Vermont Median Household Income

| 2010 | $49,406 |

Vermonts tax rates are among the highest in the country. There are four tax brackets that vary based on income level and filing status. The states top tax rate is 8.75%, but it only applies to single filers making more than $206,950 and joint filers making more than $251,950 in taxable income. If you’re a single filer with $40,950 or below in annual taxable income, you’ll pay the lowest state income tax rate in Vermont, at 3.35%.

Vermont has no cities that levy a local income tax. This means that whether you live in Burlington, Rutland or anywhere in between, you wont have an additional local withholding.

If you’re planning on relocating to Vermont or thinking about a move within the state and you’re looking to purchase a home, our Vermont mortgage guide is a great place to start learning.

Taxes Included In This Canadian Salary Calculator

Our salary calculator for Canada takes each of the four major tax expenses into account. These include:

- Federal tax, which is the money you’re paying to the Canadian government. It starts at a 15% rate and rises with your income up to 33%. If you’re employed, then recall that federal taxes have already been taken out of your paychecks.

- Provincial tax, which is the money you’re paying to the provincial government. The rate varies based on the province in which the income was generated.

- Canada Pension Plan or Quebec Pension Plan contributions, which act as a financial security blanket if you lose income due to disability, death, or retirement. These contributions and employer matches are made automatically each time you’re paid.

- Employment Insurance , which is a social insurance program supporting the unemployed during their job search or training. For Quebec, the calculator also includes the compulsory Quebec Parental Insurance Plan premiums. EI and QPIP premiums scale with your income and are also deducted automatically from your paycheck.

For a detailed breakdown of the Canadian tax system, an estimate of your taxes due, and a better idea of your net income, visit ourCanadian Tax Calculator.

Jobs in Canada

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Read Also: Can You File For Previous Years Taxes

What Will My Take

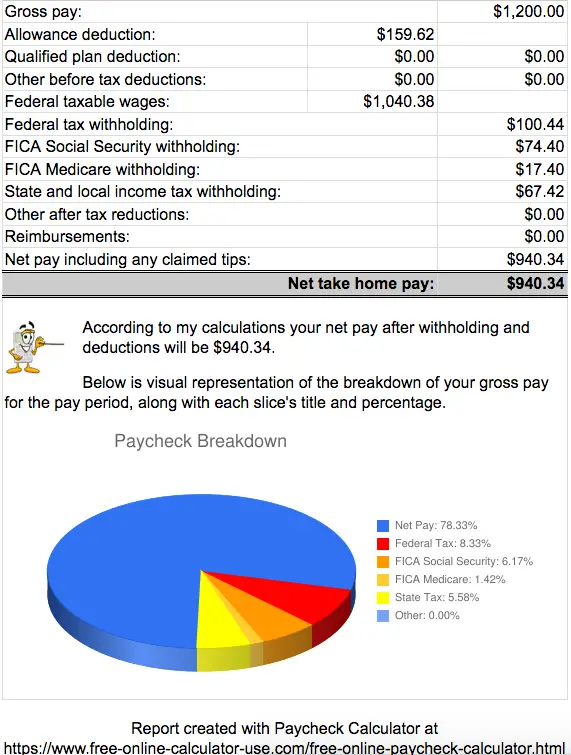

To figure out your after-tax income, enter your gross pay and additional details.

Why use this calculator?

You know your salary. But how much are you really making? Once youve accounted for taxes, the amount of money left in your paycheck might be a lot less than you think. Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out. How much youre actually taxed depends on various factors such as your marital status, whether you contribute to an employer-sponsored retirement plan, and how many deductions you take and allowances you claim. Whether your pay is weekly, bi-weekly, monthly or yearly, this calculator can help you figure out your after-tax income, once you enter your gross pay and additional details.

How To Use The Salary Calculator For Australia

Using the Australian salary calculator is easy! Simply enter your gross salary, choose if you’re being paid yearly, monthly or weekly, and let our site do the rest. The calculator will work out how much tax you’ll owe based on your salary.

When working out your take-home pay, the salary calculator assumes that you are not married and have no dependants. You may end up paying less if any tax credits or other deductions apply, but your calculator result will still give you a good indication of what you’ll earn.

Read Also: Do I Have To Give My Ex My Tax Returns

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How To Calculate Your Take

If you recently started a job, you might notice that your paychecks are less than the wage you were offered when hired. That’s a normal part of working life, and it reflects the taxes you pay to the federal, state, and local government. Estimating your tax burden can help you more accurately anticipate paychecks.

Learn about how FICO taxes, retirement contributions, and other paycheck reducers explain the difference between your salary and the actual amount you take home.

Also Check: How Much Does The Top 1 Percent Pay In Taxes

How To Use The Take

To use the tax calculator, enter your annual salary in the salary box above

If you are earning a bonus payment one month, enter the £ value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Find out the benefit of that overtime! Enter the number of hours, and the rate at which you will get paid. For example, for 5 hours a month at time and a half, enter 5 @ 1.5. There are two options in case you have two different overtime rates. To make sure the calculations are as accurate as possible, enter the number of non-overtime hours in the week.

New! If your main residence is in Scotland, tick the “Resident in Scotland” box. This will apply the Scottish rates of income tax.

If you know your tax code, enter it into the tax code box for a more accurate take-home pay calculation. If you are unsure of your tax code just leave it blank and the default code will be applied.

If you have a pension which is deducted automatically, enter the percentage rate at which this is deducted and choose the type of pension into which you are contributing. Pension contributions are estimates, click to learn more about pension contributions on The Salary calculator.

If you receive Childcare vouchers as part of a salary sacrifice scheme, enter the value of the vouchers you receive each month into the field provided. If you signed up for the voucher scheme before 6th April 2011, tick the box – this affects the amount of tax relief you are due.

Financial Facts About The Us

The average monthly net salary in the United States is around 2 730 USD, with a minimum income of 1 120 USD per month. This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012.

The United States’ economy is the largest and one of the most open economies in the world, representing approximately 22% of the gross world product. The US leads the world by having a high productivity of manufactured goods, a well-developed infrastructure, and abundant natural resources. The United States financial market is also the largest and the most influential in the world. This makes the USD the most used currency in international transactions.

Over 128 of the world’s 500 largest companies are headquartered here, including: Walmart, ExxonMobil, Chevron, Apple, JP Morgan Chase, and many others. Thanks to its strong economy, the United States has always attracted a high number of immigrants from all over the world. The net migration rate is among the highest in the world.

The US is the 4th largest country by area in the world with over 50 states, covering a vast part of North America. Washington D.C. is the capital of the United States. Other major cities include: New York a global finance and culture center, Los Angeles famed for filmmaking and known as the “Creative Capital of the World”, Chicago renowned for its museums and bold architecture.

Also Check: How To File Joint Taxes For The First Time

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Hourly Paycheck And Payroll Calculator

Need help calculating paychecks? Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

Simply enter their federal and state W-4 information as well as their pay rate, deductions and benefits, and well crunch the numbers for you.

The information provided by the Paycheck Calculator provides general information regarding thecalculation of taxes on wages. It is not a substitute for the advice of anaccountant or other tax professional. The Paycheck Calculator may not account for every tax orfee that applies to you or your employer at any time. ZenPayroll, Inc., dba Gusto does not warrant, promise or guarantee that the information in the PaycheckCalculator is accurate or complete, and Gusto expressly disclaims all liability, loss or riskincurred by employers or employees as a direct or indirect consequence of its use. By using thePaycheck Calculator, you waive any rights or claims you may have against Gusto in connectionwith its use.

Want to leave the payroll work to someone else?

Read Also: Do Unemployment Benefits Get Taxed

Compute Social Security Deductions

Use the employee’s gross pay with no deductions to calculate Social Security tax and Medicare tax. Multiply gross pay by 6.2 percent to find the amount of Social Security tax. If gross pay is $500, multiply $500 times 6.2 percent , which equals $31. As of 2019, Social Security tax is levied only on the first $128,400 of yearly wages.

Stop deducting this tax if the year-to-date gross pay exceeds this amount. The income cap changes periodically, so check IRS Publication 15, Circular E for the current amount.

California Median Household Income

| 2011 | $57,287 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

Also Check: When Are Oregon State Taxes Due

Uk Take Home Pay Calculator

Use this calculator to find exactly what you take home from any salary you provide. We have redesigned this tool to be as easy to use as possible whilst maintaining the level of accuracy you expect from our selection of tax tools.

The actual income that is paid into your bank account will vary drastically from what you see declared on a job description! It’s okay though, everyone has to pay taxes but working out what will end up in your pocket is tedious and hard to get your head around sometimes.

The most widely factored deductions are built into our take home pay calculator so even if you are repaying student loans, planning for your future by making pension contributions or receiving perks from work for things like company cars, we have you covered.

We’ll show you your full pay before and after deductions and then break down each of the items taken from your income. We’ll go one step further and show you which tax bands you fall into too. To wrap it all up there will be a quick comparison between the take home pay from the year before .

What You Need To Calculate Your Take

Want to know what your paycheck will look like before you take a job? There is a way to figure out exactly how much youll have left after FICA, federal taxes, state taxes, and any other applicable deductions are removed. You need a few pieces of information in order to calculate your take-home pay:

- The amount of your gross pay. If you earn a fixed salary, this is easy to figure out. Just divide the annual amount by the number of periods each year. If you are paid hourly, multiply that rate by 40 hours to determine your weekly pay.

- Your number of personal exemptions. When you start a new job, you fill out a W-4 form to tell your employer how much to withhold from your check.

- Your tax filing status. There are standard federal and state tax deductions that vary depending on whether you are single, married filing jointly, married filing separately, head of household, or a surviving spouse.

- Other payroll deductions. This category could include contributions to a 401 retirement plan, health insurance, life insurance, or a flexible spending account for medical expenses. It also may include union dues or any other garnishments that are taken from your wages. It helps to categorize these according to pre-tax and after-tax contributions, to deduct them from either your gross salary or after-tax calculation.

You May Like: How To Calculate Federal Tax

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

You May Like: How To Calculate Long Term Capital Gains Tax