Is The Child Tax Credit The Same As The Earned Income Credit

Child Tax Credit vs. Earned Income Credit. The Child Tax Credit and the Earned Income Tax Credit are not mutually exclusive. If you meet the requirements for dependent children and income, you can claim both on your tax return.

When do you get the additional child tax credit?

The Additional Child Tax Credit Beginning With Tax Years After 2017: The Additional Child Tax Credit is up to 15% of your taxable earned income over $2,500. For example, if you have three children: If your earned income was $29,500, the additional credit would apply to $27,000 .

Whats the difference between the child and dependent care tax credit?

The other creditthe child and dependent care tax creditoffers relief to working people who must pay someone to care for their children or other dependents.

People Who Are Eligible For The Full Credit Amount

These people are eligible for the full 2021 Child Tax Credit for each qualifying child:

- Families with a single parent with income of $112,500 or less.

- Everyone else with income of $75,000 or less.

For the 2021 Child Tax Credit, the age of each qualifying child whether they were older or younger than 6 years old at the end of 2021 will determine the Child Tax Credit amount that their parents or guardians are eligible to receive.

Description Of The Child Tax Credit

Child Tax Credit and Additional Child Tax Credit

The federal Child Tax Credit is worth up to $2,000 for each qualifying dependent child under 17 claimed on the familys tax return and is used to offset any federal income tax owed for the year. A familys income level determines the exact amount. Earnings be at least $2,500 to qualify for the CTC. The credit phases out for income above $200,000 for single filers and $400,000 for joint filers.

If the credit exceeds the taxes owed, families may receive a refund of up to $1,400 per child known as the additional child tax credit or refundable CTC. The ACTC is limited to 15% of earnings above $2,500.

Certain dependents who are not eligible for the CTC can receive a nonrefundable credit of up to $500 for each qualifying dependent.

Empire State Child Credit

The Empire State child credit is a refundable credit available to full-year New York State residents who have at least one qualifying child who is at least 4 years old and under 17, who meet income limitations.

For taxpayers who claim the federal child tax credit, the Empire State child credit is $100 for each child or 33% of the federal credit, whichever is greater. Taxpayers who dont claim the federal credit can claim $100 for each child.

Recommended Reading: Do You Need Previous Tax Return To File

Qualifying For The Child & Dependent Care Tax Credit

Qualifying Filer

- Federal and NYS Child and Dependent Care Tax CreditTo qualify an individual must have earned income in the tax filing year, must file as single, head of household, qualifying widow, or married filing jointly. The filer must have reported expenses for the care of a qualifying dependent who has been living with the filer for more than 6 months. For the purpose of the CDCC, qualifying dependents include:

- Children under age 13, or

- A spouse who is physically or mentally unable to care for him or herself, or

- A dependent who is physically or mentally unable to care for him or herself and for whom the taxpayer can claim an exemption.

Qualifying Expenses

Claimants must have child and/or dependent care expenses that are work-related to qualify for the credit. Expenses are considered work-related if:

- Such expenses allow the claimant to work or look for work, and

- The expenses are for a qualifying persons care

Qualifying Provider

Citizenship/Immigration Requirements

Workers must be U.S. citizens or lawfully residing immigrants who can lawfully work in the U.S.

Residency

Assets/Resources

Income

Get This Year’s Expanded Child Tax Credit

File your taxes to get your full Child Tax Credit now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U.S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their childrens development and health and educational attainment.

learn more about the expanded child tax credit

Read Also: Is It Too Late To Do My Taxes

Tips For Saving On Your Taxes

- A financial advisor can help you optimize your tax strategy for your familys needs. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To make sure you dont miss a credit or deduction that you qualify for, use a good tax software. SmartAsset evaluated common tax filing services to find the best online tax software for your specific situation.

Am I Eligible For The Ctc

There are three main criteria to claim the CTC:

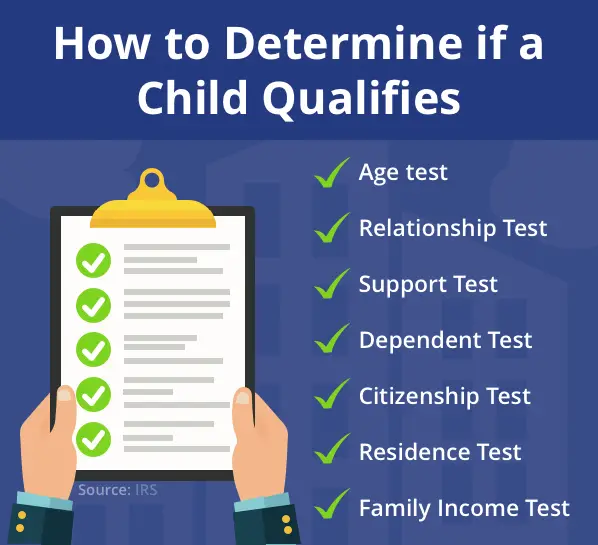

To claim children for the CTC, they must pass the following tests to be a qualifying child:

Recommended Reading: Where To Mail Your Federal Tax Return

How To Claim And Track Your Child Tax Credit

Heres what you need to know about claiming your credit. Eligible filers can claim the CTC on Form 1040, line 12a, or on Form 1040NR, line 49. To help you determine exactly how much of the credit you qualify for, you can use the Child Tax Credit and Credit for Other Dependents Worksheet provided by the Internal Revenue Service. If you need to file a return for a year before 2018, you can only claim the credit on Forms 1040, 1040A or 1040NR.

Eligible recipients who did not receive the right amount or nothing at all should verify their information on the IRS Child Tax Credit Update Portal. For cases where the portal shows that payment has already been disbursed but not received, a trace or inquiry to locate funds can be filed by mailing or faxing Form 3911 to the agency.

There could be a payment delay depending on the disbursement method. The IRS says that it can trace payments:

- 5 days after the deposit date and the bank says it hasnt received the payment

- 4 weeks after the payment is in the mail by check to a standard address

- 6 weeks after the payment is in the mail, and you have a forwarding address on file with the local post office

- 9 weeks after the payment is in the mail, and you have a foreign address

The agency updates its frequently asked questions page with information about Child Tax Credit payments and posts notifications about delays.

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Recommended Reading: When Are Individual Tax Returns Due

Child And Dependent Care Tax Credit

You can claim this credit if you have earned income and if youre paying someone else to care for a dependent. Unlike the CTC, which you can only claim if youre the parent or guardian of minor children, you can claim the CDCTC for aging parents and other disabled relatives. Qualifying dependents for the CDCTC include the following:

- Children who are 12 or younger at the end of the tax year

- Dependent adult family members or spouses who are not able to care for themselves due to mental or physical impairments, unless they had gross income of $4,300 or more

With the CDCTC, you can claim a credit from 35% to 50% of qualified care expenses for tax year 2021 . The exact percentage that you are eligible to deduct depends on your income level. The maximum amount of care expenses to which you can apply the credit is $8,000 in 2021 if you have one dependent and $16,000 if you have more than one dependent. That means 35% of the credit is $2,800 with one dependent and $5,600 with multiple. The CDCTC is non-refundable. According to the IRS, expenses that qualify for the CDCTC include money that you paid for household services and care of the qualifying person while you worked or looked for work. Child support payments do not qualify. To claim the CDCTC, you need to fill out Form 2441.

Consequences Of A Ctc

An error on your tax form can mean delays on your refund or on the CTC part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

-

You must pay back any CTC amount youve been paid in error, plus interest.

-

You might need to file Form 8862, “Information To Claim Certain Credits After Disallowance,” before you can claim the CTC again.

-

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

Read Also: Do You Pay Taxes On Unemployment

Us Citizen Or Resident Alien

To claim the EITC, you and your spouse must be U.S. citizens or resident aliens.

If you or your spouse were a nonresident alien for any part of the tax year, you can only claim the EITC if your filing status is married filing jointly and you or your spouse is a:

- U.S. Citizen with a valid Social Security number or

- Resident alien who was in the U.S. at least 6 months of the year youre filing for and has a valid Social Security number

How To Claim Child Tax Credit

Even if they dont typically file a federal tax return, taxpayers may still be able to claim the Child Credit. A taxpayer must submit Form 1040 in order to claim the Child Tax Credit . A taxpayer must also include Schedule 8812. .

A taxpayers eligibility for the Child Tax Credit and the amount of additional taxes that could be due if they received more advance child tax credits than they actually needed are determined using Schedule 8812.

Recommended Reading: How To Do State Taxes For Free

The Maximum Child Tax Credit That Parents Can Receive Based On Their Annual Income

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than:

- $150,000 for a person who is married and filing a joint return

- $112,500 for a family with a single parent and

- $75,000 for a single filer or a person who is married and filing a separate return.

Parents and guardians with higher incomes may still receive a partial payment. Eligible parents and guardians receive a maximum of $3,000 for each qualifying child who was between the ages of 6 and 17 at the end of 2021. Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of $3,600 per child. Children who attend college are qualifying children for the Child Tax Credit if they meet the age and other requirements described in the next section.

Dependent children age 18 and older can qualify their parents for the $500 Credit for Other Dependents. For more information about the Credit for Other Dependents, see the Instructions for Schedule 8812 .

If you do not qualify to receive the maximum amount, use the Get your Child Tax Credit tool to estimate how much you should receive.

Social Security Numbers And Individual Taxpayer Identification Numbers

You and your spouse, if married and filing a joint return must have either a Social Security Number or an Individual Taxpayer Identification Number issued by the Internal Revenue Service to be eligible to claim the Child Tax Credit.

In order for you to qualify for the Child Tax Credit, your child must have an SSN that is valid for employment. An SSN is valid for employment if your child is able to legally work in the United States, even if they are currently too young to work or do not work.

If your childs Social Security card has the words NOT VALID FOR EMPLOYMENT on it then you cannot claim the Child Tax Credit for them. If those words do not appear on your childs Social Security card, and their immigration status hasnt changed since it was issued, then your childs SSN is valid for employment.

If your child is not a qualifying child for the Child Tax Credit, you may be able to claim the $500 Credit for Other Dependents for that child when you file 2021 your tax return. For more information about the Credit for Other Dependents, see the Instructions for Schedule 8812 .

Heres how to get an ITIN if you do not currently have one.

Recommended Reading: Do Seniors On Social Security Have To File Taxes

If You’re A Foster Carer

You cant claim child tax credits for a foster child if you get a fostering allowance, or the childs maintenance or accommodation is paid for by someone other than yourself.

If you arent sure, call the tax credits helpline to check.

HM Revenue and Customs tax credits helpline

Telephone: 0345 300 3900

Relay UK – if you can’t hear or speak on the phone, you can type what you want to say: 18001 then 0345 300 3900

You can use Relay UK with an app or a textphone. Theres no extra charge to use it. Find out how to use Relay UK on the Relay UK website.

If you’re calling outside of the UK: +44 2890 538 192

Monday to Friday, 8am to 6pm

Telephone : 0300 200 1900

Monday to Friday, 8.30am to 5pm

Your call is likely to be free of charge if you have a phone deal that includes free calls to landlines – find out more about calling 0345 numbers.

Checking Youre Below The Income Limit

You dont need to be working to claim child tax credits, but if you are you need to earn less than a certain amount.

The amount you can earn depends on your circumstances. HMRC looks at things like:

- the number of hours you work

- how many children you have

-

if youre a single parent

If you’re 18 or over, you can use the Turn2us benefits calculator to check if you can get child tax credits.

Also Check: Can I Do My Taxes Myself

Child Tax Credit Changes From Prior Years

The Child Tax Credit has not had any changes for 2020 compared with 2019. However, the Child Tax Credit changed dramatically when the Tax Cuts and Jobs Act of 2017 were enacted. Starting in the tax year 2018, the Child Tax Credit increased from $1,000 per qualifying child to $2,000 per qualifying child and the income limits for qualifying for the credit were raised significantly.

Northwest Territories Child Benefit

This benefit is a non-taxable amount paid monthly to qualifying families with children under 18 years of age.

You may be entitled to receive the following monthly amounts:

Children under the age of 6:

- $67.91 for one child

- $163.00 for four children

- $24.41 for each additional child

If your adjusted family net income is above $30,000, you may get part of the benefit.

These amounts are combined with the CCB into a single monthly payment.

This program is fully funded by the Northwest Territories.

Recommended Reading: How Are Revocable Trusts Taxed

The Expansion Will Help Workers And Children For Whom The Pandemic Has Exacerbated Financial Need

The expansion of the EITC and CTC particularly targets demographics that have been most severely affected by the pandemic, including children, low-wage workers, young adults, and people of color.

It is well-established that low-wage workerswho are disproportionately women and people of colorhave experienced the brunt of the pain of the pandemic economy.21 This is in part due to the ways that systemic racism, sexism, and other forms of marginalization have concentrated workers with the least economic and political power into sectors where jobs are underpaid and undervalued. However, a study from the Bureau of Labor Statistics finds that the concentration of low-wage workers in low-wage sectors does not entirely explain the disparities: Across a larger variety of industries, the most poorly compensated workers have suffered disproportionately.22 That same study found that low-wage workers who remained employed during the pandemic also experienced an increased probability of working part time for economic reasons, further limiting their earnings.