Your Roth Ira Options

The rules that beneficiaries who inherit a Roth IRA must follow differ depending on whether they are the deceased persons spouse or not. If the IRA originally belonged to your parent, you fall into one of two categories: designated beneficiary or eligible designated beneficiary.

Note that the Setting Every Community Up for Retirement Enhancement Act of 2019 changed some of the rules on inherited IRAs. These are the current rules, which apply if your parent died after Dec. 31, 2019.

Inherited Ira Tax Strategies

One inherited IRA tax management tip is to avoid immediately withdrawing a single lump sum from the IRA. Instead, wait until RMDs are due or, if you got the IRA from a non-spouse, stretch withdrawals over 10 years.

RMDs are taxable and can change your tax bracket and increase your overall tax burden. But if, as is often the case, you are in a lower tax bracket when you have to start taking them, you may be able to save on taxes by deferring withdrawals until the RMD rules force you to start.

If you have to empty the account in 10 years, you dont have to withdraw equal annual amounts. You can instead wait until when your income is lower than normal, then take a larger withdrawal from the inherited IRA. Similarly, if your income is higher in another year, you can take less that year, as long as the entire amount is withdrawn after 10 years. This income-leveling strategy can result in a lower overall tax outlay.

Option #: Open An Inherited Ira: Ten Year Method

| Account type | The assets are transferred into an Inherited Roth IRA held in your name. |

|---|---|

| Money is available | At any time up until 12/31 of the tenth year after the year in which the account holder died, at which point all assets need to be fully distributed. |

| Other considerations |

|

You May Like: What Tax Bracket Are You In

Traditional Inherited Iras Inherited Roth Iras And Inherited 401k Accounts

Traditionalinherited IRAs are traditional IRAs, SEP IRAs, and SIMPLE IRAsthat are left to beneficiaries when the account owners die. SEP IRAs and SIMPLEIRAs become traditional inherited IRAs after the account holders pass away andfollow the same rules.

Inherited Roth IRAs allow the beneficiaries to takewithdrawals without paying taxes. However, they cannot choose to keep the moneyin the Roth IRA accounts like the original account holders were able to do.

Inherited 401 accounts are 401 plans that areinherited from spouses or from non-spouses. Just like you have to pay tax on aninherited IRA, you also have to pay tax on an inherited401. Under the rules on an inherited 401, the taxes on aninherited 401 are assessed at the time that you take distributions. Theinheritance tax rate when you take distributions from an inherited 401 or atraditional IRA is your ordinary income tax rate.

The rules on an inherited 401 differ depending onwhether you are a spouse or a non-spouse. The inherited 401 rollover rulesallow spouses to roll the funds over into their own accounts. However, theinherited 401 rollover rules do not allow non-spouse beneficiaries to rollthe funds over into their own accounts. You can roll the funds over into anaccount that you have designated as an inherited IRA under the inherited 401rules.

How Can I Avoid Tax On An Inherited Ira

If you inherited a Roth IRA, you likely wont have to pay any income taxes on it. Spouses just need to make sure the funds have sat for at least five years before withdrawing earnings, if they leave the original Roth IRA account open.

Its harder to avoid taxes when you inherit traditional retirement accounts. As noted above, you can spread the distributions over 10 years. If the estate had to pay estate taxes, you can take a deduction for it as well.

Read Also: Can You Pay Estimated Taxes Online

View Important Information About Our Fees And Commissions

- View important information about our fees and commissions

-

3. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

Schwab ETFs are distributed by SEI Investments Distribution Co. . SIDCO is not affiliated with Charles Schwab & Co., Inc.

How To Minimize Taxes When You Inherit An Ira

New Rules for an Inherited IRA, what you need to know as a beneficiary to minimize taxes

getty

Over the next twenty-five years, Americans are expected to inherit an astonishing $72.6 trillion. Yes, that is TRILLION with a T. Many of these inheritances will be delivered to beneficiaries of IRAs, 401 or other retirement accounts. How you handle your inherited IRA can greatly increase or decrease the taxes due and, ultimately, the value of your inheritance.

With the 2017 tax overhaul, which doubled the size of an estate that can be passed estate tax-free to heirs. While it is true that far inheritances will be subject to estate taxes, assets held in retirement accounts will still be subject to income taxes when funds are withdrawn.

The larger the inherited IRA , the more valuable having a proactive plan to minimize taxes will be to you. I’m a financial advisor in Los Angeles, where making a mistake with your inherited IRA could take the taxes due from near zero percent to above 50% . Put another way, not planning to minimize the taxes on your inheritance could cut its value in half.

For ease of reading, I will just use Inherited IRA- but the concept applies whether you are inheriting a 401, 403 or any other -pre-tax retirement account.

What you need to know about required minimum distributions for Inherited IRA. What you don’t know … can cost you a lot when it comes to taxation.

getty

Also Check: How Do I File My Taxes Electronically

Rules For Inheriting An Ira: Children And Other Non

If a parent leaves you an IRA, you are the beneficiary. The IRS calls this situation a non-spouse inheritance. Parent to child is the most common non-spouse situation, but its not exclusive. As a non-spouse beneficiary, you cannot retitle the IRA in your own name. That benefit is only available for spouses. You can, however, transfer the account into a new account. This is known as an inherited IRA.

You could immediately cash out traditional or Roth IRAs through a lump sum distribution. With traditional IRAs, withdrawals are taxable income. However, withdrawals from Roth IRAs are tax-free. The downside of taking all the money out immediately is that you lose the long-term benefits that occur when the money grows within the IRA. However, it is an option if you need funds right away.

If you only want to withdraw some money, but not all, you can do so. You have to transfer the account to an inherited IRA held in your name. Note that non-spouse beneficiaries who inherit an IRA in 2020 or later now have to withdraw all funds within 10 years of the original owners death.

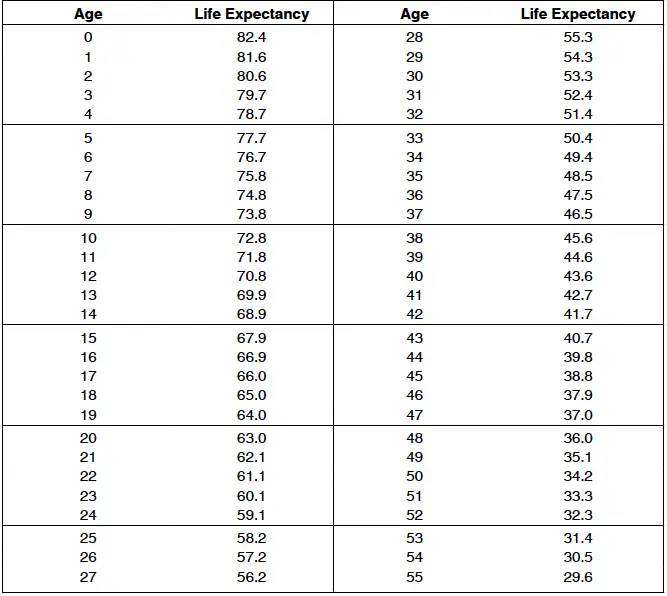

Before the 2019 SECURE Act, non-spouse beneficiaries could have used an estate planning strategy to stretch distributions over their lifetime. So if you were a 35-year-old beneficiary in 2019, you could have stretched distributions over 48.5 years based on the IRS life expectancy tables.

What To Do With An Inherited Ira

Beneficiaries fall into two categories: designated and not-designated .

All beneficiaries have the option to cash out their inheritance: Take a lump-sum withdrawal from the deceased’s IRA and shut it down though experts usually advise against this strategy since doing so can incur a whopping tax bill. Because that money is still growing in the inherited IRA, it can be beneficial to hold off on withdrawals to let the account grow as much as possible.

Spouses can set up an inherited IRA, but they don’t necessarily have to. It’s actually more advantageous to forgo the inherited IRA and treat the deceased’s IRA as their own: putting it into their name, or rolling it over into another IRA they already have. This is a special privilege that only spouses possess.

In contrast, non-spouse beneficiaries everybody else, basically have to set up a separate inherited IRA.

Recommended Reading: How To Save Capital Gain Tax

What Is An Inherited Ira What Are The Taxes On An Inherited Ira

An inherited IRA refers to an IRA that is passed from theoriginal account holder to a beneficiary after the account holder dies. It isimportant for people to understand the inheritedIRA rules for different beneficiaries and heirs.

Do you have to pay taxes on an inherited IRA? Whether youwill have to pay tax on an inherited IRA will depend on the type of IRA thatyou are receiving under the inherited IRA rules. You will usually not haveto payinherited IRA taxes if you inherit a Roth IRA. If you inherit atraditional IRA, you will generally have to pay taxes. Spouses and non-spousalbeneficiaries have different rules for inherited IRAs. The taxes on aninherited IRA will be assessed at the time that distributions are taken unlessit is an inherited Roth IRA.

Nonspouses Can No Longer Stretch An Inherited Ira

In the past, nonspouse individual beneficiaries could use a life expectancy calculation to figure out how much to take from an inherited IRA. This was a way to reduce the tax burden on the beneficiary. However, since the passage of the SECURE Act, things have changed.

Now, most nonspouse beneficiaries are required to draw down the inherited IRA within 10 years. As a result, some beneficiaries find themselves taking larger chunks out of inherited IRAsand paying higher taxes.

Special note for certain beneficiaries of IRA owners who passed away in 2020 or later: While the IRS has yet to publish final regulations, currently proposed regulations would require certain beneficiaries to take annual required minimum distributions from an inherited IRA while also being required to deplete the entire inherited IRA within 10 years following the original IRA owners year of death. This proposed rule would generally only impact beneficiaries of deceased IRA owners who are not considered eligible designated beneficiaries in situations where a Traditional IRA owner passed away on/after their required beginning date . Please consult with your tax advisor if you have questions about whether you should take a required distribution from your inherited IRA before December 31, 2022.

Also Check: When Do Tax Returns Come 2021

Seven Other Inheritance Rules To Know

Outside of the elimination of the stretch provision for inherited IRAs, here are seven other critical pieces of information to know before determining an appropriate withdrawal strategy given your circumstances.

1. No Roth conversions: Account owners of traditional IRAs, and spousal beneficiaries of inherited IRAs, can execute Roth conversions in any tax year. However, non-spousal beneficiaries of inherited IRAs cannot execute Roth conversions.

2. Designate a beneficiary, but be careful with trusts: Consider the trade-offs between asset protection/control and tax efficiency before naming a trust as the beneficiary of an inherited IRA. In most cases, distributions from IRAs retained in a trust will result in income being taxed at compressed tax brackets, resulting in a larger tax bill and a smaller ultimate inheritance.

However, the distribution of RMDs to beneficiaries may not align with your overall estate plan. Its common to create inheritance trusts to separate inherited assets from personal/marital assets, but careful consideration is required to ensure the trust is drafted so that the outcome is aligned with your legacy wishes.

This process can get complicated quickly, so its best to err on the side of caution and consult with a qualified estate attorney and tax advisor.

Finally, there are a few things you cannot do with an inherited IRA that you normally could with your own individual retirement account:

Rules For Inheriting A Roth Ira: Spouses

If you inherit a Roth IRA as a spouse, you can withdraw any or all of the account, tax-free, provided the account has existed for at least five years. In this case, you will not be charged the 10% early withdrawal penalty.

If youd rather not take the Roth IRA as a lump sum, you have options. The better option for long-term savings is to transfer the assets to an existing Roth or to open a new Roth IRA. The account can grow without penalty, due to the lack of required minimum distributions. You can also leave the money in the account to grow indefinitely for the next generation. This is one of the biggest differences between Roth and traditional IRAs.

You May Like: How Do I Find My Personal Property Tax In Missouri

Do I Have To Pay Taxes On An Inherited 401

The Secure Act changes the rules around the non-spouse inheritance of 401. Under the new law, the non-spouse beneficiaries must take total payouts within 10 years of inheriting the account. If they are minors, the 10-year rule starts when they become of age. Any withdrawals from the account are taxed as income.

Why Do You Owe Taxes On An Inherited Ira

The government provides tax breaks for investing in an IRA to encourage retirement savings. But while accountholders can contribute to their accounts with pre-tax dollars and allow money in their IRAs to grow tax-free, the government eventually wants its piece of the pie.

To make sure the money in an IRA is taxed eventually, the original accountholder must begin taking required minimum distributions starting at age 72. But if the accountholder dies prior to all the money being withdrawn, the government still wants to make sure taxes are paid on gains. As a result, it requires those who inherit to also take the money out within an acceptable timeline and to pay taxes when they do.

Also Check: How To Pay Pa State Taxes

Inherited Ira From Spouse

A spouse who inherits an IRA has options available to them that are unavailable to non-spousal beneficiaries. A spouse may treat the inherited IRA as if it is their own by designating themselves as the account holder. A spouse who designates themselves as the account holder will benefit from the traditional attributes of an IRA such as tax-free growth. However, these individuals will also be subject to the withdrawal rules that dictate that an individual must take required minimum distributions . The RMDs will be based on the age of the surviving spouse. A spousal beneficiary may also roll-over the inherited IRA into a qualified plan such as a qualified employer plan and tax-sheltered annuity plan. Pragmatically, most German domiciled individuals will view these options as being unattractive. Many German domiciled individuals will not want to maintain an IRA in the U.S. Further, many of these individuals will not have a qualified plan for the IRA to be rolled into and there are only a few U.S. financial institutions which offer financial services for nonresidents. In light of these issues, many German domiciled individuals will l seek to be treated as a beneficiary and seek a distribution of the assets.

Enumerate The Tax Implications On Required Minimum Distributions For A Roth Ira

It is mandated by the IRS to take withdrawals from your inherited Roth IRA if you are not a spouse of the deceased person failing which a tax penalty of 50 percent would be levied upon you on the sum not withdrawn. This shall be applicable even in a scenario wherein the distribution does not come under the ambit of taxation originally. Alternatively, if you are a spouse, and treat the inherited account as your own, you would have access to other provisions and exemptions not available to non-spouses.

When it comes to an inherited Roth IRA account, your relationship with the original account owner and when the account owner passed away, plays a major role in the taxable amount that you may or may not have to pay on your inherited Roth IRA.

- Based on your relationship: If the beneficiary of an inherited Roth IRA account is a spouse, the IRS lets the spouse use the funds from the inherited account as theirs only. However, if the beneficiary is not the spouse, then different rules apply to them.

- Based on the death of the account holder: On December 20th, 2019, The Setting Every Community Up for Retirement Enhancement Act, 2019 was enforced wherein the rules for inherited retirement accounts including the Roth IRA, were altered. If your loved one passed away before December 31, 2019, then the new IRS rules do not apply to you but if the death occurred after the specified date, then they will have to adhere to new distribution rules of the Roth IRA.

You May Like: When Do You Have To Pay Taxes On Crypto

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.