How Does This Tax Credit Work

The tax credit is not a cash rebate or refund, but instead reduces the amount of federal taxes you owe in the year you purchase the EV. It should be noted that if you do not have a tax liability the year you purchase the vehicle, you will not get the credit in another format. For example, if you buy an EV eligible for the full $7,500 but owe only $6,000 of taxes that year, you will receive a tax break for $6,000 only.

That said, different states have different initiatives, so do your research for specific details.

Ev Tax Credit Restrictions

The IRA will soon require the EVs and PHEVs to be assembled in North America to be eligible for the tax credit. Refer to the Department of Energys Alternative Fuels Data Center for a list of EVs that should meet the new assembly requirements.

Unfortunately, this can get complicated because even within a given model, the location where vehicles are assembled can vary. Therefore, we recommend using a VIN decoder to verify where the vehicle was assembled. In addition, there will also be new qualifications on where major vehicle components originate that even Tesla and General Motors might have difficulties meeting. And starting in 2024, there will be additional requirements for where the batteries are manufactured and where the materials originated.

In an effort to make the tax credits primarily available to people with low to moderate incomes, there are some additional restrictions. Soon, new electric SUVs, pickups, and vans cannot exceed $80,000, and sedans, wagons, hatchbacks, and other vehicles cannot exceed $55,000 to qualify. Also, there are personal income limits for qualifying for the EV tax credit of $300,000 for couples and $150,000 for individuals.

What Is The Electric Car Tax Credit

To encourage sales of plug-in electric vehicles, also known as electric cars or EVs, the federal government began offering a federal income tax credit in 2010 for eligible electric vehicles purchased after Dec. 31, 2009. The amount of the tax credit cant exceed $7,500 per vehicle.

Several factors can affect the amount of the tax credit for an eligible vehicle, but here are two.

1. Battery capacity You can look up the tax credit associated with a specific make and model with this handy guide.

2. Tax obligation The credit is nonrefundable, so while it could drop your federal tax liability to zero, it wont contribute to a potential tax refund. For example, if the tax credit for a Kia 2019 Niro EV is $7,500, but your federal tax obligation for the tax year in which you bought the car is only $4,500, youd only be able to claim a tax credit of $4,500.

Keep in mind that a tax credit is not a rebate you wont receive cash back or a discount when you buy the car. After you purchase your EV, youll have to complete and file IRS Form 8936 with your federal tax return to claim the credit. If youre not sure how to complete the form, ask a tax professional.

Read Also: When Do Llc File Taxes

Heres Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit

As sales of electric vehicles continue to surge, many new and prospective customers have questions about qualifying for federal tax credit on electric vehicles, especially now that a slew of new credits have been reinstated to US consumers.

Whether you qualify is not a simple yes or no question well, actually it sort of is, but the amount you may qualify for varies by household due to a number of different factors. Furthermore, there are other potential savings available to you that you might not even know about yet.

Luckily, we have compiled everything you need to know about tax credits for your new or current electric vehicle into one place. The goal is to help ensure you are receiving the maximum value on your carbon-conscious investment because, lets face it, youve gone green and you deserve it.

Do States Offer Ev Tax Credits

Yes, some States do offer EV tax credits too. You can find out what is available to you on this website from the U.S. Department of Energy, Alternate Fuels Data Center. In some cases, localized incentives are offered by electricity companies in the form of rebates.

Now that you understand how do EV tax credits work, you can start researching the best electric vehicles to buy. Check out our EV Comparison tool. We simplify the research for you so you can focus on what matters most. Also, please stay tuned for more posts in our Frequently Asked Questions series to bring you answers to commonly asked questions for Electric Vehicles.

Don’t Miss: How Much Is The Gas Tax In California

Can You Really Get A $7500 Electric Car Tax Credit

Yes, it is absolutely possible. But your tax credit will be based on what vehicle you decide to purchase. Once you purchase your car, youâll simply file form 8936 with your tax returns. That tax credit will be applied to the year you file.

Generally, you need to apply for the tax credit the year you purchase the vehicle. However, in some cases, you may be able to amend your tax return.4 So, if youâve purchased an electric vehicle recently or are planning to purchase one, you could end up with a hefty tax refund check in the mailâor pay a lot less than you otherwise would have.

The IRS has all the eligibility details. And a tax professional can always help you make the right decision about filing your tax return.

Will This Change Anytime Soon

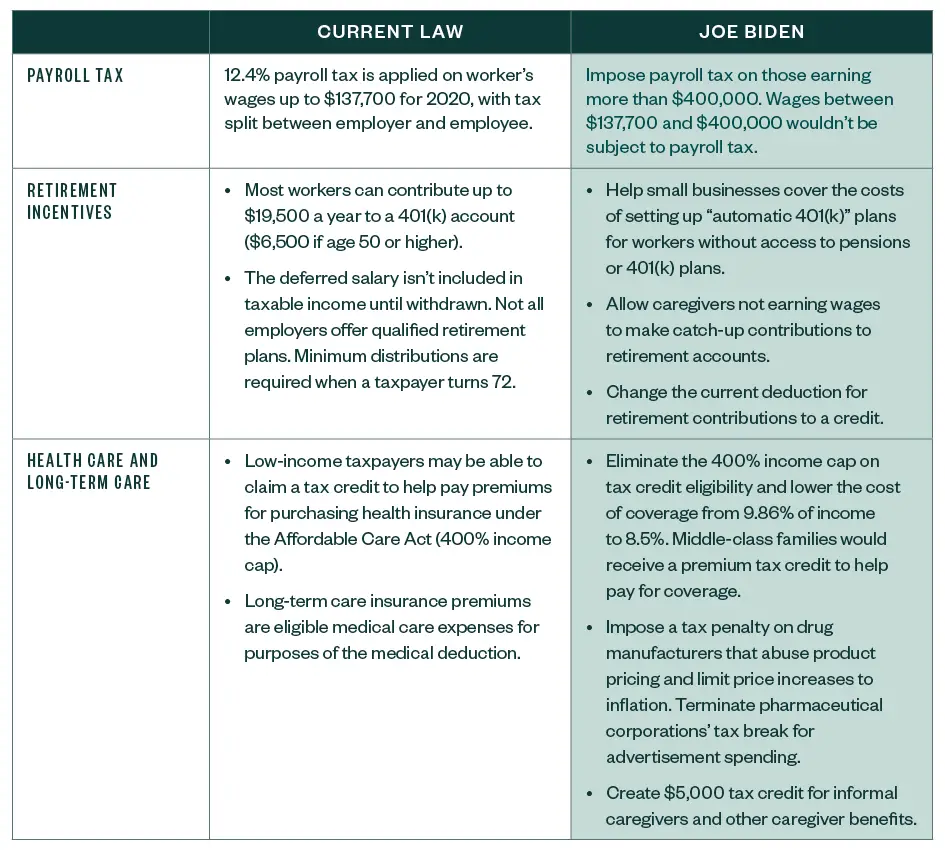

Maybe. Joe Biden has floated introducing a point-of-sale rebate for EVs, meaning buyers would get an up-front discount rather than a tax-time credit. Some Democratic lawmakers want to increase the credit and eliminate the 200,000-unit rule, which would bring Tesla and GM’s popular vehicles back into play.

There’s also been talk of creating price and income caps. As it stands now, a surgeon who buys a $160,000 Bentley Bentayga Hybrid gets the same credit as a teacher who picks up a $27,400 Nissan Leaf.

Biden has talked a big game about aggressively pushing the US toward an electric future. So there’s reason to believe he will work to make the EV tax credit more effective and equitable.

In 2020, a decade after the policy was launched, plug-ins made up just 2.2% of light vehicle sales in the US, so the White House may have no choice.

Recommended Reading: When Is The Last Day You Can File Taxes

How Does The New Ev Tax Credit Differ From The Current One

The existing federal EV tax credit offers consumers $2,500 to $7,500 in credit for vehicles with a battery capacity of at least 5 kilowatt-hours, but starts to phase out after the manufacturers first 200,000 qualifying electric vehicles have been purchased.

The new law allows consumers to get up to $7,500 no matter how many cars have been sold, said Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute.

Whereas the original credit only applied to the purchase of new vehicles, the new credit also expands eligibility to used vehicles, said Nick Nigro, founder of Atlas Public Policy and an expert on alternative fuel vehicle financing, policy and technology. Nigro said that this is significant because used vehicles account for the vast majority of vehicle purchases in the country.

Eligible used vehicles qualify for a credit of up to $4,000 under the Inflation Reduction Act.

Also, the new credit is not a traditional delayed tax credit, said Gil Tal, director of the Plug-in Hybrid and Electric Vehicle Research Center at UC Davis. Instead, its what is known as cash on the hood, or a rebate that is applied at the point of sale.

This means that buyers wont need to finance the full price of the car before getting the money back when they file their taxes. Instead, if the purchase is eligible for the tax credit, the actual price of the car at the dealership will immediately be up to $7,500 lower.

How Do Ev Tax Credits Work

EV tax credits come from buying a vehicle with a battery propulsion system that can draw power from an external power source. The nonrefundable credits are available for battery-electric vehicles, plug-in hybrids , and hydrogen fuel-cell vehicles . The credits earned depend on a variety of factors and are used to decrease the taxes you owe in a given year. For instance, if you bought an EV eligible for a $7500 tax credit and your total federal taxes for the year came to $8500, then you would owe $1000 to the government.

The number of credits, or tax incentives, an EV can qualify for depends on the capacity of its battery pack. If a battery-electric or plug-in hybrid vehicle has a battery with a capacity of less than 7.0 kWh, then it does not qualify for any EV tax credits. Vehicles can qualify for up to $7500 in tax credits, and all HFCVs are eligible for the full amount.

Don’t Miss: How To File My Taxes

One Thing To Look Out For

One important exception is the final assembly requirement ushered in by the IRA. Clean vehicles that were purchased Aug. 16, 2022, or later must have had their final assembly in North America to meet the eligibility criteria.

To see a list of cars that likely qualify through the end of 2022 and into early 2023, you can reference this list of electric vehicles compiled by the U.S. Department of Energy.

And, importantly, if you already entered into what the IRS calls a binding written contract to purchase an EV before Aug. 16 and expect the car to be delivered at a later date, youre likely able to claim the credit without meeting this new final assembly requirement. Still, its a good idea to check with the dealership and a tax pro to make sure.

Filing Tax Form 8: Qualified Plug

OVERVIEW

If you purchased a new vehicle that runs on electricity drawn from a plug-in rechargeable battery, you may be eligible to claim the qualified plug-in electric drive motor vehicle tax credit, which can reduce your tax bill. In order to take the credit, you must file IRS Form 8936 with your return and meet certain requirements.

Don’t Miss: How To Calculate Payroll Taxes

Vehicles Purchased And Delivered Between August 16 2022 And December 31 2022

If you purchase and take possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply . If you entered into a written binding contract to purchase a new qualifying vehicle before August 16, 2022, see the rule above.

The $7500 Electric Vehicle Tax Credit Is Harder To Get Than You Think

- Publish date: Oct 24, 2022 11:55 AM EDT

The federal government has the bullhorn out and is letting Americans know they can earn $7,500 on a new tax credit. The deal comes from the recently-enacted Inflation Reduction Act, where the legislation generated a tax credit for any Americans who buy a new electric vehicle.

Recommended Reading: Do I Claim Stimulus Check On Taxes

What Are The Current Electric Vehicle Credits Before The Terms Change

As youll see from the rather barren list below of EVs that might qualify under the new terms of the Inflation Reduction Act, a majority of EVs currently available for credits to US consumers will soon no longer qualify.

That isnt to say they wont be back on in the yes column come January 1, 2023 since many of these automakers do have North American production facilities. Other EVs like Rivian models for example are American made, but some are priced above the $80k threshold for trucks.

Fisker has been long touting is flagship Ocean SUV as an EV priced below $30k for those who qualify for the entire $7,500 credit. However, under the new terms, the Austrian built SUV will qualify for zero federal credits. That being said, its current MSRP of $37,499 is still pretty enticing, but this is a major blow to its marketing strategy to the point that the American automaker is now considering adding US production for the Ocean.

The quick workaround that felt like a mad scramble was some verbiage allowing for written binding contracts under a transition rule in the Inflation Reduction Act. That rule allowed consumers to still qualify if they signed the binding contract before the date of bill being signed into law, even if the car is delivered after the bill is signed. This is covered on page 393-394 of the bill.

This New Incentive Helps Pay For Your Next Electric Vehicle Heres The Catch

A federal tax credit included in the Inflation Reduction Act aims to expand access to electric vehicles , while also introducing new limitations that could make it hard to qualify for now.

The IRA, signed into law last week by President Joe Biden, is poised to revamp the U.S. energy landscape by making greener technology more affordable for lower- to middle-income consumers, as well as deliver other reforms on drug pricing, tax enforcement and more. But despite its transformational potential, new requirements in the law that start Jan. 1, 2023, actually make most currently available EVs ineligible for the credit.

No matter what, the auto industry is making the transition to electric power. California regulators on Thursday voted to implement a plan to ban the sale of gasoline-powered cars by 2035, a move intended to divert business instead to EV manufacturers. As the largest market for auto sales in the United States, Californias moves on emissions and climate are broadly influential and a dozen or so other states are expected to follow suit, including Washington and Massachusetts.

Heres what electric vehicle researchers and a tax expert say you need to know about requirements to claim the tax credit, which vehicles qualify and more.

Read Also: What States Do Not Tax Social Security

Can A Tax Credit Increase My Refund

Tax credits differ from tax deductions. Tax credits can increase the money you are refunded and reduce the money that you owe to the IRS that year. So yes, an electric vehicle tax credit can potentially increase your annual tax refund. This can be viewed in two ways.

You can check your EV of interests eligibility and consider the price reduced if it is eligible. Another way to look at it is, youre paying the full price for your EV, and your Uncle Sam will pat you on the back for doing the right thing around tax time. Either way, electric vehicles are more affordable than ever before, and automakers like Tesla are looking to drop prices even lower.

Form 8936 Credit Calculation

Form 8936 has three parts. Part I calculates your tentative credit amount, which, in many cases, the manufacturer will have provided with its certification. If the vehicle satisfies the at least the minimum requirements, the credit starts at $2,500 and goes to a maximum of $7,500.

After calculating your tentative credit in the first part of Form 8936, the remaining two parts allocate the credit between your business in Part II and personal use of the vehicle in Part III.

You May Like: How To Keep Track Of Mileage For Taxes

Vehicle Eligibility For Ev Tax Credits

- The vehicle must be made by a manufacturer .

- It must be treated as a motor vehicle for purposes of title II of the Clean Air Act.

- It must have a gross vehicle weight rating of not more than 14,000 lbs.

- It must be propelled to a significant extent by an electric motor which draws electricity from a battery which

- has a capacity of not less than 4 kilowatt hours and

- is capable of being recharged from an external source of electricity.

The following requirements must also be met for a certified vehicle to qualify:

- The original use of the vehicle commences with the taxpayerit must be a new vehicle.

- The vehicle is acquired for use or lease by the taxpayer, and not for resale.

- The vehicle is used mostly in the United States.

- The vehicle must be placed in service by the taxpayer during or after the 2010 calendar year.

What Is A Written Binding Contract

In general, a written contract is binding if it is enforceable under State law and does not limit damages to a specified amount . While the enforceability of a contract under State law is a facts-and-circumstances determination to be made under relevant State law, if a customer has made a significant non-refundable deposit or down payment, it is an indication of a binding contract. For tax purposes in general, a contract provision that limits damages to an amount equal to at least 5 percent of the total contract price is not treated as limiting damages to a specified amount. For example, if a customer has made a non-refundable deposit or down payment of 5 percent of the total contract price, it is an indication of a binding contract. A contract is binding even if subject to a condition, as long as the condition is not within the control of either party. A contract will continue to be binding if the parties make insubstantial changes in its terms and conditions.

Recommended Reading: Is The Tax Assessment The Value Of The Property

Which New Vehicles Qualify For The Federal Ev Tax Credit For The Rest Of 2022

The following vehicles should qualify the federal EV tax credit for the remainder of 2022 because they are or will be assembled in North America. After the guidelines have been set for 2023, we’ll have a better idea of the exact amount of tax credits each vehicle will qualify for and the list of eligible vehicles may change. The current list comes from the U.S. Department of Energy and is based on data submitted to the National Highway Traffic Safety Administration and FuelEconomy.gov as of August 1, 2022.

Whether or not the vehicle you’re interested in is on the list, it’s a good idea to double-check its build location to be sure. You can run the vehicle identification number through a VIN decoder and look for the country name in the “Plant Information” field at the bottom of the page, or else simply check the window sticker if you have access.

We will strive to keep the list up to date as vehicle manufacturers continue to submit the applicable vehicle identification information to the relevant government agencies and more information becomes available.

| EV Sales Cap Met for 2022? | Built in North America? |

|---|---|

| Not all. Verify your VIN, as it may be built in either Mexico or Germany. | |

| 2022 | |

| Yes, but price limitations will make it ineligible in 2023. | |

| 2022 | |

| Yes, but cap goes away in 2023 | Yes |

| Yes, but cap goes away in 2023 | Yes |

| Not all. Verify your VIN, as it may be built in either Mexico or Germany. | |

| 2023 | |

| Yes, but price limitations will make it ineligible in 2023. | |

| 2023 |