Can I Deduct $300 Of Charitable Contributions In 2021 Without Itemizing Like Last Year

Yes. If you are single, you can deduct up to $300 of cash contributions to qualified charities and still take the standard deduction. If you are married and filing a joint return for 2021, you can claim the standard deduction and also deduct up to $600 of cash contributions to qualified charities. Remember that gifts to some charitable organizationsfor example, those to private, non-operating foundations and donor-advised fundsare deductible only as itemized deductions. In addition, if you made substantial cash contributions in 2021, you may claim itemized deductions for cash contributions in an amount equal to 100% of your AGI.

Estimate Again Once Time Has Passed

Anytime something changes with your tax situation, you may want to come back to the calculator again. This will ensure that you are always on the right track financially. The more often you estimate your taxes, the better prepared you can be when it comes time to file.

Tax laws change throughout the year, but you can make sure that you are prepared using a tax calculator. By utilizing a tax refund calculator, you can have peace of mind knowing that your tax refund will be the best one possible.

Who Cannot Get An Estimate Online

You cannot get an estimate online if you:

- are entitled to claim

- were born on or before 5 April 1938 and get the higher allowances

- have other taxable income, for example from dividends and trusts

- are a higher rate taxpayer and want to estimate your Gift Aid tax relief

You can check youve paid the right tax by contacting HMRC or by getting help from an accountant.

Recommended Reading: How Much Will My Mortgage Be With Taxes And Insurance

Read Also: When Do Taxes Come In 2021

How Do State And Federal Taxes Affect Your Refund

In addition to federal income tax, you may also pay state income taxes depending on where you live. You wont pay state income tax if you live in one of these eight states: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

New Hampshire doesnt tax wages, but does tax dividends and interest, though recent legislation has been passed to phase out this tax beginning in 2024.

If you live in one of the other 41 states, youll need to file a state tax return in addition to your federal tax return. The IRS website contains a directory to help you find information on your states tax requirements.

Key Differences Between State and Federal Taxes

- State tax rates are typically lower than federal tax rates.

- States can have different types of tax credits and deductions.

- The amount of tax withholdings will vary for state and federal taxes.

Private Mortgage Insurance Deductions

If you placed a down payment of less than 20%, you will be charged for private mortgage insurance thats also tax deductible. Youll qualify for a PMI deduction if you meet the following requirements:

- Your loan was taken out in or after 2007

- If youre single and your gross income is less than $50,000

- Or if youre married and your gross income is less than $100,000

Also Check: When Is The Deadline To File 2021 Taxes

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

How Much Is Massachusetts Tax Rebate For

Massachusetts Finance Secretary Michael Heffernan said taxpayers will receive a credit “in the proportion that they paid in.”Previously, the administration said the refund would be approximately 13% of their 2021 state income tax liability but the exact amount is still to be determined. A website has been set up to answer frequently asked questions and help residents get a preliminary estimate of their refund. A call center is also available at 877-677-9727.

You May Like: How To Avoid Capital Gains Tax On Cryptocurrency

Irs Online Tax Calculator

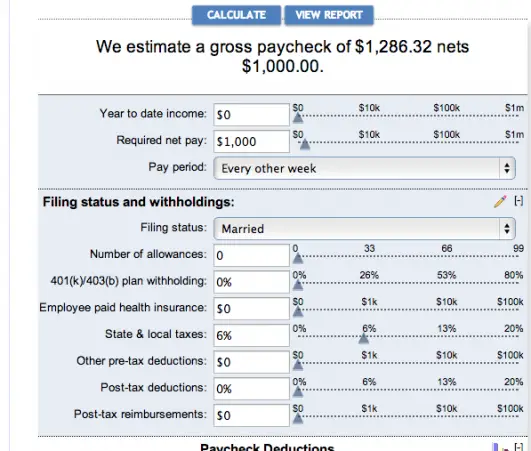

If your anticipated refund took a disheartening turn in the wrong direction, you may owe more taxes than youve already paid. The IRS provides an online calculator to help you adjust the amount you have withheld from your paychecks . From the IRS website, type IRS withholding calculator into the search field. When the search results load, click on IRS withholding calculator to begin using this interactive tool.

You May Like: How To File Past Years Taxes

How Much Do I Get Back In Taxes

To understand how much you get back in taxes, you need a quick lesson in withholdings.

Now youve probably noticed that a large portion of your income is missing from your paycheck each month. Part of the reason its missing is because the government is withholding your pay based on how you filled out IRS form W4. This form determines how much you and your employer agree to withhold for taxes.

To get a rough estimate of how much youll get back, then, you need to:

Amount withheld Your tax obligation = Refund

This is a very simple breakdown of how tax refunds are calculated and doesnt take into account things like tax deductions, exemptions, and benefits claimed throughout the year. But it can give you a rough idea of how much you might get back from the IRS come tax season.

Lets take a look at this using two more VERY simplistic examples.

Also Check: When Are Quarterly Estimated Taxes Due

Loan Payment Suspension And Forgiveness Programs

Due to the COVID-19 emergency, the Department of Education announced that loan payments and collections on federal student loans have been suspended, with interest rates set at zero through Dec. 31, 2022.

In August of 2021, the U.S. Department of Education announced that more than 323,000 borrowers with a total and permanent disability would receive more than $5.8 billion in automatic student loan discharges.

Teachers who have worked full-time for five consecutive and complete academic years in a low-income secondary school, elementary school, or educational service agency might be eligible for up to $17,500 in loan forgiveness on a Federal Direct Loan or Federal Family Education Loan .

Those employed by a government or not-for-profit organization might be eligible to receive loan forgiveness under the Public Service Loan Forgiveness Program. PSLF forgives the remaining debt owed on Federal Direct Loans after the borrower has made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

The PSLF applies to borrowers with Direct Loans and those who have consolidated other student loans into the Direct Loan Program. Also, borrowers who have yet to consolidate can submit a consolidation application to the Direct Loan Program but must do so by the Oct. 31, 2022 deadline.

Can You Write Off Closing Costs

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Recommended Reading: Can I Do My Taxes Myself

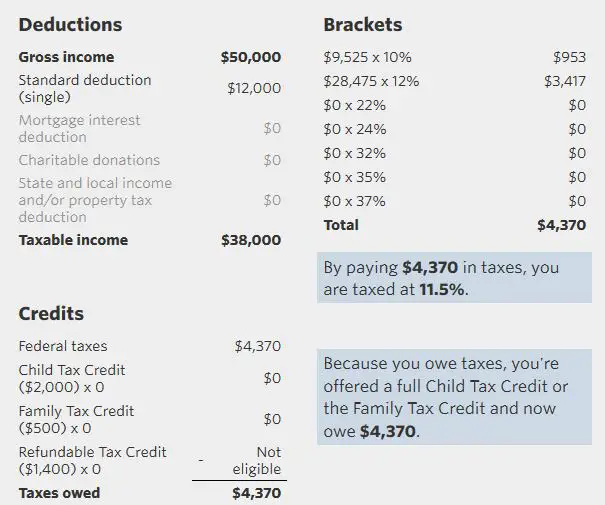

Tax Refund Calculator: How Much Will Margaret Get Back In Taxes

How much does she stand to get back?

Subtract the red circle from the blue for the refund.

Uncle Sam might owe Margaret $14,465 when all is said and done. And if her situation doesnt change in 2021, her refund will actually grow to $20,584.

NOTE: Everyones tax situation is unique and any online tax refund calculator will, at best, provide you with a rough estimate of how much youll get back. The two examples above are incredibly simple and dont fully capture the nuances of someones actual financial situation.

Play around with them and be as specific as you can. The more details you can provide the better of an idea youll have of what youll receive for your refund.

So now you know roughly how much youll be getting back and youre ready to collect the money Uncle Sam owes you.

Before you hoist your Dont tread on me flag and march down to the IRS building to get your money, you should know about all the ways you can get your tax refund.

Why Havent You Received Your Refund

The CRA may keep all or part of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

Read Also: How Can I File My Past Years Taxes

Don’t Miss: Do You Have To Pay Back Unemployment On Taxes

Heres What You Need To Do

Itemize your deductions instead of taking the standard deduction as long as your itemized deductions are more than the standard deduction. To determine this, youll need to do the math.

In 2019, for example, the standard deduction for a married couple filing jointly was $24,400 . If you dont have more than that to write off, it makes sense to just take the standard deduction.

Swecker points out that itemizing this deduction usually makes the most sense for someone that is single and blowing it out of the water financially, he says.

Think about it with a couple, you are two people, but theres just one mortgage deduction. A single person could buy the same house and would only need to find $12,200 in deductions, whereas a couple still needs to find $24,400.

If our hypothetical homeowner itemized their taxes, they could deduct approximately $5,500 in mortgage interest from their taxable income .

Take note: Your loan provider will send you a tax document outlining exactly how much interest youve paid on your mortgage each year.

Read Also: What Is California State Tax Rate

Legal Ways To Maximise Your Tax Refund

As in many other countries, Germany allows you to deduct a variety of expenses from your taxable income, thereby lowering your tax burden and increasing your refund. Some of the expenses which you can specify in your tax return are listed below:

Income-related expenses including

- Expenses for moving house for professional reasons,

- The costs of applying for jobs, including those applied for from abroad

- Expenses for traveling from your home to your place of work

- Costs of vocational further training, such as work-related books, training courses, language courses etc.

- Expenses for work-related equipment, e.g. laptop, desktop etc.

- The costs of running two households within Germany or in Germany and abroad, e.g. if you have a primary household abroad where your family are living: flight and train tickets, telephone calls, rent paid in Germany

Special expenses , including

- Retirement insurance expenses, i.e. insurance premiums and contributions to private pension schemes

- Expenses for additional retirement savings

- Charitable and political donations to German entities

Exceptional costs , including

- Personal expenses which most taxpayers inevitably incur e.g. personal medical costs

- Financial support to close dependents in need

- Professional training

The following is provided for each child under 18

- A tax-free child allowance and an allowance for the childâs care, educational or professional training requirements OR

Recommended Reading: How Much Taxes Do I Pay On Unemployment

Some $200 Automatic Taxpayer Refunds Are On The Way

If you were eligible for the initial $125 ATR, you will receive a one-time payment of $200 for the additional ATR. DOR provided information for almost 1.5 million taxpayers to the states banking institution for distribution to taxpayers bank accounts on Aug. 16.

For your security, DOR and Auditor of State’s Office cannot add or update banking information.

There is an automatic process in place to send you a check if your direct deposit does not go through you do not need to contact DOR or the Auditor of States Office.

The Auditor of State’s Office began printing Automatic Taxpayer Refund checks Aug. 15. With roughly 50,000 checks printed daily, their office anticipates all 1.7 million refund checks will be mailed by early to mid-October.

To allow us to better serve our customers, please wait until Nov. 1 to contact DOR by phone or INTIME secure message regarding Automatic Taxpayer Refunds.

The General Assembly did not pass legislation proposing an affidavit to apply for the $200 Automatic Taxpayer Refund.There is no special form to complete to receive this refund.If you were ineligible for the $125 ATR and meet the legal requirements, you can claim $200 ATR as a credit on your 2022 taxes filed next year .

Under Indiana law, eligibility requirements for the $200 Automatic Taxpayer Refund are different from the $125 Automatic Taxpayer Refund.

Tax Credits For Education Expenses

Two types of tax credits, the Lifetime Learning Credit and the American Opportunity Tax Credit, provide tax benefits for qualified educational expenses for postsecondary education. The rules for these credits differ. The IRS provides a comparison chart online. It also provides an extensive list of FAQs to help you determine which credit to claim.

Recommended Reading: Are New York State Tax Refunds Delayed

Is It Better To Claim 1 Or 0

It is better to claim 1 if you are good with your money and 0 if you aren’t. This is because if you claim 1 you’ll get taxed less, but you may have to pay more taxes later. If you do you’ll have to address this out of pocket and if you didn’t save up enough you may have to wait to take care of your tax bill.

Tax Deductions Vs Tax Credits

Tax deductions and credits are two ways you can get a tax break as a homeowner. Within those two categories there are different subtypes of both, and it can be confusing to understand what applies to you, the homeowner and taxpayer.

Below, well discuss both tax groups, as well as some common tax breaks within each category.

You May Like: What Does Payroll Tax Pay For

How To Maximize Your Tax Refund

There are several ways you can get a bigger refund on your taxes this year. Here are just a few of the best ways to maximize your refund.

Top 5 Tips to Get Your Maximum Tax Refund

Figuring out how to maximize your refund can involve some pretty in-depth knowledge. If the process seems a bit overwhelming, talking to a CPA or tax professional can help make sure you dont miss anything.

The Bottom Line On Tax Returns For New Homeowners

This crash course on tax returns for new homeowners is not extensive. Every state and local municipality will have different options for tax credit and tax deduction that you can take advantage of, and the average tax return after buying houses fluctuates. To that end, its important to do some research on your local areas laws so you can handle your return like a tax pro..

While tax returns can feel like a maze, you dont have to do it alone. Consider consulting a financial advisor to discover what sorts of tax breaks you might qualify for.

Credit Karma. Buying a House: The Tax Impact of Your New Home. Investopedia. Top Tax Advantages of a Buying a Home. Investopedia. Tax Credit.

Recommended Reading: How Much Is Taken In Taxes From Paycheck

How Much Should I Put Back For Taxes 1099

Earned income is generally recorded in two ways for federal tax purposes. There is W-2 income and 1099-MISC income. The former is for employees, either full- or part-time the latt

Earned income is generally recorded in two ways for federal tax purposes. There is W-2 income and 1099-MISC income. The former is for employees, either full- or part-time the latter is for contract workers, sometimes known as a freelancers. Heres what you need to know to minimize your tax liability if you file a 1099-MISC. If youre unsure about filing taxes, engage the services of a financial advisor.

Contract work is by far the most common form of self-employment. It allows workers to strike out on their own without necessarily having to launch a formal business.However, taxes for freelancers arent fun. For a W-2 employee, the employer and the employee each pays half of the individuals payroll taxes. This comes to about 7.65% for the employer and the employee each. However, a 1099-MISC employee must pay both halves of this tax, amounting to a flat-tax increase of 7.65% across the board for the self-employed. This is known, appropriately enough, as the self-employment tax.

Since taxes tend to start out pretty high for contractors they try hard to cut that bill. If this is how you earn a living or just some money on the side, here are some tips.

How Do I Get My Tax Refund

Luckily for you, the IRS is very good about getting your tax refund to you.

In fact, you can check out the IRSs Wheres my refund? tool to find the status of your tax refund right now. And according to the IRS, they issue nine out of ten refunds back to the taxpayer within 21 days after they file their taxes.

Ultimately, though, how soon you get your refund back depends on two things:

- How you file your taxes

- How you elect to receive your refund

If you decide to file your taxes through good old fashioned pen and paper, its going to take considerably longer to get your refund back. In fact, youre going to have to wait four to six weeks before youre even able to check your status on their Wheres my refund? tool.

There is another route though: Electronic tax filings.

You receive your tax refund even faster when you file it electronically via platforms like TurboTax or IRS e-file. There you can elect to receive your refund through direct deposit . Its secure, fast, and the same way the government deposits millions of Social Security and Veteran Affairs benefits each year.

When you get your money back, be sure to put it to good use:

So you know how much youre getting back and how to get your money. Now lets get into what you might be getting WRONG about your tax refund.

Recommended Reading: What Does Payroll Tax Mean