See Accountant Tax Preparers Salaries In Other Areas

Tax Preparer Education Requirements

Unlike tax attorneys or CPAs , a tax preparer is not required to hold a four-year degree or a license to practice Accounting to be a tax preparer.

In fact, anyone can become a tax preparer without these credentials, provided you following these important steps:

- Obtain a high school diploma as a minimum with strong Math skills.

- Take at least 60 hours in tax preparation training through an ACAT

training course or from the National Association of Tax Professionals

- Purchase a $5,000 tax preparer bond from an insurance or surety agent.

- You can also attend a community college that specializes in tax preparation careers and receive a one-year certificate. But this is not required.

- Obtain a tax preparer identification number from the IRS.

This is a requirement to serve as a tax preparer. You must be registered with a TPIN through the IRS website. If you have completed the above requirements, start by applying on the IRS website to get your TPIN number, then pay the $50 fee to get started.

- Register as a tax preparer with your state.

Start with a search for “tax preparer registration within….” and add your state. This will give you the requirements that you need to proceed.

What Are The Irs E

The IRS takes the sanctity of the e-file system very seriously, and it has become an area of increased scrutiny, mainly because this is a high-risk area for potential hacking and fraud. As a result, its a little more work for a preparer to complete this process.

In many ways, e-file requirements are like acquiring a PTIN. E-file requirements ask for two additional security measures.

First, a professional certification is required, as well as an official copy of your fingerprints. Once youve submitted the online documents and sent in your fingerprints, you will receive an electronic filing identification number . Then you are ready to access the portal to submit e-filings.

If a preparer prepares less than ten returns, they are not required to e-file. If they have filed more than ten returns in a given year, they are required to e-file every single return they prepare. While there are some exceptions, they are rare.

You May Like: How Does Business Tax Work

Be Realistic About Your New Tax Preparation Career

The first advice wed give you, if youre asking yourself these kinds of questionsand we would encourage you to ask questions before purchasing Pronto Tax Classis to look at the situation realistically.

Unless youre doing something illegal, you are not going to get rich in two or three years preparing tax returns. There is too much competition in the tax preparation industry and only two or three years into a new career, you just arent good enough at doing taxes to make huge money. There are many other people, EAs, CPAs, tax preparers with 10+ years experience, not to mention the huge brand name companies in this area who spend millions of millions of dollars on marketingall these people and companies are fighting like rabid dogs for tax preparation business, so you need to be realistic and dont expect to kill it before you even properly know what youre doing.

It usually takes at least three years for a new tax preparer to approach a level of mastery that will command high fees.

However, the good news would be that once you do achieve a decent level of mastery over the tax game, you absolutely can transition from being a seasonal tax preparer to working year-round. Top-notch tax professionals, contrary to popular belief, can and often do work and earn money all year-round. In particular, business-owning tax clients have tax obligations all year that their tax preparers help with .

Glassdoor Economist Pay Overview

Jobs in finance and accounting are expected to see continued demand, with employment growth linked to the health of the broader economy. These jobs will continue to offer above average pay but usually require higher education or certification to enter the field. While automation will replace many common tasks, it is not expected to reduce the need for these employees it will instead allow them to focus on core soft skills like advising clients and analyzing trends.

You May Like: Are Home Association Fees Tax Deductible

How Much Do Tax Preparers Make Based On Experience

Experience is essential to know how much tax preparers make in different parts of America. At the time of hiring, the experience of the tax preparer is considered by the businesses and individuals. The more experienced professionals carry, the more efficient and hourly rate they can charge. Throughout the tax preparation process, the experience of a tax preparer is important in making profitable strategies.

An average tax preparation specialist with less than a year of experience charges $11 per hour. On the other hand, a professional with more than 10-20 years of experience charges $16-$20 per hour. This hourly rate can go to $12.50 for tax preparers with 1-4 years of experience, while $16 for those with 5-9 years of experience.

How Much Can You Make As An Enrolled Agent

According to ZipRecruiter.com, the national average salary for an Enrolled Agent as of July 2019 is $57,041. Jobs paying $41,500 or less are in the 25th or less percentile range, while jobs paying more than $64,500 are in the 75th or more percentile range. Most salaries fall between $41,500 and $64,500.

You May Like: Do State And Federal Taxes For Free

How Long Does It Take To Become A Tax Preparer

The simplest answer to this is: in the time it takes to apply for and receive a PTIN and an EFIN.

However, how long it takes to become a seasoned tax preparer is perhaps the more correct question to ask, as the ability to make money and build a career is dependent upon a certain amount of experience and skill.

In most cases, it takes about two seasons to learn the basics of tax preparation. Whether you plan on starting at a firm or becoming a sole practitioner, the career progression looks similar. In the first year, most new preparers will focus on raw data entry. The second year brings a little more autonomy. By the third year, youre armed with the necessary experience and skills to work as a full-fledged staff preparer.

After the initial period of seasoning, it takes about five years to learn the nuances and niche areas of your clients and your practice. In that time, you gain expertise that differentiates you as a tax preparer and allows you to set yourself apart in the market.

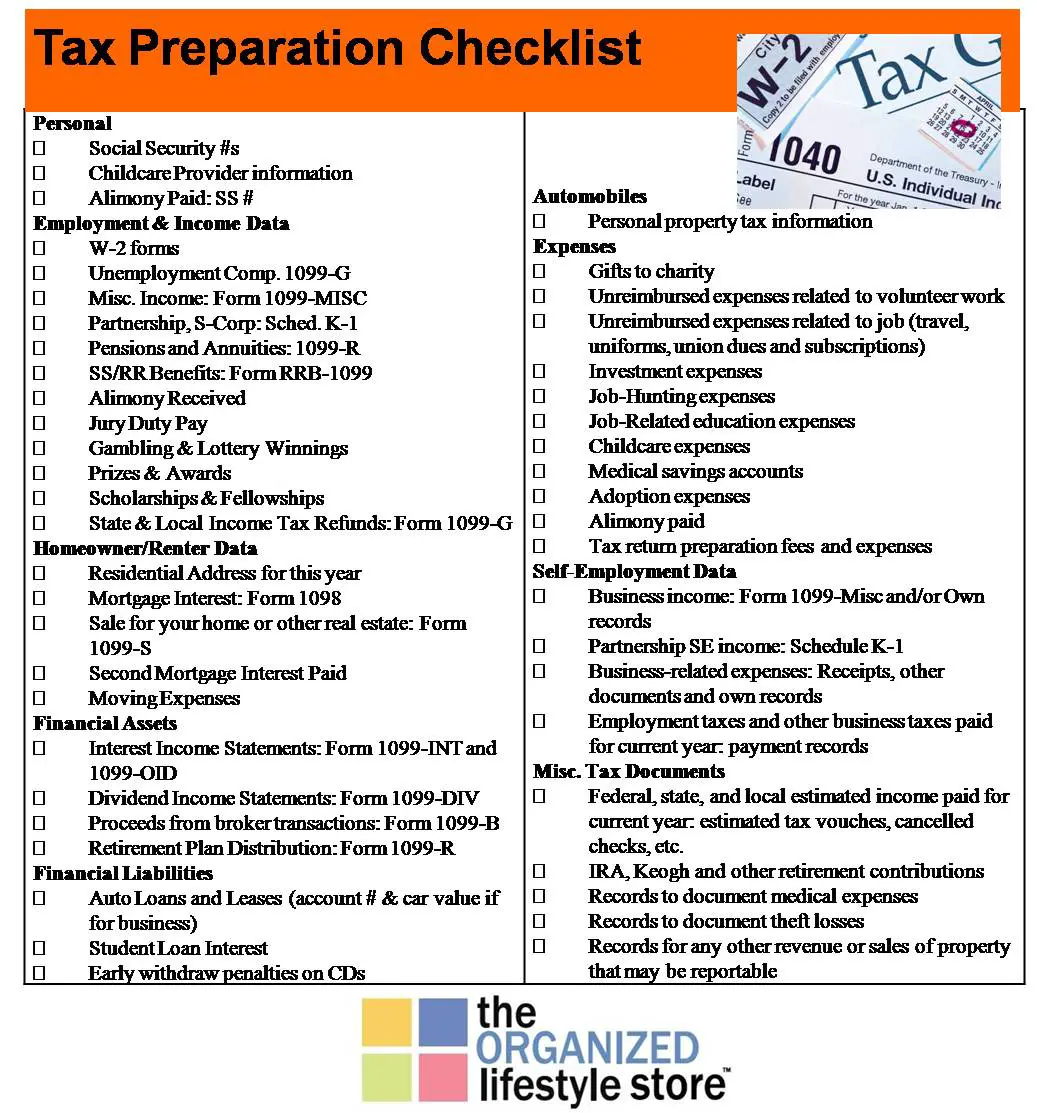

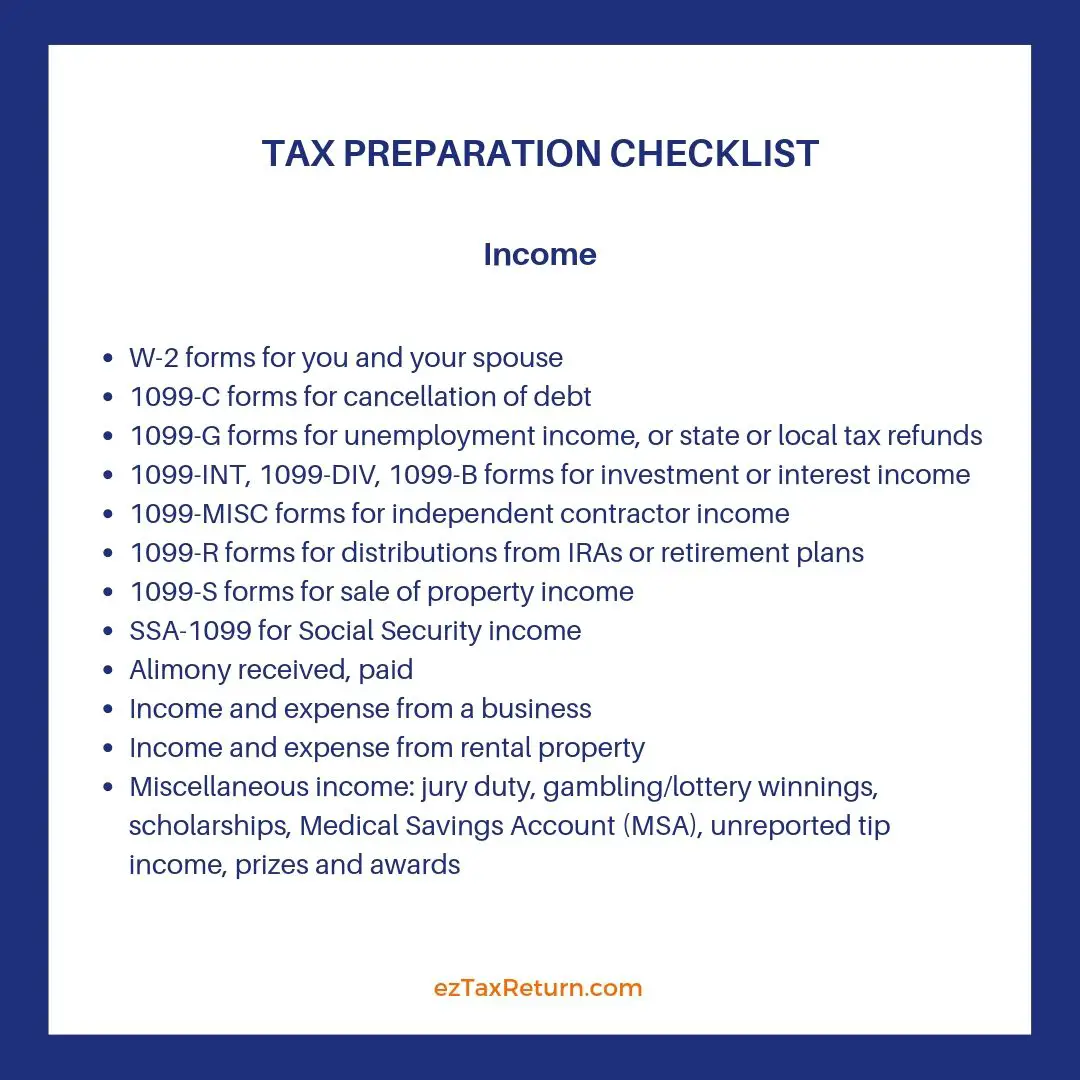

“We find the people who have done some write-up have the easiest transition to tax prep. We start them out entering W2s and 1099s into UltraTax CS, and then transition to Schedule C and F, etc. We have them print out the organizer, and enter the info on it before they enter it into UltraTax CS. It makes it easier for us to review the return, and see where they may have gone wrong, and go over the return with them to point those things out.”

– UltraTax CS user Lynn Wells of Paul T. Wells CPAs

See Income Tax Preparers Salaries In Other Areas

You May Like: When Will I Receive My Federal Tax Return

Seasonal Tax Preparer Earning Potential

In our experience, an above-average first year tax preparer, working full-time during tax season, can hope to make about $7,000-$10,000 in the first tax season, $10,000-$15,000 in the second tax season, and $12,000-$20,000 in the third tax season. While tax earning will vary based upon a number of factors, we can use those as benchmark figures.

Thats as an employee of an established and busy tax office, remember, and working an average of 40 hours per week January 15-April 15. If you work more hours, if you are the guy/girl who comes early and stays late, you may make more money because youll pick up those early/late clients.

But lets say for the sake of argument that an above-average-but-not-necessarily-excellent, full-time first year tax preparer can expect to make $7,000-$12,000 during that first tax season those are perfectly reasonable benchmark figures to use for a first year full-time seasonal tax preparer.

If your state allows tax preparers to receive unemployment insurance in the off-season, as does California , you may pick up another $5,000-$10,000 or so of unemployment income when its not tax season, depending on your tax season earnings. This is a little known bonus to being a seasonal tax preparer is that you can get unemployment during the off season, so long as you work for an employer who pays the rightful amount into the unemployment fund .

Can you make it on that, until you learn your craft?

How Much Do Tax Preparers Make Through Their Professional Service

The question of how much tax preparers make depends on their services. Some tax preparers work in an organization as an employee, while others offer their services to individual clients. The role of the tax preparer is to help their clients file income tax returns to the IRS. These professionals can work with individuals or organizations.

Their role is to review and prepare financial records, complete the various tax forms, and file tax returns. According to the research, the annual wage of the tax preparer was $50,000 in 2021. On the other hand, the median yearly wage for this preparation was $44,500. The salary of the tax preparer depends on various factors like experience, education, and employment.

The top percent of tax preparers earn more than $87,000 annually, while the lower tax preparers earn less than $22,000 annually. More than 70% of tax preparers in the US make more than $28,000 per year right now.

Read Also: How Do Tax Write Offs Work

How To Become A Certified Tax Preparer

Depending on which route you choose to take, tax preparer certification may be required.

If you choose the CPA route, you must have a bachelors degree in accounting or a related field. Then, you must pass the Uniform CPA Examination from the American Institute of Certified Public Accountants and obtain a license from your state accountancy board.

The Uniform CPA exam contains four key sections which you must score at least 75 on:

- Auditing and Attestation

- Financial Accounting and Reporting

To become an enrolled agent, you must pass the three-part Special Enrollment exam or gain work experience as an IRS employee. Enrolled agents are also required to apply for enrollment, adhere to specific ethical standards, and complete 72 hours of continuing education every three years.

Is It Worth Being A Tax Preparer

If youre looking for a profession that features stability, flexibility, and high earning potential, there are several reasons to consider becoming a tax preparer, especially if youre proficient in math, you exhibit organization and attention to detail, and you enjoy working with clients and helping them save money.

Also Check: Do You Pay Taxes On Workers Comp

What’s The Best Industry To Work In As A Tax Preparer

There are a number of different industries you could work in as a tax preparer. Tax preparation might not be your only job responsibility in various industries.

According to the BLS, both the highest levels of employment and the highest concentration of employment for tax preparers are in the following industries:

- Accounting, Tax Preparation, Bookkeeping, and Payroll Services

- Management, Scientific, and Technical Consulting Services

- Securities, Commodity Contracts, and Other Financial Investments and Related Activities

The industries that pay the best for tax preparers likely include other tasks besides tax preparation. Here are their mean annual salaries:

- Management of Companies and Enterprises: $74,660

- Legal Services: $70,260

An Overview Of Tax Preparation Fees In 2022

Home»Tax Optimization»An Overview of Tax Preparation Fees in 2022

- OnNovember 16, 2022

Taxes are inescapable, but there are some steps you can take to reduce your annual tax burden. One method of lowering your amount owing involves using a tax preparation professional to review your income statements and expenses to uncover tax deductions and credits for which you might be eligible.

A tax preparation expert can also recommend ways to reduce your taxes in future years. The result is more significant savings for your business or estate and a long-term tax strategy to help you reach your financial planning goals.

Having an industry professional prepare your taxes can help you avoid mistakes because this service provider will understand federal and state tax rules and their implications. This guide will examine tax preparation fees for 2022 and how these professionals determine how much to charge their clients.

Don’t Miss: How Do I Pay My Indiana State Taxes

What Software Do Tax Preparers Use

Thomson Reuters UltraTax CS is a leading professional tax preparation software that automates your entire business whether for individual tax preparation or business clients.

Filled with powerful time-saving tools and features, UltraTax CS gives preparers access to federal, state, and local tax programs including individual, corporate, partnership, estates and trusts, multi-state returns, and many others.

UltraTax CS also offers seamless integration with other Thomson Reuters solutions, including CS Professional Suite and Onvio Firm Management, connecting your entire practice and ensuring that youll never lose time doing a task manually.

From cloud computing to advanced data sharing and paperless processing, UltraTax CS meets all your tax workflow needs with a customizable, end-to-end solution.

Set Fee For Each Item Of Data

A set fee for each data item is often reserved for complicated returns that could include numerous deductions and lots of paperwork to examine. The preparer will set a price for each item that requires review in this situation to ensure theyre adequately compensated for the work.

Understanding how your tax professional will bill you can eliminate surprises regarding your tax documents. It can also help as you shop for the best service provider to meet your needs.

Don’t Miss: What Will My Tax Refund Be

What Does A Tax Preparer Do

Most tax preparers prepare, file, or assist with general tax forms. Beyond these basic services, a tax preparer can also defend a taxpayer with the IRS. This includes audits and tax court issues. However, the extent of what a tax preparer can do is based on their credentials and whether they have representation rights.

In a way, tax preparers are asked to serve two masters their clients and the IRS. They must assist their clients in complying with the state and federal tax codes, while simultaneously minimizing the clients tax burden. While they are hired to serve their client, they must also diligently remember their obligation to the IRS and not break any laws or help others file a fraudulent return.

Stress And High Pressure

Even income tax preparers who love their job are not immune from stress during tax season. Pressure is intense to meet with clients every hour of the day. In your role of tax preparer, you will scramble to find time to research questions related to IRs regulations.

Tax returns must be filed by the deadline to avoid penalties. Tax preparers at large firms may handle thousands of returns each tax season, according to Traceview Finance. Although appointments are fast-paced, the job of pouring through forms and schedules can get boring and tedious. HealthDay reports that income tax preparers experience health problems related to weight gain, lack of sleep and poor diets.

Don’t Miss: What Is The Best Tax Relief Company

Do Tax Preparers Make Good Money

Income tax preparers typically dont start out earning high wages however, their earnings grow as they gain clients and build their reputation. According to the U.S. Bureau of Labor Statistics, or BLS, tax preparers earned an average salary of $52,710 per year as of May 2020. Salaries for CPAs are even higher.

Is Becoming A Tax Preparer Hard

The task of becoming a tax preparer can be relatively easy compared to the rocky road of some similar ventures, such as becoming a real estate agent or an insurance agent. Tax preparation can be a quirky profession, meaning it is essentially not a year round profession but a more seasonal one.

You May Like: When Is The Tax Extension Deadline

You Can Define When And How Much You Want To Work

Do you have another job and just want to do tax prep work during peak season? Or do you want to complete tax returns year-round for small business owners or individuals with more complex tax scenarios? You get to choose! A cloud-based tax prep solution gives you greater flexibility and independence. You can work from home, your office, a remote location, or your favorite vacation spot scaling your business up or down is simple and seamless. And if you want to shorten your tax season or extend it to attract new clients, TaxWise Online’s browser-based access can help you set up additional tax preparers or remote locations in minutes, with no expensive office leases or IT infrastructure to manage.