Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes then 12% on anything earned from $9,786 to $40,125 then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Understanding Canadas Personal Income Tax Brackets

Tax rates apply to personal income earned between predetermined minimum and maximum amounts, also referred to as tax brackets.

Knowing where your income falls within the tax brackets can help you make decisions about when and how to claim certain deductions and credits. By understanding which tax bracket you are currently in, it can also help you understand changes in your income taxes if, for example, you start a side-gig or have other extra income that pushes you into the next bracket.

When youre preparing your income taxes this year, this could explain why you have taxes owing or your refund amount is different than what it was last year.

It is important to note that these rates apply to taxable income, which is your Total Income from Line 15000 less any deductions you may be entitled to.

Remember, all provinces and territories also have their own tax brackets. When using the tax brackets and your annual earnings to make contribution decisions, make sure to also consider the tax rates for the province where you reside.

You May Like: Do You Have To Pay Taxes On Plasma Donations

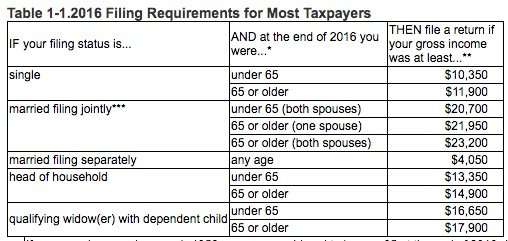

Income Thresholds For Taxpayers 65 And Older Are Higher

If you are at least 65 years old, you get an increase in your standard deduction. You also get an increased standard deduction if:

- You are blind

- Or your spouse is also at least 65

- Or if your spouse is blind

The largest standard deduction would be for a married couple that are both blind and both over 65 years old.

Having a larger standard deduction can allow you to have more income than someone under age 65 and still not have to file a return. TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

How Much Money Do You Have To Make To Not Pay Taxes

The amount that you have to make to not pay federal income tax depends on your age, filing status, your dependency on other taxpayers and your gross income. For example, in the year 2018, the maximum earning before paying taxes for a single person under the age of 65 was $12,000.

If your income is below the threshold limit specified by IRS, you may not need to file taxes, though its still a good idea to do so.

What this article covers:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

You May Like: Is Plasma Donation Taxable Income

Who Should Pay Estimated Taxes

The IRS uses a pay-as-you-go income tax system, meaning you must pay your taxes as you earn income. It enforces this by charging penalties for underpayment if you haven’t paid enough income taxes through withholding or making quarterly estimated payments. It also charges penalties on late payments even if you get a refund.

The IRS uses a couple of rules to determine if you should make quarterly estimated tax payments:

- You expect to owe more than $1,000 after subtracting withholding and tax credits when filing your return.

- You expect your withholding and tax credits to be less than:

- 90% of your estimated tax liability for the current tax year

- 100% of the previous year’s tax liability, assuming it covers all 12 months of the calendar year

The tax code calls this last item the safe harbor rule. This requirement increases to 110% of your adjusted gross income exceeds $150,000 .

One exception applies for farmers and fishers who earn at least 66.6% of their income from their trades and so only need to meet an equivalent amount of their tax liability.

Paying your taxes quarterly can also avoid the cash crunch you might face come tax time. Paying in quarterly installments makes paying your bill far easier than one lump sum payment, especially if you’ve underestimated your taxes due.

A Guide To Paying Quarterly Taxes

OVERVIEW

Self-employed taxpayers likely need to pay quarterly tax payments and meet key IRS deadlines. Heres a closer look at how quarterly taxes work and what you need to know when filing your tax returns.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Working for yourself presents a host of benefits, such as never having to report to a boss and setting your own hours. It also carries a few added tax requirements, such as paying your taxes quarterly instead of with each paycheck as a W-2 employee would.

Keep reading to learn answers to questions like, “Who has to pay quarterly taxes?” “When are quarterly taxes due?” and “How do I pay quarterly taxes?”

You May Like: How Much Does H& r Block Charge To Do Taxes

How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest your property or state income taxes are high medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2020 tax year, due May 17, 2021

- Single filers: $12,400

- $12,400

- Heads of households: $18,650

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

How Much Do You Need To Make Before Paying Taxes

Our jobs bring us different incomes and, therefore, different personal income tax requirements. That being said, the majority of Americans do have to pay taxes on the money they make. If you are a single person or are married and filing separately from your spouse, to be required to file a federal tax return, you will need to have gross income of more than $12,000 in 2018. However, different rules may apply if you are married, file as Head of Household, are self-employed or can be claimed as a dependent of another taxpayer.

Once you understand where your taxable income stands in relation to these minimums, youll want to know the tax protocol that applies when you earn no income, are paid in cash, or are paid under the table.

Don’t Miss: Have My Taxes Been Accepted

Are There Any Exceptions

The nanny tax doesn’t apply to babysitters who are under 18 years old.

They don’t apply if you’re not primarily engaged in babysitting as a household employment profession. For example, even if you’re over 18, if you’re a full-time student then families could argue that you aren’t babysitting as a full-time profession.

A nanny tax also doesn’t apply to the family if you’re hired through an employment agency. In that case, the agency that you work for is your employer and they’re the ones responsible for paying the nanny tax.

Filing Requirements For Dependents

Taxpayers who are claimed as dependents are subject to different rules for filing taxes.

Dependents include children under the age of 19 , or who are permanently disabled along with qualifying relatives . When their earned income is more than their standard deduction, taxes have to be filed. A dependent’s income is unearned when it comes from sources such as dividends and interest.

Single, under the age of 65 and not older or blind, you must file your taxes if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Gross income was more than the larger of $1,050 or on earned income up to $11,650 plus $350

If Single, aged 65 or older or blind, you must file a return if:

- Unearned income was more than $2,650 or $4,250 if youre both 65 or older and blind

- Earned income was more than $13,600 or $15,200 if youre both 65 or older and blind

If youre married, under the age of 65 and not older or blind, you must file a return if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Your gross income was at least $5 and your spouse itemizes deductions

- Your gross income was more than the larger of $1,050 or your earned income was $11,650 plus $350

You May Like: How To Get Stimulus Check 2021 Without Filing Taxes

Does The 4 Retirement Rule Include Taxes

The 4 percent rule assumes that there is no tax deduction, as if all of your assets were held in a Roth IRA where there are no more tax payments. The reality is that income tax will be mandatory on all deferred tax deductions, and tax on dividends and capital gains will be owed on taxable accounts each year.

Are taxes taken out of retirement pay?

The taxable portion of your pension or annuity is generally subject to withholding tax. You may be able to choose not to have your income tax withheld from your pension or annuity payments , or you may want to specify how much tax is withheld.

What retirement plan is not taxable?

With a deferred tax account, tax savings are realized when you pay contributions, but with a tax-exempt account, the payments are tax-exempt. The usual deferred tax retirement accounts are the traditional IRA and the 401 s. Popular tax-exempt accounts are Roth IRAs and Roth 401 s.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The credit can be up to $6,660 per year for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $3,000 or $6,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Recommended Reading: Buying Tax Liens California

What If The Parent I Babysit For Requests A Tax Receipt

Parents might ask you to give them a receipt for any money they pay you for babysitting.

The reason they do this is usually that they want to claim the money they pay to you for babysitting as a childcare expense on their own tax return. The government often asks for proof or evidence from parents who claim this deduction, so parents need to have proof in writing showing that they actually paid you. Especially if they’re paying cash and have no other paper trail.

You can print out your own receipts. Alternatively, office supply stores sell receipt books. These are little booklets with forms that you just need to fill out in order to issue receipts for your babysitting services. It usually costs less than $5 for a booklet of 50 receipts, and you’ll be able to easily create a duplicate carbon copy of each receipt that you issue to keep for your own records. That makes it easy for you to keep track of all the income that you earned from babysitting once tax time comes around too.

In order for your babysitting receipt to be valid, you should make sure to include:

- Your name

How Much Money Do I Need To Retire At 55

For example, generally accepted retirement planning advice suggests that you save seven times your annual income by the age of 55. So if youre making $ 100,000 a year, youll need $ 700,000 saved by your 55th birthday.

How much money do you need to retire with $ 100,000 a year? Most experts say your retirement income should be about 80% of your final annual income before retirement. 1 This means that if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to have a comfortable lifestyle after leaving the workforce.

You May Like: Will A Roth Ira Reduce My Taxes

Are You An Employee

If the parents that you babysit for are able to control what you do, how you do it, and when you do it, then tax authorities might consider them to be your employer.

If they’re your employer, then you should receive a payment summary each year that shows how much tax they’ve withheld and submitted on your behalf. In the US this is called a W-2 form, or in Canada, it’s a T4 slip. In addition to income tax, employers might be required to withhold money from your paycheck for things like retirement benefits, Social Security, or healthcare.

If you babysit full-time for a single family and have a set schedule, then you’re likely considered an employee.

How To Calculate How Much Youll Owe If Youre Self

Lets talk specifics here. You may think that you have to pay tax on every dollar your business earns, but thats actually not the case. Youre only required to pay income tax on your business earnings after business expenses. Moreover, you can lower your average tax rate and thus your tax bill even more by taking advantage of other personal tax deductions and tax credits, such as claiming some of your RRSP contributions as deductions.

For example:

Lets say youre a self-employed web designer in Ontario and you earned $100,000 in business revenue. Business revenue is the total amount of income your business generated by selling goods and/or services. Business revenue does not include any sales tax collected .

You spent $30,000 on business expenses and operating costs.

That leaves you with $70,000 in business earnings after expenses. Using this free tax calculator, youll find that your average tax rate would be 26.66%, and you should set aside $18,662 to pay your federal and provincial taxes and your CPP premiums.

Now, lets say you also contributed $10,000 to your RRSP which you claim as a tax deduction.

As you can see, your RRSP deduction lowered your average tax rate to 22.42%, thus decreasing your tax bill to only $15,697.

Recommended Reading: Plasma Donation Taxes