If You Filed Taxes Early Dont File An Amended Return Yet

If you filed your 2020 taxes before the American Rescue Plan was signed into law and didnt take advantage of the unemployment tax break, the IRS is strongly urging you to hold off on amending your return.

For those who received unemployment benefits last year and have already filed their 2020 tax return, the IRS emphasizes they should not file an amended return at this time, until the IRS issues additional guidance, the IRS wrote in a .

As Samuels explains, They plan on coming up with some methodology for people who already filed that could have excluded that $10,200. It might be a single form. They might just re-compute those peoples taxes and send them an additional refund. They need a couple more weeks to figure out how theyre going to handle that.

Its possible you wont have to file an amended return at all. We believe that we will be able to automatically issue refunds associated with the $10,200, IRS Commissioner Charles Rettig said during a congressional hearing Thursday.

Many advocates have called for the IRS to proactively issue refunds to taxpayers who overpaid, including Senator Richard Durbin, D-IL, and Congresswoman Cindy Axne, D-IA. In addition, 19 members of the House and Senate have urged the IRS to automatically issue refunds without requiring taxpayers to file amended tax returns.

Read Also: Missouri Edd Unemployment

Will I Owe Taxes If Im Unemployed

If you dont currently have a job, but you were employed for most or part of the prior year, youll still need to file a tax return for that earned income. Just bear in mind that filing taxes doesnt necessarily mean that you owe taxes. It simply informs the IRS about your income, employment situation, and family status. In fact, some people may realize that they dropped to a lower income bracket because of the COVID-19 pandemic, and therefore may owe less or even receive a refund.

Qualifying For Job Search Tax Deductions

To qualify for the deduction, your job search must be for a job in your current, or most recent, trade or business.

- If you havent held a job in that trade or business for an extended length of time, your job search will be considered for a new trade or business, and your deductions may not be allowed.

- If youre just out of school and had no paying jobs while in school that were related to your trade or business, your deductions wont be allowed.

You May Like: Do Seniors Have To File Taxes

How To Prepare For Your 2021 Tax Bill

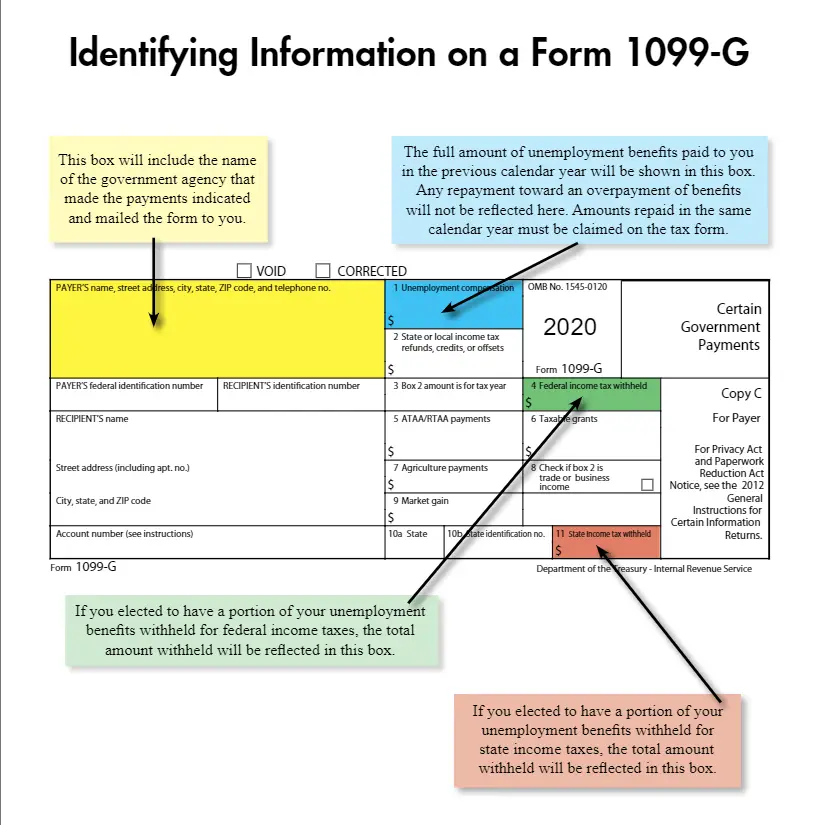

You can have income tax withheld from your unemployment benefits, so you dont have to pay it all at once when you file your tax returnbut it wont happen automatically. You must complete and submit Form W-4V to the authority paying your benefits. Withheld amounts appear in box 4 of your Form 1099-G.

You can have federal taxes withheld from your benefits, but it is limited to 10% of each payment. This may not be enough to adequately cover taxes on the benefits you received. If youve returned to work, you can opt to have extra tax withheld from your paychecks through the end of the year to help cover taxes owed on your unemployment benefits as well as your regular pay.

Your other option is to make advance estimated quarterly payments of any tax you think you might owe on your benefits. You have until Jan. 15 to make estimated tax payments on any benefits you receive between September and December of the prior tax year. In fact, you must do so if sufficient tax wasnt withheld from your unemployment benefit payments. You could be charged a tax penalty if you dont pay as you go through either additional withholding or estimated payments during the tax year.

Will I Owe Taxes On Stimulus Checks

No, stimulus checks aren’t considered income by the IRS. They are prepaid tax credits for your 2020 tax return, authorized by two relief bills passed last year that aimed at stabilizing the struggling U.S. economy in the wake of the pandemic. Because the stimulus payments arent considered income by the tax agency, it wont impact your refund by increasing your adjusted gross income or putting you in a higher tax bracket, for instance.

When it comes to getting paperwork ready, you’ll want to dig up the IRS Notice 1444 for the stimulus payment amount you were issued in 2020. And the second round of payments would be outlined in Notice 1444-B.

Jessica Menton and Aimee Picchi

Follow Jessica on Twitter @JessicaMenton and Aimee @aimeepicchi

Recommended Reading: What If I Filed My Taxes Wrong

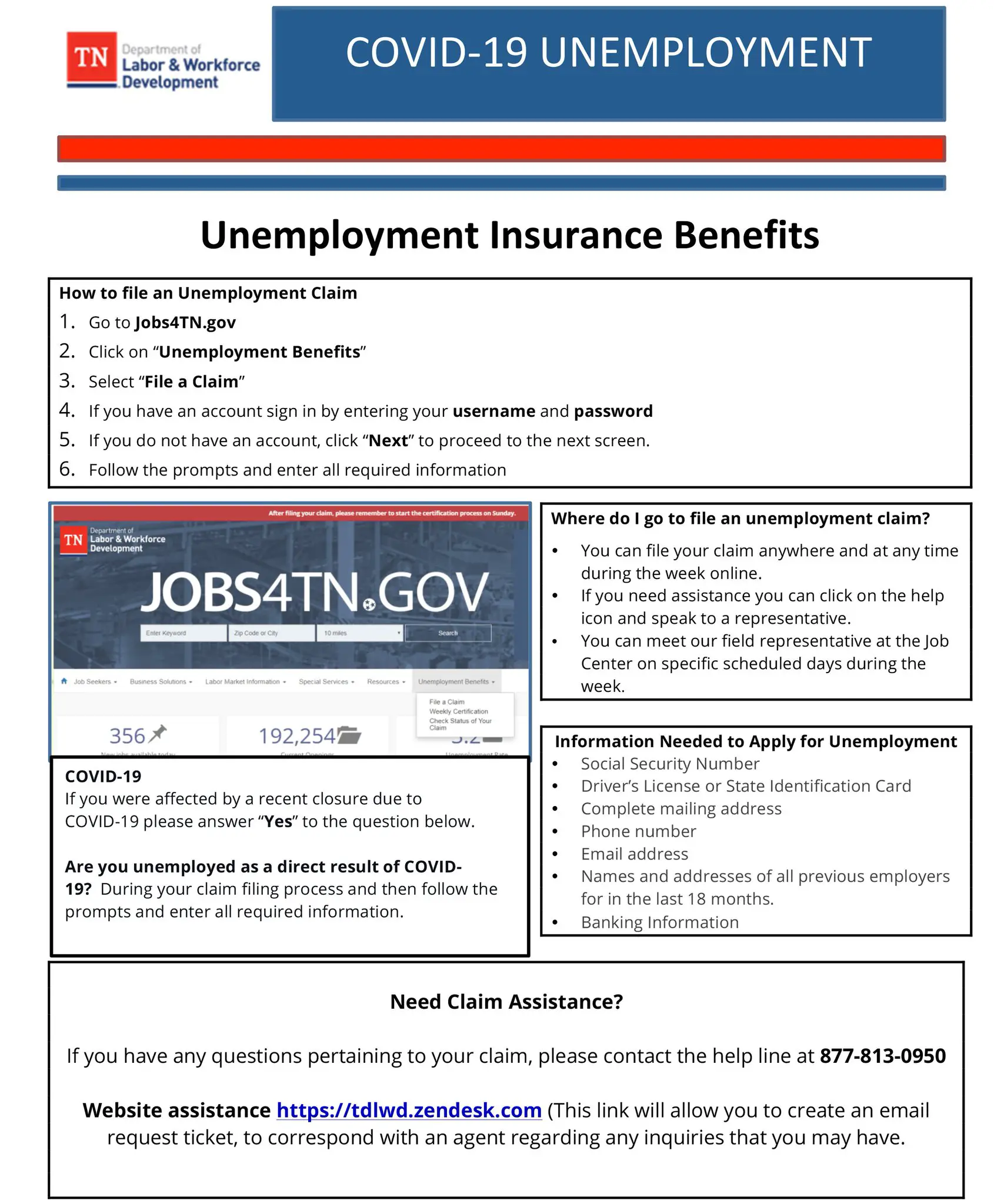

How Do I File A Peuc Claim In Maryland

Connect with IVR System to File Telecerts and More

Donât Miss: Www.njuifile.net 1099

Where Will There Be Tax Headaches

Families who received the monthly advance payments for the child tax credit should plan to take extra time when preparing their own returns or getting the paperwork ready for tax professionals.

The IRS even has posted a special web page calledUnderstanding Your Letter 6419at IRS.gov.

About 36 million families received more than $93 billion in monthly child tax credit payments from July through December 2021.

People, of course, have bad habits and throw away letters they dont understand. IRS letters sometimes dont arrive early enough for some if youre in a rush to file a return in late January or early February.

Make sure you have all of your documents and have received everything rather than rushing off to file, Walker said.

If you rush, you could run into a similar problem that some experienced when dealing with the stimulus payouts for 2020 on the tax returns filed last year. Mistakes happened and delays mounted.

Last year, the IRS ended up manually processing more than 11 million tax returns because of inconsistencies between what people received for the first and second stimulus payments and what they were claiming for the recovery rebate credit.

The National Taxpayer Advocate predicts the IRS will be faced with the daunting task of reviewing millions of returns by hand this year, too, as tens of millions of individuals claim a recovery rebate credit on 2021 returns and the child tax credit.

Read Also: How To File Unemployment On Taxes

Take Out A Personal Loan

Another option to consider if you cannot pay your taxes in full is a personal loan. You may be able to borrow money from family or friends to pay your tax bill.

Many family members and friends may be wary to lend money to you. This has nothing to do with them not trusting you or concerns about your character, but rather a fear of damaging your relationship with them. One option is to consider collateral for that loan. You give them an item of value to hold. If you repay the loan in the timeframe that you promised, they give the item back to you otherwise, they keep the item.

How Do Unemployment Taxes Work

Unemployment Taxes at the Federal Level

At the federal level, your income, including your earnings, salaries, bonuses, etc., is counted and taxed following your federal income tax bracket.

Most income, including wages, is subject to pay-as-you-go taxes. You must pay taxes on your income as you receive it when you receive compensation. As an employee, your federal income and Social Security taxes are typically withheld from a portion of your paycheck. Federal income taxes are not routinely deducted from unemployment benefits like they are from earnings.

Your unemployment compensation is subject to taxation. You have three options for paying your federal taxes: paying the tax in total when its due and paying the projected tax installments every quarter.

Unemployment Taxes at the State Level

You could pay state income taxes on your unemployment benefits and federal income taxes if you reside in a state that levies one.

You wont have to pay state income taxes on your unemployment benefits if your state doesnt have one or doesnt consider them to be taxable income.

Unemployment Taxes at the Local Level

Depending on where you live, your city or county may also tax your unemployment benefits at the local income tax rate. Get in touch with your state, county, or municipal unemployment agency to learn more about local taxes and unemployment benefits.

You May Like: How To Apply For State Tax Extension

Coronavirus Unemployment Benefits And Economic Impact Payments

You may have received unemployment benefits or an EIP in 2020 due to the COVID-19 pandemic.

Unemployment compensation is considered taxable income. You must report unemployment benefits on your tax return if you are required to file.

If you received the EIP, you do not need to report it as income whether youre required to file a tax return or not. If you did not receive some or all of your stimulus payments, you may claim missing stimulus money that you are owed by filing for a Recovery Rebate Credit on your 2020 return.

How Do I File Taxes If Im Unemployed

You file taxes similarly to how youd file if you were employed. Youll still receive your W-2 form from your employer, along with any other tax forms, such as those associated with a severance package or self-employment work. Plus, your state will send you a Form 1099-G for any unemployment you received. All of this income will need to be claimed on your tax return.

Also Check: How To File Quarterly Taxes

Can A Single Mother With No Income File Taxes

Yes, a single mother with a child, but no income, can file a tax return. There is, however, no reason to file a return if you have have no income. … If you have no income of any kind to report on a tax return, then there is no need or reason to file a tax return, with or without a dependent child.

What To Do If You Have Not Filed Taxes

If you havent already filed your 2020 tax return, you can claim the exemption allowed by the American Rescue Plan when you file.

You can find all the information about what benefits you were paid and how much was withheld using Form 1099-G, which you should have received from your state unemployment office by mail or electronically. You may receive separate forms for state unemployment compensation and any federal benefits you received, but you should report all benefits you were paid on your return, according to the IRS.

If you qualify, youll report your total benefits from Form 1099-G separately from the exclusion. Heres how:

Generally, you report your taxes using Form 1040. But when you claim unemployment insurance, you must also complete a Schedule 1 form to report this additional income. Under the new exemption, you should report the total amount of unemployment compensation you received on line 7 of Schedule 1. Then, use the Unemployment Compensation Exclusion Worksheet to determine the exclusion amount youre eligible for, which youll report on line 8 of Schedule 1.

If you work with a tax preparer to file, they should be able to assist you in working out what to report on these forms using IRS guidance. If you file using a tax software, the IRS says these changes should now be reflected in the software you use to prepare electronically.

Recommended Reading: Is There State Income Tax In Tennessee

Take Advantage Of These Tax Breaks Using Turbotax

If you lost your job during the past year, TurboTax can help you make sure you get the deductions and credits you deserve. Well ask simple questions about your situation and guide you to the credits and deductions that will put the most money back in your pocket.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

Recommended Reading: How To Earn Money When Unemployed

File Your Taxeseven If You Didnt Work A Day In 2016

There are a lot of people who believe that because they didnt work last year, they dont have to file taxes, says Flores. But thats a common misconception.

If you collected unemployment benefits, the IRS still considers it taxable income, Flores explains.

If you were unemployed for all or part of 2016, youll receive a Form 1099-G that spells out how much unemployment you need to report on your tax return. What you owe will depend on whether you opted to have taxes withheld from your unemployment benefits.

Most people choose to receive their full unemployment benefits upfront, which makes sense: when youre out of work, you need the moneyespecially if youve depleted your savings. However, if you opted to have taxes withheld, it could offset what you owe, or you could qualify for a tax refund, says Albert.

Dont Miss: How To Report Unemployment Fraud In Ny

Also Check: How To File My Taxes For The First Time

How Much You Have To Make To File Taxes

Your first consideration is: Does my level of earnings mean I must file taxes? If your gross income for 2021 is above the thresholds for your age and filing status, you must file a federal tax return. See the table below.

Income requirements for filing a tax return| Filing status |

|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, nine states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance and FAQs.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

Recommended Reading: When Do You Need To File Taxes 2021

Read Also: How To Do Your Taxes If You Are Self Employed

Do I Have To File Taxes If I Was Unemployed All Of 2018 However I Sold Some Stocks

If your income is over the filing requirement, you do have to file. If you are a dependent, you requirement is $1050. For non-dependents, see below. You have to go by the gross proceeds, not the gain on the stocks.

Single Under 65$12,000

- Under 65 $24,000

- 65 or older $25,300

- 65 or older $26,600

Head of household Under65 $18,000

- 65 or older $19,600

Qualifying widow withdependent child

- Under 65 $24,000

Unemployment Compensation Is Taxable Many Are Just Figuring This Out As They Sit Down To Do Their 2020 Taxes Even Though They Remain Out Of Work

Erika Rose was shocked this month when she sat down to do her taxes and realized she owed $600 to the federal government. She has been on unemployment since April and has spent much of the winter stretching every penny to pay rent and to keep the lights on. On a recent trip to the grocery store, she had only $20 in her bank account.

I was so upset. How do I owe over $600 in taxes? said Rose, 31, who lives in Los Angeles. I have never been so fearful in my life of how Im going to pay my bills.

Rose is among millions of unemployed workers facing surprise tax bills, ranging from several hundred to several thousand dollars, and many say they just cannot pay. For tax purposes, weekly unemployment payments count as income just like wages from a job. But few people realize the money they get from the government is actually taxable. Fewer than 40 percent of the 40 million unemployed workers in 2020 had taxes withheld from their payments, according to the Century Foundation, a left-leaning think tank.

For people who have been without a job for nearly a year, finding money to pay their tax bills is yet another financial burden coming at a fraught time. Advocates for the poor as well as some Democratic lawmakers are trying to get these tax bills waived entirely or at least reduced.

Recommended Reading: Are Lawyer Fees Tax Deductible

Get Your Forms Straight

Your states Department of Labor and Employment will mail you a Form 1099G for the unemployment benefits you received during the year. The form shows the total amount of benefits you were paid in box 1. Unemployment compensation includes Railroad Retirement Board payments. If you requested voluntary federal withholding the amount that was withheld is shown on Form 1099G. You may also choose to have state income tax withheld if your state taxes unemployment benefits.

Although no tax is automatically withheld from unemployment benefits, you can request that 10 percent be withheld for federal income taxes. To do this, fill out a Form W-4V to request voluntary withholding and submit it to your states unemployment office. You can submit another Form W-4V if you change your mind.

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Also Check: How Does The New Child Tax Credit Work