Your Tax Situation Is Really Complicated And You Just Need More Time

Itemizing tax deductions or owning a small business can make your tax filing really difficult. In that case, pushing the deadline to October can prevent you from rushing through your taxes and making dumb mistakes.

But listen: If your tax situation is that complicated, you should work with a pro. What may take you days or weeks to do can take a pro far less time.

Dealing With Economic Uncertainty

- The coronavirus pandemic has pushed millions into unemployment and the economy into a recession. Financial advisors can help navigate these troubled times. To simplify the search, use SmartAssets free tool. It will match you with financial advisors in your area in just 5 minutes. If youre ready to find an advisor, get started now.

- There are certain personal finance fundamentals that you need to get in order, ideally before a recession hits. Heres how to prepare for a recession.

- Extending the tax deadline isnt the only thing the government is doing to take the economic pressure off Americans. Learn what relief is available to you.

S Corporation And Partnership Tax Returns Due

Today is the deadline to file your S corporation tax return or Partnership return .

Note that S corporations and Partnerships do not pay taxes on their income. That tax is paid on the individual incomes of the shareholders or partners, respectively.

March 15 is also the deadline to file for an extension for S corp and partnership tax returns.

Forms:

You May Like: Federal Tax Return Irs

Financial Institution And Insurance Company

Overview

These are due dates for calendar year filers. Fiscal year filers must determine due dates based upon tax period end date. Extension and estimated payment due date information is included below.

Due on or before April 15, 2021

Form 63FI:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Form 63-20P:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Form 63-23P:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Form 121A:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Due on or before May 17, 2021

Form 63-29A:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Reasons Not To Get A Tax Extension

While you donât need one, there are a few reasons you may not want to file a tax extension:

You want more time to pay a tax bill. A tax extension to October 15 only gives you more time to file your tax return. If you owe a tax bill, the payment deadline is still Tax Day, so you need to pay what you believe you owe and you may owe fees and interest if you pay too little. Missing the deadline will also result in a penalty and interest on the amount you owe. If you need help paying, the IRS does offer payment plans.

Youâre getting a tax refund. Thereâs no IRS penalty for filing after Tax Day if the IRS owes you a refund. So if you know that youâre getting a tax refund, thereâs no need to do the work of getting an extension. Just make sure youâre positive that youâre getting a refund and always file within three years of the filing deadline, or you will lose your refund.

You want more time to contribute to retirement accounts or an HSA. The contribution deadline for most retirement accounts, like a Roth IRA, is Tax Day. A tax extension wonât usually give you more time to contribute to aretirement account or a health savings account .

Recommended Reading: Is Plasma Donation Money Taxable

Extra Time To Make Elections

A wide variety of decisions must be made when you’re preparing your tax return. It can take some work and maybe a consultation with a professional to determine whether you’re actually qualified to take certain deductions and creditsand whether it’s really in your best interest.

Filing an extension gives you extra time to mull it over or to seek help.

If You Need Help Paying

You can often set up an installment agreement with the IRS to pay your tax debt off over time if you can’t afford to pay immediately and in full. You can see whether you qualify, and apply online to set up a payment plan. The IRS will inform you directly whether your payment plan has been approved, after it receives your application.

Don’t Miss: How To Get Doordash 1099

Compare Online Tax Filing Services

Can I mail my tax extension?

If you prefer to go the snail mail route, print and fill out your tax extension form, and drop it in the mail. Make sure you have proof that you mailed it. This way the IRS cant come back and claim they never received it.

Page four of Form 4868 lists several addresses to mail out your extension. The exact address depends on the state you live in and whether youre including a payment with your form.

Can I Get A Tax Extension Online

Yes. To file an extension, just sign in to your 1040.com account and click the Get a Federal Extension button on the main page of your return.

Youll need to fill out the Name & Address screen, then select whether you expect a refund or you expect to owe tax. The extension only gives you more time to file, not to payso anything you owe will still be due by the original deadline. If you dont know whether you have taxes owed or a refund, we can help you determine whether you need to include payment.

If you want to include a tax payment, youll have the option of paying from your bank account or credit card, or you may choose to mail a check.

When youre through making your selections, youre ready to e-file the extension!

Read Also: Protest Property Taxes In Harris County

Approval Is Usually Automatic

Most extension requests will be honored automatically you don’t even have to explain to the IRS why you need the extension. Simply file the form.

But file it correctly: double-check your Social Security number and other data. Erroneous information can trigger a rare rejection.

Certain individualssuch as members of the military serving abroadreceive an automatic extension without having to apply or File Form 4868.

Is The Tax Deadline Going To Be Extended Again In 2021

Generally, Americans are due by April 15 to file their taxes annually. The past two years havent seen those trends repeat. As a response to the COVID-19 pandemic in 2020, the Treasury Department pushed back the tax filing deadline to July 15, and it pushed back the deadline again in 2021, according to reports.

Also Check: How To Get Doordash Tax Form

How Do I Know My Tax Extension Request Has Been Approved

If you sent Form 4868 electronically to the IRS, you should receive an email within 24 hours confirming that it has been received. For mail applications, you wont receive an email and will most likely need to call the IRS for confirmation that your request is in the right hands.

Silence is normally a good sign. The IRS won’t contact you following the filing of a tax extension unless there is an issue with it. That doesn’t happen too often, although there are occasions when a tax extension request may be denied.

Contact An Experienced Raleigh Accountant About Tax Filing

The firm of C.E. Thorn, CPA, PLLC has provided the Raleigh area businesses with tax support for more than 28 years. Our team of accounting professionals are here to support you and your business throughout the fiscal year. If you are interested in requesting a tax extension, our office is available for advice.

Call our office at or complete the online contact form for support.

Don’t Miss: Is Doordash Taxable

Am I Eligible To File A Tax Extension

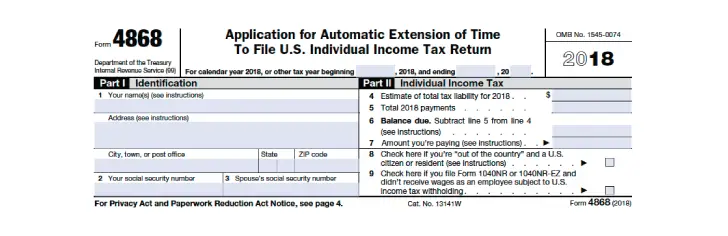

If you’re planning to file a tax extension this year, you’ll need to submit Form 4868 to the IRS either by paper or electronically using e-file before the April 18 deadline. Note that you’ll still have to pay all or part of your estimated income tax due using Direct Pay, the Electronic Federal Tax Payment System, or using a debit or , and note that you’re filing for an extension.

Some taxpayers are automatically granted more time to file. This includes military personnel who are serving in a combat zone or persons in federally declared disaster areas.

How To File For The Extension

Download Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, from the IRS website. If you’ve calculated that you probably owe tax, write a check for that amount and mail the extension form with your check.

The form comes with a list of addresses telling you where to send the form and your payment. It depends on the state in which you live. Send the extension form by certified mail with return receipt requested so you’ll have proof of the date you mailed it and when the IRS received it.

You can also file an extension online with the IRS, and there’s no need to also mail in a paper Form 4868 if you use IRS Direct Pay to make your payment. Simply mark it as an extension payment on the Direct Pay website. The IRS will accept this as notice that you want an extension.

You May Like: Restaurant Tax In Philadelphia

Automatic Extension If You Work Outside The Country

If you work outside of the U.S. or in Puerto Rico, including people on military or naval duty, you will receive an automatic two-month extension without needing to fill out any forms. The two-month extension means you had until June 15, 2021, to file. If you need more time you can request a tax extension, which will give you four extra months, until October 15. Learn more about the two-month extension inIRS Publication 54.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

How Do I File An Extension For Business Taxes

The California Department of Tax and Fee Administration offers online services for requesting extension of filing. Those without a CDTFA Online Services Username or User ID and Password must have them in order to access Online Services. They must request extension no later than one month after submitting returns and payment forms or preparing prepayments.

Read Also: Does Doordash Deduct Taxes

How Are 2021 Tax Returns Related To Stimulus Payments

If the IRS owes you money for the third stimulus check due to a new qualifying dependent you gained in 2021, you can file for that payment through a recovery rebate credit when you file your taxes. You could get up to $1,400 for your dependent — that includes a new baby born or adopted. Keep an eye out for Letter 6475 from the IRS as it will have all the details you need about last year’s stimulus check when you file.

As for the first two stimulus checks, if you didn’t receive either check or received less than you qualified for, you could still be eligible to claim the money through a recovery rebate credit. You’ll either need to file a 2020 tax return if you haven’t yet, or amend your 2020 tax return if it’s already been processed.

At the end of 2021, the IRS still had some 6 million unprocessed tax returns to go through and advises you not to file a second return if your 2020 tax return still hasn’t been processed yet.

Between the child tax credit and child care expenses, you could get a lot of money back this year.

Filing For A Tax Extension: Form 4868

If you need an extension of time to file your individual income tax return, you must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

The deadline is the same as the date your tax return is normally due. In most years, that’s April 15 or the next weekday.

Residents and business owners in Louisiana and parts of Mississippi, New York, and New Jersey were automatically granted extensions on their deadlines for filings and payments to the IRS due to Hurricane Ida. Due to the tornado in December 2021, taxpayers in parts of Kentucky were also granted extensions. You can consult IRS disaster relief announcements to determine your eligibility.

Requesting an extension is free and relatively simple, and it can be done either electronically or on paper. Either way, you will need to provide identification information and your individual income tax information .

There are also checkboxes to indicate if you are either a U.S. citizen or resident who is out of the country or if you file Form 1040-NR, which is an income tax return that nonresident aliens may have to file if they engaged in business in the U.S. during the tax year or otherwise earned income from U.S. sources.

Like all other tax forms, Form 4868 is available on the IRS website. Visit the “Forms, Instructions & Publications” section for a list of frequently downloaded forms and publications, including Form 4868.

Read Also: Doordash Tax Form

Tips For Maximizing Your Tax Savings

- A financial advisor could help you maximize your tax savings to set and reach investing and retirement goals. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you find that youre regularly receiving large tax refunds, this may mean that youre paying too much in taxes in the first place. In that case, you may want to adjust the withholding amounts on your W-4 so you can keep more money throughout the course of the year. Big refunds are exciting, but why give the IRS a free loan?

- Take advantage of SmartAssets free resources during tax season. Check out our income tax calculator today and get started!

Extended 2021 Filing Deadline For Hurricane Ida Victims

Individuals and businesses in Pennsylvania, New York, and New Jersey affected by Hurricane Ida have been granted an extension to certain filing deadlines.

If you are an individual or business that successfully extended your tax filing to October 15, 2021, you now have until January 3, 2022 to file.

Quarterly estimated income tax payments originally due on September 15, 2021 and excise tax returns due on November 1, 2021 have also been pushed to January 3, 2022.

Also Check: Do Doordash Drivers Have To Pay Taxes

Youll Have To File A Separate Extension For State Taxes

Extensions granted by the IRS only apply to your federal taxes. Youll also need to request one from your states revenue office. The rules regarding the extension deadlines, penalties and interest vary from state to state. Check the website of your stated department of revenue to see how long you have to file and what its going to cost you if you dont pay right away.

What Happens If I Miss The Tax Deadline

If you are owed a refund, there is no penalty for filing federal taxes late, though this may be different for your state taxes. Still, it’s best to e-file or postmark your individual tax return as early as possible.

If you owe the IRS, penalties and interest start to accrue on any remaining unpaid taxes after the filing deadline. The late-filing penalty is 5% of the taxes due for each month your return is behind, with fees increasing to up to 25% of your due balance after 60 days have passed. You may also incur a late-payment penalty, which is 0.5% of the taxes due for each month your return is late, with penalties increasing to up to 25% of your unpaid tax, depending on how long you take to file.

Another caveat: If you’re serving in the military — in a combat zone or a contingency operation in support of the armed forces — you may be granted additional time to file, according to the IRS.

Also Check: Efstatus.taxact.com.

Can An Extension Be Filed Electronically

Free Files Free Extension Form can be used to automatically extend an individuals tax season to include income deductions. Anyone may use Free File to have their tax deadline extended online. Tax liability, if any is due, is provided on this form. You can also pay any amount due if you wish to extend.

Do Not Risk Having Your Benefits And Credits Interrupted

Doing taxes on time is the best way to ensure your entitlement to benefits and credits, like the Canada child benefit , the Old Age Security pension payments, and the goods and services tax/harmonized sales tax credit, are not interrupted. Even if you owe tax, dont risk having your benefits and credits interrupted by not filing. If you cannot pay your balance owing, the CRA can work with you on a payment arrangement.

Read Also: Tax Preparation License