Obligations Of The Payer

Regulation 105 withholding, remitting, and reporting

¶ 41. Amounts withheld from payments to a non-resident must be remitted to the Receiver General by the 15th of the month following the month in which the payment is made to the non-resident. A payer, whether a resident or non-resident of Canada, who fails to deduct and remit an amount as required by paragraph 153 of the Act and Regulation 105, will be held liable for the whole amount together with any interest and penalties.

¶ 42. Whether or not a waiver or reduction of withholding was issued to a non-resident , a T4A-NR Information Return , reporting all amounts paid to non-residents for services provided in Canada must be filed with the CRA by the last day of February in the year following the year in which the amounts were paid. A copy of the T4A-NR information slip must also be issued to each non-resident. This slip includes, the identification of the payer and payee, gross income paid, and applicable travel expenses and taxes withheld. Further information on completing each of these forms can be found in the guide T4061, Non-Resident Withholding Tax.

Exceptions To The Treaty

The treaty-based waiver guidelines do not apply to the following exceptions:

1. Residents of non-treaty countries. Such persons are taxable in Canada on income earned in Canada from employment or from carrying on business. The concepts of permanent establishment and fixed base are not relevant for residents of non-treaty countries. However, an individual who is a resident of a non-treaty country may apply for a waiver when his or her income for the calendar year is less than CAN$5,000.

2. Residents of countries whose treaty with Canada specifies a deemed permanent establishment. Examples of activities include:

a) construction, installation or assembly types of services

b) specified offshore activities for residents of Denmark, the Netherlands, the United Kingdom, and the United States

c) international transportation operations.

In cases where the non-resident applicant is involved in any of the above activities, we will review the appropriate treaty article to ensure the type of services being rendered are included therein. If the treaty article applies then the appropriate waiver determination may be made based on that specific article rather than the general guidelines.

- If gross income is less than CAN$15,000 for the calendar year, a waiver may be considered based on these guidelines.

- Non-residents with a previously determined permanent establishment who have had a break in presence of two or more previous calendar years will be reviewed under the guidelines.

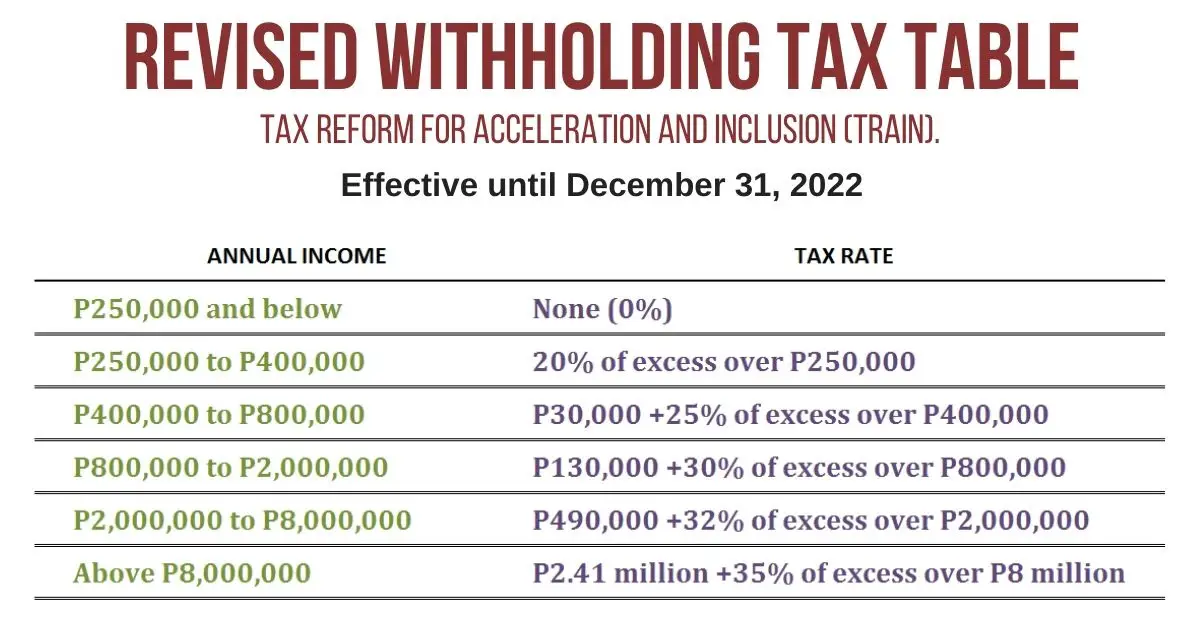

How To Calculate Withholding Tax

These are calculated and deducted based on two things, the amount of income earned and the details provided by the employee to the employer in term W-4.

For each category of recipients, it is calculated differently. For example, the retention tax on wages is calculated as per the withholding table and publication 15. In contrast, retention tax on an individual is calculated on various regular income as well as lottery, betting, etc. using the withholding estimator and expected income.

Read Also: Are New York State Tax Refunds Delayed

Penalty For Getting This Wrong

Withholding tax submission must be done on the 7th for offline /or the 15th for online channel following the month during which the payment has been done.

If the form is not submitted and paid at the specific time or file, but the amount is not fully delivered. Those responsible for withholding tax will be liable for fines by the Revenue Department guidelines.

- Criminal Penalty

An employer who does not submit the tax shall be liable to a fine of up to 2,000 baht under Section 35 of the Revenue Code, which the Revenue Department requires to compare fines at the following rates:

If file the form and pay taxes within 7 days from the end of the delivery deadline. Minimum 100 Baht.

If file the form and pay taxes more than 7 days from the date of the delivery deadline. Minimum 200 Baht

If the officer is found guilty. Minimum 1,000 baht

- Civil Penalty

An employer is liable, along with the employee, to pay the amount of non-deductible and non-remit tax, and will be subjected to an additional 1.5 percent per month.

2. In case of filing the form but not delivering the full tax amount.

An employer is liable in conjunction with the taxpayer who pays the amount of missing tax and will be subjected to an additional 1.5 percent per month.

When Do I Need To Appoint A Tax Representative

When a person not established in France is liable for certain tax obligations , he or she is required to have an accredited representative who agrees to accomplish the various formalities incumbent on that person and, in the case of taxable transactions, to pay the tax in his or her stead.

EXCEPTION, you do not need to appoint a tax representative if you reside in:

- The European Union

- a European Economic Area country that has entered into an administrative assistance agreement with France to prevent tax evasion and avoidance, as well as a mutual assistance agreement concerning the recovery of claims

The representative must be a taxpayer established in France and must be accredited by the French tax authorities. He or she must agree, on your behalf, to complete formalities relating to the withholding tax and, where applicable, to pay over the debited sums on your behalf. These commitments must be explicitly included in the contractual agreement signed by both parties.

You May Like: Do You Have To Pay Taxes On Court Settlements

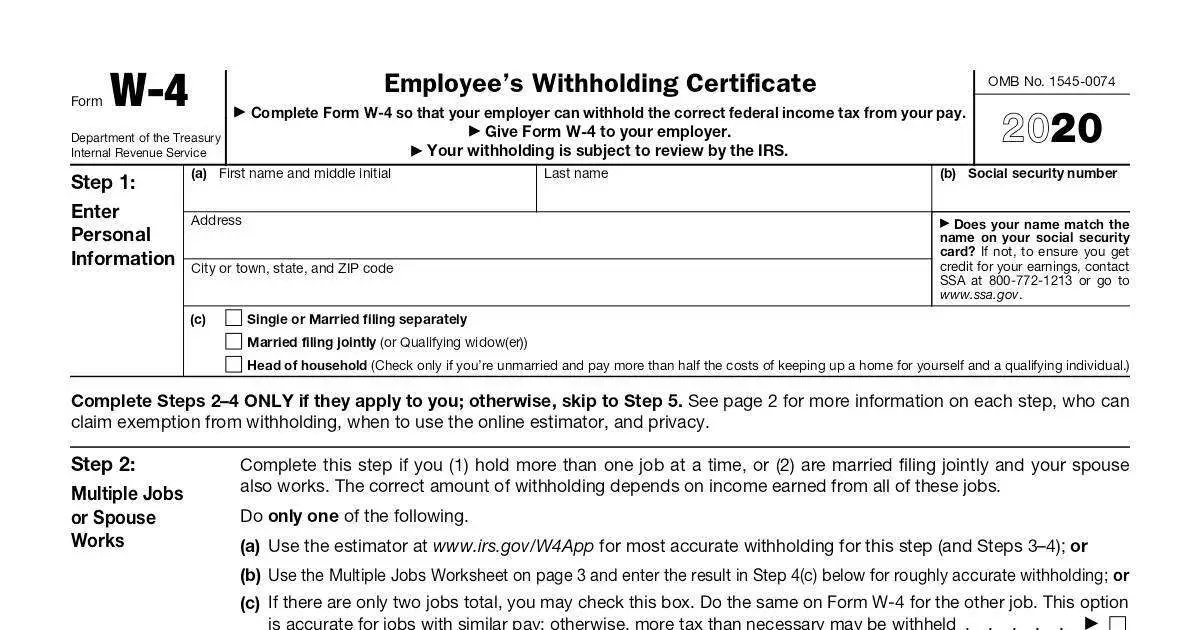

How Does The New W

Thankfully, the new W-4 form was designed to be more taxpayer-friendly. There are five steps, or sections, that youll need to fill out, but not every step may apply to you. Dont worryits simpler than you think.

Heres what youll fill out:

- Step 1: Name, address, Social Security number and expected filing status

- Step 2: Any side hustles, other jobs and income from your spouse

- Step 3: Any children or other dependents

- Step 4: Any extra income and any extra withholding

- Step 5: Your signature

Once your John Hancocks on the dotted line, voilà! Youre done filling out your W-4.

Remember, you dont want too much taken outjust enough to appease your favorite Uncle Sam.

Consequences Of Withdrawing Rrsp Money Early

The biggest consequence of prematurely withdrawing RRSP funds early is certainly the tax penalties. Your tax bill can really suffer, especially if you withdraw a large amount, since in addition to the withdrawal taxes youll also be paying combined income tax.

But another huge consequence of withdrawing funds early? The simple truth is that youre just robbing your future self of money youll need in retirement. An RRSP works its magic when longterm, steady contributions allow funds to grow thanks to the magic of compounding. Withdrawing funds is a huge setback for the progress of your retirement fund, especially since you wont be able to recuperate the contribution room youve lost through early withdrawal.

Keep in mind that withdrawing multiple smaller amounts in a short period of time in an attempt to avoid the higher withholding tax comes with certain disadvantages as well. Your financial institution could still deduct the amount of withholding tax that would apply to the total amount. For example, if you want to withdraw $10,000 but you split it into four monthly withdrawals of $2,500 to avoid the 20% tax withholding rate, your financial institution could still withhold 20% on the last withdrawal if they notice the pattern. The point is: Withdrawals are generally not advisable and you should be exploring other possible avenues before you touch your RRSP.

Recommended Reading: When Is The Due Date For Taxes

What Is A Withholding Tax

Withholding tax refers to an amount an employer withholds from employees salaried income and submits directly to the federal taxing authorities. Levying of withholding tax takes place at the time of the disbursement of the employees income. The deductions are then given to the federal government by the authorized tax collecting entities.

Examples Of Payments Subject To Regulation 105 Withholding

Payments to non-resident artistes and athletes

¶ 11. Payments to non-resident artistes and athletes for services provided in Canada e.g., appearance and endorsement fees, are subject to withholding.

Advance payments

¶ 12. Regulation 105 withholding is applicable to advance payments made in respect of services to be performed in Canada by a non-resident.

Withholding paid on behalf of a non-resident

¶ 13. A payer may be contractually required to make a payment to the CRA on behalf of a non-resident that is equivalent to the Regulation 105 withholding amount otherwise required to be deducted from a payment to the non-resident. A payer may also be contractually required to make payments for other potential Canadian tax liabilities of the non-resident whether federal, provincial, territorial, municipal or others. The CRA considers this to be an additional payment in respect of the services to be provided in Canada and it is subject to Regulation 105 withholding. When pursuant to their contractual arrangement the payer remits the equivalent of the withholding to the CRA on behalf of the non-resident, the payer should calculate the withholding on the grossed-up amount. This grossed-up withholding amount should be remitted to the Receiver General on behalf of the non-resident. This amount paid on behalf of the non-resident must also be included on the T4A-NR information slip as additional income for the non-resident .

Required withholding = ÷

Travel time

Don’t Miss: How Much Tax Do I Need To Pay

What Changed In 2020

Another reason to check in on your withholdings this year? The IRS gave the W-4 form a big makeover starting in 2020. The new form was redesigned to make it easier to understand and to make the whole withholding process more accurate and crystal clear. Good on them!

The W-4 change is a result of the 2018 tax reform bill. Since the bill got rid of personal exemptions, the new W-4 form has done away with using personal allowanceslike claiming 1 if youre single and have one job or claiming 3 if youre married and have one childto figure out how much to withhold from your paycheck.

But the basics of the form are the same, so no need to panic! This isnt a complete overhaul. The new W-4 form just replaces the old headache-causing worksheets with simplified questions, which makes it easier to fill out all your iinformation and make sure youre getting your tax withholding right.

Dividends Royalties Interest Rents Service Fees Etc

Items of income paid to a foreign corporation are generally subject to Japanese withholding income tax at a rate of 20.42 percent . However, double tax treaties may grant a special concession to a resident individual or a resident corporation in a foreign jurisdiction. Some double tax treaties provide that a person with dual residence may be determined to be a person with single residence by mutual agreement between competent authorities. In order to enjoy benefits under double tax treaties, an application form must be filed with the relevant tax office before the first payment between parties is made.

Read Also: What Is Agi On Tax Form

Understand What Exactly Is Withholding Tax

Prior to the year 2019, income tax was paid one year after the actual income was received. With the concept of withholding at source, the tax is paid during the same year concerned. Indeed, the principle being to avoid the delay during the payment of income tax, the deduction at source makes the payment more flexible, as it is contemporaneous with the collection of income.

After the various studies and analyzes carried out with taxpayers, the results have clearly shown that the tax payment delay could cause real cash flow difficulties. In this specific case, the payment did not adapt in real time to the income. A concern that can only be noted, especially when a taxpayer experiences a change in situation with significant impacts on their income.

The application of the withholding tax directive has thus made it possible to pay the tax at the very moment when the income is received. However, not all types of income are affected by this new law.

How To Determine Your Federal Tax Withholding

Your withholding amount depends on a couple things, including how much income you earn and the information your employer receives when you fill out your W-4 form.

You can figure out the right amount of tax withholding a couple of ways. The firstif you want to be super thoroughis doing a mock tax return. That will show exactly what you would owe for the year. If you get paid every two weeks, divide that tax bill by 26 , and youll have the amount of tax that needs to come out of each paycheckassuming your income stays the same all year.

Another way is to take a look at the last year and see if thereve been any major changes in your life. Did you buy a home, have a baby, get married? Things like that will affect your tax bill, so you should update your W-4 right away so your withholding is as spot on as possible.

Lets say you didnt have any major changes last year and for the last few years youve had a $3,000 refund. Youd want to adjust your W-4 so you dont get a refund. Why? Because that $3,000 refund comes out to an extra $250 in your pocket each month. Think that could make a big difference in your monthly budget or your debt snowball? Heck yes!

If youve still got questions or you have a complicated tax situation, connect with a tax pro to help you get the adjustments right.

Don’t Miss: When Is It Too Late To File Taxes

How To Check Withholding

- Use the instructions in Publication 505, Tax Withholding and Estimated Tax.Taxpayers with more complex situations may need to use Publication 505 instead of the Tax Withholding Estimator. This includes employees who owe, the alternative minimum tax or tax on unearned income from dependents. It can also help those who receive non-wage income such as dividends, capital gains, rents and royalties. The publication includes worksheets and examples to guide taxpayers through these special situations.

Employee Withholding Exemption Certificate

Arizona wages paid to certain individuals are exempt from Arizona income tax withholding. Individuals who qualify for this include:

- Native Americans,

- Nonresidents.

See the discussion below for details. If you believe you are an individual who is exempt from Arizona income tax withholding, complete Arizona Form WEC, Withholding Exemption Certificate, and provide it to your employer and keep a copy for your records.

Native Americans

If you are a Native American, your wages are exempt from Arizona income tax withholding if you:

- Live on the reservation,

- Work on that reservation, AND

- Are an affiliated and enrolled member of the tribe for which that reservation was established.

NOTE: If you have any wages or other income earned off the reservation you may be subject to Arizona income tax on that income. If you are subject to Arizona income tax and you meet the Arizona filing requirements, you will need to file an Arizona income tax return.

For additional information, see the departments ruling, Individual Tax Ruling 96-4, Income Taxation of Indians and Spouses, available here:

Military Spouses

The federal Military Spouses Residency Relief Act provides tax relief for qualifying spouses of military personnel. Under this act, wages earned in Arizona by a qualifying spouse are not deemed to be income for work performed in Arizona. Those wages are exempt from Arizona income tax withholding.

Nonresidents

For additional information, see Arizona Form 309, .

Also Check: How To File Taxes Online

Understanding The Us Tax Withholding System

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Income taxes weren’t always withheld from people’s paychecks. In fact, income tax withholding is a relatively recent development. Before 1943, taxes were only withheld in spurts when the government needed to raise extra revenue. This article explains how we arrived at the current system that takes income taxes out of your paycheck and how this withholding process works.

Difference Between The Withholding Tax And Tax Deducted At Source

There is a thin line difference between withholding tax and tax deducted at source is a mechanism wherein income tax is collected at the source of income generation. The one who makes payment to another person deducts TDS out of the amount and remits the amount to the government on behalf of the receiver. read more) where the retention tax term is usually more prevalent in case of out of country payment or the payment made to non-residents. The same is the amount that is deducted well in advance by the payer before the actual payment and then deposited to the government as per the due date. At the same time, tax deducted at source is the amount deducted at the time of making payment and paid to the government on behalf of the deductee.

Read Also: When Will The Irs Open For 2021 Tax Returns

What A Tax Withholding Means For Individuals

Understanding tax withholding is important for individuals when it comes to tax management and budgeting. If you dont fill out your W-4 form accurately, for example, you might receive a higher paycheck and spend more money, only to be confronted by a tax bill later on that youll have to figure out a way to pay.

Some individuals might consider intentionally having more withheld from their paycheck so they end up with a tax refund after they file. However, you may want to consider other saving strategies, such as depositing a small amount from each paycheck into an interest-bearing bank account.