How To File Late Tax Returns In Canada

The longer you wait after the deadline to go about filing late taxes Canada, the more difficult your situation will become. The CRA continues to charge interest on outstanding debt, and penalties continue to add up each month. Also, the longer you go without filing, the greater the likelihood of the CRA will consider your situation to be purposeful evasion and potentially seek criminal charges against you.

If your return is less than a year overdue, the most straightforward thing you can do is file it as normal. This means sending in your paper returns or using Netfile to submit online. Keep in mind that outside of the typical tax season, the Netfile service may not be open to receive returns at all times. Once you submit your return, the CRA will assess it as per usual. If you owe interest or penalties, the CRA will inform you of this fact and you will be responsible for paying what you owe.

If you wish to know how to file late tax return Canada, know that if your returns are more than a year late or if you have several returns that have not been filed, your best option may be to apply for the Voluntary Disclosure Program . This program is designed to give those who have not filed returns that should have been filed or who have made errors or omissions on their returns a second chance.

To qualify for the Voluntary Disclosure Program, your situation must:

If you are considering applying to the VDP, . Our team will help give you the best chance of success.

Complete And Submit The Return Forms

Though the specific list of forms needed to file back taxes depends on your personal financial situation, below are some of the documents you’ll likely have to round up for the year you need to file.

Forms for filing back taxes

They include:

- Form W-2, a wage and tax statement

- Form 1099-G if you received unemployment benefits

- forms 1099-MISC or 1099-NEC if you completed contract work or received certain kinds of payments

- forms 1099-INT and 1099-DIV if you had interest income or dividends

- Form 1099-R if you took distributions from a retirement account

- Form SSA-1099 if you got Social Security benefits

- Form 1098 if you received over $600 of mortgage interest

- Form 1098-T if you paid tuition expenses

- records that prove you’re eligible for certain deductions and credits

Where to submit back taxes

The IRS says you can “file your past due return the same way and to the same location where you would file an on-time return,” though if you received an IRS notice you should follow its instructions.

We’ve rounded up the best tax software programs here, but note that the fine print may be different for the current year than it is for back taxes.

For example, tax prep service TurboTax has links on its website where you can buy products to prepare your 2018, 2019 and 2020 taxes, though it says “you will have to print out and mail in your tax return for previous years.” In other words, you can’t file these tax returns online through TurboTax.

What To Do If You Can’t Afford To Pay Back Taxes

Because of the potential for interest, the IRS advises you to pay your tax bill in full as soon as possible.

If you owe less than $100,000 and can’t pay right away but will be able to soon, you may want to pursue a short-term payment plan. Short-term payment plans can buy you an extra 180 days and don’t cost anything to set up online. You can apply using the Online Payment Agreement tool at IRS.gov or call 800-829-1040.

If you’re unable to pay that quickly, there are other options.

Request an installment agreement

If you can’t afford to cover your unpaid taxes, you can request an installment agreement by filling out Form 9465 . Fees start at $31 but vary based on your income level, how much you owe, how you pay and how you set up the long-term payment plan.

Request an offer in compromise

If paying your bill would be a serious financial hardship, you might consider an offer in compromise, which is essentially a settlement with the IRS for less than your total bill. The IRS warns that this program is “not for everyone” given its restrictions and rigor. Fees depend on your income but start at $205 .

You can apply for an offer in compromise, or OIC, by completing Form 656. Lacy says it’s a good idea to hire a tax professional if you’re planning to pursue an OIC because it’s “a lengthy process, and it does take diligence.”

Also Check: When Is The Earliest You Can File Taxes 2021

How Many Years Back Can I Get A Tax Refund

In general, it is not too late to file a tax return. Even after seven years, you can still file your tax return for the IRS. Except in some specific cases, you cannot get your tax refund after seven years, since the statue of the limits will have expired. However, if you owe money, it is likely to be penalized for seven years of delay. So now we will talk about this important question, How many years back can I get a tax refund?

Related To How Many Years Back Can I Get a Tax Refund:

Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

Why You Should File Your Past Due Return Soon

Avoiding penalties and interest is perhaps the most compelling reason to file late tax returns sooner rather than later. When youre struggling and short on cash, your tax bill may feel so overwhelming that $50 in interest and $500 in interest both feel like equally insurmountable obstacles. Eventually, however, the taxman will come calling and when he does, youll want to have yourself in the best position possible. Your tax bill isnt going away, so act today to keep it as low as you possibly can. We promise you that there is light at the end of the tunnel, so keep that tunnel as short as you can.

Youll also need to file previous year taxes if youre due a tax return. This works in two ways. The IRS wont process your tax refund if you dont file your taxes. If you were due a tax refund in 2018 but never filed your taxes, you wont get your 2018 refund until you do. You have three years in which to file your taxes and claim any money youre due. As the kids are fond of saying, if you snooze, you lose. Wait too long and youll forfeit your refund and any tax credits you could have taken.

A missed return in the past can also foul up your refund this year. The IRS pays attention. If you missed filing a return in the past, youre not getting this years tax refund until you either correct the problem or give them a valid reason for skipping out on the missed filing.

You May Like: Can You Pay Taxes In Installments

An Offer In Compromise

An offer in compromise is a bit more complex. It involves reaching an agreement with the IRS to pay less than your full balance due. An offer in compromise is typically only approved if youre unable to pay through an installment plan and comes with an application fee. Youll probably need the help of a professional for this option.

You must establish that you cannot pay your balance through an installment agreement or by any other means. All your past due tax returns must be filed before the IRS can grant you this relief, and you must have made some payment toward taxes in the current year, either through withholding from your paychecks or by sending in quarterly estimated payments, even though you havent filed a tax return for the year yet.

How To File Back Taxes

Although it can feel stressful or embarrassing, youre not alone if youre sitting on a past-due tax return. Whether life happened and you just forgot to file or if you couldnt pay your tax and shut down, back taxes happen. The good news is that its not too late to remedy the problem. Uncle Sam has a long memory, so its important to clear up tax issues so they dont haunt you indefinitely. There are a lot of good reasons to do so.

Although it can feel stressful or embarrassing, youre not alone if youre sitting on a past-due tax return. Whether life happened and you just forgot to file or if you couldnt pay your tax and shut down, back taxes happen. The good news is that its not too late to remedy the problem. Uncle Sam has a long memory, so its important to clear up tax issues so they dont haunt you indefinitely. There are a lot of good reasons to do so.

Read Also: Do You Need To Claim Unemployment On Taxes

How Many Years Back Can You Get A Tax Refund

The IRS Statute of Limitations allows you three years from the filing deadline to file your prior year return and claim your refund. For example, the last day to claim your tax refund for the 2016 tax year is April 15, 2020. The original tax deadline was April 15, 2017, therefore, you have three years from that date to claim your refund.

Keep in mind that they also have the same amount of time to audit you and up to ten years to collect any unpaid tax. Be advised, the IRS is allowed to hold your refund or take a portion of your refund to pay any past debts.

Filing Income Tax Return Late: How Many Years Can You Go Back

Related

The IRS statute of limitations says that normally they can’t look at back tax returns older than six years. If you haven’t filed a return, however, there’s no legal limit to when the IRS can come after you. If you want to clear up a lingering shadow on your business finances by filing a decade-old return, for example, the IRS won’t object. If you hope to collect a 10-year-old refund, however, you’re out of luck.

Recommended Reading: How To Get Business Tax Transcript

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didn’t file? You’ll need as many relevant tax documents as you can gather for the years you did not file.

If youre missing past year tax documents, you can request copies from the IRS by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2021 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

How To File Tax Returns For Previous Years

Filing a tax return for a previous year isn’t as hard as you may think, but it does require a few steps.

1. Gather information

The first step is gathering any information from the year you want to file a tax return for. Pull together your W-2s, 1099s, and information for any deductions or credits you may qualify for. Look on the tax forms you gather for the year of the tax return you’re filing to make sure you use the right ones.

2. Request tax documents from the IRS

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

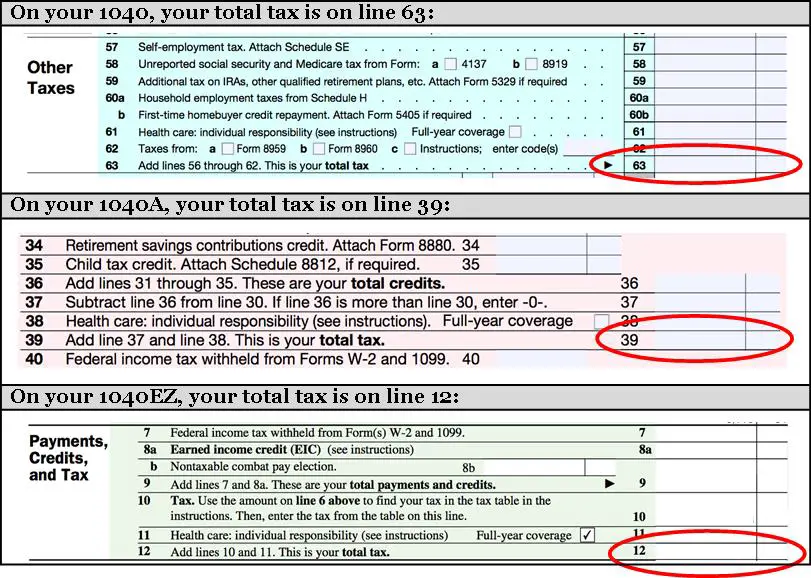

3. Complete and file your tax return

Once you have all the forms you need, be sure to use the tax forms from the year you’re filing. For instance, you must use 2018 tax return forms to file a 2018 tax return. You can find these documents on the IRS website. Patience is important when filling out a tax return by hand. And thankfully, you can also file tax returns from previous years using TurboTax.

Don’t Miss: How Much Tax Deduction For Car Donation

What Is A Tax Assessment

As the CRA puts it, an assessment is designed to promote awareness of and compliance with the laws it administers.

This means that the CRA will look at the information you provided on your return, check it for accuracy, and potentially request additional information as needed. When the CRA initially assesses your tax return, you will receive a Notice of Assessment . This will detail the amount of tax that you owe , as well as other information about your tax situation. However, once your return has been assessed, the CRA can reassess it later if they choose to.

The CRA usually processes tax returns in about two to six weeks after they have been filed. In some cases, a pre-assessment review could be conducted before you receive your Notice of Assessment. This is a situation where the agency will review the credits and deductions that you claimed, and potentially ask you for additional information or documentation. Once the NOA is sent out, your return could be reviewed under the processing review program.

You Can Set Up A Payment Agreement With The Irs

If you owe money to the IRS, you can set up payment agreements if you cant pay back your returns right away. There several types of payment plans, depending on what you need. If you dont set up a payment plan with the IRS and you avoid paying the IRS, the IRS will send their collections department after you.

RELATED ARTICLES

Read Also: Can I Pay My Federal And State Taxes Online

The Statute Of Limitations For Unfiled Taxes

Statutes of limitations place time limits on how long individuals can be held responsible for criminal offenses, but there is no statute of limitations for failing to file tax returns. This means that the IRS can in theory go back decades to assess taxes and penalties when returns were not filed, but this rarely actually happens. The agencys non-filing enforcement usually goes back no more than six years, and most actions dealing with SFRs and delinquent returns are completed less than three years after the return was due.

What Happens If You Dont File Your Taxes In Canada

If you are required to file a tax return, you must do so by law. It isnt a crime to owe tax debt, but it is a crime to not file taxes if you are required to do so. Most Canadians are required to file income taxes every year.

Not filing a tax return = tax evasion = crime.

Each day that you are behind filing your returns, you could be considered to essentially be committing tax evasion. Tax evasion is a situation where an individual or a business intentionally ignores Canadian tax law. By not filing income taxes when they are due, you are ignoring Canadian tax law and the Canada Revenue Agency could consider this to be an intentional attempt to evade taxes. There are significant penalties for tax evasion, including fingerprinting, court-imposed fines, prison time, and a possible criminal record. This can damage your reputation and your future.

As mentioned, it is not against the law to have a tax debt and owe money to the CRA . It is against the law to not file your tax returns.

Even if the CRA does not seek tax evasion charges against you, there are still possible ways that you can be hurt by filing taxes late in Canada. The CRA can charge significant late-filing penalties as well as interest charges on the tax debt that you owe. The longer you wait and the longer your late tax filing is outstanding, the more you will accrue large penalties and interest. You could even be subject to prosecution.

Also Check: How To File Quarterly Taxes For Business

What Happens If You File Your Taxes Late

You may wonder what happens if you dont file your taxes or what happens if you file your taxes late. In Canada, these are two different situations and the consequences of both are also different.

Not filing taxes when you are required to file them can be considered a crime, so its critical to file your returns, even if they are late and you cannot afford to pay immediately.

Tax evasion has serious consequences. Not paying your taxes is a crime, and has major financial and personal costs. If you are convicted of tax evasion, it can also lead to court-imposed fines, jail time, and a criminal record.

If convicted of tax evasion, you must repay the full amount of taxes owing, plus interest and any civil penalties assessed by the Canada Revenue Agency . Courts may impose a 5-year jail term or fine of up to 200% of the evaded taxes amount.

If you are required to file your taxes, you should file your taxes in full and on time. If you cannot file your taxes on time for whatever reason, you should take action and file them as soon as possible.

The longer you wait, the more difficult your situation could become. Late filing penalties, interest, and other fees add up the longer you go without filing.

In fact, you should even file your taxes if you do not owe any money. Filing taxes late when you dont owe the Canada Revenue Agency any money is still a mistake.