as stated at the bottom of your tax return.

Also Check: How To Pay My Federal Income Taxes Online

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real-time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Don’t Miss: What Can I Write Off On My Taxes For Instacart

Tax Refund Frequently Asked Questions

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasury’s Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds. Direct Deposit combined with IRS e-file provides taxpayers with the fastest and safest way to receive refunds.

This resource page of frequently asked questions about IRS tax refunds provides financial institutions with useful information for reference while assisting customers during the tax filing season.

For other FAQs about Direct Deposit, .

Wheres My State Tax Refund North Dakota

North Dakotas Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

Recommended Reading: How To Pay My Property Taxes Online

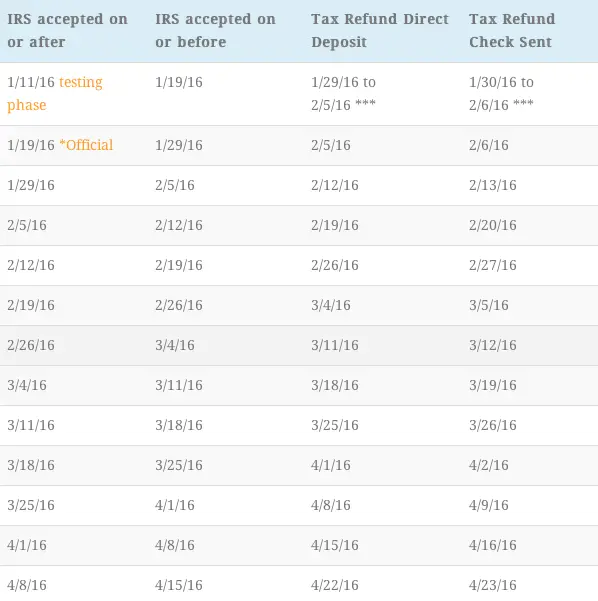

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

How Much Of Your Refund Claim Can You Get

When you claim for a refund, it gets processed by the IT department. The tax authorities assess and verify your claim. The amount of refund you get is based on this assessment. It could match the amount you have claimed, or it may be more or less than it. You will be notified about the refund amount you are eligible to receive from the IT department under section 143 by the Central Processing Centre .

Also Check: How To Know Tax Id Number

Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include Surviving Spouse and Deceased next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Don’t Miss: How To Find Annual Income Before Taxes

What To Do If You Need The Money From Your State Tax Refund

Unfortunately, you cant pester your states revenue department into issuing your refund sooner, even if you need the money. There really isnt much you can do to get the money in your hands faster.

Rather than fret about the refund that is slow to reach you, consider alternative ways to increase your income. If you made any student loan payments in the last 24 months, you may qualify for a refund of your student loans. You can also earn money quickly through selling valuables or side hustling.

For next tax season, consider adjusting your state tax withholdings, so you keep more of your paycheck each month. That way youll have more money each time you get paid and you wont be waiting on such a large refund in the future.

Q: How Can I Receive My Employee Retention Tax Credit Refund Faster

- A: There are a few ways to speed up the Employee Retention Tax Credit process. First, businesses can file for an expedited refund by including a statement with their return that explains why they need the money quickly. Second, businesses can make an estimated tax payment using Form 4466, which will reduce the amount of time it takes to receive a refund. Finally, businesses can contact their local IRS office to inquire about the status of their refund. By taking these steps, businesses can get their employee retention tax credit refunds faster. Also, always be sure to consult with your CPA about next steps as well as your ERC filing company to help assess your return status.

Don’t Miss: What If I Filed My Taxes Wrong

How Do I Contact The Canada Revenue Agency

If you filed your taxes through the Canada Revenue Agency , it can take up to six weeks for your refund to show up in your bank account. If you opted for direct deposit, it should show up within a few days.

There are a few things to keep in mind if youre waiting longer than six weeks for your tax refund:

My Bank Account Number Has Changed I Want To Change The Bank Account Number Which I Mentioned In My Income Tax Return

You can only change your Bank Account Number if you had a refund failure i.e your IT Return is processed and a refund was generated for you but you did not receive it. If you wish to change the Bank Account Number for Refund failure case, then login in the Income Tax e-Filing website and go to My Account â Refund re-issue request. Select the mode through which you wish to receive the refund- ECS or Cheque. Enter the new Bank Account Number and provide address details. Submit the request.

Once the request is submitted, your new Address is updated with the Income Tax Department.

You May Like: Does Irs Tax Advocate Help

Will I Continue To Receive Copies Of Wells Fargo Tax Documents In The Mail If I Viewed Them Online

You will still receive a copy of your tax document in the mail if the delivery preference for your eligible account is set to Mail. If the delivery preference for your eligible account is set to Online, you will not receive a paper copy in the mail and your tax document will be viewable only through Wells Fargo Online®. To update delivery preference options for your tax documents, sign on to Wells Fargo Online.

Guide To Check Your Refund Status Through Tax Information Network Portal

You May Like: How Much Can I Make And Not File Taxes

Could You Give An Example Of How This Would Work

Example: Bill is entitled to a $2,500 federal income tax refund. He decides to save $1,000 of the refund by buying savings bonds, to save another $1,000 by having the IRS direct deposit that amount to his IRA, and have the IRS direct deposit the remaining $500 to his checking account. Bill gives the IRS these instructions by completing Form 8888 and attaching it to his Form 1040. On the Form 8888, he checks the appropriate checking or savings boxes, gives the IRS the routing and account numbers for his IRA and checking accounts and completes the information specified in the Form 8888 instructions for the bond purchase. Six $50 savings bonds, one $200 savings bond and one $500 savings bond will be mailed to him.

Recommended Reading: What Is The Mailing Address For Irs Tax Returns

Checking Your Tax Refund Status Online

Step 1Wait

Wait at least three days after e-filing your tax return before checking a refund status. When you e-file your tax return to the IRS, it needs approximately three days to update your information on the website.

If you e-filed your tax return using TurboTax, you can check your e-file status online, to ensure it was accepted by the IRS. You’ll also receive an e-mail confirmation directly from the IRS.

However, if you mail a paper copy of your tax return, the IRS recommends that you wait three weeks before you begin checking your refund status. Most taxpayers who e-file will receive their tax refund sooner.

Step 2Obtain a copy of your tax return

Before you sit down to check your refund status, the IRS requires that you have some of the information from your tax return. If you printed a copy of your tax return, grab ityoull need the following information from it:

- The Social Security number that you entered at the top of your tax return

- The filing status you chose, which you can locate in the top portion of the first page to your tax form.

- The exact amount of your tax refund. You can find this at the end of your tax return.

Step 3Go to the “Wheres My Refund?” page on the IRS website

When you access the “Where’s My Refund?” tool, you will see three separate boxes to enter your filing status, refund amount and Social Security number. When you finish entering this information, click on the “Submit” button on the page to see the status of your refund.

Don’t Miss: What Is The Fica Tax Rate

Wheres My State Tax Refund New Mexico

The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. To check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page.

Taxpayers who filed electronically can expect a refund to take six to eight weeks to process. The state asks that you wait at least eight weeks before calling with inquiries about your return. Paper returns will likely take eight to 12 weeks to process. The state advises waiting 12 weeks before calling with refund status questions.

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to a form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Recommended Reading: How Long Can You Go Without Filing Your Taxes

Checking The Status Of State Tax Return