How Much Does It Cost To Hire A Professional Tax Service

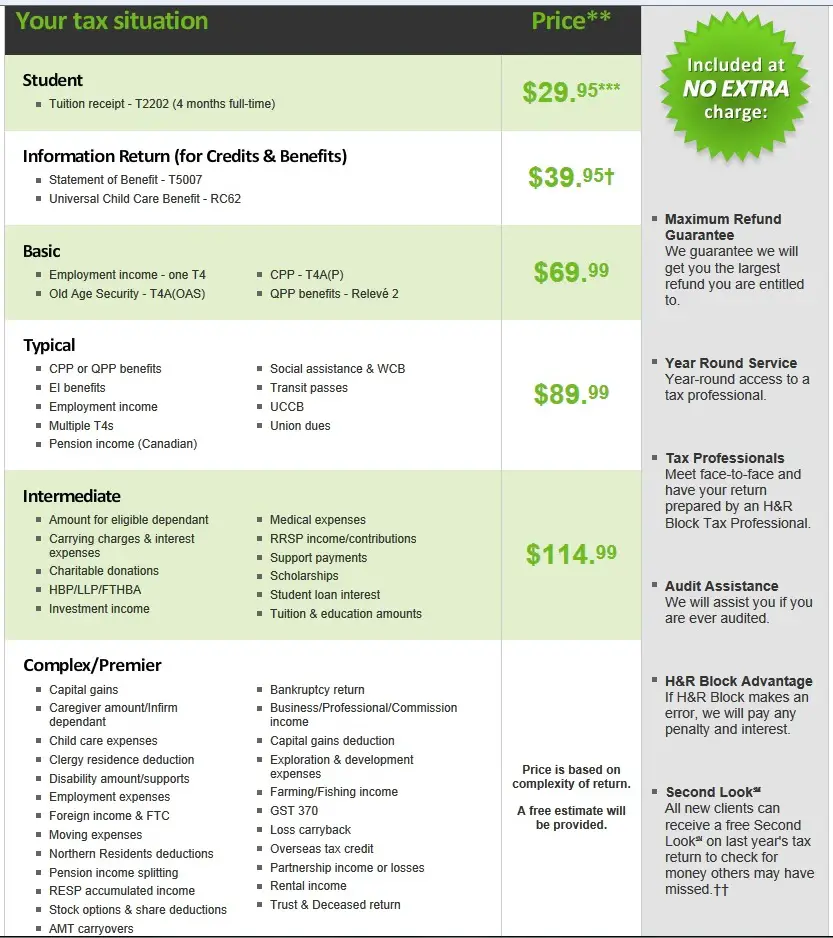

Your fees will depend on the complexity of your tax situation and the level of help you receive. On the lower end, you may be able to hire a CPA or an independent preparer for a flat fee or their hourly rate to file a simple 1040. At H& R Block, it can start for as little as $80 and work up from there. However, if you run a small business, plan to itemize deductions, or wish to add bonus features like audit support, you will likely have to pay more.

Cost Of Diy Options And What They Cover

- Free Online: $0. Supports W-2 income, unemployment income, interest and dividend income, retirement distributions, the student loan interest deduction, the tuition and fees deduction, the child tax credit, and the earned income tax credit . You can’t itemize deductions, but that’s typical of a free version. Notably, H& R Block’s free version includes student deductions, while TurboTax’s does not.

- Deluxe Online: $49.99. Everything the free version includes, plus the mortgage interest deduction and health savings accounts, and you can itemize.

- Premium Online: $69.99. Supports everything in the Deluxe version, plus rental property income and freelance/contractor income below $5,000. You can also import mileage and other expenses from common tracking apps.

- Self-Employed Online: $109.99. The highest-tier online package offered by H& R Block. It’s ideal for self-employed people, including small business owners, partners, and contractors who earned more than $5,000.

Can I File My Taxes For Free With H& r Block

You can technically file your taxes for free with H& R Block, using their free online tax filing service. However, the free service offers limited features and is probably best suited for those with straightforward tax situations.

If you choose to file for free with H& R Block, youll be able to upload relevant documents from your employer, as well as deduct student tuition, payments, and loan interests. Youll also benefit from the companys highest-return guarantee and always have the option of adding more features, such as more expansive human support.

However, there are many other companies that offer a wide variety of tax services, for free. Wealthsimple Tax, for example, is always free . In addition to offering you human support and the seamless integration of any retirement accounts you may have, theres also the option to make readjustments to your return after you file, in case youve made a mistake.

Ultimately, what tax preparation company you choose will depend on what level of service and assistance your financial situation requires. Keeping an eye out for flexibility, access to professionals, and refund optimization guarantees will save you plenty of headaches and potential fees down the line.

Article Contents3 min read

Recommended Reading: How To Deal With Taxes

Easy To File And Get Expert Help This App Is Where Its At

The newly designed H& R Block Tax Prep app lets you do your own taxes on any device, with on-demand help from our tax experts if needed.* Import or upload your W-2s with ease, then prep at your own pace. Start for free and get your biggest refund possible, guaranteed.

Limitations apply. Visit our guarantees for more information. *Additional fees apply for expert tax help.

Spruce is a financial technology platform built by H& R Block, which is not a bank. Banking products provided by MetaBank®, N.A., Member FDIC.

Banking products and services are provided by MetaBank®, N.A., Member FDIC.

Spruce* Spending and Savings Accounts are established at, and the Spruce debit card is issued by, MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard® and the circles design are registered trademarks of Mastercard International Incorporated.

Apple and the Apple Logo are registered trademarks of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC. Message and data rates may apply.

Is It Safe And Secure

Tax Prep companies are valuable targets for hackers seeking personal information. H& R Block uses encryption, multi-factor authentication, and web-browsing encryption to keep users financial information safe. However, the company is not perfect. In 2019, the company suffered a data breach in which some customer information was leaked.

Also Check: What Is The Employer Portion Of Payroll Taxes

Final Thoughts On H& R Block 2021

For those who qualify for free filing, H& R Block Online deserves to be on the short list. It is a premium software, and the free offering is expansive. Additionally, the Premium edition of the software could offer a good value for investors, and gig workers.

However, users considering the Deluxe Tier should think carefully before paying the price. Deluxe users may find a better by considering TaxSlayer Classic or FreeTaxUSA. These tools may also be a good alternative for self-employed people who dont have depreciating assets in their business.

Landlords and others with depreciating assets should also carefully consider whether H& R Block is the right tool to get the job done. TurboTax has a superior user experience for rental property owners which is important given the complexity of depreciation.

Dont Miss: How To Appeal Cook County Property Taxes

What Is The H& R Block Budget Challenge

The H& R Block Budget Challenge is a personal finance simulation that teaches teenagers money management skills. During a 10-week competition, students receive virtual paychecks and bills in real-time and are challenged to build a budget and make financial decisions to help them learn how to pay bills on time, manage a credit card balance, and save money for retirement. H& R Block is sponsoring high school students to participate for free and is giving away college scholarships to those who excel in the competition.

You May Like: Can I File Old Taxes Online

You May Like: How To Subtract Tax From Your Paycheck

H& r Block Tax Solutions And Other Financial Services

The company offers help with nearly any possible tax situation, from the simplest to the most complex returns involving several itemized deductions that may require judgment calls based on extensive tax experience. Even if you dont have a Social Security Number, so long as you earn money in the United States, H& R Block can also help you apply for an Individual Taxpayer Identification Number and file any and all pending tax returns, thus allowing you to, among others, open a bank account or apply for a mortgage loan. It has also developed a proprietary Tax Identity Shield to protect you from tax identity theft.

At H& R Block, you can have your taxes electonically filed. Remember that it is important to pay by the April 15 deadline to avoid interest and penalties. In addition to sending a check or money order, there are other ways to pay. When you have your taxes prepared by H& R Block, you can immediately pay your federal tax due at the H& R Block office with any MasterCard, Visa, American Express or Discover credit or debit card.

If you find yourself under audit by the IRS, the company will assign a qualified enrolled agent to accompany, assist and represent you. If you are found owing additional taxes due to the error in the preparation of your return by the company, it will pay up to $6,000 of the additional amount due.

The H& R Block User Experience

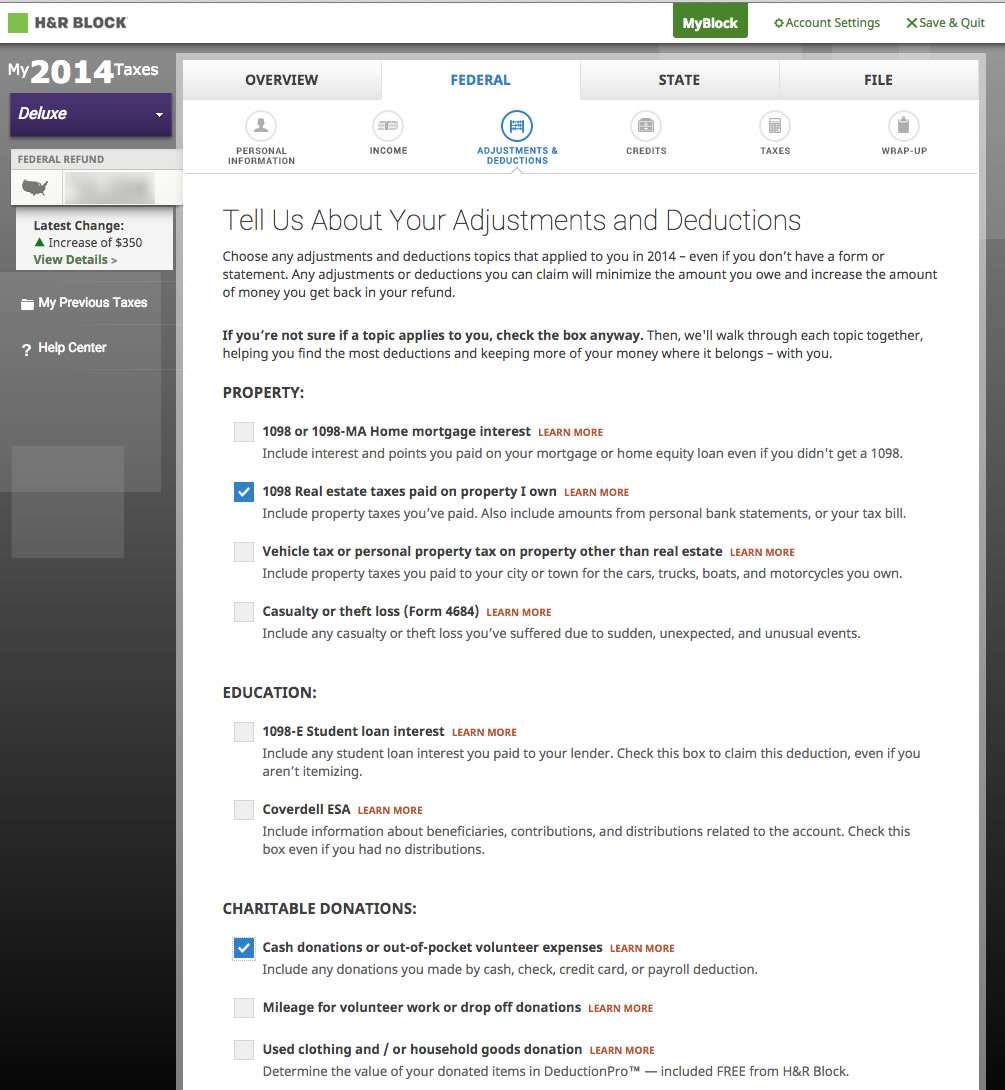

Navigation is very simple and straightforward. You advance from screen to screen by clicking the Back and Next buttons. You do this throughout the site, though there are other navigation options, too. You can, for example, click a tab in the horizontal toolbar at the top to see its subsections . Directly below this is a list of the forms youve completed click on one to return to it. Links in the left vertical pane show you your real-time, ever-updating tax obligation or refund and take you to housekeeping pages.

The entire site functions in this way. H& R Block Deluxe makes it clear on each page what action you need to take and where you need to go next. But it lacks a comprehensive navigation tool like the one FreeTaxUSA offers. It also feels choppier than TurboTax Deluxes smooth, linear flow. Even on screens where youre just clicking Yes or No options, you still have to click the Next button to advance. That adds up to a lot of extra clicks.

H& R Block is a little more formal in its language and looks than the friendlyeven folksyTurboTax. It uses clear, understandable language, and its navigation and data entry conventions should be familiar to most taxpayers. The two sites simply have different personalities. TurboTax is the human preparer who greets you with a big smile and makes some small talk as he or she goes along. H& R Block is a bit more businesslike. Both are effective approaches.

You May Like: When Did The Child Tax Credit Start

How Hard Is The H & R Block Test

The assessment is based off you skills taught during training some test are open book but most are Ethical questions in regards to your knowledge about taxes and tax laws. We have to take and pass the Income Tax Course and Test. You go through training and the answers are provided during that time. It is not difficult.

H& R Block Pricing Changes

Like many tax prep software providers, H& R Block raises its fees as Tax Day approaches. The step-up date varies yearly and generally isnt revealed well in advance. As such, it pays to begin your return as early as possible, even if you dont have everything you need to complete your return.

On the bright side, H& R Blocks pricing is transparent. You know your final price as soon as you select a plan.

You can select any of the available plans to start. If you attempt to do something your current plan doesnt support, H& R Block prompts you to upgrade and doesnt allow you to continue your return until you do. But its best to choose the least expensive plan you think you need to start.

Read Also: How Do I Get My Pin For My Taxes

Can I Do My Taxes Online With H& r Block

H& R Block tax filing software makes it easy to complete your taxes online if you donât want to go to a local office. You can opt to use H& R Blocks software and complete your forms yourself or can get expert tax help from home with Tax Pro Go.

With Tax Pro Go, you simply upload your tax documents and youâre matched with a professional experienced with situations like yours. You can schedule a phone call to talk with your tax pro if you have any questions, and the pro will complete your taxes for you. The cost for Tax Pro Go starts at $69 and increases from there based on the complexity of your return as well as other factors.

You May Like: How Are Reit Dividends Taxed

Which Tax Software Is Free

Almost all of CNETs best tax software selections for 2022 include free options for simple tax returns. However, some of those free options only include your federal tax return youll occasionally need to pay extra to file state tax returns.

TurboTax, H& R Block, TaxSlayer and Cash App Taxes all provide free tax-filing services that include one federal tax return and one state tax return. FreeTaxUSAs basic plan is free for federal and $15 for unlimited state returns, whereas TaxActs free plan requires $40 per state tax return.

Be careful to check for restrictions before you start the process of using free tax software at any of the providers. For example, TurboTaxs Basic plan only allows simple tax returns with 1040 forms no unemployment income, stock sales or any itemized deductions like mortgage interest. H& R Blocks Free Online adds a few more forms like Schedules 1 and 3, but youll still need to take the standard deduction. TaxSlayer Simply Free doesnt allow taxable income over $100,000.

Even Cash App Taxes, which earns CNETs award for Best Free Tax Software, doesnt cover absolutely all tax situations. While it does include advanced tax forms for self-employment, rental property, stock sales, small business income and the child care credit, it doesnt allow for foreign earned income, the health coverage tax credit or income from an estate or trust .

You May Like: Can You File Taxes Before Feb 12

Recommended Reading: What Is Federal Income Tax Withheld

Final Thoughts On H& r Block 2021

For those who qualify for free filing, H& R Block Online deserves to be on the short list. It is a premium software, and the free offering is expansive. Additionally, the Premium edition of the software could offer a good value for investors, and gig workers.

However, users considering the Deluxe Tier should think carefully before paying the price. Deluxe users may find a better by considering TaxSlayer Classic or FreeTaxUSA. These tools may also be a good alternative for self-employed people who dont have depreciating assets in their business.

Landlords and others with depreciating assets should also carefully consider whether H& R Block is the right tool to get the job done. TurboTax has a superior user experience for rental property owners which is important given the complexity of depreciation.

You May Like: How To Pay Taxes For Free

H& r Block Vs Turbotax: User Friendliness

Both of these services are known for their ease of use, but TurboTax is generally the more user-friendly of the two. This is generally true for both desktop and mobile users.

TurboTaxs interview-style approach will guide you through the filing process with simple and straightforward questions. There is minimal tax jargon. H& R Block is also user-friendly, but its questions and explanations are not always as clear as you would hope.

The filing process with TurboTax also includes encouraging phrases throughout. This isnt a necessary feature, but taxes are stressful for many people. Seeing, You can do this, throughout the process may help to reduce some anxiety.

Another important consideration is how easy it is to upload documents. Both services do well on this front. H& R Block and TurboTax both let you upload your W-2 by taking a picture of it. Both services allow you to import your previous returns no matter which tax service you used . They also make it easy to fill out your state return after going through your federal return. Your information quickly transfers so you dont waste time retyping everything.

Also Check: How To Amend My Tax Return

H& r Block Vs Turbotax: Cost

Cost is always a consideration when you choose a tax filing service. H& R Block and TurboTax are the two most comprehensive online services available and likewise they are also the most expensive.

As mentioned, both services offer a free option, covering simple returns. You can also file some additional schedules and forms with this option. However, H& R Block does cover more forms and schedules with its free option. It also allows you to file multiple state returns for free. By contrast, the free plan from TurboTax includes only one free state return. This all gives H& R Block a slight advantage if you qualify for the free option.

Its great if you can file your taxes for free, but the average filer will need to upgrade to another option. The Deluxe option is enough for many filers. Both Deluxe options include deduction-finding software, help with charitable donations and access to tax financial experts through online chat.

There are a couple of big differences between the options in the forms that they support. TurboTaxs Deluxe option supports Schedule SE, which allows you to file self-employment taxes. It also allows you to file Schedule C and Schedule C-EZ if you have business income to report but do not have any expenses to report.

Read Also: How Can I Make Payments For My Taxes

How To Send And Receive Money

As with most other companies, you can pay your fees and taxes by debit card or credit card. There is a 2.49% fee for this service with a minimum fee of $2.59.

If you want to avoid the fees, you can pay directly from your bank account. You can also pay by check or money order.

When it comes to getting your refund, the standard IRS options are direct deposit to your bank account or a check in the mail. H& R Block has an exclusive payment option that will put your refund onto an H& R Block Emerald Prepaid Mastercard.

If you already paid your H& R Block fees, you can receive the entirety of your refund on this card. You can also pay your fees with a Refund Transfer, meaning H& R Block will take their fees from your refund and send the remainder to the Emerald card.

While the Refund Transfer comes with a $34.95 fee, it does help if you need cash now. An additional option if youre strapped for cash is the Refund Advance, but its only available for certain periods.

For 2018 taxes, it was available from January 4 to February 28 and had four loan amounts: $500, $750, $1,250, or $3,000 depending on how much your refund is. There are no finance charges and no loan fees , and the loan processing review doesnt affect your credit score.

This means you could have access to a portion of your refund on the same day you request the loan. Its automatically repaid when the IRS sends your refund.

I dont recommend this option for everyone, but its a great way to take out a loan if you qualify.

Read Also: What Bank Does Liberty Tax Use