Roll Number Is The Account Number

Make sure the Calgary property tax account number registered in your banks bill payment profile matches the 9-digit property tax roll number shown on your tax bill or statement, entered without spaces or dashes. If an invalid 9-digit roll number is used it may result in a Payment Alignment fee of $25.

Roll number location on a property tax bill

Roll number location on a property tax statement of account

Apply payment to the correct property – check your roll number

The property tax roll number is linked to the property NOT the owner.

When you sell a property, that propertys tax roll number does not follow you to your next property.

Your new property will have its own roll number, which appears on your bill.

You must register your new propertys 9-digit roll number as the account number before making payment. Not changing the roll number registered with your bank will result in your payment being applied to your previous property, not your current bill. If your previous roll number is used to make the payment, it may result in a Payment Alignment fee of $25.

Need a copy of your tax bill? Visit Property Tax Document Request.

Keep your receipt as proof of the date and time of payment.

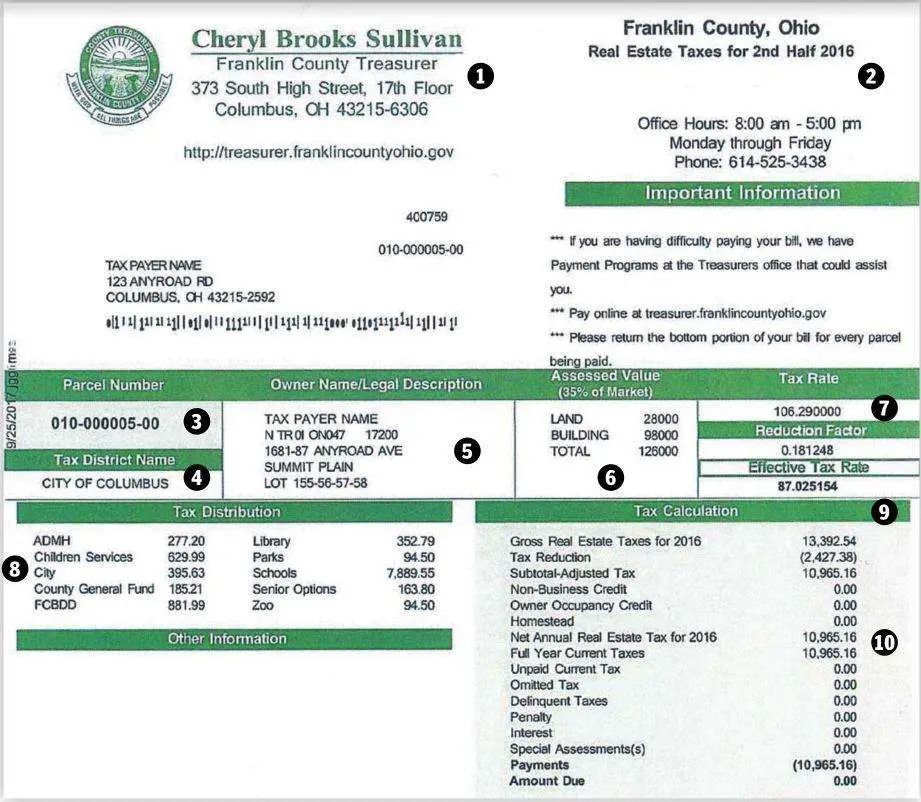

How Do Property Taxes Work

Let’s define a couple of key terms before we get into the details of how property taxes work. First, you must become familiar with the “assessment ratio.” The assessment ratio is the ratio of the home value as determined by an official appraisal and the value as determined by the market. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Wondering how the county assessor appraises your property? Again, this will depend on your countys practices, but its common for appraisals to occur once a year, once every five years or somewhere in between. The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

To put it all together, take your assessed value and subtract any applicable exemptions for which you’re eligible and you get the taxable value of your property.

Example : Increase In Municipal Costs

If your municipality needs more money, your property taxes may increase.

Using the original property values of $125,000, $175,000 and $200,000, an increase in municipal costs to $2,500 increases the overall tax rate to 0.5%.

The total value of the three properties is $500,000 and the cost of services is now $2,500, so the tax rate is 2,500/500,000 = 0.005, or 0.5%. Therefore:

- The owner of the $125,000 property pays 0.5%, or $625.

- The owner of the $175,000 property pays 0.5%, or $875.

- The owner of the $200,000 property pays 0.5%, or $1,000.

- The total of the tax paid by the three property owners is $2,500.

Also Check: What Tax Bracket Are You In

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.;

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

Department Of Real Property Tax Services

2021 Tax Sale Auction:Oswego County Tax Delinquent Property Auction2021-22 School Taxes:school tax collector

- Maintain tax maps that serve as base maps for Geographic Information Systems

- Maintain, implement and administer the GIS system

- Maintain and produce assessment rolls, tax rolls and tax bills

- Process applications for corrected tax billings

- Provide assistance in the enforcement of unpaid taxes

- Provide training for assessors and boards of assessment review members

- Administer special franchise, utilities and special district tax matters

- Provide real property tax exemption administration services

- Administer and maintain the Real Property System NYS software system used by all municipalities in Oswego County

- Provide advisory appraisals to the county and/or the local assessor

- Provide assistance to the general public regarding real property tax matters

- Provide assistance and support to local municipalities in assessment administration matters

- Serve as the clearing house for the collection and distribution of information relating to the assessment of real property

- Serve school districts and local municipalities in the preparation of levy and apportionment data

- Produce and provide Impact Notices and Change of Assessment Notices for all municipalities in Oswego County

- Maintain the RPTS web site with assessment data for consumers and taxpayers

Hours

Also Check: How To Calculate Quarterly Taxes

What Happens If Property Taxes Are Not Paid

Payment of property taxes is a legal obligation of property owners, as taxes are the means by which local residents contribute to the cost of education and local services in their community. Failure to pay taxes result in a loss of revenue, impacting the communitiesâ ability to provide municipal services such as water, sewer, and waste disposal.

In addition, failure to pay outstanding taxes may result in:

- Your property being placed in tax sale

- Further legal action taken by the provincial government

Bcs Homeowner Grant Centralization

B.C. municipalities are no longer accepting home owner grant applications. All property owners must now claim their home owner grants with the Province.

How to apply?

- Apply online at gov.bc.ca/homeownergrant

It is quick, easy and secure. Be sure to have your social insurance number, jurisdiction number for Maple Ridge and your folio / roll number .

Read Also: How To Calculate Payroll Tax Expense

Property Taxes Are Due On July 2 2021

Property tax notices are mailed each year in late May and include a brochure “How to do it all online” . Have you considered going paperless? Register for;Property Account;to access your City accounts information and opt-in to receive next year’s tax bill by email.

City Hall is located at 1435 Water Street, Kelowna BC V1Y 1J4.Our hours of operation are 8;a.m. to 4;p.m. Monday to Friday . In the interest of health and safety,;we recommend;taxpayers;use one of the online payment options to pay property taxes instead of visiting City Hall in person. General enquiries can be emailed to,or sent byservice request.;

The Speculation and Vacancy Tax is a provincial initiative.;For more information, visit the;BC Government’s Speculation Tax website or contact the Provincial office toll-free at .;;

How Do You Find Out Property Taxes By Address

SFGate Home Guides explains that since property taxes are public records, information about the taxes levied on a specific address are obtainable from the local government entity that maintains those records, which is typically the county assessor’s office or recorder’s office. Many localities make this information available online.

Most local governments in the United States levy real estate and personal property taxes on property owners as a primary source of revenue, according to Wikipedia. The locality, typically at the county level of administration, assesses the fair market value of a property. Determination of the tax due is calculated by multiplying the assessed value of the property by the established tax rate. Property taxes are determined annually. The amount of taxes due on a property can fluctuate depending on the estimated value of property due to changes in the housing market, modifications to the property and other factors. Also, tax rates can change from year to year.

Additional supplemental taxes from local municipalities are usually included as part of a property tax bill, according to Wikipedia. In California, for example, a typical property tax bill includes taxes for special assessment districts, emergency services, education funds and other specific purposes.

Don’t Miss: Where Can I Find My Agi On My Tax Return

Payments Must Be Received By The Due Date

Starting 2021, property tax and utility payments must be received by the due date, in our office, to be considered on time.

It is your responsibility to make payments early enough so that we receive them on time. Payments received after midnight on the due date will be considered late. Postmarks are not accepted as proof of on-time payment.

Property Taxes By State

Overall, homeowners pay the most property taxes in New Jersey, which has some of the highest effective tax rates in the country. The states average effective rate is 2.42% of a home’s value, compared to the national average of 1.07%.

With an average effective rate of 0.28%, the least expensive state for property taxes is Hawaii, surprisingly. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there.

Also of note are Colorado and Oregons property tax laws, which voters put in place to limit large taxable value increases. Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern.

Recommended Reading: How To Find Tax Amount

What Is The Education Property Tax Credit Advance How Do I Apply For It

The Education Property Tax Credit is a credit for homeowners and tenants offsetting occupancy costs – property tax for homeowners and 20% of rent for tenants â payable in Manitoba. The Advance is the Education Property Tax Credit applied directly to the municipal property tax statement for homeowners.

The Education Property Tax Credit Advance can only be claimed on a homeownerâs principal residence. The maximum Education Property Tax credit is $700.00. If the EPTCA is not included in you tax bill, you can apply for the credit in the following ways:

- If you notify our office before the printing of the property tax bill for the year, we could directly apply the credit to your tax bill starting in that year.

- If you notify our office after the printing of the property tax bill for the year, you may claim the credit on your personal income tax return for that year and will receive the credit on your property tax bill in subsequent years.

How Much Is My Tax Bill

Your annual tax statement includes the amount of taxes owing as of the date of the statement. If you are making a late payment, you may have been charged with monthly interest. Please contact our office for the up-to-date outstanding amount by toll free number at 1-888-677-6621 or email and remember to include the roll number of the property.

Read Also: What Age Do You Have To File Taxes

How To Find Property Taxes By Address

Property tax records are public information. If you visit the property tax assessor’s office for your county or find the website online, you can look up tax information by address. Learning the quirks of a given website should be the biggest challenge you’ll face.

Read More:How to Find Information on Property Owners for Free

Bc Speculation And Vacancy Tax Due March 31 2021

The Provincial Speculation and Vacancy Tax is part of the BC Governments affordable housing plan. All owners of residential property in Maple Ridge must complete an annual declaration, either by phone or on-line. The information you need will be mailed by mid-February; if you have not received one by late February, please contact the Province.

For information about the tax and the process, please contact:

Don’t Miss: Can I Pay Quarterly Taxes Online

Information In The Files

You can find a surprising amount of information in the property tax records. Here’s some of what Boston, for example, makes available online:

- The type of property: apartment building, condominium, personal residence or retail store

- The size of the lot

- The square footage of the building

- The property owner and mailing address

- The building value and land value

- Any tax exemptions the owners have claimed

- Total tax bill for the current year

- The “parcel number” the assessor uses to identify each parcel of land in county records

Other tax jurisdictions may have information about the most recent sale, the allowed land uses and a description of the buildings on the land.

Your Property Tax Is Proportional To The Value Of Your Property

In this example, a small municipality with three properties worth $125,000, $175,000 and $200,000 has services costs of $2,000 that are paid by property owners through property taxes.

Each property owner in the municipality pays a proportion of that $2,000 based on their property’s assessed value. This is calculated by first adding up the value of all three properties, for a total of $500,000. Since the cost of services is $2,000, the tax rate is 2,000/500,000 = 0.004, or 0.4%. Therefore:

- The owner of the $125,000 property pays $500.

- The owner of the $175,000 property pays;$700.

- The owner of the $200,000 property pays $800.

- The total of the property tax paid by the three property owners is $2,000.

Don’t Miss: How To Get Tax Exempt Status

Welcome To Tarrant County Property Tax Division

Tarrant County has the highest number of property tax accounts in the State of Texas. In keeping with our Mission Statement, we strive for excellence in all areas of property tax collections.;

Our primary focus is on taking care of citizens.; Please complete a blue comment card and drop in the designated location when you visit our offices, or use our electronic form to let us know how we are doing.

Please be aware that there is no fee to apply for exemptions through Tarrant Appraisal District or apply for refunds for overpayment or adjustments to your taxes.; Please contact us if you have questions before paying a third party to assist you.; Texas Attorney General Paxton has issued an alert on misleading tax exemption offers.

Effective Date Of Payment

Property tax payments can be made through most chartered banks, trust companies, credit unions, and Alberta Treasury Branches. Know your bank’s policies regarding the effective date of payment. Its important to pay at least three business days prior to the property tax payment due date to meet the payment deadline and avoid a late payment penalty. Please keep in mind that most bank transactions are based on Eastern Standard Time.

Don’t Miss: Where Do I Get Paperwork To File Taxes

Factors Affecting Your Property Value

There are five major factors that generally account for your property’s;assessed value. Learn more about the five major factors that affect the value of residential properties.

There are other features that may also affect your property’s value to a lesser extent.;Learn; about residential site features.

Your 2021 Property Tax: Important Dates To Know

;2021 is a reassessment year. Provincial legislation states that all property types must be reassessed every four years;so that property values are more;up-to-date, accurate and;fair. In 2021, your property will be reassessed and updated to reflect its assessed value as of January 1, 2019, the legislated;base date used.

Your property’s new 2021 reassessed value will be used as the starting point to calculate your property tax for the next four years 2021-2024. All property types were last reassessed in 2017. Learn more about the 2021 Reassessment.

Spring;2021:;Your 2021 Property Tax Notice,;accompanied by a helpful Guide,;will be mailed out starting the week of May 10.;You may choose to register for the;monthly payment plan to spread your property tax payments out in equal payments over the year.;The 2021;Property Tax and BID Levy Bylaws are approved.

Your 2021;Property Tax payment is due.

Please note:;There is a;Payment Drop Box outside of City Hall’s front entrance;to deposit cheques;.

Can I look up the exact amount I owe for my property taxes using the online Property Assessment & Tax Tool?No. The information found using the Property Assessment Online Tool to search a property;does not contain the full details of a specific tax account; it shows the tax levy in relation to a property’s assessment.

The amount shown does not include other charges such as BIDS, phase-in and special charges. Please call;;;for additional tax-related information you may be looking for.

Read Also: What Can I Write Off On My Taxes For Instacart

Assessor And Property Tax Records Resources

About Assessor and Property Tax Records

Every state has an office that handles the assessment of properties. The name of the office varies by state: Assessor – Auditor – County Clerk – Treasurer – Real Property Taxation and so on. Regardless of name, the responsibility remains the same – determining the value of personal and commercial property for taxation purposes. Property values change with market conditions as well as by physical changes to the property itself that affect the value of land and buildings thereon. Many states offer online access to assessment records that may be searched by property address, property id number and sometimes by owner name. Results may include owner name, tax valuations, land characteristics and sales history. Some states include mapping applications whereby one may view online maps of the property and surrounding areas.

| Search Fannie Mae properties for sale. Search by state, county, city, zip code, price, features or mls number. |