Easily Find Out Out Whether You Owe Tax Or Will Get A Refund

Filling out your Form 1040 tax return will tell you whether you’ll receive a refund or you owe taxes to the Internal Revenue Service . For many taxpayers, this process isn’t complicated. Most of the lines on the form provide simple, straightforward directions.

The IRS radically changed the Form 1040 tax return back in 2018. The revised form wasn’t well-received. As a result, the IRS made changes to the tax return again for 2019, then tweaked it a little more for tax year 2020.

The steps, schedules, and line numbers explained here apply to the 2021 Form 1040, the return you’ll file in April 2022. They’ll help you find out just how much you owe the IRSor better yet, how much of a refund you’ll be receiving.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Find A Reputable Tax Refund Calculator

Major tax software companies offer tax return estimators and calculators to help you determine how much you can expect to get back as a tax refund. Find calculators from:

While the specifics of each calculator varies, they all require much of the same information. Make sure you have all your necessary documents before starting your calculations. If you don’t, it might take you longer to compute your refund, or you might not get an accurate calculation.

Also Check: When’s The Deadline To Do Your Taxes

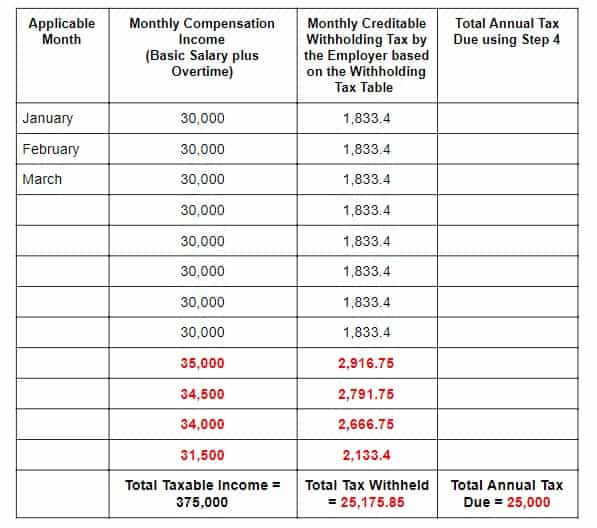

Withholding: How Its Calculated

At this point you may be thinking, OK. Well Im in the __% tax bracket, and its obvious that my employer is withholding way more than that!

Youre probably right. Thats because your employer isnt just withholding for federal income tax. Theyre also withholding for Social Security tax, Medicare tax, and state income tax.

The Social Security tax is calculated as 6.2% of your earnings, and the Medicare tax is calculated as 1.45% of your earnings. Before youve even begun to pay your income taxes, 7.65% of your income has been withheld.

Your refund is determined by comparing your total income tax to the amount that was withheld for federal income tax. Assuming that the amount withheld for federal income tax was greater than your income tax for the year, you will receive a refund for the difference.

EXAMPLE: Nicks total taxable income is $32,000. He is single. Using the tax table for single taxpayers, we can determine that his federal income tax is $3,641.

Over the course of the year, Nicks employer withheld a total of $8,500 from his pay, of which $4,000 went toward federal income tax. His refund will be $359 .

Work Out How Big Your Tax Refund Will Be When You Submit Your Return To Sars

INCOMEOTHER INCOMETAX PAIDTo get this refund you need to fill out your tax return 100% correctly.Please note that this is only an indicator of an estimated refund.TaxTim cannot be held liable for this refund not being received.Get SARS Tax Dates and Deadlines in your InboxDo your Tax Return in 20 minutes or less!TaxTim will help you:

Also Check: Do Non Profits Pay Property Taxes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

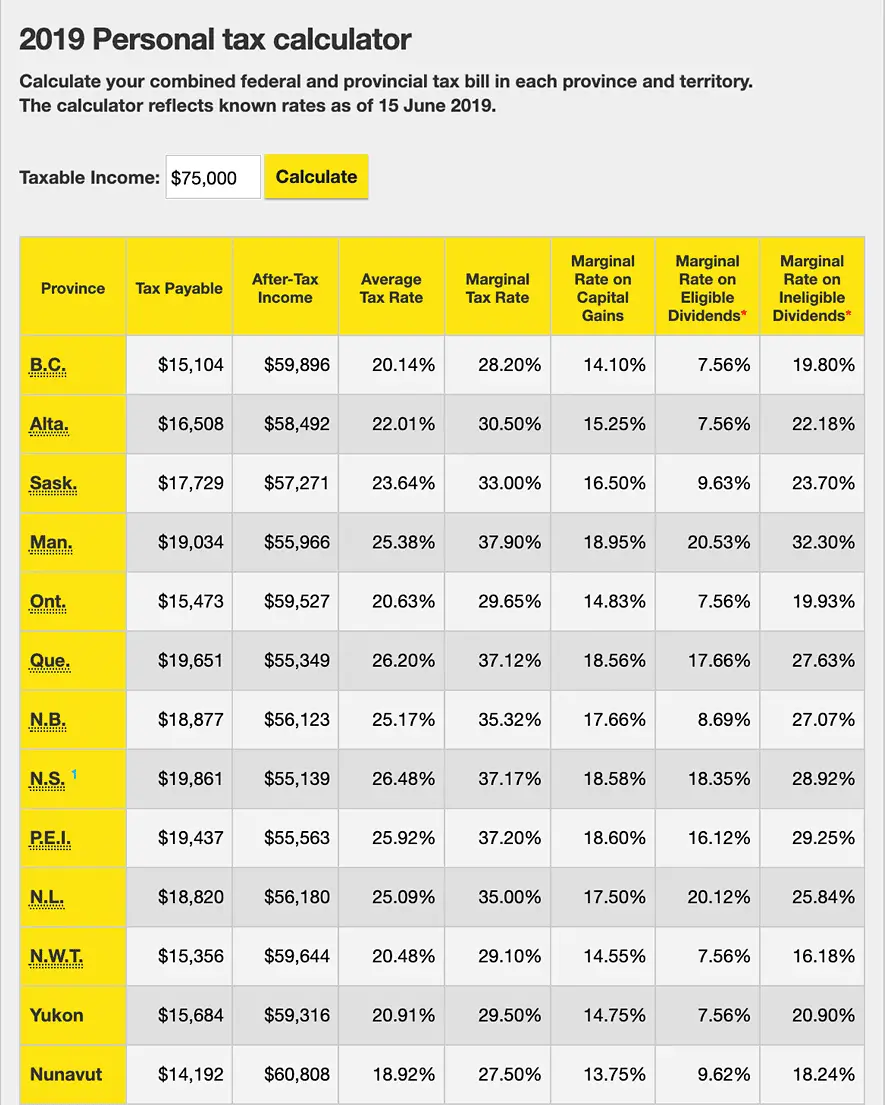

How Do State And Federal Taxes Affect Your Refund

In addition to federal income tax, you may also pay state income taxes depending on where you live. You wont pay state income tax if you live in one of these eight states: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

New Hampshire doesnt tax wages, but does tax dividends and interest, though recent legislation has been passed to phase out this tax beginning in 2024.

If you live in one of the other 41 states, youll need to file a state tax return in addition to your federal tax return. The IRS website contains a directory to help you find information on your states tax requirements.

Key Differences Between State and Federal Taxes

- State tax rates are typically lower than federal tax rates.

- States can have different types of tax credits and deductions.

- The amount of tax withholdings will vary for state and federal taxes.

You May Like: Is Memory Care Tax Deductible

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

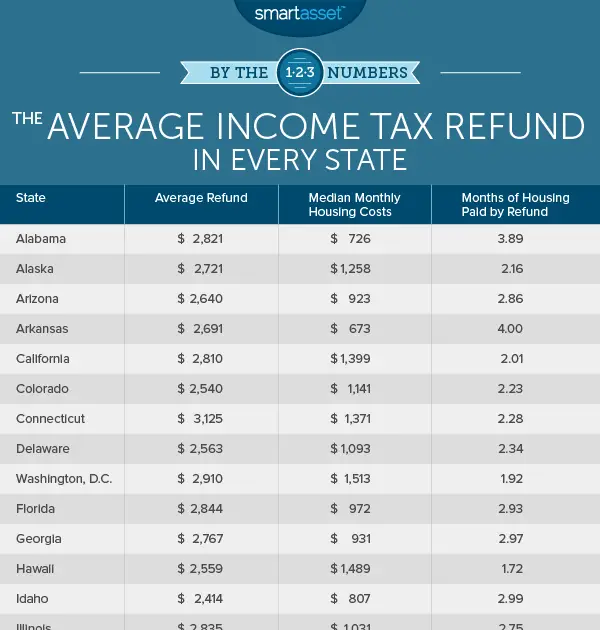

Consider If You’re Going To Get A Refund At All

Nearly three in four tax return filers in the US will receive a refund, which puts you in good company with millions of other people. The rest of us will owe the government money.

Generally, your refund is calculated by how much money is withheld for federal income tax, minus your total federal income tax for the year. Remember that the taxes withheld from your paycheck don’t always go to federal income tax. You also pay into Social Security, Medicare and depending on where you live, state income tax.

Read more:12 of the best tax deductions in 2021

If you received a modest refund last year — or actually owed money — you may need to adjust your withholding to help offset what you’ll need to pay come tax time. Otherwise, you’ll get stuck with a larger bill when taxes are due.

You can use the Tax Withholding Estimator from the IRS to make sure you have the correct amount of money withheld from your paychecks, whether they are weekly, biweekly or monthly. It’s good to have a recent pay stub and tax returns on hand to get the most accurate information when using the estimator before filing your tax return. Keep in mind that it works for most filers, but not necessarily for every filer. Every family situation, gross income, exemptions, withholdings and other factors can completely change how much you receive — or owe — come tax time.

Recommended Reading: How Can I Get My Tax Information From 2015

How To Prepare For Next Year

If you want a larger refund next year , you can update your Form W-4 to change how much is withheld from your paychecks. We recommend checking how much is being withheld from your paycheck once or twice a year to make sure youre on target. For help determining the amount that should be withheld, use the IRS’s calculator or meet with a tax professional.

Who Cannot Get An Estimate Online

You cannot get an estimate online if you:

- are entitled to claim

- were born on or before 5 April 1938 and get the higher allowances

- have other taxable income, for example from dividends and trusts

- are a higher rate taxpayer and want to estimate your Gift Aid tax relief

You can check youve paid the right tax by contacting HMRC or by getting help from an accountant.

You May Like: How To File Your Taxes For Free

Apply The Tax Brackets

The federal tax brackets will guide you on your quest to determine how much you are taxed on every additional dollar of income you earn .

Don’t fall for this common trap: believing that all your income is taxed at one rate. That’s not how it works. If you had $50,000 of taxable income in 2021 as a single filer, you’re going to pay 10% on that first $9,950 and 12% on the chunk of income between $9,951 and $40,525 and so on — this is how marginal tax rates work for everyone, regardless of how much money you earn.

|

Tax Rate |

|---|

|

$314,150 or more |

Data source: IRS.

Good news: If you are an investor who has held your stocks for over a year before selling, you get to unlock long-term capital gains tax rates of 0%, 15%, and 20%, subject to an additional 3.8% net investment income tax for higher earners.

Tax Refunds Depend On Your Withholding

Uncle Sam withholds a portion of every paycheck to cover your tax obligation for the year. In a perfect world, you’d know exactly what that obligation was and could withhold accordingly. As a result, you’d never be owed a refund or receive a surprise bill after preparing your tax return.

In the real world, however, calculating your tax obligation in advance is difficult because your income might change or you may want to claim certain deductions. That’s why most people either receive a refund or have to pay a bit extra when they file.

Neither is a judgment about your finances. A refund just means you withheld too much from your paycheck, while an addition tax liability means you didn’t withhold enough.

Don’t Miss: How To Protest Property Taxes In Texas

Consider What If Scenarios

Did you go through the calculator and find out that your refund is low or your balance due is too high. If so, try playing around with different scenarios to reach a number that you are satisfied with. For example, you could increase your charitable contributions or add some energy-saving home improvements.

If you foresee your income changing, you may want to try estimating taxes with a lower or higher income so you can see just how much of a difference it makes.

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Also Check: Where Can I Get 1040 Tax Forms

Pay Taxes By Credit Or Debit Card

You can also pay your taxes by credit card or debit card. The IRS provides links to three payment processors on its website. They charge a processing fee for setting up credit card payments to the IRS.

If you use a credit card to pay your taxes, be sure to eliminate your balance as quickly as possible to avoid costly interest charges.

What Tax Withholding Is For

When you receive your salary, youll see certain tax amounts withheld on your payslip. This is your withholding tax. Its the amount withheld by your employer, so they can pay it to the IRS.

Most Americans spend most, if not all, of their money before they can pay their taxes. This is why the federal government created a system that lets it receive taxes, even before taxpayers get their hands on their take-home pay.

Also Check: Can You Turn In Taxes Late

Documentation Of The Difference

Once you get the official word on why your refund is not what you had expected, its time to figure out what happened.

A typical notice will show you some basic 1040 information: adjusted gross income, taxable income and total tax due. In each of these categories, the IRS will indicate what you entered and what the agency came up with. A major difference in one of these areas will pretty clearly show you where the problem lies.

The document should also note how much tax you paid and any over- or underpayment. Additional charges or credits, such as interest and penalties, also are taken into account.

Get out your return and try to reconcile it that way, says Scharin. If you used a tax professional to file your return, call that person for help in clearing up the matter.

In many cases, the notice will include a phone number. Scharin says a personal inquiry directly to the IRS could also help.

You might want to call before sending documentation, he says. You might find in speaking with a person, any confusion is cleared up, for good or otherwise. At least youll know exactly what the agency needs from you to resolve the issue.

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

Recommended Reading: How Do I Get My Tax Transcript

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Popular Tax Preparation Software

There are several tax preparation software tools and programs available to help you file your taxes correctly.

eFile.comeFile.com lets you file your 1040EZ return form for free. You have the option of filing individually or jointly with your spouse. State Filing can also be done for a fee of $19.95, and there is a support team available 24 hours a day, 7 days a week to assist you with any questions. You can’t claim dependents, make over $100,000 per year, or have a mortgage. The Standard package is free, and the Deluxe and Premium packages cost $29.95 and $39.95, respectively.

H& R Block eFile H& R Block offers a free e-File option that allows anyone who uses it to import their tax information into their system from any competitors. You are also able to directly upload any tax documents, and file your tax return on any laptop, desktop, or tablet. H& R Block offers three versions for e-filing. The Basic edition is free Deluxe is $54.99 a year, and Premium is $79.99 annually.

Tax Act Tax Act has free online filing for both state and federal taxes. They also have desktop software versions available as well. Their software works you through the pages using a question and answer format. They give you unlimited email and telephone support for all of your questions. You can track your refund directly once you file. Tax Act offers three versions of their software starting with the Basic free version. They also have a Plus package for $37 and a Premium package for $47 annually.

Don’t Miss: Who Do I Call About My Tax Return

How Do I Calculate My Tax Return

Your tax return amount is, in general, based on line 24 and line 33 . Subtract line 24 from line 33. If the amount on line 33 is larger than the amount on line 24, that’s what you overpaid. In theory, you should get this amount back as a refund. Enter this overpayment on line 34.

If the total tax owed is more than the tax you paid , you’ll owe taxes. Subtract line 33 from line 24 to find out how much. Put this underpayment amount on line 37. This is the amount you owe.

Put “0” on lines 34 and 35a if the result is exactly zero, although this is rare. It means that your payments met your tax liability dollar for dollar. You have no refund coming and no balance due.