A Payroll Tax Withholding Example

Lets say a business has an employee named Bob who is married, has two children and a spouse who also works. How would his federal tax withholding each pay period be determined if he earns $1,000 per week?

First, see if Bobs wages need to be adjusted. Since he isnt claiming any additional income from investments, dividends or retirement and hes chosen the standard deduction, his wages remain $1000.

Second, look at the weekly pay period bracket table on 15-T. For married filing jointly with the Form W-4 Step 2 checkbox withholding option, the tentative withholding amount is $88.

Third, account for tax credits. Bob has two children, so he may get $4000 in tax credits. Divide this number by 52 since hes paid weekly and subtract the result from $88 . The result is $11.08.

Finally, if Bob requested an additional $1000 withheld from his taxes each year on his Form W-4, divide that number by 52. The result is $19.23, which when added to $11.08, equates to a final withholding amount of $30.31 per pay period.

Eight : Take Other Deductions

Youâre not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations

Remember, all deductions start with and are based on gross pay.

Everyone Should Check Withholding

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, its also important for anyone whose refund is larger or smaller than expected. By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes.

Recommended Reading: What Is The Last Day To File Taxes

Tax As % Of Income : 000

Did you know that you may not pay the same tax rate onall your income? The higher rates only apply to theupper portions of your income.

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 12/02/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Refund Transfer: Refund Transfers are fee- based products offered by Republic Bank & Trust Company, Member FDIC. A Refund Transfer Fee and all other authorized amounts will be deducted from the taxpayers tax refund.

What Happens When You Claim 0 Allowances

If you were to have claimed zero allowances, your employer would have withheld the maximum amount possible. If you didn’t claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. If you claimed too many allowances, you probably ended up owing the IRS money.

Also Check: Is Social Security Taxed In Pa

What Is The Standard Deduction

The standard deduction is an automatic deduction from your taxable income that you can receive without any itemizing.

Before deciding to claim the standard deduction, its a good idea to compare your standard deduction amount with your total itemized deductions.

For the 2022 tax year , the standard deduction amounts are: :

- $12,950 for single and married filing separate taxpayers

- $19,400 for head of household taxpayers

- $25,900 for married taxpayers filing jointly or qualifying widows

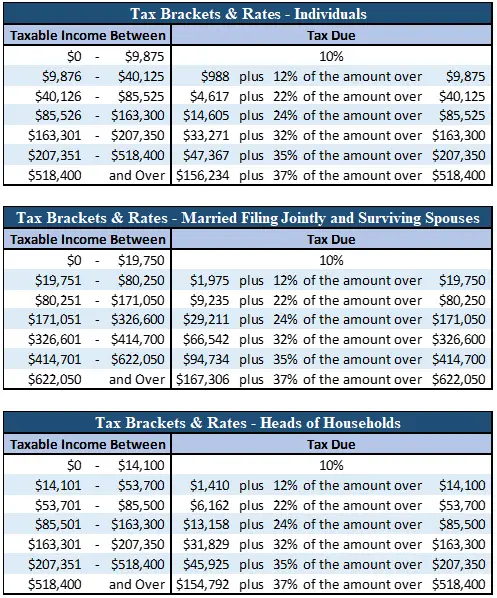

Current Income Tax Rates

Tax bracket rates can change from year to year, so its important to research the rates as listed by the IRS when calculating your owed income tax for the year. For 2022, the tax brackets are as follows for single filers:

- 10% tax rate for income between $0 and $10,275

- 12% tax rate for income between $10,276 to $41,775

- 22% tax rate for income between $41,776 to $89,075

- 24% tax rate for income between $89,076 to $170,050

- 32% tax rate for income between $170,051 to $215,950

- 35% tax rate for income between $215,951 to $539,900

- 37% tax rate for income of $539,901 or more

For married couples filing jointly, the tax rates are as follows:

- 10% tax rate for income between $0 and $20,550

- 12% tax rate for income between $20,551 and $83,550

- 22% tax rate for income between $83,551 and $178,150

- 24% tax rate for income between $178,151 and $340,100

- 32% tax rate for income between $340,101 and $431,900

- 35% tax rate for income between $431,901 and $647,850

- 37% tax rate for income of $647,851 or more

So, for example, let us say you are a single filer making $75,000 a year from your salary job. We wont add in tax credits or deductions for this example, but those can lower your taxable income and lower the tax bracket you are in.

This is a bit lower than if you taxed the full income at 22% like some people try to do to guess their taxes. If you taxed the full income at 22%, you would believe you would need to pay $16,500 in income taxes.

You May Like: How To File Taxes Online

Tax Withholding Estimator: Calculating Taxable Income Using Exemptions And Deductions

Federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Determining The Amount Of Taxes You Should Withhold

If you are newly retired, it can be difficult to figure out how much in taxes to withhold from your pension, because your tax rate depends on your household sources of income and deductions.

When you add up all your sources of income and subtract your deductions, you get your taxable income, which determines your tax bracket. You can use this tax bracket to estimate how much to withhold. When you look at a chart of tax rates, you can see that higher amounts of income will be taxed at higher rates.

Tax planning can help you figure out the right amount to withhold. With tax planning, you put together a “pretend” tax return, called a “tax projection.” As you transition into retirement, you might want to work with a CPA, tax professional, or retirement planner to help you with this.

If you prefer to do it yourself, you can plug numbers into an online 1040 tax calculator to get a rough estimate, or you can fill out your federal tax form as if you were filing taxes. Follow the instructions to see where each source of income goes. Calculate the tax you think you will owe. Divide that by your total income. Use the answer to see what percentage to withhold.

Recommended Reading: What Is The Sales Tax Rate In Tennessee

How You Can Affect Your North Carolina Paycheck

North Carolina taxpayers who find themselves facing a large IRS bill each tax season should review their W-4 forms, as theres a simple way to use the form to address this issue. Specifically, you can elect to have an extra dollar amount withheld from each of your paychecks to go toward your taxes. While your paychecks will be slightly smaller, youll lower the chances of owing money to Uncle Sam during tax season.

You can also save on taxes by putting your money into pre-tax accounts like a 401, 403 or health savings account , provided your employer offers these options. Retirement accounts like a 401 and 403 not only help you save money for your future, but can also help lower how much you owe in taxes. The money that goes into these accounts comes out of your paycheck before taxes are deducted, so you are effectively lowering your taxable income while saving for the future. HSAs work in a similar manner and you can use the money you put in there toward medical-related expenses like copays or certain prescriptions.

Not yet a North Carolina taxpayer, but planning a move to the state soon? Take a look at our North Carolina mortgage guide for important information about rates and getting a mortgage in the state.

Gross Income Vs Net Income

Workers receive their earnings either as net income , also known as take-home pay, or gross income. Net income is the total amount received after taxes, benefits, and voluntary contributions are deducted from the paycheck. When taxes are withheld, it means the company or payer has paid the tax to the government on the workers behalf.

The amount your employer withholds for taxes depends on how much you earn and the information you gave your employer on Form W-4. All money earned, whether as a wage, salary, cash gift from an employer, business income, tips, gambling income, bonuses, or unemployment compensation, constitutes income for federal tax purposes.

Don’t Miss: How Can I File My Past Years Taxes

Simple Annual Overview Of Deductions On A $5500000 Salary

Lets start our review of the $55,000.00 Salary example with a simple overview of income tax deductions and other payroll deductions for 2023. The table below provides the total amounts that are due for Income Tax, Social Security and Medicare. We will look at each of these and a periodic split as we go through the salary example.

$55k Salary Tax Calculation – Salary Deductions in 2023| What? | |

|---|---|

| Salary After Tax and Deductions | $43,448.10 |

It is worth noting that you can print or email this $55,000.00 salary example for later reference. There is a lot of detailed information which is worth reading and using as a reference, particularly if you file your own tax return without using a tax return software provider and/or accountant.

Save this Salary Tax Calculation for later use

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2021, the IRS recommends that you check your withholding amounts again. Do so in early 2022, before filing your federal tax return, to ensure the right amount is being withheld.

Also Check: Can I Claim Closing Costs On My Taxes

Which Provincial Or Territorial Tax Table Should You Use

Before you decide which tax table to use, you have to determine your employee’s province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located.

To withhold payroll deductions, use the tax table for that province or territory of employment.

If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employee’s salary.

For more information and examples, go to Chapter 1, “General Information” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

What Is A Marginal Tax Rate

The term “marginal tax rate” refers to the tax rate paid on your last dollar of taxable income. This typically equates to your highest tax bracket.

For example, if you’re a single filer with $35,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $46,000 of taxable income, however, most of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would then be 22%.

Also Check: Are All Donations Tax Deductible

How To Calculate Federal Payroll Tax Withholdings

Unlike the flat rate FICA taxes, calculating federal income taxes is a little more complex. To determine what to withhold for an employee who earns up to $100,00 per year and has completed the revised 2020 Form W-4, employers may use the IRS wage bracket method as follows:

How Much In Taxes Should I Withhold From My Pension

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

When you start a pension, you can choose to have federal and state taxes withheld from your monthly checks. The goal is to withhold enough taxes that you won’t owe much money when you file your tax return. You don’t want to get a large refund, either, unless you like lending money to Uncle Sam.

If you choose not to have any taxes withheld and you underpay your taxes, you could end up owing taxes plus an underpayment penalty. To avoid those fates, you’ll want to estimate your income for the year and set your tax withholding appropriately.

Don’t Miss: Is It Too Late To File Your Taxes

Role Of The Federal Income Tax Withholding

To avoid potential errors and complications, your employer will be using specific information from your new W-4 form as well as the amount of your taxable income to determine how much Federal Income Tax should be withheld from each paychecks.

FITW increases when you earn more than usual during a pay period, such as work overtime or receive a bonus. FITW decreases when you do things like work fewer hours or increase contributions to your 401k.

Your employer is responsible for forwarding the federal income tax withholding to the IRS on your behalf. Its a good idea to have more FITW than necessary during the year, in order to cover your anticipated federal income tax liability.

When you receive your Form W-2, the total FITW will be shown in Box 2. If you are too aggressive with your federal tax withholding and have a large refund every year, it might be worth adjusting your Form W-4 to withhold less.

Federal income taxes are sometimes abbreviated as FWT. This is the amount that youve already paid to the federal government and it can be called the Federal Withholding. When you file your return, any credit for this amount will be applied to taxes that owe.

The federal income tax withholding from your pay depends on:

1) You start or stop working,

2) Your marital status changes,

3) Your number of dependents changes, or

4) The amount you want withheld from each paycheck changes.

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of whats due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Also Check: Government Grants Anyone Can Get

Don’t Miss: Where Is The Best Place To File My Taxes