More Answers: Premium Tax Credits

- My eligibility results say Im also eligible for “cost-sharing reductions.” What does that mean?

-

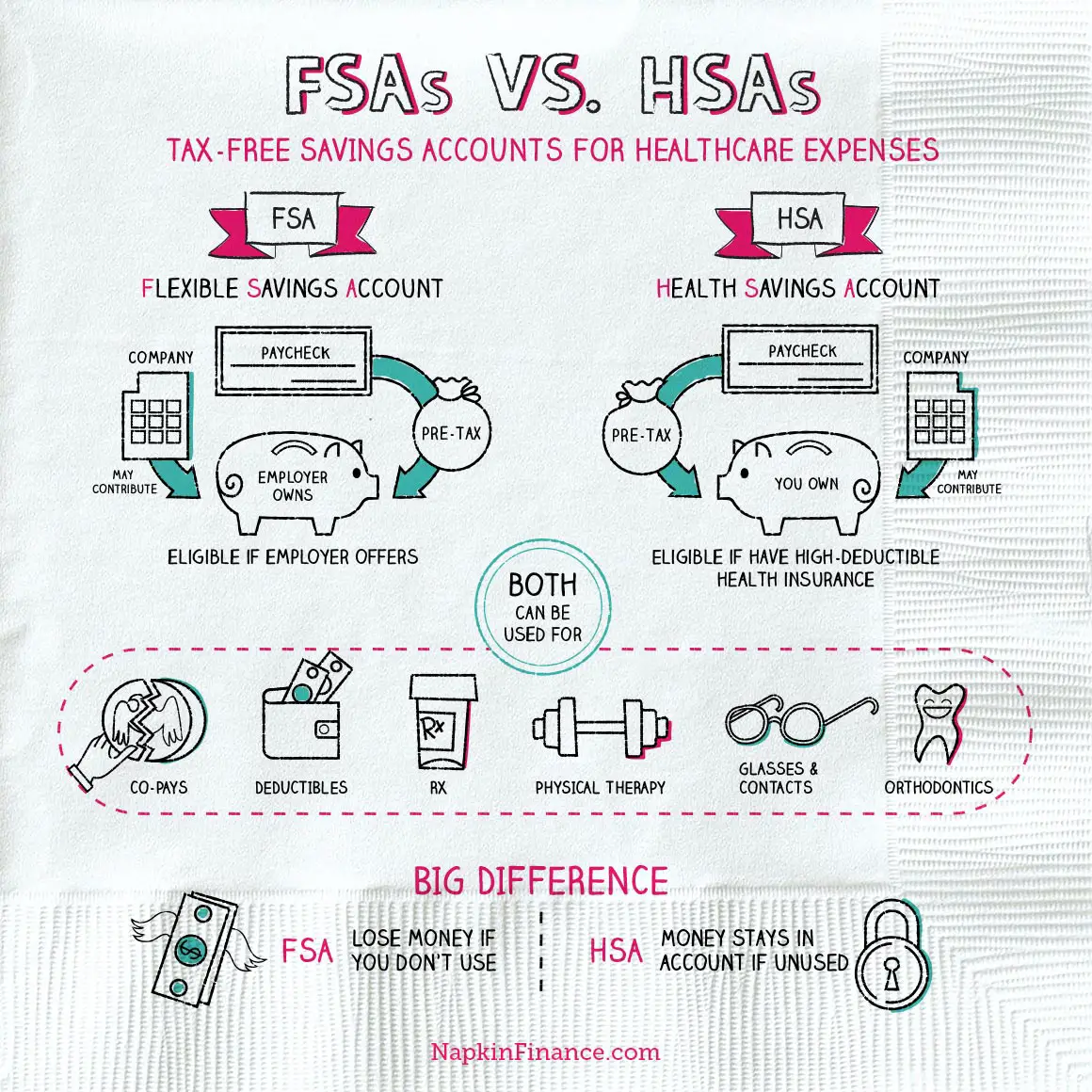

In addition to a premium credit, your income qualifies you to save on the out-of-pocket costs you pay whenever you get health care, like deductibles and copayments. But you get these additional savings only if you buy a plan in the Silver category. Learn about cost-sharing reductions.

- What if my income is too high for a premium tax credit?

-

You can still use the Marketplace to buy a health plan without a premium tax credit. You can also buy a plan outside the Marketplace, where you may find more options.

Live Your Best Life Colorado Weve Got You Covered

Apply for savings

- your familys estimated annual income.

You can use the financial help in two different ways:

If you take the financial help in advance, the amount of the tax credit you use should be based on your estimated gross income for the year youre getting coverage, not last years income.

What If I Had Multiple Types Of Coverage

On the other hand, maybe you had multiple types of health insurance coverage last year. How does this affect your taxes?

For instance, its not uncommon or illegal to have two different health insurance plans. You may have both a primary and a secondary insurance plan. In this case, the secondary plan processes a claim for whatever the primary plan doesnt cover.

Why might someone have two health insurance plans? If, for example, you are covered under both of your parents plans, the primary insurance will be the one belonging to the parent whose birthday comes first in the calendar year. Or if you also have an employer plan, the parents insurance plan may fall in line as secondary.

Another common situation is when youre married and both you and your spouse have an employer-sponsored plan. In that case, the primary plan is your employers, and your spouses plan picks up the secondary role.

Or you might have a primary insurance plan but also quality for Medicaid. So Medicaid becomes your secondary insurance plan. One benefit of having multiple plans is that all or a large part of your medical bills are more likely to be paid for between both plans.

However, you still need to pay some out-of-pocket costs and meet each plans deductible before being covered. And when it comes to how multiple types of health insurance coverage affect your taxes, it will depend on the type of plan and your premium tax credit status.

Recommended Reading: How Much Will My Llc Pay In Taxes

When Your Income Changes So Does Your Premium Tax Credit

If your income changes, or if you add or lose members of your household, your premium tax credit will probably change too.

Its very important to report income and household changes to the Marketplace as soon as possible.

- If your income goes up or you lose a member of your household: Youll probably qualify for a lower premium tax credit. You may want to reduce the amount of tax credit you take in advance each month. This way you dont wind up taking more credits than you qualify for.

- If your income goes down or you gain a household member: Youll probably qualify for a bigger premium tax credit. You may want to increase the amount of tax credit you take in advance so you have a lower premium bill each month.

Note: If your income is within a certain range, you may be able to enroll in or change Marketplace coverage through a new Special Enrollment Period based on estimated household income. Learn more..

IMPORTANT

If at the end of the year youve taken more advance payments of the premium tax credit than youre eligible for, you may have to pay money back when you file your federal income tax return. This is called reconciling the advance payments of the premium tax credit and the actual premium tax credit you qualify for based on your final 2023 income.

- Learn more about the premium tax credit from the Internal Revenue Service.

Heres How Aca Subsidies Work In A Nutshell

If you think you qualify for subsidies, apply for insurance through the government-sponsored marketplace . Subsidies are only available through the exchange.

Estimate how much income you think youll have for the year and youll receive a subsidy based on your income level and other factors. This subsidy is actually an estimated amount that the government pays to the insurance company on your behalf.

Next year when you file your taxes, you may have to pay back some or all of the subsidy if it turns out you made more income than you estimated or otherwise dont qualify.

Recommended Reading: 8448679890

Read Also: Where’s My State Taxes

How Does The Healthcare Tax Credit Work

A tax credit you can use to lower your monthly insurance payment when you enroll in a plan through the Health Insurance Marketplace®. Your tax credit is based on the income estimate and household information you put on your Marketplace application.

- A health insurance tax credit can reduce the amount you spend on insurance plans purchased through Healthcare.gov or a state marketplace. You must meet income criteria to qualify. Discounts can be applied monthly, reducing your health insurance bill, or you can receive the credits as a refund when filing your annual income taxes.

Expert Advice About Tax Credits

Youre probably wondering who qualifies for a tax credit. The government figures out who will qualify based on household income, household size, and age of household members. About 26 million Americans will qualify for health insurance tax credits. Generally, you are not eligible if your employer provides you affordable health insurance that includes a certain amount of coverage. Affordable is a key word theres actually a specific measurement for it under the Affordable Care Act . Be sure to ask your employer for more details. One more thing: If youre eligible for Medicare or Medicaid, youll probably get your health coverage through those programs. People covered under Medicare or Medicaid typically dont qualify for tax credits.

If you do qualify, how do you find out how much youll get? To predict your tax credit, go to an online estimator, like the one here on GetInsured. Youll be asked to provide your estimate of household income. Youll also be asked how many people are in your household, and how old they are. It takes only a minute or two to find out whether youre likely to be eligible for tax credits or any other government assistance.

How the tax credit works

Health insurance tax credits help people pay their monthly health insurance premiums. Credits are paid in one of three ways:

1. The government can pay the tax credit directly to your insurance company up front.

This means youll pay less of your monthly premium.

Read Also: Who Can Claim Education Tax Credit

Who Qualifies For The Aptc

People who buy health insurance through Healthcare.gov or their state insurance marketplace can qualify for the advance premium tax credit based on their income.

You arent eligible for the credit if you can be claimed as a dependent on another persons tax return or if you use the married filing separately filing status. You also cant receive this credit if you get health insurance in another way, such as Medicare or through your job.

How Do I Apply For The Premium Tax Credit Health Insurance Subsidy

Apply for the premium tax credit through your states health insurance exchange. If you get your health insurance anywhere else, you cant get the premium tax credit.

If you’re uncomfortable applying on your own for health insurance through your state’s exchange, you can get help from a licensed health insurance broker who is certified by the exchange, or from an enrollment assister/navigator. These folks can help you enroll in a plan and complete the financial eligibility verification process to determine whether you’re eligible for a subsidy.

If you’re in a state that uses HealthCare.gov as its exchange , you can use this tool to find an exchange-certified broker who can help you pick a health plan. If you already know what plan you want and just need someone to help you with the enrollment process, there are also navigators and enrollment counselors who can assist you, and you can use the same tool to find them. If you’re in a state that runs its own exchange, the exchange website will have a tool that will help you find enrollment assisters in your area .

Read Also: How Do I Find Out My Property Taxes Paid

How Does The Health Insurance Premium Tax Credit Work

Also known as an Advanced Premium Tax Credit, this tax credit can beused to lower the health insurance premium costs of Washington HealthplanfinderQualified Health Plans. If you are eligible this tax credit gives you the option to either lower the amount of yourmonthly health insurance premium payment or have a lump sum deductionwhen you file your annual income tax return. The tax credit is availablefor individuals and families whose income is between 138-400 percent ofthe federal poverty level. To check if you qualify, click “Shop fora Health Plan” from the Washington Healthplanfinder homepage.

You can use your Health Insurance Premium Tax Credit in one of the followingways:

Monthly – You can use some orall of your tax credit in advance to lower the cost of your monthly premium.

Pros: Your health plan costs willbe less each month.

Cons: You may owe money at tax filingtime if your current household income increases.

Annually – You can claim yourtax credit on your annual tax return, which will reduce what you owe orincrease your refund.

Pros: You have no risk of havingto repay at tax filing time.

Cons: Your health plan costs willbe more each month.

Your Health Insurance Premium Tax Credit will be sent directly fromthe Internal Revenue Service to the health plan carrier. If youchoose to take advantage of this tax credit, you must file taxes. Youwill use the 1095-A Statment that you receive from Washington Healthplanfinderwhen you file your taxes.

Two Things To Know About This Government Tax Program:

You May Like: Which States Freeze Property Taxes For Seniors

How Does The Tax Credit Work For Health Insurance

Find Cheap Health Insurance Quotes in Your Area

A premium tax credit can reduce your monthly health insurance cost. It’s only available for those who purchase insurance through a state or federal health insurance marketplace, and you must meet income and family size criteria to qualify. You’ll learn if you are eligible when you apply for a marketplace health insurance plan.

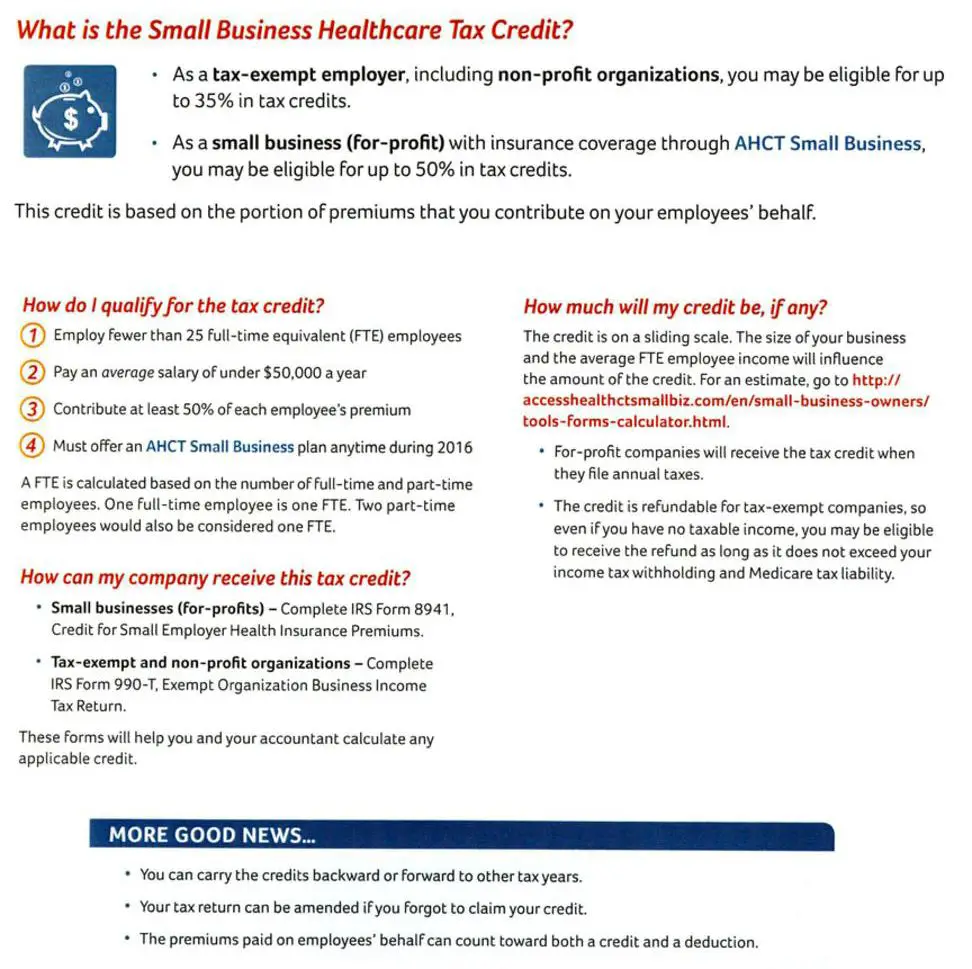

If you own a small business with fewer than 25 employees, you may also qualify for government subsidies, which can help pay for your employees’ health insurance.

Taxes And Health Care

How does the tax exclusion for employer-sponsored health insurance work?

The exclusion lowers the after-tax cost of health insurance for most Americans.

Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. Additionally, the portion of premiums employees pay is typically excluded from taxable income. The exclusion of premiums lowers most workers tax bills and thus reduces their after-tax cost of coverage. This tax subsidy partly explains why most American families have health insurance coverage through employers. Other factors play a role though, notably the economies of group coverage.

ESI Exclusion is worth more to taxpayers in higher tax brackets

Because the exclusion of premiums for employer-sponsored insurance reduces taxable income, it is worth more to taxpayers in higher tax brackets than to those in lower brackets. Consider a worker in the 12 percent income-tax bracket who also faces a payroll tax of 15.3 percent . If his employer-paid insurance premium is $1,000, his taxes are $254 less than they would be if the $1,000 were paid as taxable compensation. His after-tax cost of health insurance is thus $1,000 minus $254, or $746. In contrast, the after-tax cost of a $1,000 premium for a worker in the 22 percent income-tax bracket is just $653 . Savings on state and local income taxes typically lower the after-tax cost of health insurance even more.

ESI Exclusion is costly

Recommended Reading: When Will We Get The 3000 Child Tax Credit

Explaining Health Care Reform: Questions About Health Insurance Subsidies

Health insurance is expensive and can be hard to afford for people with lower or moderate income, particularly if they are not offered health benefits at work. In response, the Affordable Care Act provides for sliding-scale subsidies to lower premiums and out-of-pocket costs for eligible individuals.

This brief provides an overview of the financial assistance provided under the ACA for people purchasing coverage on their own through health insurance Marketplaces .

Am I Eligible For Premium Tax Credits And Csrs

To be eligible for a CSR, you must:

- be within 100-250% of the Federal Poverty Level.

- lack affordable coverage through an employer.

- be ineligible for Medicaid or Childrens Health Insurance Program .

- be a U.S. Citizen .

- file taxes jointly, if married.

To be eligible for a premium tax credit, you must:

- be within 100-400% of the Federal Poverty Level.

- lack affordable coverage through an employer.

- be ineligible for Medicaid or Childrens Health Insurance Program .

- be a U.S. Citizen .

- file taxes jointly, if married.

Other factors that weigh into your eligibility include:

- cost of available insurance coverage.

- where you live.

- your family size.

Don’t Miss: Do I Need W2 To File Taxes

Overview Of The Premium Tax Credit

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series .

The health insurance premium tax credit is part of the Affordable Care Act . Itâs often referred to as a premium subsidy, and itâs designed to help make health insurance premiums more affordable for middle and low-income people.

But the terms âlow-incomeâ and âmiddle classâ are subjective. To clarify, premium tax credits are normally available for people with household incomes as high as 400% of the poverty levelthat amounted to $103,000 for a family of four in the Continental U.S. in 2020. But for 2021 and 2022, the American Rescue Plan has removed the upper income cap for subsidy eligibility, meaning that some households with income well above 400% of the poverty level can qualify for premium subsidies.

Most people who buy their coverage through the ACAâs health insurance exchanges are receiving premium subsidies. And for enrollees who receive subsidies, the subsidies cover the majority of the monthly premiums.

The premium subsidy is often referred to as âthe ACA subsidy,â but thereâs another ACA subsidy that applies to cost-sharing and shouldnât be confused with the premium tax credit.

Donât Miss: Shoprite Employee Benefits

Questions And Answers On The Premium Tax Credit

Q1. What is the premium tax credit?

A1. The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of your premium tax credit is based on a sliding scale. Those who have a lower income get a larger credit to help cover the cost of their insurance. When you enroll in Marketplace insurance, you can choose to have the Marketplace compute an estimated credit that is paid to your insurance company to lower what you pay for your monthly premiums . Or, you can choose to get all of the benefit of the credit when you file your tax return for the year. If you choose to have advance payments of the premium tax credit made on your behalf, you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return for the year. Either way, you will complete Form 8962, Premium Tax Credit and attach it to your tax return for the year.

Note: For tax year 2020 only, you are not required to attach Form 8962 with your 2020 tax return unless your PTC is more than the APTC paid on your behalf for 2020 and you are claiming net PTC. See link below for information specific to tax year 2020.

See the Coronavirus Tax Relief section on this page for information specific to tax year 2020.

Q2. What is the Health Insurance Marketplace?

Read Also: Where’s My Unemployment Tax Refund

Advance Premium Tax Credits

If you enroll in a Vermont Health Connect qualified health plan you may be eligible for financial helpincluding the premium tax credit . You may get PTC if you meet other eligibility rules. You must file federal taxes to get premium tax credits.

If youre eligible for premium tax credits, you can choose to take them:

Many Vermonters take premium tax credits in advance to lower monthly health insurance premiums. When you take the tax credit in advance its called advance premium tax credits, or APTC. The amount of APTC you will get is based on your projected income for the year. Once you choose how much of your APTC you want to use, it comes out of your health insurance premium automatically. For example, if your total insurance premium is $500 per month and you choose to use $400 per month of the APTC amount you are eligible for, your monthly bill is $100 per month .

IMPORTANT: The amount of APTC you can use may change if your income or your tax household size changes. Read on to learn more.