When You File Very Late

The effects of not filing a tax return depend on whether the IRS owes you or your business owes the IRS. Either way, it’s a bad deal for you. If you owe the IRS, the agency can tack on a number of penalties and fines for the unpaid debt. These accumulate over time.

If you’re entitled to a refund for a missing year, you can file and receive a check for up to three years after the return was due. After that, you lose your refund. If you or your business were entitled to any tax credits, the same applies: After three years, they’re gone.

Tip

Even if your business had zero income or ran in the red, it’s worth filing a return. Depending on your situation, you may be able to deduct business losses from your other income, or claim them as a write-off in later years.

Nonresidents Military Partial Residents Residents With Out

I am a resident of Missouri. Are the wages I earn in Missouri for “remote work” subject to Missouri withholding?

Yes. Any time an employee is performing services in exchange for wages in Missouri, those wages are subject to Missouri withholding. This applies in the case of “remote work” where an employee is located in Missouri, and performs services for the employer on a remote basis. This rule also applies if the service for which the employee is receiving wages is “standing down” .

I am a resident of Kansas. I am performing “remote work” at my residence in Kansas for a Missouri-based employer. Am I obligated to withhold Missouri tax from my wages?

No. If a nonresident employee performs all of his or her services outside of Missouri, the wages paid to that employee are not subject to Missouri withholding.

I am a nonresident with Missouri source income. Why am I required to include my non-Missouri source income on my return?

If you begin with only Missouri source income, your deductions will be too high. You must begin your Missouri return with your total federal adjusted gross income, even if you have income from a state other than Missouri. Your deductions and exemptions apply to your total income, not just your Missouri source income.

For more information, refer to the Resident/Nonresident and Military Status pages.

If I serve in the United States military, what income is taxable to Missouri?

If I am unable to file my return by the due date, can I get an extension?

Can I Still File My 2016 Taxes And Get A Refund

To collect refunds for tax year 2016, taxpayers must file their 2016 tax returns with the IRS no later than this year’s extended tax due date of July 15, 2020. The IRS estimates the midpoint for the potential refunds for 2016 to be $861 that is, half of the refunds are more than $861 and half are less.

Also Check: Can I File Taxes If I Receive Ssi

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Can I File This Years Taxes Before Last Years

Theres no law or rule that says you have to file your 2020 return before you can do your 2021 return. However, its best to prepare your 2020 return first, if possible. This gives you several advantages: Youll be able transfer your 2020 data to your 2021 return, which saves time and prevents data entry errors.

Read Also: What Does Payroll Tax Pay For

Recommended Reading: How Do I Get My Pin For My Taxes

What Happens If You Don’t File Taxes For 10 Years Or More

By FindLaw Staff | Reviewed by John Devendorf, Esq. | Last updated December 13, 2021

You may have thought you didn’t have to file taxes because you didn’t make enough money or you were living overseas. However, most people who earn income over a certain amount still have to file their taxes. If it has been years since you filed taxes or paid taxes, you may still be liable for back taxes. You may also be able to claim money for refunds for prior years.

Why You Should File Back Taxes

Filing back tax returns could help you do one or more of the following:

1. Claim a refund

One practical reason to file a back tax return is to see if the IRS owes you a tax refund. While many have federal income taxes withheld from their paychecks, sometimes too much money is withheld. In these cases, filing a tax return could result in a tax refund that puts money in your bank account.

2. Stop late filing and payment penalties and interest

Filing a tax return on time is important to avoid or minimize penalties, even if you can’t pay the balance you owe. If you don’t file your return, you may have to pay an additional 5% of the unpaid tax you were required to report for each month your tax return is late, up to five months. Minimum penalty limits can also apply.

The IRS assesses another penalty for a failure to pay your taxes owed. If you do file on time, but you can’t pay what you owe in full by the due date, you’ll be charged an additional 0.5% of the amount of the tax not paid on time for each month or part of a month you are late. These fees will accrue until your balance is paid in full or the penalty reaches 25% of your tax, whichever comes first.

The IRS also charges interest on overdue taxes. Unlike penalties, interest does not stop accruing like the failure to file and failure to pay penalties.

3. Have tax returns for loan applications

4. Pay Social Security taxes to qualify for benefits

Recommended Reading: What Is Futa Payroll Tax

Penalties For Not Paying Your Taxes

Even if you file an extension to submit your tax return, you must pay any estimated tax you owe by April 15, 2022. If you do not pay your taxes, you will be charged a penalty and owe interest on any unpaid balance.

The penalty for failing to pay your taxes by the due date is 0.5 percent of your unpaid tax for each month or part of a month that your return is late. This penalty is capped at 25 percent of late unpaid taxes. If you file your return on time and request to pay by an installment agreement, the penalty drops to 0.25 percent for each month or part of a month of the installment agreement.

Youre also charged interest on the unpaid balance, which compounds daily. The rate is set each quarter and is based on the federal short-term rate, plus an additional 3 percent.

If you owe taxes and dont file your return on time, youll be charged a penalty for failing to file. This is usually 5 percent of the tax owed for each month or part of a month your return is late. This penalty is also capped at 25 percent.

When In Doubt File

You can’t be blamed for preferring not to file your income tax if you don’t have to, but there are benefits to filing.

Various tax credits can be earned by filing an income tax return, including earned income credit, child and dependent care credit, educational tax credit, and the savers credit.

These credits might offset the amount of income taxes owed for people with small amounts of income and could in some cases even yield them more money than if they had not paid taxes on that small amount of income. It is important to always consult a tax professional prior to making a decision on whether to file a yearly income tax return.

This is particularly important in 2021 due to the passage of the American Rescue Act. The Child Tax Credit has been substantially increased to $3,600 for children under age six and $3,000 for older children, and it is payable regardless of your income. In addition, the credits for Child and Dependent Care have been increased.

Recommended Reading: Is Tax Loss Harvesting Worth It

Can I File This Years Taxes Without Filing Last Years

There’s no law or rule that says you have to file your 2020 return before you can do your 2021 return. However, it’s best to prepare your 2020 return first, if possible. This gives you several advantages: You’ll be able transfer your 2020 data to your 2021 return, which saves time and prevents data entry errors.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: What Are The Current Tax Brackets

When You Have To File Income Taxes

If your income falls below taxable levels, the IRS generally doesn’t need to hear from you. Those levels are revised each year for single filers, married people filing jointly, and heads of household.

Any income made above those levels has to be reported on a personal income tax return.

If you don’t file your 2020 taxes, you might lose out on tax credits you’re owed. The American Rescue Plan has unleashed a number of generous payouts and credits for families to offset the financial harm wrought by the COVID-19 pandemic. A family of four will receive a total of $8,200 more in payments and tax credits if their income is below certain levels.

- If you don’t owe the government and the government doesn’t owe you, you might not be required to file.

- Your taxable income includes not just wages but savings account interest, Social Security payments, and many other possible sources.

- If you don’t file you could miss out on some tax credits designed especially for lower-income Americans.

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up missing out on a tax refund because you can no longer claim the lucrative tax credits or any excess withholding from your paycheck.

Recommended Reading: How To Have Less Taxes Taken Out Of Paycheck

Your Federal Payments Might Be Affected

Theres also the chance that further levies could be enactedthrough the Federal Payment Levy Program . This program allows the IRS to enact a continuous levy on specific federal payments in order to collect overdue taxes.

These are the payments that could possibly be levied under the program:

- Federal employee retirement annuities: If you were a federal employee, certain annuities may be subject to levies.

- Federal payments made to you: If you were or are a federal contractor or vendor doing business with the government, these payments may be levied. Also, if youre a federal employee, your salary may be levied.

- Travel advances or reimbursements: If youre a federal employee, reimbursements for travel costs may be withheld.

- Social Security benefits: Certain benefits can be levied.

- Others: Among the other funds that can be levied, per the IRS, are Medicare provider and supplier payments, benefits paid out by the Railroad Retirement Board, and by the Military Retirement Fund.

Quick tip: If you havent filed taxes for past tax years, you may not owe a penalty if you were due a refund. However, the only way to know if you were due a refund is to file a tax return. A good rule of thumb: If youve failed to file past returns, do so as soon as possible the IRS even has resources to help you get back on track.

Also Check: What Is My Income Tax Rate

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

You May Like: Where Do I File My Illinois Tax Return

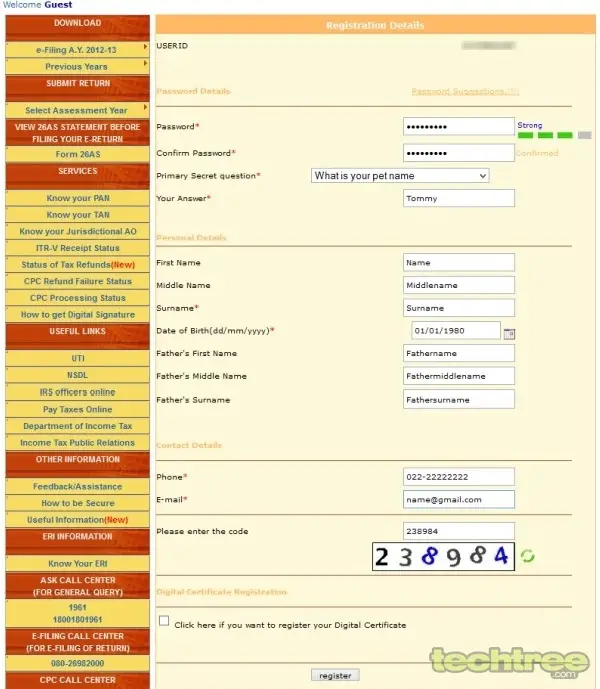

How Sprintax Will Help You

When you create your account on our 1040NR tax software, youll be asked a few easy questions. Once you complete the short form, you will then be able to download your fully completed and compliant 1040NR based on the information you provided.

Sprintax is also the go-to tax preparation software for numerous major universities in the US including, Columbia University, Arizona State University, Illinois Institute of Technology and Cornell University.Were also the nonresident partner of choice for TurboTax.

Recommended Reading: How To Find Property Tax

Or You Can Use Independent Computer Software Products

You can file both your Maryland and federal tax returns online using approved software on your personal computer. To use this method, you’ll need to know the correct county abbreviation for the Maryland county in which you live. You may need to enter the correct subdivision code for the city in Maryland in which you live.

Read Also: How Much Taxes Deducted From Paycheck Md

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

If You Owe Federal Income Tax

You may be receiving IRS notices about your tax liability in the mail, and penalties and interest will continue to add onto your bill. The IRS may also decide to file a Substitute for Return on your behalf.

The SFR usually claims you owe more in taxes than you should. Thats because the IRS is using your W-2 or 1099 to determine your income, but they have no way to calculate your potential deductions or credits. So you could miss out on some significant tax breaks. In fact, the SFR only provides the taxpayer with the standard deduction and one exemption.

The statute of limitations for the IRS to collect taxeswhich is generally ten yearsalso doesnt begin until you file your return. That means the IRS has more time to seize your assets for unpaid taxes.

Even if you cant afford to pay off your full tax bill right now, you should file your delinquent returns right away.

Don’t Miss: How Much Taxes Get Taken Out Of Your Paycheck

What Happens If You Don’t File Your Taxes For Years

If you do not file your taxes for years, the IRS can take legal action against you. This can include filing a lien against your property or seizing your assets. In some cases, you may also be subject to criminal charges. If you are facing any of these consequences, it’s important to speak with a tax attorney or another tax pro as soon as possible.

Save Up To 20% On Federal Filing Compared To Turbotax

| TurboTax |

|---|

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 07/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Edition Pricing: Actual prices are determined at the time of payment, print, or e-file and are subject to change without notice. Add sales tax for applicable orders. Offers may end at any time and promotional offers may not be combined.

You May Like: How Can I Figure Out My Property Taxes