Protect Your Partnership With A Tax Professional

Levy & Associates has decades of experience working with self-employed individuals through several different types of entities. We have assisted countless partnerships in documenting Form 1060 and Schedule K1 to file correctly.

Contact Levy & Associates today to schedule an initial free consultation. We are available at 800-TAX-LEVY or visit www.levytaxhelp.com.

Who Gets An Irs Schedule K

Among those likely to receive a Schedule K-1 are:

- S corporation shareholders

- Partners in limited liability corporations , limited liability partnerships , or other business partnerships

- Investors in limited partnerships or master limited partnerships

- Investors in certain exchange-traded funds

- Trust or estate beneficiaries

Who Has To File It

If youâre part of a:

- LLC that has elected to be taxed as a partnership

You need to do at least two things during tax season:

File your own individual Schedule K-1

Not sure whether youâre in a partnership? Here are some telltale signs:

-

You co-own a business with one or more person, but that business isnât incorporated.

-

Youâve signed a partnership agreement and registered the partnership with the state.

-

Your company is an LLC and has not decided to be taxed as a corporation this year.

There are actually two more forms that the IRS calls âSchedule K-1â:

Schedule K-1 of Form 1120S, which must be filed by the owners of S corporations

Although these forms are similar, in this guide weâll focus exclusively on Schedule K-1 of Form 1065, to be filed by partnerships.

Recommended Reading: When Do You Have To Pay Quarterly Taxes

We Recently Received A Call From A Client In Canada Who Invested In A California Llc And Was Issued A K

Never having seen a K-1 before, our client was perplexed on how to deal with it both in Canada and the US, especially since the K-1 showed our client incurred a loss for the first year of his investment in the LLC.

A K-1 represents each shareholders portion of the companys profits, losses, deductions and tax liability for the year. The Internal Revenue Service requires a partnership to issue a Schedule K-1 to all partners, even though a partner is not in any way connected to the US.

Much to our clients chagrin, we explained to him that even though he is not a US taxpayer and even though he incurred a loss, he was still obligated to file a 1040NR return and to obtain a US Individual Taxpayer Identification Number . Moreover, our client was informed that he also needs to file a California 540NR return.

Simply put, even though our client is not a US taxpayer, he still needs to file a US return because he is considered to have effectively connected income as a result of the LLCs business within the US. Under the tax code, because of our clients ownership interest in the LLC, he is considered to be engaging in a business operated within the US.

Surely, not the answer our client was hoping to hear.

What about the tax consequences in Canada? Well, well have to leave that to a future article because the tax rules in Canada with respect to a US LLC are fairly complex.

When Is The Estate Tax Year

Occasionally, the estate tax year will vary from the calendar year. Most often, an estate calendar year will start on the actual date of the owner’s death and typically end on December 31 of that same year.

That said, an Executor has the ability to file whats known as an election, requesting that a fiscal year be followed. In this case, the tax year would end the last day of the month before the estate owners one year anniversary of his or her death.

Read Also: How To Pay Income Tax

How Can You Report Income From Schedule K

Even if youve prepared and filed your taxes on your own for years, you may want to consult with a CPA, Accountant or Financial Advisor before attempting to report income from a Schedule K-1. Or, you may also choose to use online tax software, which offers information to help you navigate the process.

What happens if you dont file your K-1? Even if its through no fault of your own, for instance if you dont receive your Schedule K-1 on time, if you arent going to be able to file on time, you must file for an extension. Failing to do so will likely result in penalties.

Do You Have To File An Irs Schedule K

Yes, you do, if you are a general partner in a limited partnership or owner of a pass-through business entity or S corporation. The K-1 must be filed with your tax return.

For limited partners and trust or estate beneficiaries, actually filling the K-1 along with Form 1040 is usually not necessary .

You May Like: How To Charge Sales Tax

Where To Get Tax Forms And Publications

You can download, view, and print California tax forms and publications at ftb.ca.gov/forms.

Our California Tax Service Center website offers California business tax information and forms for the BOE, CDTFA, EDD, FTB, and IRS at taxes.ca.gov.

You can also download, view, and print federal forms and publications at irs.gov.

Allow two weeks to receive your order. If you live outside California, allow three weeks to receive your order. Write to:

Form 565codes For Principal Business Activity

This list of principal business activities and their associated codes is designed to classify a business by the type of activity in which it is engaged to facilitate the administration of the California Revenue and Taxation Code. These principal business activity codes are based on the North American Industry Classification System.

Using the list of activities and codes below, determine from which activity the partnership derives the largest percentage of its “total receipts.” Total receipts is defined as the sum of gross receipts or sales plus all other income. If the partnership purchases raw materials and supplies them to a subcontractor to produce the finished product, but retains title to the product, the partnership is considered a manufacturer and must use one of the manufacturing codes .

Once the principal business activity is determined, entries must be made on Form 565, Item K. Enter a description of the principal product or service of the partnership. For the business entity code, enter the six digit code selection from the list below.

Read Also: What Is The Easiest Online Tax Service To Use

Tax Information Slips In Msca

You can view and print copies of your T4E for Employment Insurance and your T4A/NR4 for Canada Pension Plan and Old Age Security in MSCA. To do so, register for MSCA and select Tax slips.

This service gives you access to your tax slips for the current year and the past 6 years. Submit them with your income tax return to the Canada Revenue Agency .

You can reactivate the mail option anytime by selecting Tax slip mailing options in MSCA. If you change your tax slip preference after the first week of January, the change will take effect the following year. Even if you receive mailed copies, you can still access your tax slips online

If you decide to receive your tax slips online, they will be available in MSCA on February 1. You will not be notified when they are available and will not receive your tax slip by mail.

Accessing your tax information slips online is secure. Your information is protected with the same level of security used by banks for their online services.

How Do You Report Income From Information Slips

The back of the information slip explains where to report the income shown in each box and it refers you to the appropriate section of the Federal Income Tax and Benefit Guide when necessary. See Reporting instructions for T3 slips and T5 slips for instructions on how to report the most common types of income.

If you choose to reinvest any distributions by buying more units or shares, you may not actually receive the income shown on your information slips. However, you must still report on your income tax and benefit return the amounts shown on your slips. This is because the CRA considers you to have received these amounts before reinvesting them.

You May Like: How To Apply For Irs Tax Forgiveness

What Makes K1 Tax Form Different

The K1 tax form is among the last tax-related documents a taxpayer gets when obtaining papers for tax return filing. Generally, a taxpayer doesnt file this tax form along with the individual tax return. However, filing it with the tax return is necessary when the following conditions apply:

- reporting of backup withholding required in box 13, code B

- reporting of backup withholding required in box 13 using code O

Mostly, a partnership or corporation keeps the K1 tax form for an individuals records purposes. However, an accountant must get a copy of this tax form for the proper completion of a tax return. This function makes K1 tax form serve as an information document the IRS must have a copy of.

Exception To The Rule

Withdrawals and distributions aren’t taxable as long as they don’t exceed the partner’s basis. A partner’s basis is the amount of money he’s put into the partnership plus his share of partnership income and minus his share of partnership losses. If the partner withdraws more than his basis, the difference is taxable income.

For example, say that Partner A had put $10,000 of his own cash into the partnership, and his distributive share of partnership income is $30,000. He can withdraw up to $40,000, and it will not be taxable. If he withdraws $45,000, the excess $5,000 is taxable.

The IRS notes in the Partner’s Instructions for Schedule K-1 that the partner is responsible for keeping track of his basis and reporting taxable income.

Read Also: Do You Have To Pay Inheritance Tax On Life Insurance

What Is A Mutual Fund

A mutual fund is an arrangement under which shares or units are sold to raise capital. Investors purchase units if the mutual fund is a trust or purchase shares if the fund is a corporation. When you invest in a mutual fund, your money is pooled with the money of other investors and invested on your behalf by the fund manager.

Who Is Responsible For Paying Income Tax For Estates Or Trusts

The short answer here is if a beneficiary receives income from a Trust throughout the year, they are responsible for paying the income tax on the earnings. If the Trust is the only entity that earns income, taxes would be paid for out of the estate. Either way, if there is any income earned at all, a Schedule K-1 Form 1041 is the official form to be used.

You May Like: Can I File Taxes After Deadline

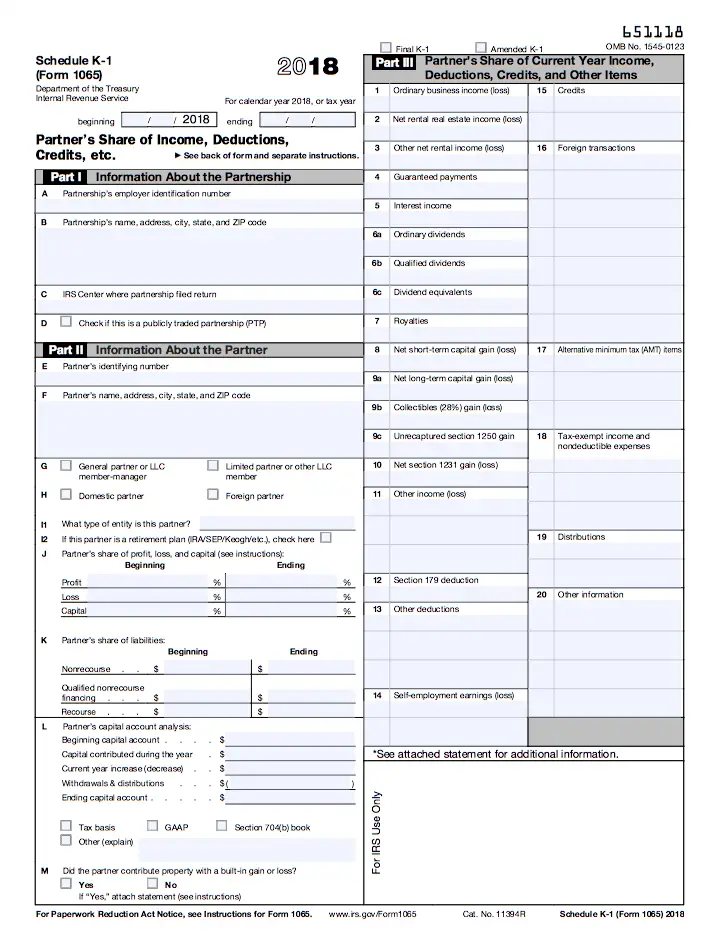

Iii Partners Share Of Current Year Income Deductions Credits And Other Items

In this section youâll report your share of the partnershipâs income, loss, deductions, credits, and any other money you might have received in connection with your stake in the partnership.

To fill out boxes 11 and boxes 13 through 20, youâll need to use the codes located on page two of the Schedule K-1 form.

Box 1. Ordinary Business Income

Enter your share of the ordinary income from trade or business activities of the partnership this year here.

Box 2. Net Rental Real Estate Income

Enter your share of net rental real estate income from the partnership here.

Box 3. Other Net Rental Income

Here youâll report your share of any other rental income you earned from the partnership.

Box 4. Guaranteed Payments

Here youâll report any guaranteed payments you received from the partnership. These are payments that the partnership made to you without regard to the partnershipâs income, usually in exchange for services or for the use of capital.

For more information about guaranteed payments and other kinds of payments partnerships make to their partners, see this guide from the IRS.

Box 5. Interest Income

Here youâll report any interest income you earned during the year, from things like bonds, certificates of deposit, bank accounts, etc.

Box 6. Dividends

Here youâll record any ordinary, qualified and dividend-equivalent payments you received from the partnership.

Box 7. Royalties

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Where’s My Tax Refund Ga

Instructions For Form 565 Partnership Return Of Income

References in these instructions are to the Internal Revenue Code as of , and to the California Revenue and Taxation Code .

In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code as of January 1, 2015. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA , and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California Revenue and Taxation Code in the instructions. Taxpayers should not consider the instructions as authoritative law.

R& TC Sections 17024.5 and 23051.5 have been amended to clarify that, unless otherwise expressly disallowed, federal elections made before a taxpayer becomes a California taxpayer are binding for California tax purposes.

Who Files For Schedule K

The three Schedule K-1 forms for different users are:

1. Form 1065

Form 1065 encompasses all types of partnerships, including general partnerships, limited partnerships , and limited liability partnerships . Certain limited liability corporations Limited Liability Company A limited liability company is a business structure for private companies in the United States, one that combines aspects of partnerships and corp with multiple members may be taxed as a partnership using the form.

Also Check: Are Membership Dues Tax Deductible

It’s About The Big Picture

If you get a Schedule K-1 because of a windfall such as an inheritance from an estate or as beneficiary of a trust, it’s just the way it is. But if you’re receiving them due to investments in LLCs, partnerships, or a “C” corp, you should look at the bigger picture.

Those entities are often able to pay out more of their cash flows because of their legal structures, but you’ll probably pay more tax on your end. In some cases, you’ll also get a share of the losses, deductions, and credits, as well. In other words, there are numerous potential benefits to these kinds of structures.

There are trade-offs, too. You’ll have more complex — and potentially more costly — tax preparation each year. If you’re only getting a small amount of income because of a minimal investment in a few shares of an MLP or LLC, it may not be worth it.

But if it’s a major source of income, such as being co-owner of a business, then it’s a different situation entirely. Whether the income you get from these investments is worth the cost and headache is something you’ll have to determine based on your situation.

Is Irs Schedule K

It varies, depending on the individual’s participation and status. For trust and estate beneficiaries, limited partners, and passive investors, Schedule K-1 income is more akin to unearned income. For general partners and active owners in a business or pass-through business entity, the income can be considered earned income, and they may owe self-employment tax on it.

Also Check: Where Is Your Agi On Your Tax Return

Special Considerations When Filing Schedule K

While not filed with an individual partner’s tax return, the Schedule K-1 is necessary for a partner to accurately determine how much income to report for the year. Unfortunately, the K-1 has a reputation for arriving late. It is required to be received by March 15 . In fact, it’s often one of the last tax documents to be received by the taxpayer.

The most common reasons are the complexity of calculating partners’ shares and the need to individually calculate every partner’s K-1.

To add insult to the injurious wait, the Schedule K-1 can be quite complex and require multiple entries on the taxpayer’s federal return, including entries on the Schedule A, Schedule B, Schedule D, and, in some cases, Form 678.

That’s because a partner can earn several types of income on Schedule K-1, including rental income from a partnership’s real estate holdings and income from bond interest and stock dividends.

It’s also possible that K-1 income can trigger the alternative minimum tax.

What Is Schedule K

Schedule K-1 is a federal tax document used to report the income, losses, and dividends of a business’ or financial entity’s partners or an S corporation’s shareholders. The Schedule K-1 document is prepared for each individual partner and is included with the partners personal tax return. An S corporation reports activity on Form 1120S, while a partnership reports transactions on Form 1065.

Recommended Reading: How To Know If My Taxes Were Filed