How Lendios Accounting Software Can Help

Hiring a CPA makes sense for some small businesses, but not all. If your financial situation is relatively straightforward, paying advisory and tax preparation fees may cost more than its worth.

However, even if your situation isnt complex enough to warrant a CPA, youll still benefit from assistance with your taxes and finances. Fortunately, Lendios Accounting Software can help, and it doesnt have to cost you anything.

We offer free accounting software for small businesses that can automatically track your transactions and generate your income statement! In addition, using our bookkeeping software gives you free access to our tax assistance program, which includes:

- An expert tax checklist to guide you through your annual tax filing

- Organization of your tax documents, like 1099s, to keep all your data in one place

- A calculator that can estimate how much money you need to have on hand at each tax deadline

Whether or not you are using a CPA for your small business, Lendios Accounting Software is a great tool to help you with your accounting and bookkeeping. You can also download our free small business accounting app to manage your finances on the go with the push of a button. Give it a try today!

About the author

Nick Gallo

Youre In Trouble With The Irs

Dealing with the IRS is a major headache, but having a good CPA makes it a lot easier. Not only can they guide you through the interactions, but they can serve as a middleman to take most of the work off your plate.

For example, if you have multiple delinquent returns or are undergoing an IRS audit, its a good idea to hire a CPA.

Can You Still Be An Accountant Without A Cpa

What Do Accountants Without Their CPA do? Many people with degrees in accounting continue to work in the field without the CPA attached to their name. The biggest difference may come in the salary, but there are still plenty of accountants that are doing the same work as CPAs, just in the private sector.

You May Like: How Much Taxes Does Unemployment Take Out

How Much Does A Cpa Cost To Do Your Taxes

Preparing taxes isnt always a fun thing to do, and this is especially true for startup founders or small business owners who choose to do their own taxes. If they take care of sales, and marketing, as well as manage a small team, doing taxes will surely feel like an added burden.

Although many find filing taxes an unpleasant process, youll be surprised that millions of business owners continue to do without a tax professional helping them come tax time. Probably they try to save a couple of dollars than pay for the CPA cost to prepare taxes. However, what they dont realize is that they could be missing a lot of opportunities when it comes to savings on tax deductions and also their time.

If youre thinking about how much a CPA cost to prepare taxes and what are the advantages of working with a tax expert, then continue reading.

How Much Does A Cpa Charge For Filing Business Taxes

Filing your own taxes is rarely a good idea in the business world. There are so many variables involved, schedules and forms to fill out, deductions to consider, its overwhelming.

You can find a CPA, or certified public accountant, to specifically handle your business taxes and let them take care of the stress for you. Youll want to take the time to see what your options are and make sure you find an accountant who is licensed to work in your state of incorporation or business operation. They should be familiar with local and federal tax laws, as well as how to make sure your business gets the maximum deductions to minimize the amount you pay to the IRS each year. There is no one-time cost for a CPA to prepare and file business taxes. There are too many variables involved.

Size Matters

One consideration that will affect how much you pay for taxes with a CPA is the size of your business. Or more importantly the size of your profits, assets, and other business assets. The larger the company, the more complex its taxes will become over the years. So while a small business may only spend a few hundred dollars on tax preparation at first that amount could add up to $1,000 or more.

Forms and schedules

Hourly rates

Additional charges

Read Also: When Are Tax Extensions Due

The Number Of Returns

- Cost of a federal business return: Around $700 to $1,000

- Cost of state business returns: Around $200 to $500

- Cost of a federal individual return: Around $300 to $500

- Cost of state individual returns: Around $100 to $300

Youll very likely pay more for a CPA if you need multiple tax returns done. You might need to file more returns if:

- You own an S corp or partnership

- You do business across multiple states

- You havent filed for multiple years

S corp and partnership owners are required to file two returns: their individual return and their business return. Single-member LLCs without a tax election only need to file their individual return. Business returns usually cost more to prepare than individual returns.

You may also need to file additional personal and business returns if your business operates in multiple states, which would cost you more. For example, a Florida-based business owner doesnt need to file a state income tax return because the state doesnt require it. But if that business owner stores their inventory or has sales in, say, California, they would need to file a business return for that state .

If you need returns done for multiple years, that may also increase the cost of working with your CPA. Its pretty common for business owners to be behind on a few years of tax returns especially if theyve never worked with a CPA before. It costs more to have multiple years of returns done, but its worth it in many cases to avoid potential audits and penalties.

Is It Worth It To Hire An Accountant For Taxes

As a trusted professional, a good accountant will be able to answer important questions that arise not just during your annual consultation, but at other times during the year. Even if your tax situation is straightforward, hiring a professional will save you the time and stress of doing your taxes.

Also Check: What Happens If I Forgot To File Taxes Last Year

Where Should You Start

We get this a lot and its understandable. Youre growing a portfolio and need the cash flow before you can spend lavishly.

If thats the case, we recommend getting your accounting in-line first. Without great records, no one can prepare an accurate tax return and we cant provide you with great tax strategies that will actually be impactful because wed just be guessing.

You dont have to spend a ton of money on accountants and software to maintain clean books. You just have to be diligent about keeping up with your own accounting records and maintaining an accounting system if you choose to do it yourself.

Once your accounting is in order, we recommend buying tax strategy services next. These services will pay for themselves and likely cover multiple years of tax preparation fees.

Last on the totem pole is tax preparation and compliance services. That doesnt mean they are less important. You can either self-prepare your return or have a tax mill prepare it relatively cheaply for you. A word of caution though: tax compliance can get really difficult and fast. If you are doing it yourself or having a tax mill complete it for you, make sure you thoroughly review every single line prior to submission to the IRS. Also, make sure you have filed every state and local return required.

How Can Cpas Help You During Tax Time

Working with a CPA during tax time has a lot of benefits. These professionals can help you prepare your business tax documents, file returns, and help strategize ways how you can maximize your tax deductions and minimize liabilities. More importantly, CPAs help ensure that your business is compliant with tax regulations and its up-to-date with the latest accounting standards. CPAs can also represent your business before the IRS should you undergo auditing.

Recommended Reading: How Long Does It Take To Get Your Tax Refund

How Much Does A Bookkeeper Cost

Bookkeeping services cost range is quite wide, but the price would depend on several factors, including the type of business you run, the number of transactions that need to keep track of, and the complexity of the services required. Any reputable firm will allow you to make variations to the services on the basis of your needs and adjust their monthly fee accordingly. The price can also vary depending on whether the bookkeeper is in-house, or outsourced.

According to Growthforce, part-time in-house bookkeeper rates can cost $400 per month on the low end, and upwards of $4500 per month on the high end, and typically averages to about $2450. You must then consider the additional costs that could be related to such a hire internally, such as the benefits, bonuses, office equipment, and anything else that would normal for a typical hire in your company.

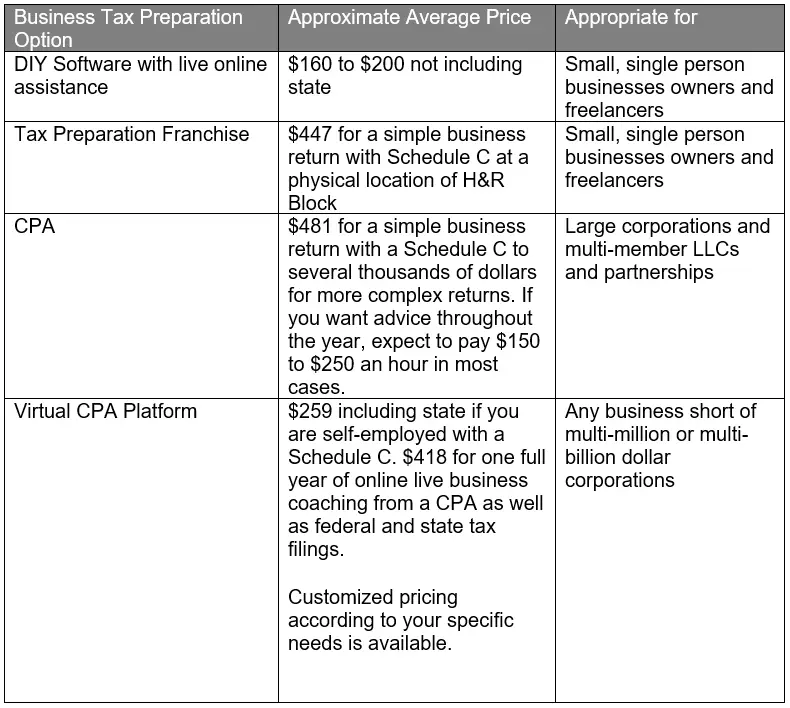

Your Business Tax Needs:

To begin, determine the level of complexity of your taxes.

- Do you freelance? If so, do you do so just occasionally or does freelancing comprise a substantial part of your income?

- Are you a single member LLC or is your business structure more complicated such as a multiple member LLC or an S corporation?

- Or perhaps you have a C corporation, partnership or multiple member LLC with revenue in excess of a million dollars?

Next, you will want to determine how much money you are willing to spend. Remember though, that the better your tax preparer, the more likely you are to save on taxes.

Keep your needs in mind while we consider your options.

You May Like: What Happens If I File My Taxes Wrong

Fee Based On Complexity

Make no bones about it if your taxes cause the CPA to work hard and spend a lot of time completing them and tracking down information you didnt keep good track of, there is a very good chance that youll be charged a lot.

If your CPAs fee is based on the complexity of your taxes, make sure that you get a figure beforehand so that there arent any surprises in the end.

What Does The Tax Preparation Fee Include

Be sure to ask what’s included in the fee if you decide to use a professional. Do they charge extra for electronic filing, or for each phone call and office visit? Some firms, especially franchise chains like H& R Block, charge an extra fee for audit protection. You’re basically prepaying for any costs you’d incur if the Internal Revenue Service decides to shine a spotlight on your tax return.

Also Check: How Much Do Taxes Take Out

How Much Will It Cost To Hire A Cpa To Prepare Your Taxes

As a new freelancer or small business owner, you might be thinking that its more affordable to file taxes yourself. I mean, how hard could it be? Why spend on a CPA if youre not even sure how much income youll make anyway. I get it.

Hiring an accountant might seem like an unnecessary expense, especially when youre working on a tight budget. But lets set the record straight. Hiring an accountant will ensure that youre covered come tax season, and can actually help you feel more confident in your business finances. Lets go through the facts and figures and help clarify if hiring an accountant is right for you.

Should You Hire A Cpa To Prepare Your Taxes

Ultimately, you should choose the option that best fits your needs and your budget, of course. Filing taxes independently is certainly a valid choice, but if hiring a CPA will reduce your stress and make tax season easier, it may well be worth the money. It might feel like a big expense, but if you can afford it, involving a financial professional in your business can be a worthwhile investment. And, youll thank yourself later when you can sleep well during tax season.

Whether you decide to work with an accountant or file your taxes independently, the most important thing to remember is to stay organized and keep track of your income and expenses throughout the year. By organizing your documents as you go, youll save yourself a headache during tax season.

Recommended Reading: How Far Back Can I File Taxes

Financial Statement Compilations Reviews And Audits

Compilations, reviews, and audits lend credibility to a companyâs financial statements. They may be required by lenders, regulators, or investors. A compilation is the most basic level of assurance because the CPA mainly does a cursory check of the companyâs financial statements to ensure there arenât any obvious issues.

A review is one step up from a compilation. The CPA reviews the financial statements, makes inquiries of management and other employees about the companyâs accounting practices, and performs analytical procedures to look for potential errors.

A financial statement audit is the highest level of assurance. The CPA is required to make inquiries, perform physical inspections, confirm balances, and perform other tests to ensure the financial statements are free from material misstatements.

Audits are the most expensive level of service a CPA provides in this area since they take the most time. According to Audit Analytics, for audit-related fees, CPAs charge an average of $548 per $1 million in revenue in 2019. So a company with $5 million in revenue can expect to pay, on average, $2,740 for an audit â less for compiled or reviewed financial statements.

Hiring A Cpa: How Much Does It Cost To Have A Cpa Do Your Taxes

Small business owners spend about 41 hours doing taxes every year. In the first quarter of every year, you have to spend time creating W-2 forms, 1099-MISCs, and file your last quarterly estimated taxes. You then have to tally your expenses and income for the year. No wonder why it can take almost two entire days to do.

You could save that time and hire a CPA instead of doing taxes yourself.

How much does it cost to have a CPA do your taxes? Keep reading to find out.

You May Like: Will I Get My Tax Refund And Stimulus Check Together

What Does An Accountant Cost

An accountant’s charges can be per hour, or a service rate dependent on a business’s needs. Accountant fees range from $30-$100an accountant’s cost is determined by the form of services offered. However, accountant fees may be based on experience, location of the business, and job requirements. Therefore, accounting service’s total cost depends on the workload, accountant fees, and how frequently you need their services.

Every business wants to be economical and maximize profit. Hence a business owner might hesitate to hire an accountant, as there are many accounting software that could help your business, as long as you have basic accounting knowledge. As much as this software can help save unnecessary costs, you may miss out on crucial financial advice from an experienced accountant.

Why should you hire an accountant? Is there a difference an accountant will make in your business? If you decide to employ one, how much will it cost? Various reasons affect whether or not you need an accountant. The following reasons are why you need their services and how much it will typically cost to get a good business accountant.

Get Help With Your Accounting

How Does Filing An Amended Tax Return Work

Taxpayers who discover they made a mistake on their tax returns after filing can file an amended tax return to correct it. This includes things like changing the filing status, and correcting income, credits or deductions. Complete and mail the paper Form 1040-X, Amended U.S. Individual Income Tax Return.

Also Check: How To Calculate Uber Miles For Taxes

Do Tax Accountants Need Cpa

Job Descriptions Most tax accountants are Certified Public Accountants. Non-CPAs can prepare and compile financial statements, whereas CPAs can also assist their clients during IRS audits. In addition to preparing taxes, tax accountants assist individuals and businesses in financial planning and estate planning.

Is It Worth Hiring A Cpa

If you’re wondering whether it’s worth hiring a CPA to do your taxes, then you’ve probably already filed tax returns yourself in the past.

And if that’s true, then there are compelling reasons why you should hire someone to take care of your taxes this year rather than filing them yourself.

One of the reasons is that filing your business taxes isn’t as easy as it seems.

Even if you’re a good accountant and know what you’re doing, the tax code has grown so complex over the years that even tax professionals have trouble deciphering it all.

And good luck trying to find some obscure tax credit or deduction every year the number of tax credits and deductions available to you each year is staggering.

Hiring a CPA can help you save money in the long run. While having someone else do your taxes takes some time and effort on your part, it’s a small price to pay compared to many of the tax credits and deductions that you could be eligible for every year.

And finally, hiring a CPA gives you access to their knowledge and experience when it comes time to file.

They can also provide you with tax advice.

Once they’ve filed all of your taxes, they’ll know what documents need to be filed where, and they’ll know what answers to give the IRS if they ever come calling.

With this kind of knowledge at your disposal, filing taxes during tax season is infinitely easier.

However, if you’re willing to put in the work, then it’s well worth paying someone to do your taxes for you.

Read Also: How To Lie And Get More Money On Taxes