Why Do I See A Tax Topic 151 Tax Topic 152 Or Irs Error Message

Although the Where’s My Refund tool typically shows a status of Received, Approved or Sent, there are a variety of other messages some users may see.

One of the most common is Tax Topic 152, indicating you’re likely getting a refund but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

The delay could be an automated message for taxpayers claiming the child tax credit or earned income tax credit sent because of additional fraud protection steps.

Tax Topic 151 means your tax return is now under review by the IRS. The agency either needs to verify certain credits or dependents, or it has determined that your tax refund will be reduced to pay money that it believes you owe. You’ll need to wait about four weeks to receive a notice from the IRS explaining what you need to do to resolve the status.

There are other IRS refund codes that a small percentage of tax filers receive, indicating freezes, math errors on tax returns or undelivered checks. The College Investor offers a list of IRS refund reference codes and errors and their meaning.

Whats Taking So Long To Receive Refunds

If you dont receive your refund in 21 days, your tax return might need further review. This may happen if your return was incomplete or incorrect. The IRS may send you instructions through the mail if it needs additional information in order to process your return.

You may also experience delays if you claimed the Earned Income Tax Credit or the Additional Child Tax Credit. Under the Protecting Americans from Tax Hikes Act of 2015, the IRS is required to hold tax returns for folks who claimed those credits until Feb. 15. If you claimed either of those tax breaks, a PATH Act message may appear when you use the Wheres My Refund? tool.

If you havent received your refund and youre becoming impatient, calling the IRS will likely not help. Its best to avoid contacting the IRS directly unless the Wheres My Refund? tool prompted you to do so or its been 21 days since you filed your tax return electronically .

How Long Does A Tax Refund Usually Take To Process

It is usually quite fast. And because most refunds come so fast, its not a good idea to visit a same day refund agent.

Electronic tax returns are the quickest, normally processed by the ATO within two weeks. Etax expects that most refunds will be out within 10 working days after lodgement of your tax return, but some people will wait a bit longer for the ATO to get it done.

Paper returns are much slower, taking 10 weeks.

When you need your tax refund in a hurry and want to avoid ATO delays, make sure all your details are correct. Prepare your receipts early and only claim eligible tax deductions to avoid ATO complications that will slow down your refund.

Also Check: How To Calculate Tax Bracket

File Your Tax Return Electronically

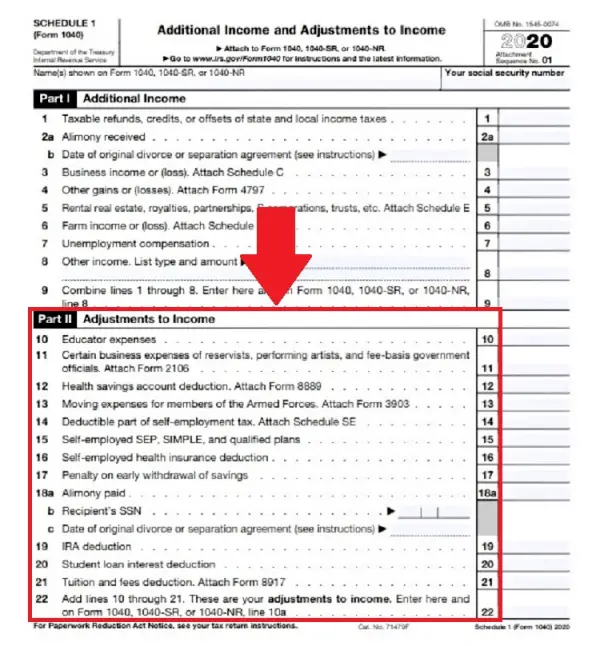

Combining direct deposit and electronic filing can greatly speed up your tax refund. Since filing electronically requires a tax software program, it can flag errors that may cause processing delays by the IRS. These errors can include incorrect Social Security numbers, dependents dates of birth, and misspelling of names.

You can electronically file your tax return for free using the IRS Free File Program if your adjusted gross income is less than $73,000. Most simple tax returns can also generally be filed for free with commercial tax software providers, although you may be charged to file your state taxes.

If your tax situation is more complicatedif you sold property, paid business expenses or earned investment or business income, for exampleyou should consider hiring a tax professional. Having a knowledgeable tax professional, such as an enrolled agent, certified public accountant , or other tax professional, can help review your tax return and identify any mistakes that may slow down the processing of your tax refund.

Featured Partner Offers

On Cash App Taxes’ Website

Whats The Fastest Way To Get A Refund

Whether you file electronically or on paper, the fastest way to get a refund is through direct deposit. Eight in 10 taxpayers get their refunds faster by using e-file and direct deposit, according to the IRS. The agency expects about 90% of individuals to file their returns electronically. You can also use direct deposit if you file by paper.

Recommended Reading: How Much Does It Cost To File Taxes With Taxslayer

How Long Does It Take To Receive An Amended Refund

You should receive your amended refund within six months from the date filed. If it has been more than five months since you filed your amended return, please call 1-877-252-3052 for assistance. Select the option for l Individual Income Tax then listen for the Refund option to speak with an agent. Please do not call 1-877-252-4052 as instructed in the main greeting. Interest will be paid on amended refunds at the applicable rate.

What Could Slow Down Your Refund

While most refunds come quickly, there are certain things that can result in a delay. It could take longer for your money to come if:

- There are mistakes on your tax return

- Your tax return isn’t complete when you submit it

- Identity theft or fraud become possible issues

- You claimed the Earned Income Tax Credit

- You claimed an Additional Child Tax Credit

If you claimed either the EITC or the ACTC, the Protecting Americans From Tax Hikes Act prohibits the IRS from issuing the refund prior to mid-February. As a result, even if you get your tax forms in ealy, file them electronically, and provide your bank information for direct deposit, you may not be able to get your funds from the IRS until late February or even early March.

Anyone who is not sure where their refund is, or when to expect it, can use the IRSWheres My Refund? Tool. You will need basic details, including your Social Security number or taxpayer ID, and the amount of your refund in order to access your data. This site updates only once per day, so once you’ve checked it, you’ll need to wait until the next day to get any new info.

Knowing when you can expect your refund can help with your financial planning, so make sure you consider your filing method and the possible causes of delay when anticipating when your money will come in.

You May Like: How Much Taxes Owed On 1099

How To Use The Irs2go App To Track Your Return

The IRS2Go app is available for both iOS and Android.

The IRS also has a mobile app, IRS2Go, which checks your tax refund status. It’s available for both iOS and Android and in English and Spanish. Using it, you’ll be able to see if your return was been received and approved and if a refund was sent.

To log in, you’ll need your Social Security number, filing status and the expected amount of your refund. The IRS updates the app overnight, so if you don’t see a status change, check back the following day.

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

You May Like: Which Hybrid Cars Are Eligible For Tax Credits

My Refund Check Is Now Six Months Old Will The Bank Still Cash The Check

A check from the NC Department of Revenue is valid up to six months after the date on the check. If a check date is older than six months, you should mail a letter along with the refund check to NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh, NC 27602-1168. Your check will be re-validated and re-mailed to you.

Common Reasons That May Cause Delays

- We found a math error on your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return. Please respond quickly so we can continue processing your return.

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund.

Recommended Reading: What Is The Best Online Tax Software

Tips For Getting Through Tax Season

- Taxes are just one aspect of your overall financial life. A financial advisor can help you plan your retirement, estate and optimize your tax strategy for all of your financial goals. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you still need to file your taxes, make sure to consider all of your filing options. Two of the largest tax-filing services are H& R Block and TurboTax. Both are easy-to-use and offer step-by-step guidance to help you maximize your return. Check out SmartAssets comparison of TurboTax and H& R Block to see which one is better for you.

- State governments use their own systems for handling tax returns. In some states youll get your refund within a couple of days, while other states will take weeks or months for processing. Learn how to check your state tax refund status.

- If you find yourself relying on your tax refund to make ends meet, you may be able to make some changes to your tax withholding. Claiming more or fewer allowances on your W-4 will impact how much tax your employer removes from checks. Withholding less in taxes will mean more take home pay. If you receive a big refund come tax time, there may be room for you to increase your allowances.

How Long Does It Take To Get A Past Years Tax Refund

Once you are accepted, you are on the IRS payment timetable. Only the IRS knows the status of processing your tax return, whether you owe taxes or are due a refund. In prior years, the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days last year. The same results are expected for 2021.

Recommended Reading: How To Keep Track Of Taxes For 1099

Experts Say Tax Returns Could Be Delayed

Although the IRS says most refunds will be sent within 21 days, experts warn that delays are likely, noting that the agency is still working through 2020 tax returns.

During the 2020 budget year, the IRS processed more than 240 million tax returns and issued roughly $736 billion in refunds, including $268 billion in federal stimulus payments, according to the latest IRS data. Over that period roughly 60 million people called or visited an IRS office.

Donald Williamson, an accounting and taxation professor at American University in Washington, said he expects “weeks and weeks” of IRS delays in 2022. “My advice in 2022 is file early, get started tomorrow and try to put your taxes together with a qualified professional.”

Compounding the challenge, tax preparers told CBS MoneyWatch that it remains hard to reach IRS personnel on the phone. The IRS answered only about 1 in 9 taxpayer calls during fiscal year 2021, Collins reported. “Many taxpayers are not getting answers to their questions and are frustrated,” she noted.

“Back in the old days, you’d wait 5-10 minutes and get an IRS agent on the phone,” said Christian Cyr, a CPA and president and chief investment officer at Cyr Financial. But now, he said, his CPAs wait hours to speak with an IRS employee, with no guarantee of ever reaching one.

1. File electronically

2. Get a refund via direct deposit

3. Don’t guesstimate

4. Save IRS letters about stimulus, CTC

Here’s What You Need To Know About Tax Refund Timelines

According to the IRS, most tax refunds are issued by the agency in 21 days or less. However, in order for you to get back your money so fast, you need to do two things:

- You need to submit your tax forms electronically. It takes much longer for the IRS to receive and process paper returns than it does for the agency to handle returns that are electronically filed. The good news is, e-filing is easier, especially if you make use of the best tax software to help you get your return completed correctly. Not only that, but it is often free to use software programs to electronically file your taxes, although your ability to submit a return at no cost depends on your income and which program you use.

- You need to request direct deposit. The IRS can deposit money right into your bank account more quickly than it can mail you a check. Direct deposit is free and secure, so you don’t have to worry about giving the IRS your bank details.

If you submit a paper return, you can expect to get your money back much more slowly. In fact, the IRS indicates it could take around six weeks for you to get back your overpaid tax money if you submit your forms via standard mail rather than sending them in electronically.

Read Also: What Form Is The State Tax Return

How Much Interest Does The Irs Owe Me

If you filed a proper return on time and the IRS does not issue your refund within 45 days after accepting it, the agency is required to start paying interest on your refund amount.

As of July 1, the interest rate rose from 4% to 5% as a result of the Federal Reserve’s recent decision to raise the federal funds rate. If you electronically filed on time, the 45-day period started on April 18. If you filed a paper return, it began the day that the IRS marked your return as “accepted.”

Of course, any IRS interest you receive with your refund is considered taxable income.

How Long Does It Take To Get A Tax Refund From Hmrc

| How long does it take to get a tax rebate? | Tax refunds in the UK can take up to 12 weeks to be processed by HMRC with a further 5 days to 5 weeks added to receive your money. |

There are a number of reasons why you may be owed a tax refund, or tax rebate, from HMRC. If you are employed and pay tax through PAYE, this may have been calculated incorrectly, or your self assessment tax return may have included errors meaning that you overpaid your tax. If this is the case and you are owed a repayment from HMRC then you will no doubt be wondering how long does a tax rebate take?

Read Also: What Do I Need To Bring To Tax Preparer

Here’s How Long It Will Take To Get Your Tax Refund In 2022

Three in four Americans receive an annual tax refund from the IRS, which often is a family’s biggest check of the year. But with this tax season now in progress, taxpayers could see a repeat of last year’s snarls in processing, when more than 30 million taxpayers had their returns and refunds held up by the IRS.

Treasury Department officials warned in January that this year’s tax season will be a challenge with the IRS starting to process returns on January 24. That’s largely due to the IRS’ sizable backlog of returns from 2021. As of December 31, the agency had 6 million unprocessed individual returns a significant reduction from a backlog of 30 million in May, but far higher than the 1 million unprocessed returns that is more typical around the start of tax season.

That may make taxpayers nervous about delays in 2022, but most Americans should get their refunds within 21 days of filing, according to the IRS. And some taxpayers are already reporting receiving their refunds, according to posts on social media.

However, so far, the typical refund is about $2,300 less than the average refund check of about $2,800 received last year. That could change as the tax season progresses, given that tens of millions of Americans have yet to file. But it could signal that taxpayers could get smaller checks this year, an issue for households already struggling with high inflation.