Add Your Email Address For My Account

As a fraud prevention initiative, its mandatory as of Feb. 7, 2022, to provide the CRA with an email address to access the online My Account portal. This allows the CRA to inform taxpayers, in real time, of any changes made to their account to help ensure such changes are authorized. The CRA has also added multi-factor authentication for all users and youre now required to enter a one-time passcode each time you sign into the CRAs digital services.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didn’t file? You’ll need as many relevant tax documents as you can gather for the years you did not file.

If youre missing past year tax documents, you can request copies from the IRS by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2021 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

Recommended Reading: What Is Federal Payroll Tax

How Long Can You Go Without Filing A Tax Return

Always remember that for the IRS, there is no time limit for collecting your taxes. And, the IRS will also impose interest and penalties for every year you do not file.

This means that not filing taxes for 10 years may result in a huge amount of penalties.

But, you may ask what happens if you do file your taxes?

As a general rule, once you file a tax return, the IRS only has ten years to go after your tax debt. This is in line with the IRS Statute of Limitations.

But this rule may be stricter, depending on your states tax agency. For example, in California and in New York, the IRS can collect for up to 20 years.

Note the following certain conditions that could suspend IRS collections: a. Bankruptcy b. Offer in Compromise or any Installment Agreements c. Collection Due Process Hearing d. Taxpayer Assistance Order e. Living abroad for 6 months f. Military deferment

Statute of Limitations Definition: The Statute of Limitations is the required time period by the IRS in which they resolve tax-related issues. Any review beyond the Statute is not valid or binding to the taxpayer anymore.

How Do I Pay Quarterly Estimated Taxes

You may have to pay quarterly estimated taxes to avoid a penalty at the end of the year if you don’t have enough taxes withheld from your paychecks or if you receive income from self-employment or another source that doesn’t withhold taxes on your behalf. Use Form 1040-ES to calculate your estimated taxes, then submit your payments via mail or through the IRS online EFTPS payment portal before the quarterly deadlines.

Also Check: How Long Do I Have To File Tax Extension

Filing Your Taxes Late Heres What You Need To Know

Tax season has long been a busy time of year for Canadians.While filing taxes early and getting them out of the way is definitely preferable, its easy to put it off and waiting until the last minute to do your taxes. Here are a few things you should know before you consider filing your taxes late.

Even in a relatively uneventful year, there are countless distractions that can lead to people saying: Ill do it tomorrow. In the wake of COVID-19, filing taxes might just be the last thing on many Canadians minds.

But what happens if you dont file your taxes on time? Is there a penalty for filing taxes late even if you owe nothing? How do you file late tax returns in Canada? Let’s find out!

Find Out Everything You Need to Know About Your Taxes for 2020: Check out our free webinar on filing your 2020 tax return in partnership with TurboTax.

How Bench Can Help

Many small business owners find themselves unable to file and pay the taxes they owe due to circumstances beyond their control. They might be facing the loss of business records, the death of a business partner, or have simply gotten behind and overwhelmed with the bookkeeping necessary for filing taxes.

As Americaâs largest professional bookkeeping service for small businesses, Bench can help. We can take some pressure off you by handling the bookkeeping and tax filing on your behalf.

Our Bench Retro team specializes in past bookkeeping and can quickly get your books caught up, your tax forms filled out and filed, and on the road to having your business financials back on track.

The weight of overdue financial obligations can be staggering. Thankfully, past-due taxes are a problem with a straightforward solution. Clean up your books , fill in the missing tax forms, and submit your income taxesâno matter how many years youâve missed. Then you can move on and focus on the more important task of running your business.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Friends donât let friends do their own bookkeeping. Share this article.

Don’t Miss: Do I Have To Pay Taxes On Stimulus Check

Is There A Penalty For Filing Taxes Late If You Owe Nothing

So, what happens if you file late with the CRA, but you dont actually owe any money? Filing taxes late when you dont owe may not result in significant interest charges, since the CRA cant apply interest on money you don’t owe. However, it can lead to other issues.

For example, if you receive government benefits, in many cases you must file an annual tax return to keep receiving them uninterrupted. The government uses tax return information to verify eligibility for certain assistance programs. If you fail to file your taxes on time, your coverage under these programs may lapse. Some of the benefits where you need to file your tax return in order to keep receiving them include the Guaranteed Income Supplement , the GST/HST credit, and the Canada child benefit .

You should also know that other benefits in different provinces and territories may also be affected if taxes arent filed on time.

What To Do If You’ve Never Filed Taxes

If you’ve never filed a tax return, it can be confusing and scary to think about the process. The important thing to remember is that the IRS is relatively reasonable. The agency wants to work with people and help them file tax returns. As long as you haven’t committed tax fraud or evasion, you will be able to file your unfiled returns and make arrangements on your tax debt.

If you’re worried that you may have committed fraud, evasion, or another tax crime, you should contact a tax attorney. They can answer your questions and help you identify the best path for dealing with your unfiled returns. Even if you’re not worried about tax crimes, you may still want to have a tax professional help you. A tax pro knows how to navigate the IRS’s rules and processes. They can help you deal with your unfiled returns and get back into good standing with the IRS.

After you contact a tax pro, the first thing you need to do is gather all of the necessary documents. This includes your W-2 forms from each employer you worked for during the year, as well as any 1099 forms if you were self-employed or had other income sources. If you plan to itemize, you should also gather information about your itemizable expenses. That includes medical bills, homeowner’s insurance and interest, state and local taxes, and similar expenses.

Don’t Miss: Can I File Taxes Without Working

What If You Cant Pay What You Owe

If youâve been stalling on filing your taxes because youâre worried you canât pay what you owe, relax. Remember that the IRS is interested in collecting what you owe, not making it impossible for you to pay it. There are several IRS tax relief programs if youâre faced with a tax amount you canât pay all at once.

The IRS appreciates it can be challenging to pay large tax sums in a single payment. Thatâs why the agency has an initiative called Fresh Start to help taxpayers get back into good standing with their tax bills.

As part of this program, taxpayers who canât pay their full tax bills have four options for how to work with the IRS to sort out what they owe.

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Recommended Reading: Can You Use Pay Stubs To File Taxes

An Offer In Compromise

An offer in compromise is a bit more complex. It involves reaching an agreement with the IRS to pay less than your full balance due. An offer in compromise is typically only approved if youre unable to pay through an installment plan and comes with an application fee. Youll probably need the help of a professional for this option.

You must establish that you cannot pay your balance through an installment agreement or by any other means. All your past due tax returns must be filed before the IRS can grant you this relief, and you must have made some payment toward taxes in the current year, either through withholding from your paychecks or by sending in quarterly estimated payments, even though you havent filed a tax return for the year yet.

How Do You File Back Taxes

Back taxes are the tax forms and payments that are overdue to the IRS. If youâve been receiving notices about owing back taxes and feel out of your financial depth, your first step might be to speak to a tax professional like an enrolled agent, CPA, or tax attorney to help you through the process.

A good tax resolution service can be a huge asset as you navigate this process. While they wonât get your tax debt down to zero, they will be able to negotiate on your behalf for a reasonable payment plan, get your books up to date so that youâre not missing any tax deductions that could lower your total debt, and generally reduce the stress of this very stressful situation.

Be mindful that some unscrupulous companies or individuals claim to be able to âfight the IRSâ on your behalf to remove debts completely or negotiate them away. These are likely scammy set-ups designed to prey on those who look for help faster than they look for proper credentials.

With the help of your tax expert, or on your own if you are comfortable doing so, youâll take the following steps to resolve your back taxes.

Contact the IRS about your intent to file and pay. The longer you ignore the IRS, the more insistent they become.

File your tax forms. Remember, once you file your tax forms, even if you canât pay the taxes yet, the failure-to-file fees stop accumulating.

Don’t Miss: How Do I Track My Tax Refund

Contact Faris Cpa For A Consultation Today

Not only can you save significant amounts of money and avoid criminal prosecution by using the VDP, but becoming current or staying current with your tax filings is an important part of avoiding a tax audit by the CRA. Whether you are under audit, or you are trying to become current to avoid or prevent an audit, you should get the help of a Chartered Professional Accountant who is a tax expert. The risks and cost of not getting your filings right or not making sure you meet the VDP requirements can be large and are often far outweighed by the cost of having an expert navigate the tax rules for you.

Figuring Out How Long You Work For The Tax Man

If taxes were simple, then it would be a trivial exercise to figure out how long youre essentially working for the IRS every year. For instance, if there were a flat tax rate of 10% that applied to all income without any deductions, youd know that youd be working 10% of the year, or 36.5 days, to make enough money to pay your taxes for that year.

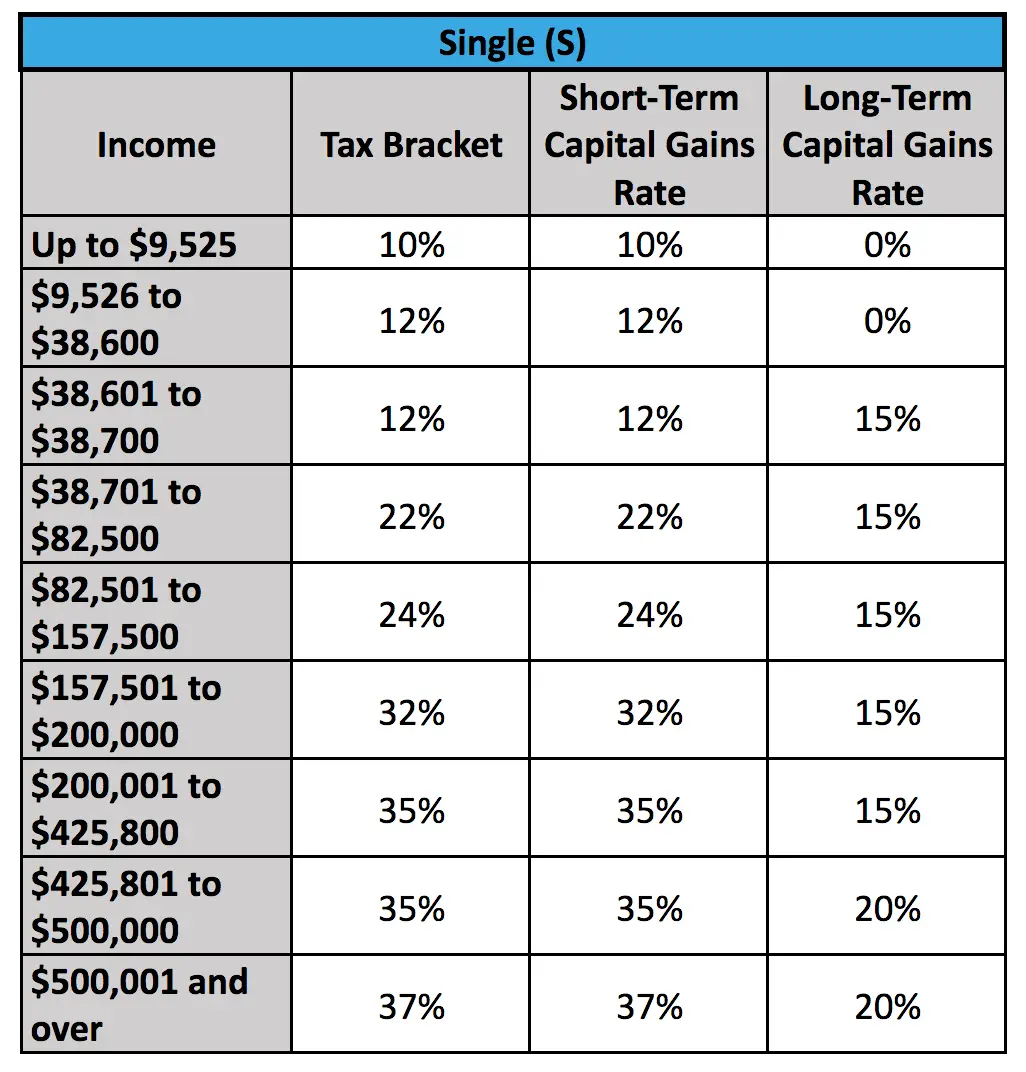

However, taxes arent simple. Even when incomes are similar, various deductions give some people tax breaks that others cant get. Progressive tax rates mean that higher-income taxpayers often pay higher tax rates than lower-income taxpayers, but there are also exceptions to that rule for those who get most of their income from tax-favored sources like dividend income or long-term capital gains. As a result, some people work a much larger portion of the year toward paying their tax bill than others.

Image source: Getty Images.

Read Also: Does Washington Have Income Tax

Recommended Reading: How Much Do You Pay In Taxes For Instacart

Can I File My Amended Return Electronically

If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can now file the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Additionally, Tax Year 2021 Form 1040-NR Amended and Tax Year 2021 Form 1040-SS/PR Corrected returns can now be filed electronically.

Visit Our Help Centre For More Information

Looking for more details about a specific service? Need to get a hold of us regarding an existing account? We are here to help!

To qualify for The Foundation, you must have an active account with a bank or financial institution, as approved by Spring Financial, and a valid government-issued Canadian ID. The Foundation is available in all provinces except Saskatchewan, Quebec, and New Brunswick. Results from The Foundation depend on the individual. All guarantee references are made in connection to the Evergreen Loan. To qualify for the Evergreen Loan, you must first successfully complete 12 months on The Foundation and save $750, have an active account with a bank or financial institution, as approved by Spring Financial, and a valid government-issued Canadian ID.

Read Also: What Is Georgia State Tax

What Happens If You Don’t File Your Taxes For Years

If you do not file your taxes for years, the IRS can take legal action against you. This can include filing a lien against your property or seizing your assets. In some cases, you may also be subject to criminal charges. If you are facing any of these consequences, it’s important to speak with a tax attorney or another tax pro as soon as possible.

How Long Can You Go Without Filing Taxes

The IRS expects every business to file a federal tax return and pay taxes every year. So the real answer to that question is : Zero.

There are no IRS-issued guidelines or allowances that will let you skip filing taxes for a year.

That being said, the IRS also realizes that life doesnât always go smoothly. Medical emergencies, the death of a loved one or business partner, a natural disaster, or other events outside oneâs control can cause severe disruption of oneâs finances, causing business owners to fall behind on all kinds of obligations.

So while youâre not technically allowed to skip filing a tax return, if you do miss the tax filing deadline this year, they wonât come knocking on your door. Instead, youâll begin incurring failure-to-pay and failure-to-file fees until you get your tax forms sorted out. The sooner you get them in, the sooner you stop the fees from piling up.

Note, too, that the IRS does not have a statute of limitations on missing or late tax forms. If you didnât file taxes for the last two, three, ten, twenty, or fifty years, the IRS will still accept your forms as soon as you can get them submitted.

The IRSâs rules are a bit different when it comes to tax refunds, however. If youâre hoping to claim a tax refund, you can only do so for three years. That means you might be forfeiting some money if you donât file within that time period.

Read Also: When’s The Last Day To Do Taxes